1

Strategic and background issues

KEY POINTS

- Impact of strategic property management on profitability

- Key issues in effective property management

- Analysing options for effective property decisions

- Getting the most form advisers and agents

- Instructing valuers and understanding valautions

- Accounting and tax issues for property decisions

This chapter covers the general issues affecting property at all stages of the process, starting with property strategy itself and then covering decision making, using advisers, valuation, accounting and tax. These are all important areas that the occupier is likely to encounter at some stage in the process, and possibly on a regular basis. The chapter provides the broad technical framework to enable the occupier to take an intelligent informed approach to these issues as they arise, and to know when an issue should be addressed in detail. The occupational process, starting with acquisition, and moving on through occupation to disposal, is discussed in detail in Chapters 2 to 5.

1.1

PROPERTY STRATEGY

Despite the importance of operational property for corporate profitability, it has not generally been given the attention it deserves by senior management. Property has traditionally been neglected in the boardroom and while there has been some improvement in recent years, many senior managers still fail to recognize the impact it can have on corporate profitability. As recently as 1992 Debenham Tewson Research reported the results of a survey of 100 major UK non-property companies, saying:

Only on rare occasions does property receive explicit treatment in corporate business plans. More often than not property is viewed as incidental

Property usually represents a business’s largest asset and second largest cost after payroll. Cost savings translate almost directly into profit and the impact of strategic property management on profitability and share value can be significant. The neglect of property by senior management cannot be explained by lack of importance; instead it probably relates to the perception that property costs are outside the control of the business, driven by the market. In the past, the lack of interest in property has largely been a consequence of complacency resulting from the inflationary environment in which rising property costs have been obscured, and of the dominant perception that rising property costs are an inevitable corollary of growth. In recent deflationary times, with all costs coming under closer scrutiny, property costs have been the subject of particular concern. The perception that they are fixed and uncontrollable has however persisted in many quarters and there is often still a failure to recognize the scope for occupancy cost management.

In fact there is significant scope to control occupancy cost. A few notable examples have demonstrated the potential for reducing cost. Rank Xerox, for example, recently cut their occupancy cost by 20% in a two-year period, by a combination of disposals and efficiency initiatives. Smaller companies may not have quite the same scope for economies, but significant savings can still be made and in a small company these can sometimes have a proportionately larger impact on profitability.

Cost is however only one side of the corporate property equation. Property is a factor of production and the role of corporate property is as a support service designed to satisfy the needs of the core business units. Corporate property strategy must satisfy both operational and financial demands. The dual objectives of cost control and performance are often in conflict and it is the role of the business manager to achieve the optimal balance between the two.

The issues involved in strategic corporate property management are complex and a detailed discussion is not within the scope of this book. Please refer to one of the specialist texts on the subject (Further Reading), such as Nourse (1989) or Silverman (1987). The next sections focus on some of the central issues, which business managers should consider as a starting point for developing property strategy.

1.1.1

The link with business strategy

A coordinated property strategy is essential to effective management of the portfolio in accordance with business needs. Even small companies with only one or two properties need to consider their business requirements and translate these into a defined strategy. At the most simple level this may be establishing a need to relocate, or to dispose of a surplus building. For larger organizations the options available are more numerous and the analysis and debate involved in agreeing the strategy are more complex.

