- 136 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Architect's Guide to Running a Practice

About this book

This is your essential one stop shop for information on starting and running a practice. Case studies and advice from practitioners, big and small, run alongside outlines of all the key topics, to give you an insight into the problems and challenges others have faced when setting up a design business. Accessible and informative, this handbook is the ideal first point of reference when starting a practice.

Architects have many different reasons for setting up in practice; equally, there are many ways of running your own business. This handbook helps you consider whether or not you should set up on your own, examining issues such as financing, office space, recruitment, IT and workingo ut a business plan. Some architects want to stay small, while others have ambitions to grow into large businesses. Some grow big accidentally. And then there are those who pick and choose their work carefully, and even turn down undesirable contracts, while others will grab at everything possible. This book woudl explore these different models and illustrate how different kinds of practice develop into successful businesses.

Importantly, the book will stress that these issues are crucial - you may be the best designer in the world, but unless your business is well managed you will fail. On the other hand, some successful architects spend a lot of time looking for new work and attending to management issues, rarely finding the time for design work. This book would illustrate how architects have struck a balance between these two extremes.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Topic

ArchitectureSubtopic

Architecture GeneralCHAPTER ONE

Money

Any serious business, architectural or not, needs to do three things: charge the right fee, manage cash flow and get a good accountant. Too many architects make too bad a living, a problem that is largely the result of believing that quality design will inevitably lead to decent clients and a fair income. The truth is that the business dimension of an architectural practice is no less important than producing the drawings; most businesses press ahead on the strength of the optimism, enthusiasm and dynamism of their founders, but these are qualities that can take a serious knock when money is short.

Finding a good accountant is worth the effort because, as well as saving a business money, financial advice will be accompanied with a range of other services. If you use an accountant as a glorified book-keeper, you are probably wasting your money. Accountants should also double-up as business consultants and professional mentors. They can provide invaluable advice about how and when to take on staff, whether or not to buy an office, what fees to charge and even (legally speaking) how best to configure the business. But accountants, like architects, have nothing to sell but their time, so they will charge what the market will bear – that is, as much as they can get away with. The only way to make this investment worthwhile is to listen to what they say and act on it; otherwise you become guilty of what accountants call ‘FTI’: Failure To Implement.

‘The thing most people suffer from, in business, is not knowing how to make a profit,’ says Andrew Rand, a director of accountancy firm Stanes Rand which manages the affairs of three architectural practices. ‘A good accountant will fundamentally save you money by reducing your taxes and, more importantly, improving your cash flow. That is, if you’re prepared to listen and take their advice on board.’

In recent years, for example, accountants have been advising practices to incorporate as limited companies. This move can easily reduce a business’s tax burden by 10 per cent, even for sole practitioners. And apart from that, incorporation protects the personal assets of a business’s directors. Accountants can also exploit the law in perfectly legitimate ways. Once you have an accountant, ask about how your business can mix and match different legal models to help plan your tax affairs in the most efficient way possible. For example, there is nothing wrong with a limited liability partnership employing one partner as a separate limited company. Indeed, the directors of a limited company could also register separate activities under basic self-employment rules. Each form of enterprise carries different tax advantages, so you might as well try and benefit from all of them. Accountant Andrew Rhodes, of accountancy firm Sobell Rhodes, has calculated that an architect earning £50 000 a year would pay £14 655 in tax and National Insurance without the benefit of tax advice. The result of advice would reduce the tax burden to £7 925, saving £6 730. There is no legal assumption that you should pay the maximum amount of tax possible – accountants assume quite the opposite.

The same lateral thinking applies to employing staff. Practices should probably delay formally employing staff for as long as possible. Instead, it will reduce your tax burden to engage people as consultants. This avoids the need to pay employers’ National Insurance. The only serious consideration is that you must ensure that the relationship of the consultant with the practice is that of self-employment. ‘You do have to watch out for the unscrupulous consultant. They might avoid paying tax and, when caught, point the finger at you by arguing that they thought they were an employee and you were deducting tax at source. You haven’t got a leg to stand on,’ says Andrew Rand.

Before engaging the services of an accountant, you need an income, and for this, you need a fee structure. Fees are generated in one of two ways, either as a percentage of contract value (a figure which diminishes as the value grows) or as an hourly rate. It is not unusual for a lawyer or an accountant to charge £150–250 an hour, but this is beyond the dreams of many architects, whose charge-out rates often come in at around £80 an hour. Generally, practices will charge different amounts according to the level (and perceived value) of staff, and there will be a sliding scale covering partners/directors, senior associates, associates, job architects and students. Fees may also vary to match the job. Winchester-based classicist Robert Adam, for example, toughs it out and charges £150–180 an hour for most architectural consultations, but a staggering £250 an hour for legal work (advising, say, on a planning enquiry). He also pays staff overtime – time and a half in 30-min slots beyond contracted working hours of 9–5. This is, however, highly unusual. Indeed, Adam says it is ‘an absolute disgrace’ that this practice is so rare.

