![]()

Part 1

National context

![]()

1 Introducing the national context for PPPs – elements and dimensions

Koen Verhoest, Martijn van den Hurk, Nunzia Carbonara, Veiko Lember, Ole Helby Petersen, Walter Scherrer and Murwantara Soecipto

Introduction1

Over the past few decades, policies and institutions to promote the uptake of Public Private Partnerships (PPPs) have spread across the globe (Hodge et al. 2010; Klijn and Teisman 2003). Many countries have shown an extensive development of PPP programmes, whereas many others tend to remain rather sceptical (McQuaid and Scherrer 2010; Petersen 2011). A wide divergence in national PPP approaches can be noticed, and this provides food for thought on the relationship between the national context for PPP policy-making on the one hand and the implementation of PPP policy on the other: which nationally driven elements are vital to the (non-) development of PPPs in practice? Which contextual factors provide a conducive or stimulating climate for PPPs and which tend to be rather inhibiting?

In this first Part, we discuss some of the alleged crucial elements of the national context for PPP development, drawing from a cross-country data collection that was conducted in the framework of the COST Action TU1001 ‘PPPs in Transport: Trends and Theory’. Within this Action, a template was developed by members of the Working Group on National Context, which is presented in the next section of this chapter. Subsequently, country teams collected descriptive country profiles for 22 European countries for the dimensions of governmental support – PPP policies, PPP regulations and PPP-supporting institutions, as described later in this introduction (see Verhoest et al. 2013; Roumboutsos et al. 2014). In this Part, three chapters are presented that use this descriptive country-specific data to develop typologies and classifications of national contexts for PPPs and to compare national context in general, and elements of governmental support for PPPs in particular, between and within groups of countries.

In the remainder of this introductory chapter we first discuss our concept of PPP context as comprised of different levels. Then we explain in more depth the different dimensions of government support for PPPs that were at the core of the comparative data collection. We end with an outline of the structure of this Part by briefly introducing the three chapters.

Before we continue the discussion on this issue, our definition of PPP requires attention. Definitions of what might be understood as PPP differ from country to country. Here, we utilise the definition provided by the OECD:

An agreement between the government and one or more private partners (which may include the operators and the financers) according to which the private partners deliver the service in such a manner that the service delivery objectives of the government are aligned with the profit objectives of the private partners and where the effectiveness of the alignment depends on a sufficient transfer of risk to the private partners.

(OECD 2008)

Within the aforementioned relationship, the government specifies the quality and quantity of the service it requires from the private partner. The private partner may be tasked with the design, construction, financing, operation and management of a capital asset and service delivery to the government or the public using that asset. The private partner will receive either payment fees from the government, or user charges levied directly on the end users, or a combination of both. If the government is responsible for paying the private partner for service delivery, the fees usually depend on the availability of the service and/or asset. Principal to the definition we use is the transfer of risks from the government to the private partner (Grimsey and Lewis 2002; Lienhard 2006). Various types of risks are identified, priced and either retained by the public sector or transferred to the private partner through an appropriate payment mechanism and specific contract terms. The transfer of risks is based on the principle that each risk should be allocated to the partner where it can be best managed. In addition to the OECD definition, the European PPP Expertise Centre (EPEC) states that PPP usually includes a long-term contract which takes account of life cycle implications for the project (EPEC 2011).

