- 288 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Managerial Finance

About this book

Managerial Finance provides a clear and readable explanation of the most important topics managers should understand about business finance. These include resource management, investment and decision making, as well as the practical use of financial rations and performance indicators. Real examples and case studies are used throughout to illustrate points in a practical context.

The book is based upon the Management Charter Initiative's Occupational Standards for Management NVQs and SVQs at Levels 4 & 5 and is also particularly suitable for managers on Certificate and Diploma in Management programmes, including those accredited by the IM and Edexcel (formerly BTEC).

Managerial Finance is part of the highly successful series of textbooks for managers which cover the knowledge and understanding required as part of any competency based management programme. The books cover the three main levels of management: supervisory/first-line management (NVQ level 3), middle management (Certificate/NVQ level 4) and senior management (Diploma/NVQ level 5).

Alan Parkinson is the Hill Samuel Senior Lecturer in Accounting & Finance at the Open Business School. He was previously responsible as Director of the Open University MBA Programme for launching the highly successful MBA Course.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Part I The Flow of Finance

1 Understanding and managing the flow of finance

Introduction

In this chapter you will meet the idea of the flow of finance within organizations, its significance and the challenges faced by management teams in managing it. You will discover the reality of the organizational pyramid of purpose, and its reflection of the need for it be accompanied by managerial decisions relating to financing and investment matters. You will consider some of the reasons why organizations exist and the influence, particularly in commercial concerns, of their specified objectives. As you work through the chapter you will draw analogies with your own personal life. This will help you in getting a grip on the nature of the flow and the complexities of managing it.

By the end of this chapter you will:

- understand the nature and significance of the pyramid of purpose

- understand the nature and significance of the flow of finance

- have gained insights into the complexities of managing the flow of finance

- have recognized the relevance of the flow of finance for later and further considerations within this book.

What organizations do

All organizations, large or small, private or public or voluntary sector, have a commonality in that they all are faced with finding finance and deciding how best to spend it, in light of their objectives. It may be that an organization’s management team (comprising one person or many) wishes to maximize the wealth of the owners, or provide value for money services to the community, or help the disadvantaged. Whatever, the financial challenges facing management teams require on their part appropriate knowledge, understanding and competences to be able to respond appropriately. Initially, any response necessitates understanding what an organization sets out to do. This is vital as it determines what financing is required and what happens to it when spent.

The pyramid of purpose

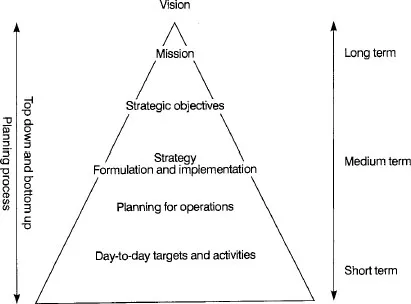

All organizations have purposes, reasons for their existence. For many there exists an ultimate vision of what an individual organization might achieve. This vision is then translated into a mission statement which defines in broad terms how the organization sets about achieving its vision and the necessary accompanying values. If the mission statement, and thus the vision, is to become a reality, more measurable and tangible aims need to be identified. Such aims are then translated into very specific objectives, often on an annual basis, which determine the day-to-day targets and required activities of staff at operational as opposed to senior management level.

This is encapsulated within Figure 1.1 and is depicted as a pyramid of purpose. The vision and mission at the top capture why the organization exists and where it is going – the resulting demands can then be translated and passed down from senior management to others to ‘do the doing’. The arrow on the right-hand side illustrates the tasks of managers at differing levels and reflects the associated time horizons of their work. Senior managers think and plan for the long term, concerning themselves with strategic matters. Further down the pyramid, more immediate challenges and demands face operational managers, the timescale being much shorter. It is important for all managers, not just accountants, to understand the organization’s vision, mission and values. If they do not, they cannot be sure that they are pursuing the right targets and carrying out the right activities.

Figure 1.1 The pyramid of purpose

In many organizations the pyramid becomes a reality through the operation of an effective budgetary planning and control system, with an emphasis on resource allocation and periodic feedback. You will concentrate on this in greater detail later in this book. For the present, it is important to focus on resource allocation only, and in broad terms.

