eBook - ePub

American Government

Conflict, Compromise, And Citizenship

Christopher J Bosso,John Portz,Michael Tolley

This is a test

- 592 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

American Government

Conflict, Compromise, And Citizenship

Christopher J Bosso,John Portz,Michael Tolley

Book details

Book preview

Table of contents

Citations

About This Book

"Woven through this text is the unifying theme that American politics represents "conflict and compromise, " in direct opposition to the increasingly commonly held view that all politics is dirty and all politicians are crooks. By presenting a balance of essential factual content with a broad assessment of system dynamics and their policy effects, the authors provide an accessible yet sophisticated overview of American politics. Features:

Coherent theme of "conflict versus compromise" in the American political system Consistent examination of American history for institutional development Emphasis on the positive role of citizenship in shaping good government Each chapter is accompanied by primary source readings Concise 12 chapter format"

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access American Government by Christopher J Bosso,John Portz,Michael Tolley in PDF and/or ePUB format, as well as other popular books in Politics & International Relations & Politics. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER 1

AMERICAN POLITICS

Transforming Conflict into Compromise

EVERYDAY POLITICS

THE NATURE OF POLITICS

CONFLICT

COMPROMISE

POWER AND AUTHORITY

GOVERNMENT

THE CONTEXT OF AMERICAN POLITICS

THE SIZE OF THE NATION

PHYSICAL DIVERSITY

RESOURCES

REGIONALISM

A DIVERSE POPULATION

SOCIAL AND ECONOMIC CONDITIONS

THE AMERICAN POLITICAL CULTURE

INDIVIDUAL LIBERTY

FEAR OF GOVERNMENT POWER

FREE MARKETS AND PRIVATE PROPERTY

POLITICAL EQUALITY

THE RULE OF LAW

CIVIC DUTY

REASON AND PROGRESS

FAITH

NATIONALISM

DEMOCRACY

ON BEING “AMERICAN”

OBJECTIVES

- ❑ To understand that conflict is natural in human society and that “politics” is about how a group of people tries to transform conflicts into mutually acceptable compromises

- ❑ To examine the societal contexts that shape American politics: the size of the nation, its physical diversity, the diversity of its population, social and economic changes, the impacts of new technologies, and broad trends occurring throughout the world

- ❑ To understand the core values that define the American political culture and how these values affect the ways in which Americans look at the world

A typical older school building. Many of the nation’s schools were constructed decades ago, and today need expensive reconstruction or replacement to meet the demands of today’s teaching methods and educational technologies, such as the Web. To do this requires a lot of money. Who pays is a political question.

In 1993 the Supreme Court of the State of New Hampshire ruled that the state has a legal duty to educate its children. The ruling came in response to a lawsuit, brought by over two dozen of the poorest school districts in the state, charging that New Hampshire’s almost exclusive use of local property taxes to finance public education prevented these districts from providing their children with the “adequate” level of education required by the state constitution. The court agreed and ordered state lawmakers to come up with a new way to pay for public education.

Few issues are more important to average Americans than public education. The United States has a long and proud tradition of providing free public education for everyone regardless of income, race, ethnicity, or religion. In this respect, the public school is an important symbol of American democratic values as well as a vehicle for ensuring economic well-being and social mobility for all Americans.

Thus, it is never a minor issue when parents complain about the quality of public schools. Almost every generation of parents seems to criticize the skill level of teachers, the adequacy of the curriculum, and the availability of special programs such as music, art, or even sports. These concerns are magnified when parents compare the quality of their children’s schools to those in neighboring communities. Some schools offer a lengthy list of optional courses, small class sizes, computer labs, and extensive extracurricular activities; others seem to offer only a basic curriculum with large class sizes and few after-school events. These disparities usually stem from the different levels of financial support the taxpayers in the districts are able or willing to provide. Parents in the less well funded school districts get upset by these disparities, particularly if they stem from the simple fact that some communities are more affluent than others. Parents contact their local, state, and federal representatives seeking what they see as a more equitable distribution of financial support. They may even go to court to force their lawmakers to act.

The conflict concerns a key question: How should we fund our public schools? Today approximately 90 percent of the funding for the typical American public school comes from state and local governments, and most is in the form of local property taxes. This is the source of the funding disparity between communities and the basic conflict in New Hampshire. A town’s property tax fund is based on the value of homes, office buildings, factories, and other commercial property in a community. A community with expensive homes and a healthy commercial base can spend more on its schools. One with less-valuable homes and scant commercial development has a far smaller base from which to generate funds for schools.

