This is a test

- 228 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Making Sense of Pensions and Retirement

Book details

Book preview

Table of contents

Citations

About This Book

The NHS pension scheme is the largest in Europe. This guide explains how it works and how to maximize its benefits and avoid its pitfalls. The book covers: recent changes to the scheme including new provisions for early retirement; personal pensions, financial planning and investment options; advice on preparing for retirement and working after retirement; state benefits; and health and leisure in retirement. It is written for all NHS staff and should be of particular value to GPs and salaried doctors.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Making Sense of Pensions and Retirement by John Lindsay, Norman Ellis in PDF and/or ePUB format, as well as other popular books in Medicine & Public Health, Administration & Care. We have over one million books available in our catalogue for you to explore.

Information

1

An outline of the NHS pension scheme

Who can join? • Contributing to the scheme • The earnings cap • Scheme benefits • Protection against inflation: index-linked pensions • Maximum service allowable • Retirement • When is the best time of year to retire? • Payment of pensions and lump sums • Questions, problems and complaints

Who can join?

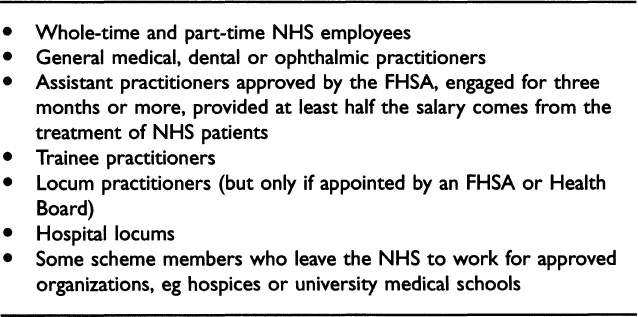

Membership of the NHS pension scheme is voluntary and is open to both NHS employees (including NHS Trust employees) and NHS practitioners, aged between 16 and 70 (Table 1.1). Prior to 6 April 1988, membership of the scheme was compulsory for eligible staff. The term ‘practitioner’ refers to independent contractors – GPs, dentists and ophthalmic practitioners – in contract with an FHSA or Health Board.

Table 1.1 Who is eligible to join the NHS pension scheme?

Doctors and nurses employed by agencies cannot join the scheme.

Part-time staff

Part-time doctors have always been able to join the scheme. Other part-timers were not able to join until 1973. From 1973, they could join if working at least half time, and from April 1991 all part-timers have been able to join irrespective of the number of hours worked.

GP practice staff

GP practice staff cannot join the scheme at present. However, the government has agreed in principle that they should be permitted to join. The Health Department is surveying practice staffing arrangements to estimate the likely costs of the proposed change. The Department is also discussing with the BMA’s General Medical Services Committee the financial and administrative arrangements for admitting such a large and diverse group of staff into the scheme. It seems unlikely that practice staff will join the scheme before 1996, if the government confirms that they can join.

Contributing to the scheme

Employees and practitioners contribute 6% of their salary (5% for manual workers), and this payment is subject to tax relief. The net cost to employees is further reduced because they are allowed a reduced rate of national insurance contribution. The overall effect of these two factors brings the real cost to an employee down from 6% to about 3% of salary. The employer contributes 4% of salary (5.5% in Scotland). In addition, the government meets the cost of increasing pensions each year in line with inflation.

How are these contribution rates set?

The contribution rates of occupational pension schemes need to be set at a level sufficient to pay for the benefits of the scheme. With most schemes, contributions are invested and the investment fund is used to pay benefits. The contribution rate is therefore adjusted up or down, depending upon the success of the investment fund.

However, the NHS pension scheme is only ‘notionally’ funded in this way. The contributions are not actually invested, but the Government Actuary’s Department (GAD) makes a notional assessment of what the investment return would have been had contributions been invested. This assessment enables GAD to recommend a level of contributions sufficient to pay for scheme benefits. The employee then pays 6% of salary, and the employer pays the balance. The employer’s share therefore fluctuates up or down, depending upon the success of the ‘notional’ investment fund.

The earnings cap

Since I June, 1989, new entrants to the NHS pension scheme (and all other occupational schemes) have been subject to an earnings cap. This means that they cannot contribute to or take benefits from the scheme in respect of income above a certain level. From April 1995, the earnings cap is £78 600. The government may increase it each year in line with inflation, but this is not guaranteed. Anyone joining the NHS for the first time after I June 1989 is subject to the earnings cap, as are any scheme members who preserved their pension benefits prior to that date and subsequently return to the NHS.

Anyone transferring between different pension schemes after I June 1989 will be caught by the cap, except for ex-NHS employees who transferred to the Universities Superannuation Scheme before I June 1989; they are not capped if they returned to the NHS scheme prior to I June 1994.

Members transferring from NHS to Trust employment will not be capped if their NHS employment commenced before I June 1989. Transfers between the NHS pension schemes in England and Wales, Scotland and Northern Ireland are not affected by the earnings cap.

Scheme benefits

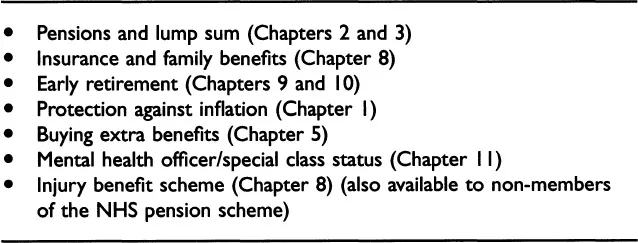

The benefits available under the NHS pension scheme are described in later chapters (Table 1.2).

