35. The Bias of American Housing Policy

Nathan Glazer

What should be the goals of housing policy? Nathan Glazer suggests a policy that “maximizes choices,” but he is quick to point to several constraints on its implementation: scarcity of resources, the visibility of past mistakes, and the American bias in favor of the single-family, owner-occupied house. Glazer traces the influence of these factors on the directions of housing policy, and against this background inquires whether the poor have benefited from federal housing policy and whether the federal policy has encouraged segregation by social class, race, and family life-style.

There is an easy verbal solution to the problem [of what shall constitute America’s housing policy]: Allow all choices to be available, and then let people choose freely what they want. . . .

. . . [T]here are always—there must inevitably be—serious constraints on the attempt to implement a policy that “maximizes choices.” The first major constraint is that economic resources are limited, and housing policy in any society, including ours, operates within a larger economic policy which limits, directly or indirectly, the resources that can be placed into housing. . . .

Aside from these general economic considerations, there are some special problems in establishing a housing policy that maximizes freedom of choice as to the kind of housing and the kind of community desired. In any public policy that involves building relatively expensive physical facilities, the constraint on a program that maximizes choices—that is, offers many different possibilities—is particularly great. The fact that one poorly conceived work training program may operate at 80 percent of capacity (what is capacity anyway?) could hardly make a serious public issue. However, when a public housing project operates with 20 percent vacancy rates or when 20 percent of the buyers in a government-insured development default on their mortgages, this becomes a visible problem which cannot be concealed and which subjects the policymakers and administrators to the greatest embarrassment. Nor are they permitted to make too many such errors. . . .

. . . In the first quarter of 1966, 7.5 percent of all rental units and 1.4 percent of homeowner units were vacant. The available for-rent vacancy rate (that is, units not deteriorated, available for year-round occupancy) was lower but still substantial—2.7 percent and .8 percent. From the point of view of providing a desirable level of choice in the search for housing, these rates are still too low for many groups and in many areas. However, from the point of view of builders and housers, the vacancy levels are too high, and they are higher than in any other major industrial nation.

Under these circumstances, just as the private builder of rental units or the developer of units for sale knows he may be courting disaster when he builds and is therefore cautious, so too are the shapers and administrators of government policy cautious. In effect, choices are already so wide that a new choice, a new approach, must compete with many existing alternative possibilities. This is perhaps one of the chief constraints on American housing policy. On the other hand, where shortages are or have been more severe and where more of the elements of investment policy are in the hands of the government (as is true of Western Europe, Eastern Europe, Japan, and the developing world), one can operate with some assurance that almost any policy one decides upon will produce houses that are occupied, even if they come in a shape and style and community that are less attractive than some conceivable alternative.

. . . Thus, paradoxically, scarcity may permit greater freedom and experimentalism in policy; while affluence, the presence of surplus, may impose greater caution.

This is one constraint, a very contemporary one, on an American housing policy that would attempt to maximize choice. It operates with another constraint, perhaps the most distinctive constraint on American housing policies. This is the consistent bias in this country in favor of the owner-occupied, single-family, freestanding house with a bit of land around it. When we speak of housing problems in this country, we tend to think of the city tenement, crowded with the poor. If this is our focus, we tend to consider how to rehabilitate it or replace it with more spacious and better planned multiple-family dwellings. Yet in the range of American housing problems and American housing policies, neither the crowded slum nor the type of multifamily housing that may potentially and has in some cases actually replaced it is central. Both have received the chief attention of reformers, writers, and analysts. But it is the single-family, owner-occupied home—getting it built, getting it financed, saving it from the banks, reducing its cost, and increasing its amenities—that has received the chief attention of elected officials, administrators, and, one suspects, the American people, even the poor among them.

The overwhelming preference of the American family in housing is the single-family home, preferably owned, preferably detached. Our housing policy at local and federal levels has been designed to facilitate its building, to protect its environment, and to make it accessible to more and more people at lower economic levels. . . .

