![]()

PART I

INFRASTRUCTURE: AN OVERVIEW

![]()

1. Infrastructure Between Old and New Trends

Alberto Belladonna, Alessandro Gili

Over the next ten years, the world’s population will grow from today’s 7.5 billion to around 8.7 billion, three quarters of whom will be living in developing countries. When the coronavirus pandemic crisis will be over, such growth will come with incommensurable challenges for these countries, which will have to provide jobs, resources and infrastructure to guarantee at least current levels of well-being to their citizens. On the other side, the developed world will face an increasing need to modernise its fast-outdating infrastructure stock, especially under the pressure of new technologies and new environmental challenges, particularly the need to cope with environmental sustainability issues.

Infrastructure, however, typically involves large up-front investments and long repayment periods. That is why they have always been associated with the direct or indirect intervention of the state, which is able to bear the risk of uncertain returns since the positive externalities, i.e. the benefit to society of an infrastructure project, can often be greater than the economic returns for private investors.

Today, however, the ability to provide reliable and efficient infrastructure is increasingly under pressure, making it even more difficult to “feed” the world with the needed infrastructure endowment. The aim of this chapter is thus to explore the main trends in infrastructure, their principal characteristics and how they can change in the future.

The Economic Rationale of Infrastructure

Investment in infrastructure has always constituted a pivotal component of a country’s development. Due to its “special foundational role, supporting other factors of production”, investment in infrastructure brings important benefits and increases the potential output and productivity of all inputs. Larger and better public transport networks, for example, reduce transport costs, improve people’s quality of life and improve the business environment for enterprises. To a certain extent, “the structure of our economy is bound by infrastructure”, since infrastructure also constitutes a platform through which major disruptive and incremental innovation could thrive, in a series of self-sustaining spillover effects that pave the way for future growth. Investment in telecommunications infrastructure can improve access to information and technology, for example, in turn broadening markets, promoting competition and enabling the development of technological innovation.

However, investment in infrastructure also plays an important role in the short term since it has a direct impact on the growth of gross domestic product (GDP) both directly and indirectly – directly, because infrastructure investment is an integral part of aggregate demand, and indirectly, because, depending on the state of the economy at the time of the investment, it produces an amplified effect on both GDP and employment through the so-called economic multiplier effect. According to the International Monetary Fund, for example, an increase in US public investment financed by a deficit of 1% of GDP tends to increase overall GDP by 0.9% in the first year and by 2.9% after four years. The IMF itself also suggests that, among OECD countries, an increase in public investment of 1% of GDP generally reduces the unemployment rate by 0.11% in the short term and by 0.35% in the medium term.

For this reason, in the countercyclical policies implemented by many countries, the increase in infrastructure investment has been one of the most frequently used instruments, often in line with the expectation of longer-term positive effects, which, however, depend on the multiple and complex response of all the factors connected with private supply.

Countercyclical Actions Following the Financial Crisis

Depending on the individual country’s political and economic situation, after an initial phase when capital investment was cut in favour of current expenditure, most central governments were called upon to take swift and unprecedented actions, and infrastructure spending was considered the main countercyclical instrument to react to the 2007 financial crisis.

The United States

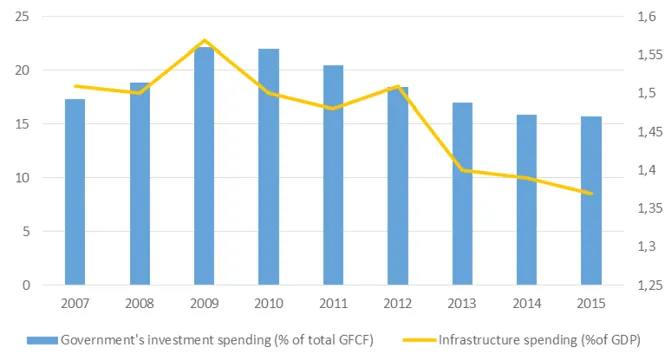

In the United States, where the global financial crisis originated, the Gross fixed capital formation (GFCF), which accounted for around 22% of GDP in 2007, fell at 19% in 2009. Household spending was the main reason for this drop, while general government progressively intervened in the economy increasing its share of GFCF from 16.3% to 22.2% in 2009.

Indeed in 2009, in response to the Great Recession, the Obama administration enacted the American Recovery and Reinvestment Act (ARRA), nicknamed the Recovery Act, consisting of an economic stimulus package with an estimated cost of $831 billion. Almost 55% of the resources were allocated to tax incentives and state and local fiscal relief (with more than 90% of the state aid going to Medicaid and education), while the remaining 45%, equivalent to almost 2.7% of GDP, was allocated to federal spending programmes, especially infrastructure such as transportation, communication, waste water and sewer infrastructure improvements, energy efficiency upgrades in private and federal buildings and scientific research programmes.

Fig. 1.1 - US government’s investment

and infrastructure spending

Source: Oxford Economics and OECD

Fig. 1.2 - US Infrastructure investment for each sector

(% of GDP)

Source: Oxford Economics and OECD

The Act sparked a heated debate among leading economists such as Nobel prize winners Paul Krugman and Joseph Stiglitz, who argued that the Plan was too small than the economic crisis required, and those who argued that in the long run the impact of the stimulus would be to create major public deficit and a crowding out effect on private investments. Nevertheless, the Congressional Budget Office has estimated that ARRA positively impacted GDP and employment: over a perio...