![]()

Part 1

The Aerospace Market and its Basic Elements

![]()

Chapter 1

The Aerospace Market: Supply, Demand, and Segmentation

The market for aerospace goods and services consists of buyers and sellers who create the basic market forces of supply and demand. Marketing, a function of the supply side of the market, is a discipline that attempts to influence buying decisions by the demand side.

In any industry, an effective marketing professional must have a comprehensive understanding of the market in which he or she is working. The purpose of this initial chapter is to provide a brief overview of the aerospace marketplace, by identifying the principal categories of products and customers in the industry, and by identifying some of the major players on the supply side.

Principal Product Segments and Customer Categories

As is the case in any marketplace, the aerospace industry and marketplace are diverse, multi-dimensional spaces. They are by no means compartmentalized, and do not readily lend themselves to classification in well-defined segments.

Part of the problem with defining segments is that the market can be stratified or defined in so many ways. We can identify segments based upon the size of the aircraft, such as airliners, commuter transports, business jets, and general aviation airplanes. Alternatively, we can divide the market into two broad categories of civil products and military products, or by the technological nature of the products, such as avionics, propulsion systems, structural components, hydraulic systems, and flying vehicles. We can divide the market into products intended for outer space and products that operate within the earth's atmosphere. The choices are endless.

One of the issues with any arbitrary system of classification is that most delineations between the categories tend to be ambiguous, and that many products fit into several categories. Obvious examples are that much equipment is used on both military and civil aircraft, and that some equipment is used for space applications as well as conventional aerospace.

Regardless of these limitations, it is evident that the aerospace industry and marketplace is divided into natural major segments. The firms in these segments share common affinities, and governments and economic observers use the segments as practical means of classifying firms and measuring market activity.

The US Department of Commerce (US DoC) uses Standard Industrial Classification (SIC) codes to categorize the industrial activity of all firms in the United States. In this system, the SIC codes are four-digit classifications that are sub-categories of three-digit industry groups of a broader nature. The DoC considers most aerospace activity to fall with industry groups 372, Aircraft and Parts, and 376, Guided Missiles and Space Vehicles and Parts. The specific SIC codes are shown below. Also shown are corresponding North American Industrial Classification System (NAICS) codes that have recently come into use by the US Office of Management and Budget.

Table 1.1 Aerospace classification codes

|

| SIC | Industry Segment | NAICS |

|

| 3721 | Aircraft | 336411 |

| 3724 | Aircraft Engines | 336412 |

| 3728 | Aircraft Parts | 336413 |

| 3761 | Guided Missiles and Space Vehicles | 226414 |

| 3764 | Space Vehicle propulsion units | 336415 |

| 3769 | Guided Missile and space Vehicle parts | 336419 |

|

These broad categories are further refined in other systems of classification, notably by the industry itself. The following breakdown by major product categories and subcategories is typical.

Table 1.2 Aerospace product categories

|

| Category | Products |

|

| Military Fixed-Wing Aircraft | Attack |

| Bombers |

| Cargo/Transport/Refueling |

| Early Warning |

| Electronic Warfare |

| Fighters |

| Observation |

| Patrol/ASW |

| Reconnaissance |

| Research/Test Bed |

| Training |

| Utility |

| Commercial Fixed-Wing Aircraft | Narrowbody turbofans |

| Widebody Turbofans |

| Turboprops |

| Rotary-Wing Aircraft | Naval |

| Scout/Attack |

| Tiltrotor |

| Training |

| Transport |

| Utility |

| Business & General Aviation Aircraft | Turbofan |

| Turboprop |

| Reciprocating engine powered |

| Gas-Turbine Engines | |

| Unmanned Aerial Vehicles & Drones | |

| Space/Launch Vehicles | Manned systems |

| Unmanned systems |

| Missiles | Air-to-Air |

| Air-to-surface |

| Anti-Armor |

| Anti-Ballistic |

| Anti-ship |

| Anti-submarine |

| Surface-to-Air |

| Surface-to-surface |

|

Note that this particular classification includes engines, but does not include aerospace electronics, commonly called avionics, or other items of aerospace equipment such as landing gear, hydraulics, control systems, electrical systems, environmental control systems, and aircraft interiors. The value of these product lines is a significant part of the overall aerospace market, and although the firms sometimes classify themselves as members of other industries, such as the electronics industry, they also have a strong identity as part of the aerospace market. The classification also omits aircraft maintenance, repair, and overhaul activities, which are an important segment of the market in terms of transaction value and number of people employed.