Thus, if we look at American housing policy, we will see that it consists of two large segments; and both are overwhelmingly directed toward facilitating the building, financing, and protection of the single-family home. On the local level we find zoning regulations, building codes, and health codes. All of these, in their origins in the early 20th century, were designed to protect the low income, immigrant- and working-class population from frightful housing conditions and to protect, too, the middle and upper income population from the evil consequences in health and amenities that flowed from these conditions. New York City was the pioneer, for it contained the greatest concentration of tenements.1 Paradoxically, all these mechanisms of housing policy soon outgrew their origins; and, as their use spread to all the cities and many of the towns of the country, in their expansion they became adapted to the housing conditions and housing desires of the greater part of the population—that is, they became policies for protecting the single-family home.2

On the federal level, we may trace a similar emphasis in policy. The first federal action in the field of housing was a survey of slums in 1892. During World War I the federal government, directly and through loans to private builders, put up war housing. These initial forays into policy had no lasting consequences, but, beginning in the early thirties with the President’s Conference on Homebuilding and Home Ownership, federal policy was set on the path of the encouragement of homeownership through the development of the amortized long-range mortgage, federal insurance of home mortgages, encouragement of large-scale development of single-family homes, and guidance of the supply of long-term housing credit. The Federal Home Loan Bank system in 1932, the Home Owners’ Loan Corporation and Federal Farm Mortgage Corporation of 1933, and the National Housing Act of 1934, setting up the Federal Housing Administration, were all steps to the creation of a federal policy which facilitated homeownership.3 Should we say these policy developments “encouraged” homeownership by providing incentives and subsidies which forced many families into the kind of dwelling conditions they would have preferred to avoid, or should we say this course of policy “satisfied” widespread desires and needs for this type of housing? This is a question around which there has been a good deal of controversy.

As against these two major forms of governmental policy—zoning, building and health codes at the local level, and the encouragement of homebuilding and homeownership at the federal level—other major thrusts of policy have been relatively minor. Federally financed public housing (the United States Housing Act of 1937) was in its origins designed to combat the Depression by encouraging building as well as to clear slums and provide housing for the poor. It has always been operated on such a small scale that its achievement in all these areas has been minor. Today public housing makes up only a little more than 1 percent of the housing units of the country and accommodates 1 percent of the population. (For certain parts of the population, of course, public housing is more important. In New York City, where public housing is most prominent, about 7 percent of the population and a quarter of the Negro population live in public housing.) Urban renewal, which began in 1949, even with the large areas that have been cleared in some American cities, is small potatoes compared to the central policy of encouraging single-family homebuilding and ownership. In contrast to some 600,000 units of public housing that have been built during the history of that program and 80,000 that have been built under urban renewal, over 5,000,000 units have been built under FHA home mortgage programs.4 It can hardly be denied this has been and remains the chief emphasis of American housing policy, but how do we evaluate its impact on the family?

This overwhelming central tendency in American housing policy undoubtedly reflects certain characteristics of the actual American family and of the models, conscious or unconscious, that are held as to the ideal family life. Thus, the emphasis on a room for every individual and on space between the houses reflects an emphasis on familial privacy and individual privacy within the family. Certainly there is no support in this approach for the extended family, which is one reason why those ethnic and cultural groups that favor extended family ties are unhappy at being forced out of denser urban areas and required to take up residence in spread-out suburbs. Having, however, decided to foster this ideal, American housing policy, because of the type of housing it encourages, does make it harder to maintain other styles of family life—such as, for example, an extended family. It thus encourages further the consequences of the initial bent to privacy and individualism, encouraging, for example, a situation in which children are raised in the expectation of earlier and earlier independence and in the expectation of less and less effective control by parents over the development of their lives. If parents lose power, the loss of power of other older family figures is of course even more radical and more complete.

Thus, housing policy, reflecting tendencies in family life, pushes those tendencies further, and yet there is no question this is what the family—for the most part—wants. William Slayton and Richard Dewey, summarizing 11 opinion studies in 1953, assert simply that, “whenever given the opportunity, most American families express their desire to own their own homes.”5 . . .

