![]()

part one

The Scope and Environment of Financial Management

Part 1 Contains the Following:

| • | Overview |

| • | Chapter 1 - Introduction |

| • | Chapter 2 - Key Issues in Modern Financial Management |

| • | Chapter 3 - The Financial Environment |

| • | Chapter 4 - Capital Markets |

| • | Case Study 1 - Financial Planning |

Part 1 provides the essential introduction to the basic principles, practices and concepts of modern financial management. Part 1 also describes the financial environment in which the business firm operates. This sets the broader environmental context in which the financial manager and the financial management process function.

The Overview offers a brief initial insight into the nature of financial management and serves to highlight some of its core concepts.

Chapter 1 provides an introduction to the key aspects of financial management, including the goal of the firm.

Chapter 2 introduces the role of the financial manager and treasury management. The chapter proceeds to explore the influence of agency theory, stakeholder theory, corporate governance, and ethics, on financial management today.

Chapter 3 analyses the nature of the firm's financial environment and the financial manager's interaction with that environment, while Chapter 4 explores more closely the role of capital markets - a major constituent of the financial environment.

Part 1 concludes with a Case Study on financial planning.

The Coffee Ventures scenario has been presented to provide a brief, initial insight into the nature of financial management and to introduce some of its core concepts. The scenario does not contain all the features of modern financial management, but it does illustrate some of the most important.

The concepts of cash flows, risk and return, and shareholder value, highlighted in the Coffee Ventures scenario, are extremely important in financial management. They form its fundamental building blocks, have a profound effect on financial decision-making, on the value of a business, and consequently on the wealth of its owners.

Similarly, the role of the financial markets, both as a source of company finance and in valuing a company's securities, is also extremely important in financial management. It is the value of a company's securities, as determined in the financial marketplace, which is used to measure the value of a company and the wealth of its owners.

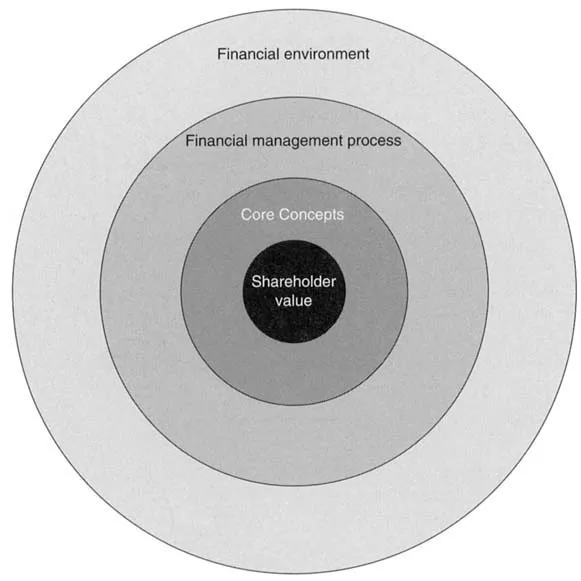

Diagram 1 is intended to illustrate the interconnections and relationships between the various aspects of financial management, and to provide a brief overview of the areas covered in the text.

Diagram 1 shows the goal of the firm - the maximisation of shareh older value - as being the central aim of financial management. The nature of this goal is explained in Chapter 1. This goal is underpinned and directly affected by the core financial management concepts - its achievement requires an understanding of their role and impact. The core concepts are the subject of Part 2.

The activities of the financial manager, and the outcomes of the financial management process (the firm's investment and financing decisions), are shaped by the core concepts and are directed at achieving the goal of the firm. For example, in Part 4 we will see how the concepts of cash flows, their timings, and risk, affect the value of investment decisions to the business. Parts 3 through 6 explore the various aspects of the financial management process, mainly in a strategic management context, while Part 7 explores the functioning of the financial management process in an operational management context.

The outer circle of the diagram shows that all the firm's financial management activities are influenced by the financial environment, which in turn is influenced by the wider business and economic environment. The financial environment, which is dynamic and rapidly changing, consists of financial markets, financial institutions, and financial instruments.

Part 1 diagram: Overview of financial management

Events in the financial environment directly impact on the firm's investing and financing activities. For example, changes in market interest rates will influence the financial manager's investment and financing decisions. Investment decisions may be deferred if interest rates are considered too high.