Another means of describing market segments involves stratifying the market into tiers. With this approach, the prime contractor, who contracts to deliver the completed aerospace product to the final customer, is at the top of the hierarchy. Below him are subordinate tiers of suppliers that feed intermediate products into the manufacturing process. Buying and selling activities occur at each transition from one tier to the next. This tiered structure is a widely recognized characteristic of the aerospace market, but is imprecise and of limited usefulness interns of establishing meaningful identification of market segments.

Table 1.3 Contract tiers

|

| Contractual Tier | Characteristics |

|

| Prime Contractors | Design, develop, and assemble complete systems |

| Major Subcontractors | Perform assembly or manufacture of major components of systems |

| Second Tier Subcontractors | Manufacture subassemblies |

| Third Tier Subcontractors | Manufacture components |

| Fourth Tier Subcontractors | Manufacture parts or perform specialized processes |

|

How do the various market segments compare in terms of size and economic importance?

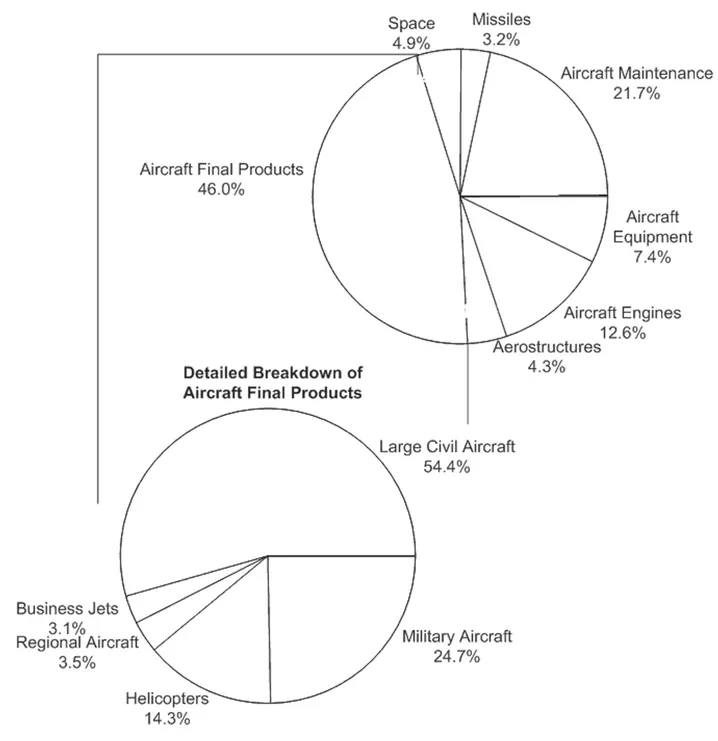

In the European aerospace market, we find that in recent years approximately 45 per cent of value consisted of sales of complete aircraft, and of these complete aircraft, approximately three-quarters of the value was attributable to civil aircraft. The other segments, in declining order of importance, were maintenance, engines, equipment, space, aerostructures, and missiles.

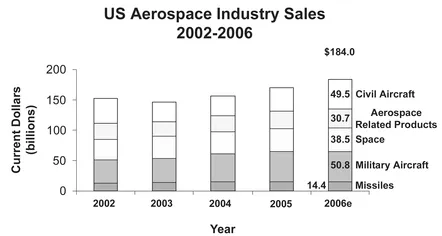

The corresponding data for the American aerospace industry, broken down on a somewhat different basis, shows that sales of complete aircraft comprise approximately 50 per cent of the total market, and that the distribution between civil and military aircraft is roughly even over the long term, although short-term market conditions greatly affect the relative balance. Following the end of the Cold War, in the 1990s demand for military aircraft dropped precipitously, particularly in Europe and Russia. However, American purchases of defense equipment began to rise again following 2001 as American military engagements in Afghanistan and Iraq placed new emphasis on national defense. Demand for civil aircraft is notoriously cyclical, following broader movements of international economic cycles. Airline demand and profits have been affected by widely felt exogenous factors such as petroleum price shocks and terrorist activities, and declines in airline demand are quickly manifested as declines in orders for civil transports.

Figure 1.1 Breakdown of relative values of European aerospace industry segments

Source: The AeroSpace and Defence Industries Association of Europe, ASD.

Figure 1.2 Comparative values of American aerospace industry segments

Source: Aerospace Industries Association.

Probably the most visible aerospace segment is the civil passenger airliner category. ...