Chapter 1

Introduction

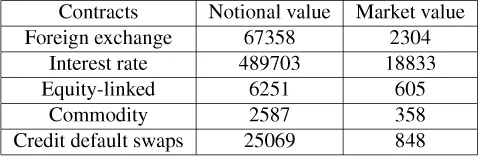

In Théorie de la Speculation (1900), Louis Bachelier made the first attempt to model the inherent randomness in stock prices using a continuous-time counterpart of white noise, the Brownian Motion. For many years this modelling approach was of purely academic interest as financial institutions used less mathematically demanding methods. More than 70 years later the ideas proposed by Bachelier were used in two seminal papers by Robert Merton on continuous-time finance in general and Fischer Black and Myron Scholes on the pricing of options and corporate liabilities. Contrary to their own expectations, this area has expanded enormously during the last decades, and Merton and Scholes received the Nobel Prize in economics in 1997 for their research (Black passed away in 1995). The amount of money involved today is reported in Table 1.1, which can be compared to the US GDP which was about 15000 billion US dollar (USD) in 2012.

Companies use these new products to protect themselves against changes in interest rates, foreign exchange rates and commodities prices. Mutual funds and pension funds use them to protect their stocks and bond investments. Major banks, brokerage firms and insurance companies write them for customers, while inventing such exotic names as caps, collars and swaptions.

The complexity of the vast range of new financial products that are continuously being introduced on the financial markets and the inherent uncertainty associated with stock prices, interest rates and foreign exchange rates have given rise to the emergence of a new scientific field: mathematical finance. This area of research encompasses the theory of stochastic processes (stochastic differential equations), partial differential equations, functional analysis and, last but not least, economics and finance.

Table 1.1: Notional and market value of outstanding OTC contracts in billions in US dollars December 2012. Data from Bank for International Settlements.

In contrast to many other books on mathematical finance, this course will also cover the modern theory of financial derivatives from an empirical point of view. Thus identification and estimation theory play an integral part of the course. The reader should be able to utilize these methods in combination with methods in operations research for risk assessment, risk management and optimal portfolio selection. This combination of mathematical finance, statistics and operations research form the foundation of the science of financial engineering.

The ambitious and broad scope of the book can only be obtained at the expense of depth of coverage, so proofs and mathematical considerations of purely technical interest will be omitted for brevity. Nevertheless, it is our aim to bring the reader up to a level of understanding and managing empirical research in this area.

1.1 Introduction to financial derivatives

Let us introduce the merits of one of the most important financial derivatives, the European call option, by considering a fairly simple transaction between two companies. Assume that the Danish company IDEA A/S today (t = 0) orders 1 000 pieces of furniture from the American company Bench Inc. to be delivered in exactly 6 months’ time (t = T). They have agreed upon a price of 500 000 USD, which should be paid upon delivery. We assume that the exchange rate today is 6 DKK/USD.

Due to the 6 months between the order and delivery date, IDEA A/S faces a serious risk regarding changes in the exchange rate between DKK and USD. Today (t = 0) they are unable to determine the exchange rate upon delivery (t = T) and hence the amount in DKK they are going to pay upon delivery is random. In the very unlikely case that the exchange rate should remain the same, they should pay 3 000 000 DKK, but if the exchange rate should go up to, say, 6.50 DKK/USD they will have to pay 3 250 000 DKK. From IDEA’s point of view there is, of course, no problem associated with a possible lower exchange rate. Thus IDEA is exposed to an asymmetrical risk. There are at least three different ways of eliminating this risk.

I: The most naive approach would be to buy 500 000 USD today (t = 0) at the known exchange rate 6 DKK/USD, which would enable IDEA to avoid exposing themselves to a higher exchange rate at time t = T. This approach eliminates the risk, but there are a couple of noticeable drawbacks. First of all, a large amount of capital is tied up during the next 6 months, which might be put to more profitable uses. Second, they have lost the opportunity to take advantage of a lower exchange rate at time t = T.

II: A slightly more sophisticated approach would be to negotiate a forward contract with a participant on the foreign exchange (FX) markets that enables IDEA to buy 500 000 USD at time t = T at an exchange rate K determined at time t = 0. The exchange rate K (unit DKK/USD) is called the strike price and it is clearly specified in the contract.

No transactions are made at t = 0 and the amount to be paid at time t = T is fixed at K × 500 000 DKK. As the writer of the contract is obliged to sell the predetermined amount of USD at the predetermined strike price at time t = T, no matter what the exchange rate will be, this contract represents a value, and it is possible to trade it as any commodity for 0 < t ≤ T.

Let us say that a contract with a strike price of K = 6.2 DKK/USD has been negotiated, and that IDEA is obliged to pay 3 100 000 DKK in 6 months’ time to the writer of the contract. If the exchange rate ST at time t = T is 6.5 DKK/USD, IDEA may congratulate themselves by having (indirectly) earned 150 000 DKK, because they would have been forced to pay 3 250 000 DKK if they had not written the contract. On the other hand, should the exchange rate drop to, say, 5.9 DKK/USD, they lose 150 000 DKK.

Again, IDEA has eliminated the risk of a higher exchange rate, but they are still unable to take advantage of a lower exchange rate.

III: Thus the question remains: Is it possible to write a contract that allows the holder of the contract (IDEA) to eliminate the risk and at the same time take advantage of a possible lower exchange rate? The answer is yes, and such a contract is called a European call option.

Definition 1.1 (European call option). A European call option on the amount of Y USD with exercise date T and strike or exercise price K is a contract, signed at time t = 0, that

gives the holder of the contract the right to buy an amount Y dollars at the exchange rate K [DKK/USD] at time t = T, and

allows the holder of the contract not to buy any dollars if the holder of the contract does not want to.

Options of this type (and a number of variations hereof) are traded on the international financial marke...