- 388 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Managing Risks in Projects

About this book

Managing Risks in Projects presents the latest skills, techniques, knowledge and experience of managing risks in projects from the leading worldwide experts. Many different types of projects are addressed spanning development, software, re-engineering, engineering and construction.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

PART 1

PUTTING PROJECT RISK MANAGEMENT INTO PERSPECTIVE

Fifteen years of project risk management applications – where are we going?

Helsinki University of Technology, Finland

Abstract

The paper discusses content and scope of project risk management. The purpose of the paper is to reflect future trends in the field of project risk management. Understanding evolution in a historical time span is essential to be able to draw conclusions of potential trends of future developments. The fifteen years in the topic of the paper refers to the length of the author’s past experience in the project risk management field.

Keywords Project management, risk management, risk analysis, quantification, project company, organizing for risk management, risk history, risk knowledge base

1. Introduction

An appropriate project risk management content is sought for. New aspects of project risk management are introduced. Also, a wider perspective is provided with a discussion about the role and content of risk management in a project company.

One basic aim of the paper is to give insight about future trends in the field of project risk management. In order to understand the trends and potential future outcomes, we will first lay a brief glimpse on recent history and current status of project risk management discipline. Understanding evolution in a historical time span is essential to be able to draw conclusions of potential trends in future developments. Project risk management practices within the author’s own fifteen-year sphere of experience form one basic starting point for the discussion.

2. Project risk management - definitions and tools

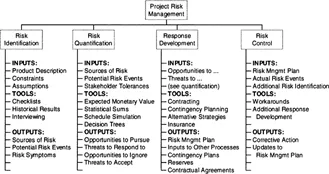

There are several project management standards that provide a definition of project risk management. The project risk management content defined according to Project Management Institute’s (PMI) definition is shown in Fig. 1 [1]. Risk management content is also reported in recent documentation for the project management quality guideline ISO [2] that recognize following risk related processes:

• risk identification

• risk estimation

• risk response development

• risk control

Fig. 1. Risk management overview

(according to [1])

The ISO [2] definition about risk management content above is similar to that of PMI’s, and in general, risk management literature defines risk management in similar manner. In some contexts, the terms risk analysis or risk appraisal are used to refer to the first stages of identification and estimation and quantification.

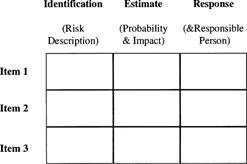

In project companies, there are risk response sheets in use as empirical tools that are designed to guide identification, estimating, and risk response planning. The structure of those sheets in use usually is consistent with the standards (cf. [1] and [2] referred to above). A hypothetical and simplified presentation of a risk management sheet visualising a tool used in several Finnish project companies is depicted in Fig. 2.

Fig. 2. A risk management sheet as a visualisation about empirical tools in use

3. Historical perspective - risk management of the 80’s

3.1. Quantitative and risk analysis oriented risk management in the 80’s

In the beginning of the 80’s, project risk management was a well recognized area in project management literature. The content consisting of risk identification, estimation, risk response development and risk control was generally known. In the discussion of risk management at that time, quantitative risk analysis was emphasized. For example, the stochastic three point estimate features of the PERT methodology vere widely referred to. The PERT methodology with a probabilistic interpretation of optimistic, pessimistic and most probable value estimates has its origin in developing the PERT methodology in the 50’s.

In project context, it is natural that subjective judgment is required. Historical data is valuable for getting a conception about risks in previous projects. However, because of the individual nature of each project, weight must be given to subjective estimates based on the expertise of the project personnel. Subjective probabilities are derived from people’s knowledge, and they are not based on measuring frequencies which would be the starting point of the objectivistic probability approach. The discussion about using subjective probabilities and allowing subjective elements in probabilities dates back to the probability research of Bayes [3] and Laplace (ca. 1800). Also remarkable more recent developments for using subjective probabilities in the decision theory were made in the 50’s, 60’s and 70’s.

In the 80’s, the quantitative side of estimating probabilities and probability distributions, and methods of combining quantitative estimates were discussed and developed. Risk modeling and the use of different probability distribution forms were considered an important and interesting features to develop. Also risk analysis software with mainly features to support risk modeling and quantification was developed at that time. The risk quantification in empirical applications were mainly based on subjective probabilities and subjective probability distributions.

3.2. Risk management applications in the 80’s

Applications in industries were mainly time and cost risk analysis applications. In many cases, a software with subjective time and cost probability distributions was used to support risk analysis. Process plant construction and engineering industries were the users of main risk management and risk analysis. In the author’s own risk management development efforts in 80’s, risk management was developed for electric utility and energy system construction projects. Further, while developing the risk management in mid-80’s, the author visited, among others, British Petroleum (BP) in the UK and Norwegian Petroleum Consultants in Norway. At that time, BP developed CATRAP (Cost and Time Risk Analysis Program) software for in-house use only. The software allowed modeling risks with several distribution forms of subjective probability distributions as inputs. The software was used in e.g. North Sea oil platform construction projects. For the same use, Norwegian Petroleum Consultants developed NPC software for Norwegian construction and engineering companies and oil platform and related system suppliers. The software was developed for certain consortium of Norwegian companies, and accordingly, was not a commercial product. NPC allowed also risk modeling and quantifying risks by using different probability distributions. An interesting feature in the software was that besides subjective distributions, also objective (frequency based) probability distributions were calculated from durations or cost data. The software allowed combining subjective and objective distributions by using pre-determined weights, and the integration of time and cost risks was enabled in modeling features.