The pyramid of purpose and resources

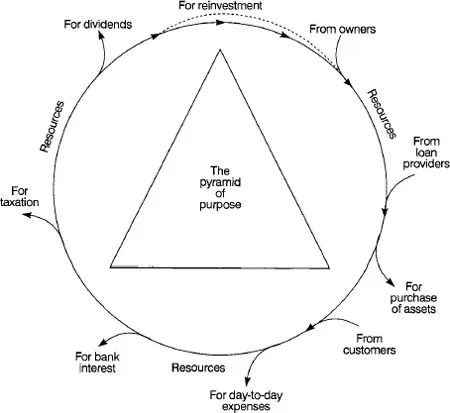

The carrying out of necessary activities to achieve day-to-day targets requires managers to be allocated resources. At the operational level this is effected by the budgetary process referred to above. At the more senior management, and thus more strategic, level broad decisions about where the resources are to be funded from and how the funding is to be divided up are necessary. This involves management teams making what might be termed financing and investment decisions to enable the pyramid of purpose to become a reality. This is depicted in Figure 1.2, which shows the pyramid of purpose encircled by a stream of finance to fund the resources and activities necessary to carry out what needs to be done.

Figure 1.2 The financial dimension of the pyramid

It is this stream of finance surrounding, and thus enabling, the pyramid of purpose which gives rise to the term flow of finance, as you see next.

Meeting and analysing the flow of finance

The stream of finance in Figure 1.2 is shown externally, encircling the pyramid of purpose. This is very appropriate, as the financial decisions required to translate the vision of the organization into reality may be viewed as reflecting decisions required to support a circular flow of finance within the pyramid of purpose. This flow is illustrated in Figure 1.3, which shows the flow associated with:

Stage 1 – | The raising of finance. |

Stage 2 – | The investment of finance in operating assets (i.e. assets to be used). |

Stage 3 – | The use of operating assets to produce or provide goods or services for sale to customers or to other clients. |

Stage 4 – | The control of day-to-day operating costs to ensure an operating profit (sales less day-to-day costs) or, where surpluses are not allowed and deficits must be avoided, break even. |

Stage 5 – | In commercial concerns, the distribution of the operating profit to: |

(a) reward providers of loan capital financing, such as banks, receiving interest, leaving net profit | |

(b) provide for corporation tax due on profit | |

(c) reward providers of share capital financing, the owners, through a return of some of the profits owned by them | |

(d) refinance the organization through profits retained. |

At each stage, managers must be prepared to make appropriate decisions. At Stage 1, the balance between differing types of capital must be assessed, usually referred to as the gearing decision. Stage 2 requires a decision which provides for an appropriate balance between investment in fixed assets – buildings, equipment, vehicles – and working capital. Stage 3 demands decisions on how to market goods and services to clients and to attract sales from customers. At Stage 4, managers will need to ensure that operating costs are controlled. This is necessary to provide an operating profit at Stage 4 for its subsequent distribution, or in public and voluntary sector concerns, to ensure at least a break-even situation. This operating profit is then used to provide for payment of loan interest, any taxation, dividends to shareholders and the reinvestment of any retained profits.

Of course, there are complexities in managing such a flow. Managers in organizations will need to:

- take account of where to obtain financing, the mix of differing funding sources, and the relative cost of each source

- be prepared to prioritize between differing and competing projects and activities on which financing obtained may be spent

- assess the risk/return profile of projects and activities

- devise systems to account for financing and investment decisions and thus to provide feedback on what has happened.

Figure 1.3 The flow of finance

It is such complexities which can present even greater challenges. After all, the financial dimension worries many managers even in uncomplicated situations. Perhaps, like you, they are not all financial specialists. With both the financial dimension and complexities in mind, it is appropriate to demonstrate to you that managing the financing and investment decisional resources within an organization is basically no different to managing finances on a day-to-day basis in your own life.

The flow of finance on a personal level

Here you examine more closely what occurs in d...

Table of contents

- Front Cover

- Title Page

- Copyright

- Contents

- Series adviser’s preface

- Introduction

- Acknowledgements

- Part I The Flow of Finance

- Part II The Financing Decision

- Part III The Investment Decision

- Part IV Other Investment Decisions

- Part V Managing through Information

- Appendix Glossary of accounting terms

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Managerial Finance by Alan Parkinson in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.