Sole practitioner Simon Foxell tends to charge a fee based on contract value, ranging from around 6–8 per cent for new-build commercial jobs with seven figure budgets to 15 per cent for small domestic work. Importantly, he tends to ignore the RIBA’s recommended fee scale – which essentially shows potential clients what architects have been charging, as an average, for a range of different jobs. ‘You can’t really start negotiating from an average,’ says Foxell, who weighs up clients on a case by case basis. ‘I’ve seen enough clients and done enough jobs to know who will pay 10 per cent and who will pay 15. And that’s what it’s all about.’

When negotiating fees, never feel sorry for the client, even if you like them. If a client likes the quality of your design, or even just your general approach, the chances are they will pay for it. And the fact is that fees are only a very small part of the overall cost, which is worth pointing out if fees become the subject of negotiation. Generally, though, domestic clients rarely negotiate; it is commercial clients who always try to talk you down, but that is more through force of habit (trying to get a deal) than anything else. Unless it is your first job and you need something for your portfolio, there is little point in reducing your fees to a level at which the job becomes unprofitable. ‘There are plenty of sole practitioners out there who earn a pittance because they don’t see the value of what it is they are selling. You have simply got to relate fees to the value of what you are contributing to a project,’ says Foxell, an RIBA presidential candidate in 2004.

Foxell recommends working for lawyers, who are generally good clients, not only because they have money to spend but because they understand, almost without question, the nature of paying fees. Also, lawyers trust an architect’s professionalism and let them get on with the job; this is often the reverse of wealthy City dealers who, according to Foxell, try to retain control and do a lot of shouting. It is worth remembering that, when pitching for work, an interview is a two-way selection process and do a lot of shouting. It is worth remembering that, when pitching for work, an interview is a two-way selection process and architects should also be weighing up the pros and cons of the potential client. Even a relatively smooth project will have its tricky moments, so if a new client looks like being difficult from the outset, don’t take the work. This is particularly true of larger jobs. ‘With a big project, you have to decide if you will come out of it feeling better or worse,’ says Foxell.

Generally, this approach works for Foxell who enjoys a good living for 80 per cent of the time (2 years out of 10 are ‘hopeless’, he admits). Most of his clients provide repeat work and he benefits from plenty of word-of-mouth commissions. In fact, Foxell was the architect mentioned at the beginning of this book who returned to rebuild an apartment interior after a £150 television set malfunctioned and reduced his £150 000 fit-out to charcoal. Revisiting the scene not only allowed him to make a few changes to the original scheme, but the intervening years allowed Foxell to push the price up to £200k.

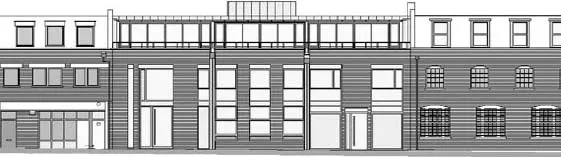

Figure 1.1 Boston Place, London, by Simon Foxell. A modern insertion in brick and expressed steel.

In terms of value, Foxell will generally turn away work with a contract value of less than £100 000, although he will make exceptions for particularly interesting offers or for jobs which could lead elsewhere. He applies no notional maximum, although his work rarely goes beyond the £1.5 million mark.

Figure 1.2 Simon Foxell’s projects rarely go beyond £1.5 million in value, for which he will charge a fee of 6-8 per cent.

Figure 1.3 Big budget jobs attract larger and more capable contractors.

For anything much bigger, Foxell would probably collaborate with another practice, as there is little to gain from turning down work because it’s worth too much. Although a £1 million job may sound daunting, there are very real advantages: design work will benefit from economies of scale (although a large building may look like a lot of design work, it is often the repeated use of single design elements). Also, larger budgets are more attractive propositions for bigger and more capable contractors.

Landing larger jobs is generally the result of reputation-building, but architects should also remember that, as the years roll by and projects get bigger, fees should also be plotted on an upward curve. It is not untypical for a practice to suffer from ‘over-trading’, a problem that results from a combination of increased overheads and declining profitablity. The following scenario is entirely plausible: a practice wins increasing amounts of work, moves to more expensive accommodation and recruits more staff who work longer hours; but fees remain unchanged and profit per hour begins to decline. If this process continues unchecked, the practice will go out of business.

Every year a practice should consider raising its fee, not just to keep pace with inflation but to ensure that the billing model matches the size and ambitions of the business. In fact, it is a useful exercise to ask the question, ‘What would be the profit effect of an X per cent fee increase, if applied to our top 10 clients?’ Then test the water on a sample client. The trick is to push the boundaries of what the market will bear without overstepping the mark. Keeping fee levels static is not an option.