When discussing risk management applications and software used in the 80’s, the successive principle developed by Steen Lichtenberg in Denmark is worth mentioning. Also commercial software was developed on ideas of successive principle. The basic features of successive principle are the following. Project cost items (or durations of tasks of the project schedule) are estimated quantitatively employing three point value estimates. A list is generated showing the items in order of decreasing risk (variance). The item or parameter contributing most to the uncertainty is further specified and divided into subitems. This way, the most critical items are specified in an aditional stage, until all the significant items are specified in a detailed manner by further subdivisions. An interested reader is adviced to consult Lichtenberg [4] for more details about the successive principle developed in the 80’s.

The interested reader might find [5] [6] and [7] interesting as short but rather comprehensive overviews of systematic risk management of the 80’s with much emphasis on risk analysis and risk quantification methods. In the quantification side, Hayes et. al. [5] describe not only the methods for probabilistic risk analysis, but also a methodology of sensitivity analyses is introduced.

4. Quantitative risk analyses today - using software for team work support

A common feature for a majority of commercially distributed risk management software is that they allow building complex risk models. In the software, inputs are subjective time and cost or other quantity probability distributions.

To look at the quantitative risk analysis for risk modeling and risk estimating from a software point of view, there are several software products today that support quantitative risk analysis. The categories consisting of some commercial software products are (see risk management software discussion also in [8]):

• Decision Support & Modeling:

• Temper System / VTT, Finland

• Futura / Proha, Finland

• Different AHP applications in general (AHP = Analytical Hierarchy Process)

• Modeling tools:

• DynRisk /Terramar, Norway

• DPL /ADA Decision Support, USA

• REP/PC / Decision Sciences, USA

• Spreadsheet add-in:

• Crystal Ball / Desicioneering, USA

• @Risk (Excel) / Palisade, USA

• Planning Package add-in:

• @Risk (MS Project) / Palisade, USA

• Monte Carlo (Primavera) / Primavera, USA

• Opera (Open Plan) /Wellcome Software, USA

• Risk+ (MS Project) / PMSI, USA

The basic risk management software features that are in use today were developed in the 80’s. The situation today is that a major effort is required for planning how to use the current software rather than to develop modeling and quantification features further in different software solutions.

Whereas risk management software were serving as tools for risk analysts in the 80’s, the tendency today has been to use quantification and risk modeling more as vehicles that promote communication, team work, and risk response planning among project personnel. The focus in risk management today is to develop processes that enable team work and the use of people’s and organizations’ experience and knowledge when planning risk management and risk responses. Thus, risk analysis software should be considered as tools promoting communication in the team. This could be accomplished by arranging team analysis sessions where the software is used to both initiate and summarize communication about risks and risk responses.

5. Project risk management in the 90’s and in the future

5.1. General

Although risk analysis and risk quantification were emphasized in the risk management development in the 80’s, it is true that many other risk management methodologies used today were known already in the 80’s. For example, when visiting BP in mid-80’s, the author recognized that influence diagramming, risk check lists and questionnaires, and risk-response diagramming methods were in use. Further, important principles associated with risk sharing by construction contracts were defined. Such methodologies were recognized also in literature, e.g. in those risk management overviews referred to above in context of risk analysis and quantification (see e.g. [5] [6] and [7]).

Influence diagramming and other corresponding qualitative methods are appropriate for the risk types which should be treated only qualitatively by a careful documentation. Such risk types comprise typically risks with a severe financial impact but minimal probability of occurrence, and on the other hand risks with no substantial consequences even if they occur.

5.2. Risk management knowledge bases as organizational memories

The approach of risk check lists and questionnaires of the 80’s has been developed further till today. And development will continue in this field. The direction is toward the creating of risk management knowledge bases. However, recent developments show that risk knowledge bases do not comprise only a description of risks to be used as check list items, but there might be other valuable data such as suggestions about responses to be used for risk response planning. The author’s forecast is that the development and growth of applying such knowledge bases will continue. Risk knowledge bases are used as organizational memories where experience about risks and e.g. potential risk responses is continuously recorded during the project execution in a multi-project environment of e.g. a project company. Real-life cases of risks occurred in projects may be included in the knowledge base. The knowledge base then provides access to the organization’s understanding about risks in real time. The knowledge base is easily accessible for risk management procedures, and it may contain possibilities to make different selections concerning e.g. the project type, or the content of information retrieved.

5.3. Risk response planning

The use of risk-response diagramming in BP already in the 80’s was based on the rationale that risks cannot be explicitly modeled or quantified without taking risk responses into account. There are three reasons why the including of risk responses is important already at the risk analysis and quantification stage. First, the estimate of the risk remaining will be different in case of different response scenarios. Second, responses consume time and cost, and adjustments to schedules and cost estimates are required accordingly. Third, perhaps the most natural phase for risk response planning is when committed simultaneously with risk analysis considerations. The author’s forecast is that risk response planning will be more emphasized in many future developments. The new systematic forms of risk response planning might be based on solutions for integrating the planning with risk estimation. The ‘decision support’ oriented software referred to above as one category differ from standard modeling software by having features that provide better support for interactive risk modeling with understanding the nature of the risks and this way better enable simultaneous choices and decision making about resp...

Table of contents

- Cover

- Halftitle

- Title

- Copyright

- Contents

- International Advisory Board

- Preface

- PART 1. Putting Project Risk Management into Perspective

- PART 2. Case Projects – Project Failures, Risk History and Lessons Learned

- PART 3. Implementation of Systematic Risk Management in Project Business

- PART 4. New Skills and Techniques for Project Risk Management

- PART 5. Project Risk Management in Development, Software and Re-Engineering Projects

- PART 6. Project Risk Management in Engineering and Construction

- PART 7. Understanding Nature of Risk-Modelling Aspects

- Keyword Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Managing Risks in Projects by K.A. Artto,K. Kahkonen in PDF and/or ePUB format, as well as other popular books in Architecture & Architecture General. We have over one million books available in our catalogue for you to explore.