Finally, the outcomes of the financial management process - the firm's financial decisions - are assessed by the financial markets and reflected in the market value of the firm's securities, and ultimately in the wealth of its shareholders. The financial environment is explored early in the text in Part 1, as it sets the broader environmental context in which the financial management of the firm takes place. An appreciation of its role is essential in understanding the topics covered in subsequent parts. In due course we will spend much of our time exploring and developing each of these, and other important aspects of financial management, in considerably more depth as we progress through this book.

Inevitably when individual topics are later analysed in detail it is easy to lose sight of the overall perspective, of 'not seeing the wood for the trees'. The reader may therefore find it helpful in restoring perspective to return to this overview section from time to time.

![]()

1

Introduction

Learning Objectives

By the end of this chapter you should be able to:

- explain the role and goal of financial management in a modern business enterprise;

- explain the financial management process; and

- understand the role of the core concepts in financial management.

Introduction

In tins chapter our primary purpose is to provide an introduction to the key concepts, principles, and practices of financial management in a modern business enterprise. This chapter thus lays the foundation for the rest of this book. Many of the concepts and terms introduced here will recur throughout the text and making an effort to come to grips with them now will produce its rewards later.

In particular this chapter introduces a unifying model of the financial management process. This model will serve as an integrated and coherent frame of reference for our approach to the study of financial management throughout this text. The model emphasises the link between an organisation's financial management and its general management processes.

Similar to other management disciplines, such as human resource and marketing management, financial management does not exist in isolation but is an integral part of the general management of any organisation. As such, it is similarly affected by the key changes and trends which are impacting on general management in the broader business environment today. For example, financial management, in common with most other aspects of business, is increasingly an internationalised affair.

The sustained progress towards the greater internationalisation of business and finance has been greatly facilitated by the dramatic advances in communications and information technology. These advances have lowered costs and increased the efficiency and attractiveness of conducting international business - so much so that the world is now virtually a global marketplace. The effect on the financial manager is that a firm's investment and financing decisions are being taken more frequently in an international business context.

A significant trend in finance has been the shift to a global financial marketplace. This has been greatly aided by changes such as the deregulation and liberalisation of financial markets, the explosion in the range of new financial products and services available to the financial manager, a practice referred to as financial innovation, and the trend by financial institutions to build up their worldwide network of operations.

There is no doubt that over the coming years these trends will continue (and seemingly at an accelerating pace) to have a profound effect on the world of business and finance. The Internet, the World-Wide Web, and electronic commerce (e.g. electronic money and payments systems and electronic retailing), for example, are comparatively recent innovations which have changed radically, in a relatively short period of time, the way individuals and businesses operate and communicate.

All of these changes ana trends present the financial manager with a greater range of challenges, opportunities, and options for enhancing the investing and financing activities of the firm, but they also have their inherent risks. The challenge for the financial manager is to explore the options, take advantage of the opportunities they present, while taking care to manage the risks.

The Nature of Financial Management

In attempting to define financial management one of the first problems we encounter is that of terminology. Confusingly, as so often the case in finance and accounting, multiple terms can be used to describe the same thing. For example, financial management is alternatively called, 'business finance', 'managerial finance', and 'corporate finance'.

All of these terms refer to the management of the essential investing and financing activities which business firms must undertake to produce the goods and services which people require. For our purposes we will adhere to the term 'financial management'.

One possible definition of financial management is simply: 'the ways and means of managing money'. A more formal definition would be: the determination, acquisition, allocation, and utilisation of financial resources, usually with the aim of achieving some particular goals or objectives.

More specifically, financial management is about: analysing financial situations, making financial decisions, setting financial objectives, formulating financial plans to attain those objectives, and providing effective systems of financial control to ensure plans progress towards the set objectives. These activities can be presented in the form of a financial management process which will be explained shortly.

In relation to the goals and objectives of financial management, these are likely to vary according to different circumstances. For example, the goal for an individual might be accumulating a certain amount of personal wealth, for a commercial company it might be making a target amount of profit. Alternatively, in the case of a not-for-profit organisation (NPO) such as a charity, the goal mi...