Cash flow is just as important. In fact, all businesses should trade on the basis of a reliable cash-flow forecast, which means knowing how much debt you will be recovering on a monthly basis and making almost constant efforts to ensure that the money arrives. Figures for bill repayment are generally appalling: a study by the University of Leeds in 2004 shows that the average time it takes a PLC to pay its bills is 46 days, a figure which hasn’t improved in 4 years. Just one third pays within 30 days; and the Federation of Small Businesses estimates that one in four businesses that fail do so because of cash flow problems incurred by late payments. Bill regularly, and employ sound administration systems in an effort to reduce ‘debtor days’, i.e. the number of days it takes someone to pay (see Appendix A). Finally, don’t place too much faith in the fact that your invoices include a statement to the effect that interest will be charged on debts which remain unpaid beyond 30 days of the date on the bill. This frightens few people and is very rarely employed, although it is useful if a case gets brought to court. Accountant Andrew Rhodes stresses, however, that architects ought probably not chase unpaid bills themselves – this is best done by an office administrator or a part-time employee who knows that debt collection is in their job description. ‘If you’re the fee-earner, you should be the last person to collect debt. Get someone else to do it, someone who isn’t emotionally involved,’ he says.

Thinking sensibly about money need not be the miserable occupation that many in the architectural profession suppose it to be. It can even help architects answer more fundamental questions like ‘What do I want to do?’ and ‘How big do I want to get?’ Some perfectly good architects have their ambitions thwarted by spending a lifetime tackling small domestic jobs which, although barely profitable, they are too frightened to turn down. Devon-based Stan Bolt, on the other hand, does precisely the opposite and makes a healthy living by staying small and turning away anything that is not a handsome house for a wealthy client (see page 50).

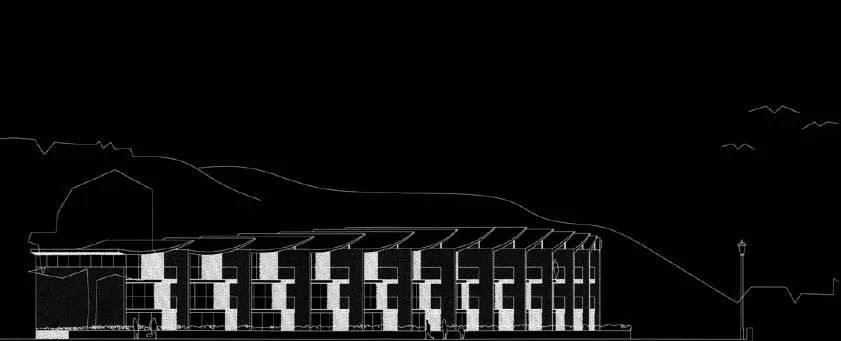

Similarly, other architects are exploring separate business ventures in an effort to supplement (or even dwarf) their mainstream architectural income. Some turn to development, an exercise which RIBA president George Ferguson prefers to call ‘cultural entrepreneurship’. When successful, development is incredibly lucrative. In 2002, architect Guy Greenfield chalked up £0.5 million profit from 25 flats he built in Falmouth, a project funded by his own development company Leafgate Ltd. Most of this profit was directed straight into a more ambitious, 28-unit scheme in Westward Ho!, which turned a profit of £2 million (see Figures 1.4 and 1.5). Roughly half of this will go into another development, probably in the West Country, where he looks for cheap, neglected sites in areas that have at least one redeeming feature (like a beach). His venture, which he has built up over a decade, also provides a useful subsidy for his five-person practice, allowing it to be choosy about the work it takes. ‘I don’t think it’s difficult. I have no business skills, really. Like all architects, you have to use your instinct,’ says Greenfield, who has formed a partnership with a builder who takes 10 per cent of the profits. ‘But you’ve got to be brave. It’s not for the foolhardy.’

Figure 1.4 Guy Greenfield’s residential scheme in Westward Ho!, for which he acted as his own client.

Figure 1.5 Architect Guy Greenfield looks to develop cheap neglected sites in the West Country.

Eric Reynolds, director of design and development agency Urban Space Management, says architects should be far more proactive in spotting sites and acting as their own client, especially in inner cities where small, awkward, brownfield plots often evade the attentions of larger developers: ‘Maybe your best client is you, and maybe you should be doing the thing yourself and making your own luck.’

Income can also be generated by developing topical specialities (some practices are building up reputations as access specialists, for example, to provide advice on schemes covered by the Disability Discrimination Act). Others market specialist skills as separate brands. Southwark-based Brookes Stacey Randall runs a parallel operation called Brookes Stacey Randall Consultants, which offers specialist cladding advice. In this case, of the 10 employees, eight are capable of acting on behalf of both the architecture practice and the cladding business. The firm was ...

Table of contents

- Cover

- Halftitle

- Title

- Copyright

- Contents

- Foreword

- Preface

- Acknowledgements

- 1 Money

- 2 Marketing

- 3 Staying small

- 4 Managing growth

- 5 Managing the office

- 6 IT

- Appendix A: Debt collection

- Appendix B: In-house PR office versus external consultant

- Appendix C: Framework agreements

- Appendix D: Aedas Management structure

- Appendix E: Employment contracts

- Appendix F: Practice administration

- Appendix G: Business models

- Appendix H: Contacts

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access The Architect's Guide to Running a Practice by David Littlefield in PDF and/or ePUB format, as well as other popular books in Architecture & Architecture General. We have over one million books available in our catalogue for you to explore.