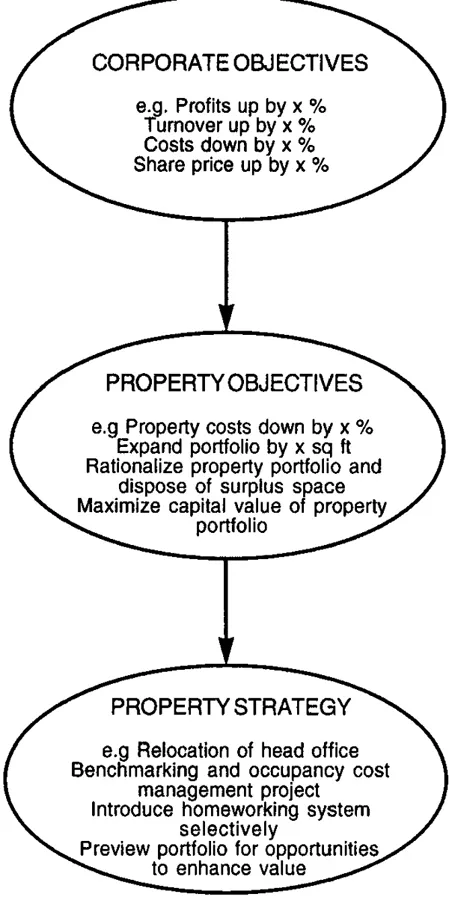

Figure 1.1 shows the process involved in developing property strategy.

The key here is the link between corporate and property objectives. The process of translating corporate objectives into a property strategy is crucial to ensuring that property decisions are driven by business strategy. The alternative is a haphazard approach to property decision making driven by individual business managers without explicit objectives or a coordinated strategy. The property strategy developed forms a strong foundation for specific property decisions, such as whether to buy or lease, choosing between different locations and properties and deciding whether to dispose of premises. These types of issue are discussed in detail in the following chapters. By articulating corporate objectives and translating these into property objectives and strategy you achieve a property strategy consistent with corporate goals. The process of explicitly identifying objectives and analysing and debating options enables management to contribute to the decision-making process and arrive at a strategy agreed and supported by all. By establishing explicit goals and methods, the different parts of the organization can work cohesively with a coordinated focused approach.

Figure 1.1 Developing property strategy.

The role of property in corporate profitability needs to be recognized by senior management and property given a central place in decision making. Property specialists need to highlight the link between corporate goals and property decisions and become better integrated into the corporate planning process.

1.1.2

Strategic property management

Active management can transform the property portfolio. A sales organization halves its property holdings by implementing teleworking and desk-sharing systems; a professional firm finds it can reduce cost and improve the working environment by a move towards a branch office portfolio instead of concentration of staff in a central London head office; a retailer improves sales substantially following a programme of disposals and acquisitions, achieving a portfolio of outlets distributed in accordance with current consumer demand patterns. These are examples of the improvements that can be made by taking an active approach to property management.

There are three objectives that normally motivate strategic property management:

- meeting operational needs—providing the space required by the core business in terms of the size, type, condition and specification of space, its location and the leasing or purchase terms;

- meeting occupancy cost objectives;

- enhancing and releasing asset value.

Capital value can have an important effect on the balance sheet. Value enhancement can often be achieved using some of the following strategies.

- sale and leaseback transactions;

- redevelopment (with or without a development partner);

- acquisitions and disposals.

However, for most occupiers asset value is secondary to the primary rationale of serving the core business units effectively at minimum occupancy cost. Traditionally, managers responsible for dealing with property decisions have tended to apply investment appraisal techniques in analysing property decisions, because the investment role of property has often been the dominant concern. For most occupiers now the crucial issues are occupational need and affordability, not investment value and capital appreciation.

The aim is to manage property costs to fit with the business plan. This requires considered explicit decisions on the type, quality, location and quantity of space occupied, in contrast to maintaining a portfolio whose size and structure is justified only by historic decisions. Occupancy cost management is considered in detail in the next section.

(a) Occupancy cost management

In general, the objectives of occupancy cost management are twofold:

- Cost efficiency—to achieve the lowest cost for a given level of service. This involves measuring occupancy cost, comparing it with other occupiers and analysing processes and practices to improve performance.

- Cost/performance trade off—to achieve the most appropriate balance between cost and level of service. Performance relates to the quality of the space and facilities, the facilities management service and the extent to which the facilities meet the needs of the business users. A key issue is flexibility which enables property managers to accommodate changing business needs. In many companies the standard of performance is unquestioned; the relationship between facilities performance and profitability is regularly over-looked and the cost/performance balance is not considered or debated explicitly. By analysing cost choices with an open mind corporate efficiency and profitability can be improved.

