eBook - ePub

Changing Face of Money

Will Electric Money Be Adopted in the United States?

This is a test

- 144 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Book details

Book preview

Table of contents

Citations

About This Book

Although the cashless society has been predicted for at least twenty years, the new forms of card-based and software based electronic money may prove to be a partial alternative to the current forms of payment. This study examines these emerging electronic money systems and their possible adoption, primarily in the United States.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Changing Face of Money by Barbara Ann Good in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

CHAPTER 1

Introduction

In the 20th century science and technology have dramatically changed how people live their lives and conduct business. These changes have touched virtually all Americans and all aspects of our lives. What is even more amazing to ponder are the changes that are yet to come. More new technologies are coming to the market faster and being adopted by an increasingly technologically savvy public than ever before.

By examining a number of yesterday’s inventions we are able to see that these inventions have conditioned and enured us to change and that acceptance of new technologies is accelerating. The following table1 shows that the time it has taken for new technologies to reach a quarter of the U.S. population has been accelerating.

| Date | Invention | Yrs. Before Mass use |

| 1873 | Electricity | 46 years |

| 1876 | Telephone | 35 years |

| 1886 | Gas Automobile | 55 years |

| 1906 | Radio | 22 years |

| 1926 | Television | 26 years |

| 1953 | Microwave oven | 30 years |

| 1975 | Personal Computer | 16 years |

| 1983 | Mobile phone | 13 years |

| 1991 | The Web | 6 years |

Source: National Center for Policy Analysis

With the introduction of electronic money systems, in both the card- and software-based forms, technology may once again change our lives, or at the very least, how we view money and make payments. Although these new money systems have not yet gained acceptance in the United States, they have made significant inroads in other parts of the world, especially Europe and Asia.

Money, in the form of currency and coin, has had a long and varied history in cultures and societies. The changes that may result from the acceptance of electronic money could affect the manner in which money is viewed, used and counted. These changes could have major implications for both society and those corporate and government entities who are stakeholders in the status quo. Those entities who are currently in control of the payments systems in cash, check, “plastic,” or electronic form, will want to continue to play a role in these new payments methods.

But, what are these new electronic money systems and are they really different from those systems we already use? Will they be accepted by consumers and merchants? Will they change the way business is conducted? Will they change the structure of society? Will they be safe to use? No matter what the new technology, many of the questions regarding new technologies are the same. In order to begin providing some answers to these questions, this study was undertaken.

Almost daily one can find articles about these new money systems in the business press, and just recently there have been numerous articles in newspapers and news magazines. As pilots are conducted, closed systems launched, and alliances built between companies, more and more of the U.S. public will become aware of these systems and have to make the decision as to whether they will adopt these new forms of payments.

As the world has changed through the introduction of new technologies, so has the concept of money. Today, money is perceived as a yardstick value, a unit of account. The vast sums of money that are exchanged on a daily basis have changed the way money is viewed. Money is no longer only in the form of paper, but is often only an electronic blip, an accounting entry. On average, more than $1 quadrillion is transferred on a daily basis electronically over Fedwire, the Federal Reserve System’s wire transfer network, primarily by corporations and banks.

Many of us are paid by direct deposit, an accounting entry that moves money from the employer’s account to our own. The new forms of electronic money take this concept one step further, as they try to replace even more of the paper and metal forms of money in society. This is truly the first time in monetary history that electronic-based money systems will be available to the public. These systems will bring to the consumer ways to move funds electronically, just as corporations and banks do today, albeit on a smaller scale.

Electronic money systems can be either card-based, using smart cards, or software-based systems, sometimes referred to as cyberpayment systems.

The terms “stored-value card” and “smart card” will be used interchangeably, although there are some technical differences between the two; both can be either a single or multi-purpose card with chip-based technology. These cards can function in either a closed system or open system. A typical closed system would be a transit system, such as the Washington, D.C. Metrocard system, or a university smart card that functions as identification, library card, copy card, meal and parking pass. An open system would generally be a larger merchant community that accepts the card for payment as though it were cash, check, or any magnetic stripe card, such as a credit or debit card.

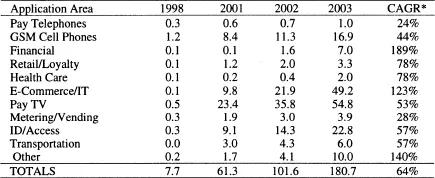

These cards are predicted to grow at dramatic rates over the next five to ten years. One forecast predicts that smart card demand will reach $1.6 billion by 2001,2 while others are even more optimistic. Opposing forecasts have predicted that the cards will never be accepted in the United States. There are forecasts announced daily that run the full gamut between these extremes. The following table shows the breakdown of the types of cards forecasted to be used by application by one forecaster.

Table 2: Projected U.S. Smart Card Use by Application (million cards)3

Source: Orga from Card Technology Magazine, November 1999, p. 32.

In addition to the card-based systems of electronic money, the world of electronic commerce opens up a whole new market for making payments over an open system like the Internet. Software-based electronic money is projected to be the preferred method for these payments. The market for on-line purchases is forecast to soar to $16 billion in the United States and Europe in 2002, according to the Datamonitor research firm. This is significant growth from 1997’s total estimated between $300 million and $500 million.4 This is considered to be a conservative forecast, as other research companies have projected much higher markets. Jupiter Communications of New York has predicted that electronic commerce will be worth $37.5 billion by 2002, while Forrester Research of Massachusetts has projected the market to be $66.5 billion by the same time.5 A more recent forecast, Global Payments 1999 released in November 1999 by the Boston Consulting Group estimates that by 2003, e-commerce in the U.S. will more than triple and that Internet transacted e-commerce will account for half of U.S. commercial transactions.6 No wonder companies are interested in finding a way to provide safe, secure, and reliable payments to this emerging market.

One reason that the electronic commerce market is predicted to grow so rapidly is the proliferation of personal computers in U.S. households. Although you do not need a PC to access the Internet, that is the way most users are accessing the Internet today. Web TVs were introduced in late 1996, and other access technologies may be developed, but PCs remain the primary access device. The following table shows the projections for households with online capabilities, giving some credence to the projections for electronic commerce.

| 1996 | 1998 | 2000 | |

| U.S. Households(millions) | 98.9 | 101.0 | 103.2 |

| Households with PCs | 38.7 | 47.8 | 55.1 |

| Households with PCs and modems | 27.2 | 42.0 | 51.4 |

| Online households | 14.7 | 27.3 | 36.0 |

Source: Jupiter Communications 1997 Consumer Internet Report

A more recent Cnet report8 stated that the number of adults using the Internet surpassed 100 million. Although this is not all home usage, a technology that has this many users provides huge marketing potential.

The acceptance of these new payments methods have some analogies historically, as the United States has experienced a number of different payments methods. Two that will be examined are considered to be revolutionary—paper money and credit cards, often referred to as “plastic money.” Although electronic money systems are more evolutionary in nature, these earlier payments innovations will help in establishing parallels and determining lessons that can be learned from the adoption of these methods of payment.

According to a recent article, money is a system of thought, a way of organizing social behavior, and an integral part of modern culture, but money need not necessarily be an object.9 This view is different fr...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Dedication

- Table of Contents

- List of Figures

- List of Tables

- Preface

- 1. Introduction

- 2. Money: What it is and How it works

- 3. An Overview of Electronic Money—Its Forms and Functions, Standards and Design Issues

- 4. Innovation, Diffusion, and Electronic Money

- 5. Electronic Money Pilot Programs

- 6. Policy and Legal Issues of Electronic Money

- 7. Final Thoughts and Conclusions

- Bibliography

- Index