![]()

PART I

Economics

A pluralistic definition

Part I explores several different definitions of what economics is and the different ways in which economists practice the social science of economics (economic methodology).

The first chapter, “What is economics?”, begins by describing why economic policy matters to the country and to every person. It begins by describing the debate over whether or not politicians should balance their budgets every year given the regular occurrence of recessions in the economy (downturns in which unemployment increases and business activity decreases). The chapter then offers 4 different definitions of economics: One offered by mainstream economists (who tend to advocate a capitalist market system with limited government intervention), one preferred by economists practicing progressive political economy (PPE, which includes Institutionalist, Social, Post-Keynesian, and Feminist economists who believe capitalism can and should be reformed), another from economists who engage in radical political economy (RPE—Marxists and others who believe capitalism is fatally flawed and should be replaced), and a broad definition of pluralistic economics that synthesizes the other definitions.

Chapter 1 then takes up methodology, or how economists attempt to “do” economics. This will give you an idea of what it means to be an economist from the various perspectives—the kind of things you study, what you look for, and how you construct knowledge about the economy. The chapter then goes through a series of short examples so that you can see different types of economic analysis in action when economists study consumer behavior, labor markets, and the business cycle. The chapter concludes by briefly laying out the different schools of economics that will be discussed in the book.

Chapter 2, “Opportunity costs and production possibilities curves”, takes up a simple mainstream economics concept, opportunity costs, and a simple economic model, the production possibilities curve (PPC). The PPC model is applied to several economic issues, including a treatment of defense spending and its impact on economic growth. The chapter concludes with a section on the potential limitations of economic models in capturing economic reality, building on the work of PPE and RPE economists.

![]()

The answer depends on who you ask

Each chapter in this book will begin with a list of learning goals. These goals will help you to focus on the key themes in the material.

1.0 Chapter 1 learning goals

After reading this chapter you should be able to:

• Explain in your own words the importance of economics for you and for society as a whole;

• Briefly contrast unregulated market capitalism with mixed market capitalism;

• Describe the difference between mainstream economics, progressive political economy (PPE), and radical political economy (RPE), using their different definitions of economics and their different methods;

• Explain and begin to apply the methods of mainstream, PPE, and RPE economists to economic issues; and,

• Understand how the 10 different schools of economics match up with conservative, moderate, liberal, and radical political approaches to the economy.

Note that there is a lot of material in this chapter. However, the topics in this chapter will become clearer and clearer as the book progresses, so do not feel like you need to get all the details down now. Instead, work to grasp the basic ideas and gain a general understanding of the material.

1.1 Why economics matters: Economic policy

Economics is a crucial subject that every educated voter and politician should understand. To show this, we begin with a brief example of how economic debates and a government’s economic policy can matter to us all. As we go through this book, it is especially important for you to try to understand all of the different views of the various schools of economic thought that we will be studying. Understanding their differences teaches us more about this subject than any other way we might study it. As you read through this first example, and as a general rule while going through this book, take the time to try to figure out the meaning of each part of each section, including the key terms that are used, what they mean, and how they work.

Let’s begin by taking a look at a government policy called austerity , where governments reduce or eliminate social programs like food stamps, unemployment insurance, and education in order to balance the government budget (they try to balance the incoming tax revenues with the spending amounts going out). Political leaders around the world regularly make the argument that the government should balance its budget each year, spending no more than it takes in via tax revenue. Such a policy is frequently justified by folksy expressions such as, “if households balance their checkbooks then the government should balance its budget.” And this policy is sometimes supported by a few “crank” economists who are, in general, opposed to any type of government intervention. (These economists can be labelled “cranks” because their views have been dismissed by the vast majority of the economics profession.) The problem is that an obsession with balancing the government budget each and every year could cause an economic disaster. Here is a brief explanation for why it is a bad idea to try and balance the government budget when a recession hits.