Different analytical levels of national context

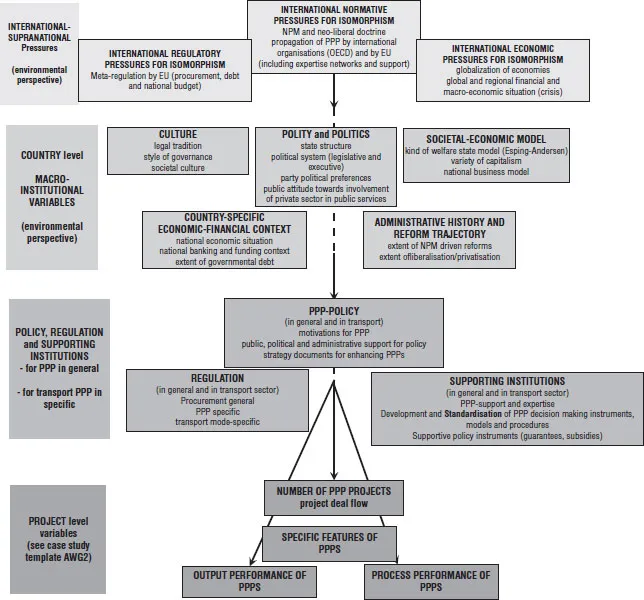

The national context for PPPs should be analysed by taking into account different levels of institutions. The context for PPPs in a country is an interplay of pressures and constraints situated at different levels of government. Therefore, although national context is highly important to PPP development, the role of institutions at higher (supranational) or lower (subnational) levels needs to be taken into account as well. For countries in the European Union (EU), PPP research has illustrated that institutions like the European Commission, Eurostat and the EIB are important policy-makers and/or regulatory players (Petersen 2010). Moreover, and also relevant for countries outside the EU, international bodies such as the OECD, IMF and the World Bank have important roles as agenda setters and promoters of new governance models in general and PPPs in particular (see, for example, OECD 2008). Consequently, the institutional context of PPP development in a country can only be analysed fully if one applies a multi-level approach. In accordance with Pollitt and Bouckaert (2004) and Verhoest et al. (2010) we distinguish between four levels of governance (as shown in Figure 1.1). The first three levels are to be considered as jointly creating the national context for PPP development.

First, there are international-supranational pressures for countries, which stimulate them to launch PPPs. These factors include regulatory, normative and economic pressures for isomorphism. Examples of this type of pressure are: meta-regulation by the EU, for example on procurement, public debt and national budget; the propagation of PPPs by international organizations, based on the New Public Management (NPM) discourse or related neoliberal doctrines; globalization of the economy.

Second, there are pressures and constraints that can be situated at national level, and we make a distinction between macro-institutional dimensions as well as PPP-oriented governmental policies and actions. Macro-institutional variables encompass five national dimensions, which set the scene for all government policies and actions, and not only policies and actions regarding PPP development. The first dimension is the administrative history and reform trajectory of a country, which includes the realisation of NPM-based reforms and measures of liberalisation and privatisation (Osborne and Gaebler 1992; Painter and Pierre 2005). Second, a country’s socio-economic model or structure is, inter alia, formed by its welfare regime (Esping-Andersen 1999) and varieties of capitalism (Nölke and Vliegenthart 2009). The third dimension, polity and politics, includes state structure and political system (Hague and Harrop 2007; Lijphart 1999). Culture, then, refers to both legal and societal aspects of culture (Hofstede and Hofstede 2005; House et al. 2004). Finally, the financial–economic dimension addresses a country’s macro-economic conditions, level of public debt and budgetary equilibrium, access to capital and credit markets, and the level of investment needs in infrastructure (European Commission 2012; WEF 2012; World Bank 2012).

Figure 1.1 Four different institutional levels influencing the development of PPP policies and projects (based on Pollitt and Bouckaert, 2004; Verhoest, et al. 2010).

The third level of analysis focuses on the specific policies and actions governments pursue in order to stimulate PPP take-up in their country, in which policy and political commitment, regulation and the legal framework, as well as supporting institutions, are crucial. This was the core focus of the data collection and analysis that was undertaken within COST Action TU1001. In the next section we will outline in more depth these different aspects of governmental support. The chapter by Soecipto et al. in this volume as well as Verhoest et al. (2015) both go a long way in grounding this conceptualisation of governmental support in literature.