Let’s go back to New Hampshire. In 1993 residents of Allenstown paid a property tax rate of about $20 per $1,000 of the value of their property. That is, someone with a house valued at $100,000 paid $2,000 in property taxes. This is a very high property tax rate compared to most other communities in the nation. At the same time the residents of Newington paid a tax rate of only $2 per $1,000, so the taxes on a $100,000 house in that town came to only $200. Yet Allenstown, a poorer residential area, could only provide $3,400 per pupil. Newington, a more affluent town with a strong commercial base, could afford more than $10,000 per pupil despite having a far lower tax rate. As a result, Newington’s schools were much better equipped.1

This kind of gap caused a great deal of conflict among New Hampshire residents and led to the lawsuit that eventually overturned the way schools were funded. New Hampshire was only one of dozens of states in which this conflict arose. Today getting a good education is far more important to a person’s economic future than it might have been a generation or two ago, when many high school graduates took high-paying jobs in factories rather than go to college. Parents know that the quality of public schools will directly affect their children’s ability to compete for the best career options. They wanted more financial support from the state to make up for the gaps between the richer and poorer districts.

States have responded to these pressures by developing funding formulas to allocate money to school districts across the state, but these responses have provoked their own conflicts. If some parents are concerned about the inequities that result from the property tax, others argue just as strongly that the property tax should remain the primary source of school funding. Why, they argue, should some communities be penalized just because they have high property values and can afford more school funding? Still others argue that because the state has an overall legal responsibility for education, all school districts, regardless of their property values, should receive state support. Nevertheless, almost no one wants to raise state taxes to cover these expenses.

State lawmakers usually try to put together some kind of compromise solution to address as many of these competing demands as possible. In some states, such as Massachusetts, the state government will provide additional state money, generated by either state income taxes or sales taxes, to bring communities with lower property values up to some minimum level of support. Other states, such as Georgia, use state lottery proceeds to provide supplemental funding. Wealthier communities naturally will get less state funding, but sometimes states will provide those school districts with a minimum level of support based simply on the number of students in the district. Such formulas ensure that every district gets at least some state support—a strategy designed largely to reduce opposition to any state funding for poorer areas.

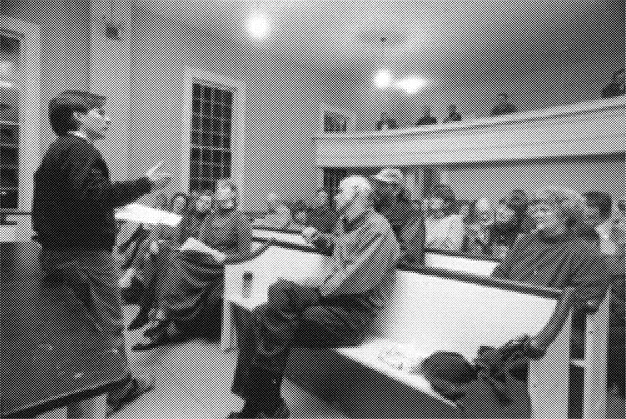

A resident speaks at the annual Weybridge, Vermont, town meeting. Such “direct democracy” is increasingly rare, even in New England, as town populations grow larger and the demands on government become more complex. In many cases, town meetings are replaced by elected town councils and mayors.

However, some states, such as Vermont, have gone even further and created programs that openly transfer money raised in a wealthy community to schools in poorer ones. Not surprisingly, such open transfers are hotly opposed by residents in communities where property values are high. On one side is a local district’s right to finance the level of education its residents want to provide if they can afford it. On the other side is the state’s responsibility to ensure that all of its residents, rich or poor, can enjoy comparable levels of educational quality.

What would you do? This isn’t an easy question to answer, as we will see throughout this text. How to resolve these kinds of conflicts and how to balance competing needs are political matters. They involve efforts by concerned citizens and government officials to resolve a problem p...

Table of contents

- Cover

- Half Title

- Title

- Dedication

- Contents

- List of Tables and Illustrations

- Preface with Acknowledgments

- 1 American Politics: Transforming Conflict into Compromise

- 2 The Constitution as a Political Document

- 3 Federalism: One Nation, Many Governments

- 4 Civil Rights and Liberties

- 5 Public Values, Public Opinion, and Mass Media

- 6 Political Parties and Elections

- 7 Interest Groups, Conflict, and Power

- 8 Congress

- 9 The Presidency

- 10 The Federal Bureaucracy

- 11 The Judiciary

- 12 Challenges for American Democracy

- Appendix

- Index