Table 1.2 NHS pension scheme benefits

Protection against inflation: index-linked pensions

NHS pensions are increased in April each year in line with the movement in the retail prices index during a 12-month period ending the previous September. For those retiring during the 12 months preceding the April increase, the increase received will be in proportion to the number of months that have elapsed since retirement.

If an NHS pension is drawn before the age of 55, it is not increased until 55, at which point it is increased to cover the inflation that has occurred since the date when it was first drawn. However, ill-health, injury benefit and dependants’ (spouses’ and children’s) pensions are increased annually, irrespective of the recipient’s age.

Maximum service allowable

Scheme members can achieve a total of 40 years’ reckonable service by the age of 60 and 45 years by the age of 65 (reckonable service is calendar year service, whether whole time or part time). Contributions can continue to be paid beyond the age of 65 up to the age of 70, providing that the maximum service limit of 45 years has not been reached. Special arrangements apply to members with mental health officer/special class status (see Chapter 11).

Retirement

Normal retirement age in the NHS pension scheme is 60; at this age, any scheme member may retire and claim benefits. However, it is possible to retire before the age of 60 under the following arrangements:

- voluntary early retirement (Chapter 10)

- ill-health retirement (Chapter 8)

- redundancy, organizational change, in the interests of the service or ‘achieving a balance’ (Chapter 9)

- mental health officer/special class status (Chapter 11).

Anyone still in service at age 70 must retire and take the pension and lump sum.

Scheme members are asked to give three months’ notice of retirement; they should apply for retirement on a form available from employers and FHSAs/Health Boards and should take care to give at least the required amount of notice (see below).

When is the best time of year to retire?

Anyone contemplating retirement should consider the likely relative rates of salary increase and inflation over the following 12 months before choosing a retirement date. For example, if inflation is at a high level and the government has introduced a pay freeze, it would be advisable to retire sooner rather than later. This is because the pension in payment would be increased in line with inflation, whereas the salary paid in employment would not be increased and consequently would not generate a much larger pension. If the opposite circumstances prevail, ie high salary increases being awarded at a time of low inflation, it may be advisable to defer retirement.

Traditionally, salary increases and inflation normally move at about the same rate, and therefore the precise timing of the retirement date within a period of 12 months is not particularly significant. However, individual circumstances need to be taken into account, particularly since pensionable salary for employees is based on the best of the last three years of service. For instance, care should be taken when negotiating clinical director and medical director contracts and in assessing the effect of domiciliary visit fees (see Chapter 2).

If possible, NHS practitioners should retire at the beginning of a month rather than the end, because working for even one day attracts full dynamizing for that month (Chapter 3).

Payment of pensions and lump sums

The Paymaster General’s Office (PGO) (see Appendix A) is responsible for paying pension benefits. The lump sum is entirely free of tax. Pensions are taxable and the PGO will deduct any income tax due.

The lump sum should be paid on the day following the retirement date.

Pensions are paid on the same day each month. The precise day will be chosen by the PGO to ensure an even spread of the huge number of monthly payments it makes (any arrears will of course be paid).

Box 1.1 Overpayments need to be repaid

Dr G’s pension was a little better than expected. Unfortunately, it was also calculated wrongly, and the Paymaster General’s Office took five years to notice. They had been paying Dr G £ 1200 per annum too much for this period.

To soften the blow just a little, it was possible to persuade the PGO to allow the doctor to repay the excess over the same period that it had been wrongly paid, ie five years.

From the BMA’s files

It is important to give at least the required three months’ notice of retirement to ensure that benefits are paid on time. If the required notice has been given, and the lump sum is nevertheless paid late, it may be possible to obtain an ex gratia payment by way of compensation. This would be based on the interest lost in not having being able to invest the lump sum for the period involved. It is more difficult to obtain compensation for late payment of pension, since it is assumed that because this would not have been invested if paid on time, no interest would have been lost. Any claim for compensation should be made to the relevant pensions agency (see Appendix A) in ...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Contents

- Contributor

- Foreword

- Introduction

- Authors’ Note

- 1 An Outline of the NHS Pension Scheme

- 2 NHS Employees: Their Pension and Lump Sum

- 3 NHS Practitioners: Their Pension and Lump Sum

- 4 Practitioners: Partnerships, Retirement and other Issues

- 5 Financial Planning for Retirement: the NHS Pension Scheme

- 6 Financial Planning for Retirement: Personal Pensions

- 7 Financial Planning for Retirement: Investments other than Pensions

- 8 The NHS Pension Scheme: Insurance and Family Benefits

- 9 Early Retirement

- 10 Voluntary Early Retirement

- 11 Mental Health Officer/Special Class Status

- 12 Leaving or Joining the NHS Pension Scheme: Transfers and other Options

- 13 Three Views on Investing the NHS Pension Scheme Lump Sum

- 14 Other Public Sector Pension Schemes

- 15 Working After Retirement

- 16 Changes to the NHS Pension Scheme

- 17 State Benefits on Retirement

- 18 Pensions in a Changing Society

- 19 Health

- 20 Leisure in Retirement

- 21 Preparing for Retirement

- Appendix A Organizations Active in the World of Pensions and Retirement

- Appendix B Early Retirement Factors

- Index