Finally, the fourth level of analysis in Figure 1.1 refers to the outcome of this institutional context in the form of PPP projects, emphasising issues such as the diffusion of PPP practice, features of specific PPPs, processes of PPP implementation, and evaluations of their performance (Verhoest et al. 2012). This level was tackled by the Working Group on Performance, which developed a template for the description of PPP projects in different countries (Roumboutsos et al. 2013).

Policy, regulation and supporting institutions as core elements of PPP governmental support

To enable the descriptive analysis of the third level in Figure 1.1, which focuses on the government support for PPPs, a guiding framework was developed within the respective Working Group of COST Action TU1001. A significant part of this framework derives from practitioner-oriented literature (see, for an elaboration, Soecipto et al. in this volume as well as Verhoest et al. 2015). Table 1.1 shows the different elements that were gathered across countries concerning the political commitment to PPP and PPP policies. Emphasis is put on a country’s policy framework for PPPs, its experience with PPPs, its political stability, the direct effects of the financial crisis on PPPs in general and in transport, and the respective policy changes. PPP policy is often used as a means to stimulate the growth and development of a pipeline of PPP projects. For example, while not having strictly legal status, government bodies may issue a specific policy in relation to the rules of tendering and the terms of contract. Moreover, PPP policies serve to define PPPs in comparison with other infrastructure service procurement options, and they serve to describe the reasons and goals for adopting PPP schemes. Finally, PPP policies can encourage good relationships by directing and coordinating cooperation between interested sectors and institutions of government (cf. OECD 2006). All in all, a country’s political commitment to PPP and the form and strength of its PPP policy are vital to the PPP-development of a country (Verhoest et al. 2015).

Table 1.1 Variables and indicators for the dimension political commitment to PPP and PPP policies

Variables | Indicators |

PPP policy framework | Separate strategic policy document that outlines an explicit policy strategy on PPP. PPP as an element in sectorial policy framework documents. Clear PPP programme with a significant pipeline and timetable of viable projects that government is committed to procure. Main political motivations for PPP. |

Previous and current PPP experience | Number of PPP projects, in general and in transport. Lending volume via PPP projects, in general and in transport. Percentage of infrastructure investment through PPP over time, in general and in transport. |

Political stability | Major changes in political landscape that have affected political will and/or support regarding PPP. |

Effects of financial crisis on PPPs | Obtaining and securing financing for PPP projects. Number of planned and closed PPP projects. Duration time of PPP contracts. Difficulties in project operation phase. Financial issues. International financing of PPP projects. Transfer of risks to private sector. Contract renegotiations. Scale/size of PPP projects. |

PPP policy changes due to financial crisis | Government funding of PPP projects. Emphasis on traditional procurement. Emphasis on smaller/larger scale contracts. Government guarantees for funding/financing. Government involvement in Special Purpose Vehicles (SPVs). Project bonds. |

Concerning the dimension of legal and regulatory framework for PPP, Table 1.2 presents the elements that were assessed across countries. More specifically, they discuss the presence (and content) or absence of a legal framework for PPP and relevant elements in PPP-related and public procurement legislation (European Bank for Reconstruction and Development 2012).

The third and final dimension of the guidance for the descriptive analysis is that of PPP-supporting institutions. The implementation of PPP policies and the development of PPP projects are likely to be affected by either the presence or absence of these institutions, such as PPP units or agencies, fixed procedures for PPP project appraisal and prioritisation, and standardised PPP contracts (EIB 2004; Farrugia et al. 2008; OECD 2010; World Bank and PPIAF 2006). Table 1.3 lists the variables and indicators that were assessed in the cross-country data gathering within COST Action TU1001.

Table 1.2 Variables and indicators for the dimension legal and regulatory framework for PPP

Variables | Indicators |

Legal PPP framework | Explicit general PPP or concession law. Transport-specific law on PPPs or concessions. Public procurement law. Accordance with EU guidelines. |

Scope and boundaries of specific PPP law | PPP definition. Sectors and types of infrastructure/services co... |