![]()

1 Spatial Planning and Fiscal Impact Analysis Method

The Spatial Planning and Fiscal Impact Analysis Method is a different approach to measuring the impact of land development, particularly with regard to fiscal impact, compared to other methods. It recognizes that all revenues and expenditures are spatially related. It takes advantage of readily available data that reflect the flows of revenues and expenditures in a city, using the tools of Geographic Information Systems (GIS). The method results in a detailed planning database at the parcel level to be able to analyze existing and proposed land use. The time and effort for the method are more extensive than traditional fiscal impact, but the resulting database can be considered an investment in “information infrastructure”.

I Definitions

The Spatial Planning and Fiscal Impact Analysis Method (SPFIA) is defined as:

The determination of the direct, current, city costs and revenues associated with all types of land use in a city that can be used to project the fiscal impact of new development that is taking place or estimate the benefits of redevelopment.

This differs somewhat from the definition stated in the book The Fiscal Impact Handbook by Burchell and Listokin, published in 1978 (p. 1): “The projection of the direct, current, city costs and revenues associated with residential or nonresidential growth to the local jurisdiction(s) in which the growth is taking place.”

The difference is that the old definition assumes that one knows the impacts of land uses and is focused on projections. The Spatial Method is based on the premise that one must first evaluate the impact of detailed land use categories in order to make accurate projections. Many methods treat residential and non-residential development as blocks of land use, assuming that they are homogeneous in their characteristics and impacts.

Here is a perfect example as to why that assumption is wrong. In the City of Bloomington, Illinois, in 2013, it was found that a single large office development had a surplus of $1,987,928, while a large discount department store had a deficit of $811,056. Both uses were classified as commercial. Making projections based on gross estimates of the average impact of commercial development would not be very meaningful, and even misleading.

II Conceptual Basis

The Spatial Method is based on the premise that nearly all revenue a city collects is based on geographically distributed factors, such as the value of land parcels that generate property taxes, or population and employment that generate sales taxes. Nearly all expenditures are delivered to places in the city based on need or demands, such as police calls, or the need for access by local public roads. It is difficult to think of anything a city does that is not based on geography. The Spatial Method uses the land parcel as the smallest unit of geography. Land parcels can be categorized as to land use, and summaries by land use can be used to indicate the fiscal impact of each type.

If one had the ideal transaction processing system for city finances that was able to indicate from where each dollar of revenue is derived or where each dollar of expenditure is spent, one could easily determine the fiscal impact of every part of the city. However, this type of system does not exist and would be prohibitively expensive to develop.

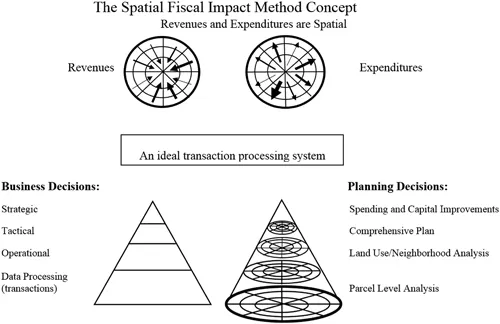

Figure 1.1 shows graphically the concepts behind the Spatial Method, adapted from Tomaselli (1991, pp. 53–54).

Figure 1.1 The Spatial Fiscal Impact Analysis Concept.

First, revenues and expenditures are spatially distributed. Here, parcels are conceptually represented as sections of the city, with city government in the center. Revenues come in from parcels, whether it be from the assessed values and property taxes from population or employment in the form of charges for services, or from income or sales taxes. Expenditures go out to parcels based on police and fire calls for service, local street maintenance or other general government activities.

In the lower left of the diagram, a typical management information system is shown, whether it be for businesses or cities, in the form of a triangle. At the bottom are the day-to-day transactions. These get summarized to help make operational decisions and then in turn get further summarized to make tactical decisions. At the top, there are the strategic decisions of a business or a city.

The ideal transaction processing system for a city to measure fiscal impact would convert the triangle to a cone. At the bottom are the parcel-level transactions of revenue in and expenditures out. The parcel-level impacts can be summarized by land use and/or neighborhood to help with operational decisions. Further summarizing the data yields tactical decisions, such as the impact of the comprehensive plan. At the top are strategic decisions, which the city would make to decide on spending and capital improvement decisions that support the comprehensive plan.

The Spatial Method of Fiscal Impact Analysis is based on these concepts, and the best way to evaluate the fiscal impact of land development is to try to model what such an ideal system might produce. Modeling is done by identifying those available and measurable factors that are indicators of the distribution of revenues and expenditures.

III A Parcel-Level Planning Database

The Spatial Method has its foundation built upon a parcel-level planning database. Parcels are the lowest common denominator for land use, with the exception of mixed-use parcels. Therefore, once the data is compiled by parcel, it can all be summarized by land use as well as many other cross-tabulation factors.

Parcels are the basic data unit for analysis, but not because one necessarily wants to know the impact of each and every parcel. A parcel may be a single family, but it may be different than other single-family parcels. It may be owner or renter occupied. It may have a brand-new house or a house dating back to the turn of the century. It may have only two bedrooms or five bedrooms. It may be only 800 square feet or 4,000 square feet. These parcel-building attributes provide the basis for analyzing groups of parcels by land use classification, valuation, neighborhood or year built. The reason the analysis is done at the parcel level is that one can capture all of the variations among the parcels that make up the land use categories instead of guessing.

The d...