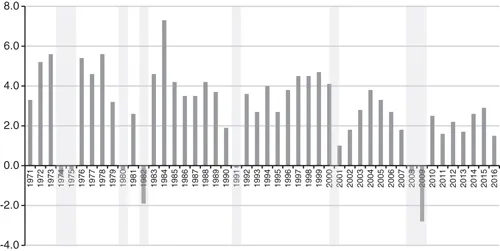

In the modern U.S., the economy tends to hit a major crisis, called a recession, every 8–10 years. As you can see in Figure 1.1, the U.S. experienced recessions beginning in 1980, 1990, 2000 and 2008, when the U.S. real gross domestic product, which is the total output of goods and services, declined. A recession is usually sparked by a major panic of some sort, such as the financial crisis of 2007–2008 when stock markets plunged, banks failed, and the global economy shrank considerably. After a financial market collapse, businesses and consumers become pessimistic. Businesses lay off workers and consumers stop spending. This reduces overall spending in the economy, which reduces the incomes of both workers and business owners.

FIGURE 1.1 U.S. real gross domestic product (GDP) growth in the modern era (1971–2016).

Reduced incomes in the economy mean that governments take in less tax revenue from income and sales taxes, and that the government will start running a large budget deficit because tax revenues will have fallen below the level of government spending. How should the government respond to the fact that a recession caused a decline in incomes, which caused a decline in tax revenues and an increase in the government deficit? If the government decides to balance the government budget right away, then it must either raise taxes or cut spending, an economic policy called austerity . But, and here is where the crucial knowledge of economics comes in, AUSTERITY WILL NOT SUCCEED IN BALANCING THE BUDGET IN A RECESSION!

Here is why: If a nation’s economy is in a recession, and if its government responds by raising taxes and cutting government spending, then the result will be that consumers and businesses have even less money to spend than before. Raising taxes directly reduces the money consumers and businesses have to spend. Reducing government spending directly reduces incomes: Teachers and other government personnel are laid off, construction firms see less revenue from building fewer roads and bridges, and so on. So cutting government spending and raising taxes directly reduces income and spending. Also, the decline in incomes and spending means additional reductions in tax revenues from income and sales taxes, making the government deficit worse! Thus, as any student of economics should know, trying to balance a government budget in a recession via austerity makes the recession worse, which makes the government deficit worse, not better.

Furthermore, even though it seems counterintuitive, governments can actually improve the deficit situation over the long term by spending more in a recession and running larger deficits! If the government cuts taxes and increases spending when a recession hits, which means running a larger budget deficit, it directly increases the incomes of consumers and the revenues of businesses. This leads consumers to spend more money and businesses to hire more people, raising incomes further, and increasing tax revenues in the process. By stimulating economic growth, government spending, and tax cuts can help to pay for themselves. (Before you go on, try reading back through the last two paragraphs until you understand the material. They contain a number of terms that we will deal with all semester.)

There are some major lessons to be learned from this example. First, what seems to be logical to most people (balancing one’s budget every year) can fly in the face of what economists have learned. For example, the best way to combat a recession is for the government to increase spending, cut taxes, and inject money into the banking system to promote lending. Even though this will increase government deficits in the short term, it will likely stimulate economic growth, which will actually reduce deficits over the long term once economic growth is restored. However, efforts to balance the government budget in a recession via austerity will not work. When a recession hits, incomes and spending fall, and that reduces tax revenues, leading to substantial government deficits. If the government responds by raising taxes and cutting spending (austerity), this makes a fragile economy even worse, slowing economic growth, reducing incomes and tax revenues further, resulting in even more deficits.

Second, our example demonstrates that economics is an uncertain field, and there is much disagreement between economists from the different economic schools of thought. This means that it is usually possible for politicians to find support for their ideas, no matter how bad those ideas are. Politicians frequently seize on bad ideas from crank economists because those ideas support their political perspective, even though most of the economics profession would consider those ideas to be ridiculous. This was certainly true of austerity policies, which have been promoted recently by a few crank economists but opposed by most economists.

Your job, as you read through this book, is to understand and evaluate the best ideas that economists have about how the economy works and what economic policies should be used in certain situations. However, we need to avoid making the mistake that some politicians do when they listen only to the economists who say what they want to hear. Instead, critically evaluate the ideas of all the economists you study, assess the available evidenc...