[That] this has been the taste of the American family . . . . can hardly be argued with, since the choice has a certain amount of face validity. It means more space for children, inside and out; it means the opportunity to invest one’s resources, if they are available, in newer equipment and better upkeep; it means a generally rising investment; it means freedom to alter the home at will and to keep pets and animals; and one may proceed from there to various more subtle gains, all of which quite overwhelmed the demonstrations of housing experts 20 years ago that ownership was often financially unwise.6 Together with the housing policies we have outlined, this preference has resulted in a homeownership rate of 62 percent of all housing units in 1962.

Even this understates the prevalence of the single-family house, for many are rented. In 1960 no less than 70 percent of all housing units in this country were one-family houses, detached; another 6 percent were one-family, attached; 13 percent were in structures with 2 to 4 units; another 11 percent were in structures with more than 5 units. Even in metropolitan areas the apartment house was—statistically—a relatively rare phenomenon. Sixteen percent of all housing units in SMSA’s were in structures containing more than 5 units; 17 percent were in structures with 2 to 4 units. However, the single-family structure dominated overwhelmingly: 60 percent of all metropolitan housing units were single-family, detached; another 8 percent were one-family, attached.7

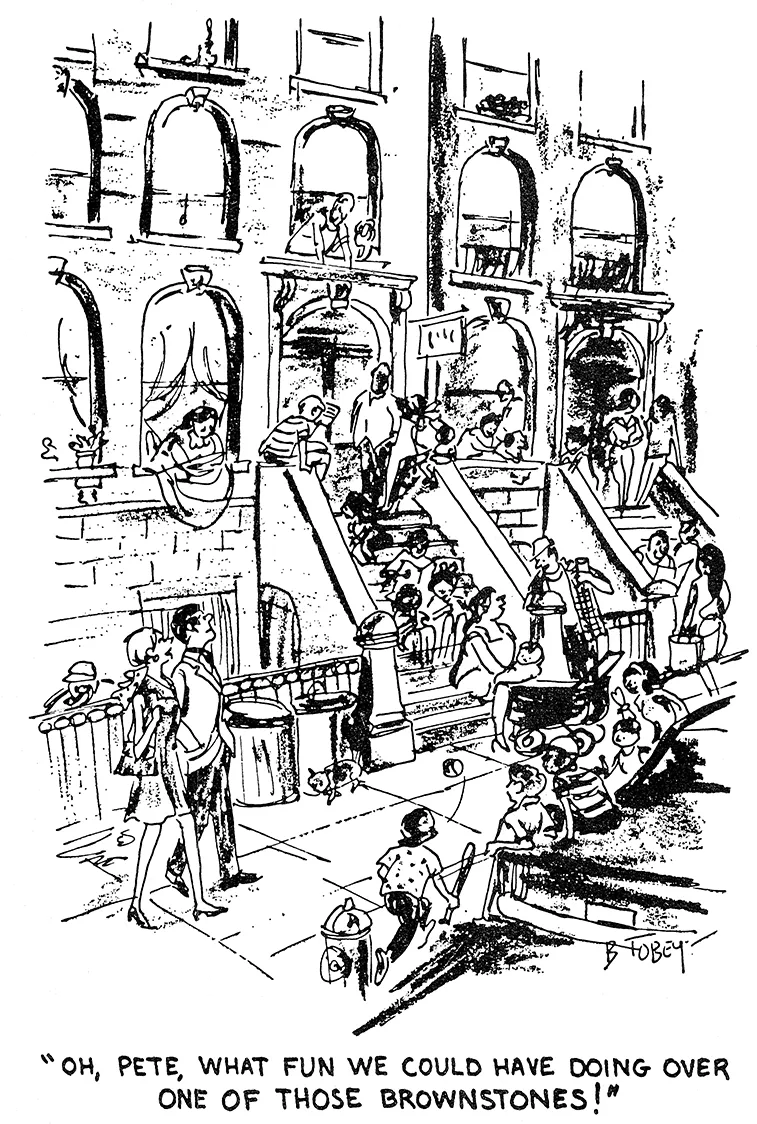

New York is the unique city which, for reasons of culture, or crowding, or land value, breaks with this pattern. It contains the bulk of the apartment houses of the country—in 1950, 51 percent of apartment units in structures of more than 20 units were in New York City!8

Presumably, homeownership and the single-family detached dwelling have now reache...