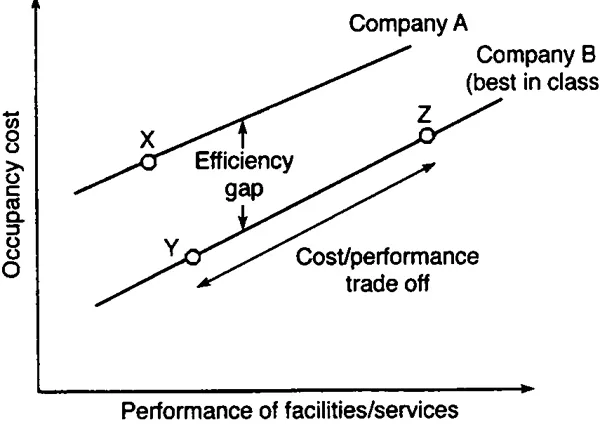

Figure 1.2 illustrates the relationship between the dual objectives of efficiency and the cost/performance balance. In this example, Company A needs to close the efficiency gap to move from point X onto Company B’s trade-off line. Once Company A achieves this trade off they may not choose Company B’s point on the line, Y, as they may decide that a different balance between cost and performance, for example Z, is appropriate to their business needs.

Figure 1.2 Occupancy cost management—objectives.

The corporate property manager needs to identify the organization’s preferred cost/ performance balance in addition to achieving the lowest level of cost for a given level of performance. In practice, management of occupancy cost to achieve efficiency happens during occupation and many of the issues relevant to this process are discussed in Chapter 4; choices relating to the quality and nature of the space are in practice made as part of the acquisition and disposal processes, which are discussed in Chapters 2 and 5 respectively. The decisions are integrated into the practical process of finding and acquiring space and subsequently deciding to dispose of it. The practical aspects of these processes are discussed in detail in the following chapters, but in order to manage those processes effectively the underlying objectives and priorities of the organization need to have been established.

It is important to understand clearly the factors that drive occupancy cost, both generally and for your particular organization. A useful framework has been developed by a US management consultant, Mahlon Apgar. He highlights ‘The Three Ls’, location, layout and leasing, as the factors which determine occupancy cost levels.

- Location. The supply and demand relationship in the property market is location specific and all occupancy costs are affected by location to a greater or lesser extent. This is most evident in the case of rent and property taxes (which in the UK are rentrelated) but also applies to other costs to the extent that the economy generally exhibits locational cost differences. In the UK non-rental cost differentials are clearly demonstrable, for example between town centre and out of town locations, north versus south and so on. Arguably locational cost differentials may diminish as technological change increases the dispersion of business activity.

For the occupier the challenge is to ensure that every activity within the organization is located in the most cost-efficient location taking into account the needs of the business users. In practice it is not possible to achieve a perfect distribution of all activities in the most cost-efficient location and this can only be approximated. It is important however that the occupier recognizes the impact of location on cost and analyses corporate needs and objectives to choose the most appropriate location for all areas of the business. In some cases economies achieved by consolidation may outweigh savings achieved by a dispersion of activities according to locational needs and the consolidation/diversification question needs to be considered as part of the locational decision.

- Layout. Layout is the amount and type of space used by the organization as well as the manner in which the space is used and located internally. The most significant issue is usually the quantity of space. This is often seen as outside the control of the property manager and driven by the business units or by historic levels of space usage. It is important to recognize that the size of the property portfolio can be chosen based on analysis: space can be acquired and disposed of in the medium to long term.

Use of space should be seen as an investment decision. Breakeven analysis and net present value analysis (Section 1.2) can assist in evaluating expansion and contraction. In all cases the space usage decision should take into account both revenue and cost: the use must be justified not just in terms of relative costs but in terms also of the revenue that will be generated from the space. Managing growth and controlling demand is an important role for the strategic property manager. Internal rent charging system...