![]()

1 Introduction

What is this book all about?

Strategic thinking and planning should move from being 80% static and 20% Dynamic to 20% Static and 80% Dynamic.

– Tony G.

Every book needs a rationale d’etre. This one has one in spades.

It was more than 35 years ago that I first became gripped by the concept of “Corporate Planning,” conceived of as a theory of corporate development and change that would steer a more complex business through new and uncharted waters. New concepts at that time were things like life cycle analysis, environmental analysis and capability (strengths and weaknesses) analysis.

At that time I was in my first “real” job in BP Group Internal Audit, at a time when BP basked in two massive fountains of oil from Alaska and the North Sea. As a newly qualified Chartered Accountant I had signed a two year deal mixing work and an endless sequence of serial package holidays that took me to five-star hotels globally. In those comfortable days I used to read a new book on Corporate Planning at least every other week!

Planning appealed to me as a way of overviewing a business, especially as I regarded the financial training that I had received. It did seem to me that the Corporate Planning discipline was far more interesting than following a purely financial career. But whilst the new discipline was for sure more holistic, it was framed in a more or less steady-state universe, maybe with the exception of the scenario storytelling that was being done by Shell.

But looking back at these first generation planning systems, particularly those of one of the founding gurus of Corporate Planning, Igor Ansoff himself, the models were very static. “SWOT” (strengths and weaknesses, opportunities and threats) analysis was portrayed as a snapshot, or X-ray picture of the current situation, not an evolving capability. “PEST” (political, economic, social and technological) analysis, although naturally a more dynamic tool for charting organizational shifts, was used much the same.

By looking at the historical context we can better understand how the strategy models of today are by and large, dynamically stillborn. Equally, if we look at the business context of that time, with the exception of the economic cycle and balance of payments crises the UK (and most of the EU) was in during generally stable economic growth, competition never quite had the cutting edge of today, which is often ferocious. Looking back, one can only think one thing: How things change!

Whilst contemporary strategy claims to deal with “99% of known strategic germs” about today, I feel it is stuck between its original first generation model, or “paradigm”, and the much more agile kinds of processes that characterise the present business world. This is manifest in:

- the fact that almost universally the tools in regular use by managers have only static application;

- the fact that there were very few tools to capture the dynamics;

- the fact that managers primarily construct the future through projections from the present and the past; sometimes I call that “T-1 thinking”;

- the fact that, with exceptions, the “environment” is seen as bit of a nuisance in planning – addressed by either static PEST analysis, or if you get really lucky, with Porter’s Five Competitive Forces – but again from the present perspective rather than future.

In addition, probably 90% of plans are really very average in their thinking and do little to add any innovative or “bendy” contribution to the business model and to the economic performance of the business.

I feel that many plans are akin to having a plan for Christmas which is “get a Christmas tree, some decorations, roast a turkey and consume a lot of alcohol and food and invite family around.” That is so very average. We need a lot more from strategic planning! What about getting the best value for money in the market for the bird, some Italian sparkling wine that outdoes champagne at half the price, and deflecting your mother-in-law from making negative comments about the newly fitted kitchen? A strategic plan worth its stuffing needs to be clever enough to handle dysfunctional behaviours, random upsets and sudden new opportunities arriving (let’s abandon the burnt goose and just go out to the pub!).

In this chapter I look at:

- Deficiencies in the traditional models

- Dynamic competitive strategy from previous theory

- How is this book different?

- The Evolution of my thinking

- Here’s what you will get out of this book

- Who is it aimed at?

- Content of the book

- Chapter summary of key points.

Important note on style

I write in a lively way, as if we were in the same room. I don’t do boring. I use little twists and my unusual humour to carry you with me. It will not just be reading a book; it will be an experience – and it will stick!

Deficiencies in the traditional models

We now look at a number of the more popular models in traditional strategic planning. This will show that these models are at least 80% static but can be made far more dynamic. These include:

- SWOT analysis

- PEST analysis

- Porter’s Five Competitive Forces

- “GE” (General Electric) Grid

- Competitive positioning.

“How is a threat an opportunity and the weakness a potential strength?”

–Tony G

SWOT analysis

First, let’s take “SWOT” analysis:

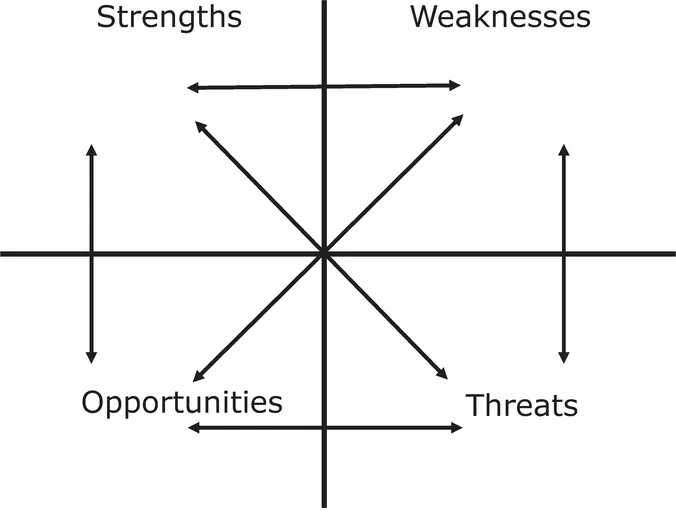

“SWOT” (or Strengths and Weaknesses, Opportunities and Threats) analysis is a quick and dirty brain dump of the things that determine a company’s position internally and externally. Typically a SWOT picture (Figure 1.1) is drawn as four quadrants on a page. “Strengths” include the things that the company is good at, and the test should be only when it is better than the average competitor. Weaknesses are the corollary of this. Typically we would include things like brand, technology, leadership and management, unit costs, customer service and innovation.

