![]()

1

VALUE-BASED PRICING ROI

Roger J. Best and Peter J. Vomocil

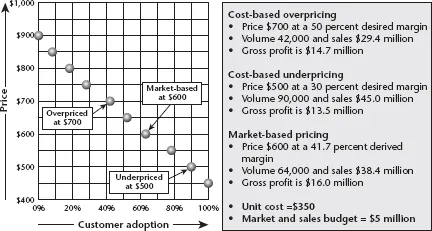

Pricing arguably has the most dramatic and immediate impact on sales and profits. Yet, it is one of the most mismanaged areas of marketing management. Sixty percent of businesses default to using cost-based pricing—a pricing strategy wherein price is determined by a business’s cost and margin requirements—with no real idea of the value their product, whether positive or negative (Cressman Jr. 1999; Noble and Gruca 1999). Since cost-based pricing ignores market intelligence, it often results in overpricing which lowers volume and profits; or in underpricing, which lowers gross profits despite higher volume. For example, a media tablet with a unit cost of $350 would require a price of $700 at a desired margin of 50 percent, as shown in Figure 1.1. At a desired margin of 30 percent, the cost-based price would be $500.

A different approach would be to adopt a market-based price—a price based on the needs of target customers, competitors’ product positions, and the strength of a business’s product, service, or brand advantage. Based on an understanding of customers’ willingness to pay at ten different price points (Retrevo 2009), a market-based price of $600 would be more desirable since it produces a higher level of gross profit. The market-based price of $600 is close to the average selling price of the iPad when launched in 2010.

We can take it one step further and employ a value-based pricing strategy— charging a price that creates a meaningful difference between a fair-market price and a price for a certain level of performance. Value-based pricing requires an understanding of the value that a customer derives from a product, and how it compares to competing offerings. In this chapter, we will explore three value-based pricing methods and examine the corresponding Pricing ROI for each method.

FIGURE 1.1 Cost-based pricing vs. market-based pricing: media tablets

Value-based pricing and net marketing contribution

There are several aspects of a successful value-based pricing strategy. The most important factor is that target customers perceive value that is clearly superior over competing products. Customer value is the difference between a product’s fair price and the selling price. Superior value can be based on a meaningful advantage in actual or perceived performance; total cost of ownership; and preferences for certain price-performance combinations. Each of these sources of customer value will be demonstrated in the remainder of this chapter as we examine three different value-based pricing methods.

Before we discuss Pricing ROI, we need to discuss the foundation of the Pricing ROI equation. Net Marketing Contribution (NMC) is a fundamental measure of marketing profitability. We will use NMC as a core element of the Pricing ROI calculation. It is defined simply as the contribution to profits after deducting marketing and sales expenses (Best 2013).

FIGURE 1.2 How value-based pricing impacts net market contribution

Regardless of how superior value is created, it has the potential to impact each area of performance in the NMC equation, as shown in Figure 1.2. Each of these potential impacts on NMC can contribute to a larger numerator in the Pricing ROI equation when a value-based pricing strategy is successful.

Value-based Pricing ROI

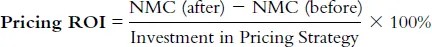

Pricing ROI is a measure of the performance of pricing decisions and enables marketers to compare investments in various pricing opportunities. In order to accurately measure the Pricing ROI of a value-based price change, we need to capture the investment required to execute a new pricing strategy, in addition to measuring the impact on marketing profits. We propose to measure Pricing ROI based on the difference in NMC before and after a value-based price change strategy, divided by the investment needed to create, communicate, and deliver the value-based pricing strategy.

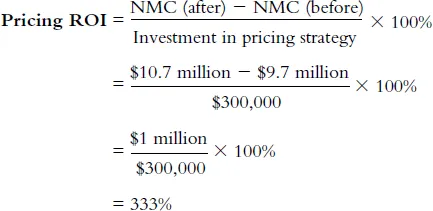

This can be expressed as:

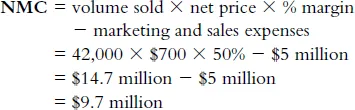

For example, the tablet in Figure 1.1 that is overpriced at $700 would produce a NMC of $9.7 million as shown below:

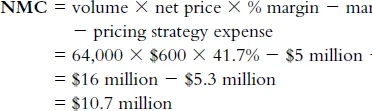

With an investment of $500,000 for market intelligence and additions to the marketing budget to communicate the new market-based price of $600, the following NMC is produced:

Pricing ROI is subsequently computed as shown below. With an incremental gain of $1 million in NMC that required an investment of $300,000, the Pricing ROI for this pricing strategy was 333 percent.

Investing in value-based pricing

Potential gains in marketing performance and profits are only possible with a true investment in the value-based pricing strategy. Value-based pricing requires time and investment to create, communicate, and deliver value that is meaningful to target customers. However, businesses often resist investing in pricing strategies because they are accustomed to simply changing a price and passively observing the resulting changes in performance. Let’s looks at the requisite investment in pricing for these three steps in building a value-based pricing strategy.

Creating value

For customer value to be meaningful it needs to be based on a superior and sustainable performance advantage that is valued by target customers. For most businesses, this means some level of customer research to determine the sources of advantage. For example, a producer of gas chromatographs found that its $50,000 product has a lifespan of five years, while their competitor’s similarly priced product has a lifespan of four years. On an annualized basis, the competitor’s customer pays $12,500 more. In this case there was an investment in competitive benchmarking to uncover a meaningful source of advantage.

The business also found that their gas chromatograph had superior performance, but the product was difficult to use. The difficulty of product use diminished the perceived value and had to be addressed in order to improve the customer experience. In this case an investment in customer intelligence and product engineering created a complete product that offered a higher value to target customers.

Communicating value

Simply because a business creates superior customer value does not mean target customers will understand their value advantage. Marketing communication is often needed to illustrate how a product creates a superior value and how that value is an advantage to the customer.

In many value-based pricing situations, sales training and new sales collateral will also need to be created. The sales force may need to be trained how to communicate the benefit of the customer value, thereby justifying the higher price of the product. This investment in the value-based pricing strategy is critical and the strategy will most likely fail without it, despite any value created.

Delivering value

In order for the value-based pricing strategy to achieve the desired sales and profit objectives, the customer must recognize the value created and be willing to pay a premium for that superior value. This requires an additional investment in customer intelligence to determine the value realized and the strength of the customer’s commitment to the business’s product due to their value advantage.

Figure 1.3 illustrates two examples of communicating and delivering customer value. The recreation of an AirCap advertisement positions a typical customer...