“Opportunities” would be things like new markets, products, channels, alliances and technologies. “Threats” would arise from competitors, entrants, regulations, economic uncertainty, substitutes, technology and the internet, market maturity and commoditisation.

Strengths and weaknesses, opportunities and threats, are all likely to shift over time. For instance, Tesco PLC, the international supermarket retailer, boasted superior customer service from around 1997 through to 2007, then started to slip. This relative decline accelerated from 2010 to around 2014 to a point where it would be fair to say it had dropped from “strong” to “weak” (see more on Tesco in Chapter 7).

A new CEO, David Lewis, was then brought in in October 2014 from the FMCG Company Unilever to turn it around. Even so, there seemed to still be huge issues in turning the company around, which had lost its direction in many ways. By late 2016 there were some marked improvements. By that point, for example, Tesco was now gaining relative market share and not losing it (an important but not the sole indicator). David Lewis’s magic was beginning to work, which is not bad after just two years. The point here is that a strong position (and the various strengths within that) can go from being really strong to weak, and then back to a bit stronger in only around eight years: a true, very dynamic rollercoaster. (See more on Tesco in Chapter 7).

External opportunities and threats are even more volatile. Picture January 2016. Except for a small number of commentators, “Brexit” was never going to happen. But after the referendum, where that was all upset, by January 2017 the battle was really heating up to try to get the best possible deal for the UK both outside the EU and with the EU without being saddled with the burdens of Brussels and what had been seen to be an open border for migrant workers.

A relatively simple way of making a SWOT analysis more dynamic is to identify the interrelationships within the dour elements of the SWOT, in particular where:

- a strength is offset by a weakness, or a weakness is compensated for by a strength

- there is a strength which makes it easier to exploit an opportunity

- there is a strength which makes it easier to deal with a threat

- there is a weakness making it harder to exploit an opportunity

- there is a weakness making it more vulnerable to a threat

- there is a threat that undermines an opportunity.

These interdependencies are shown as arrows on Figure 1.2

Figure 1.2 SWOT Analysis – with Cross-Impact Analysis

PEST factors

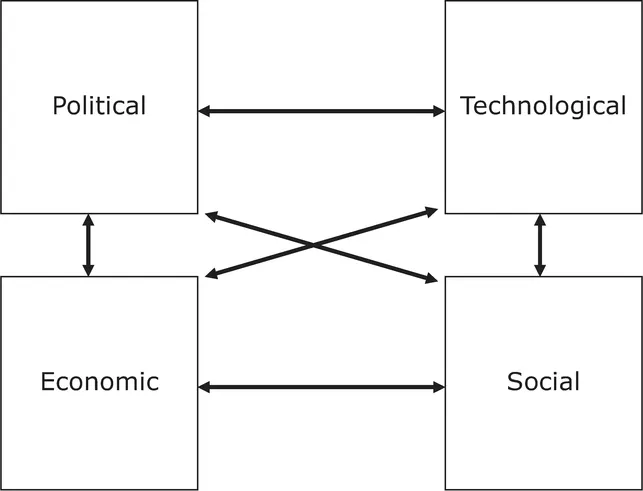

PEST factors are the Political, the Economic, the Social, and the Technological factors that shape the industry environment (Figure 1.3). Again, this technique as generally practised is no more than a listing of the factors that people see around them. This is a bit like the experience of flying when you look out of the window sideways from the plane and see some brightness and clouds. But this sideways out picture could be horrendously misleading. For all you know you might be hurtling towards a terrible storm, a mountain or into a new dimension!

At minimum, the PEST should be done as a time series, say of short term, medium and longer term – if you choose to do it like a series of black and white stills. But it is always better if you can stretch to do it more as a cine film with a proper, dynamic flow featuring a chain of events. For example:

The complacency of the conservative party and the disinterest of the labour party in the UK (political) in 2016 allowed Brexit champions to mobilise the fear of working class and provincial families of inward worker migration and the threat to jobs (social and economic) to result in a finely balanced and surprising “vote out” for Brexit…

This threatens foreign interests in investing in sterling resulting in an effective devaluation (economic factor), a surge in share prices (inflating the value of UK corporate overseas earnings-economic factor) and thus paradoxically stabilises the economy. This dampens the fear amongst the electorate that Brexit will be very damaging (social factor), so that any unexpected turn down in the economy from a “hard Brexit” will then result in a big shock (social and economic factors). The stock market might then crash triggered by a wave of automatic selling of shares (technological factor).

Notice here a systemic picture over two to three periods of time has been created for a dynamic PEST with an interlinked chain of events. How many “PESTs” have you seen with such systemic qualities, if any?

Another way of making it more dynamic is – just like we showed with the SWOT analysis earlier – to look at the interactions of the forces with each other. So we should look at how:

- the political environment shapes the economic (for example with the uncertainty that Brexit caused for the UK economy);

- the economic environment shapes the political environment (so a recession may make voters believe the government’s management of the economy is bad and threaten re-election);

- the political environment may impact on the social environment (for example, Brexit may encourage migrant workers to leave, actually shrinking the population);

- the social environment may influence the political (through shifts in attitudes towards politicians overly overtly and obviously pursuing their self-interests cause political alienation causing abstinence from voting, and thus greater political volatility);

- technological factors impacting on the economic (for example through the threat of higher unemployment and major structural chang...