![]()

Section I

FDI, Trade and Economic Growth

![]()

1

India-ASEAN Trade, FDI and Growth: Exploring Challenges and Opportunities Post-global Financial Crisis

Tran Van Hoa

The recent economic (and geopolitical) rise of China and India in the world has attracted extensive international attention, debate and policy re-evaluation. As a result, in Asia, a focus on India and the ASEAN and their relations has become a major regional research and policy study. To partly underscore this interest, the world leaders at the First East Asia Summit in Kuala Lumpur, Malaysia, on 14 December 2005, endorsed high-level studies and dialogues on an enlarged ASEAN free trade agreement (AFTA) to promote further regional integration for mutual economic and political benefits between the ASEAN and the world’s other trading blocs (e.g., India, the US, the EU, East Asia, Oceania, and Russia). The endorsement is consistent with India’s post-1991 reforms, the ‘Look East’ policy, ‘economic diplomacy’ and recent energy diplomacy (DFAT, 2011). While these policies have been helped by regional reform and cooperation, they have also been hindered to some extent by geopolitical regional developments, natural disasters and the global financial crisis (GFC).

This chapter is, in addition to its descriptive analysis, an evidence-based contribution to the study of this ASEAN-India trade, economic and regional integration areas and their significant and credible policy implications. It adapts a new endogenous growthtrade theory and improved flexible modelling policy approach that has won international acclaim (see Tran, 2002a, 2004, 2005, 2007c, 2008, 2010) to construct a causality model of ASEAN-India trade, growth and political economy. Using historical harmonised data from the Reserve Bank of India (RBI) and the Asian Development Bank (ADB) and advanced econometric estimation methods, the chapter provides efficient and robust empirical findings on the determinants of the ASEAN-India trade in goods, FDI and services, and their linkage to economic growth for more credible policy analysis in the framework of Friedman (1953) and Kydland (2006). Implications of the findings for ASEAN-India relations in the context of challenges and opportunities in the economic and trade policy of an enlarged AFTA or East Asia Summit (EAS) free trade agreement (FTA) and regional post-GFC cooperation are also discussed.

Trends and Major Features of India’s Trade Relations with Asia and its Major Partners

Since its independence in 1947, India has regarded itself as a major international player. It has been at the forefront of developing country activism, a member of the Non-Aligned Movement (NAM), the United Nations and the Commonwealth. Recently, the country has sought to expand its cooperation with East Asia and ASEAN (DFAT, 2011). For nearly four decades after independence, however, India’s economic development through a number of expansive five-year plans was relatively sluggish and apparently failed to some extent to realise the country’s full economic potential. As a result of the balance-of-payments and investment crises in 1991 and the subsequent introduction of the reform process, ‘economic diplomacy’, and the ‘Look East’ policy with Asia, India is showing clear signs of realising what the country can and wants to achieve as an international player. We note that while India is the major power in South Asia and its relations with its neighbours had traditionally governed the tenor of foreign relations in the region, its major strategic focus has more recently broadened, notably towards East Asia in general and ASEAN in particular (ibid.).

Like Australia, India has been pursuing a combined multilateral, regional and bilateral approach to trade policy with its major trade partners. For example, while the country is a WTO member, it also has an India-Sri Lanka FTA in operation since 2002; it signed a Comprehensive Economic Cooperation Agreement with Singapore in June 2005, and entered the first stage of an India-Thailand FTA in September 2004, although there has been no further implementation of this FTA. In late 1995, India was granted full dialogue partner status with ASEAN and was admitted as a member of the ASEAN Regional Forum in July 1996. An ASEAN-India FTA was signed in 2009. India, together with Australia and New Zealand, is also an EAS member.

In 2002, India participated in its first summit meeting with ASEAN. In 2003, it signed three significant agreements with ASEAN including the important ASEAN-friendly Treaty of Amity and Cooperation. On 14 December 2005, India attended the first East Asia Summit meeting where, with the world’s major trading bloc leaders, it endorsed an enlarged ASEAN and subsequently an EAS FTA. As it stands now, however, India is not an Asia-Pacific Economic Co-operation (APEC, a group spearheaded by Australia) member.

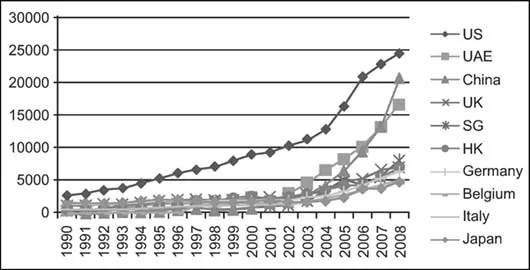

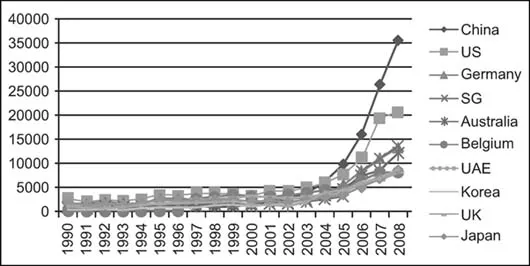

As a result of this national eco-political approach with apparently clear leadership foresight, the world’s trading blocs have seen rapid growth and strong dynamics in their trade with India. India’s recent growth and the trends and patterns of trade with its top-10s trading blocs during 1990 and 2008 are shown in Figures 1.1 (exports) and 1.2 (imports). During the period 1990–2008, the average share of the top-10 trade to India’s total trade is 55.74 per cent for exports and 42.75 per cent for imports. In terms of total trade, the data shows that, with a modest pre-reform start of US$ 17.81 billion in 1990, India’s total exports reached US$ 187.35 billion in 2008 (or a rise of 52.9 per cent annual average). The country’s imports also show a faster rising trend with US$ 23.99 billion in 1990 and a peak of US$ 299.49 billion in 2008 (or an increase of 63.8 per cent annual average). The largest increases in India’s exports and imports, however, seem to coincide with the country’s World Trade Organisation (WTO) membership in 1995 and especially the reforms in the early 2000s.

Source: ADB (Asian Development Bank). 2011. Available at http://www.adb.org/Documents/Books/Key_Indicators/2010/Country.asp (accessed 15 January 2011); and author’s calculations.

Figure 1.1: India’s Top 10 Export Destination Trend, in US$ Millions

Source: ADB (Asian Development Bank). 2011. Available at http://www.adb.org/Documents/Books/Key_Indicators/2010/Country.asp (accessed 15 January 2011); and author’s calculations.

Figure 1.2: India’s Top 10 Import Source Trend, in US$ Millions

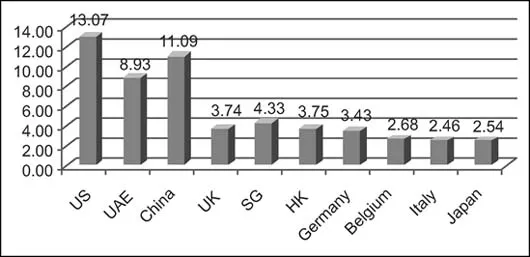

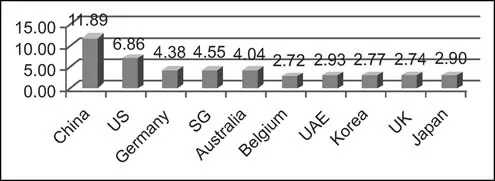

In terms of market shares, the data in Figure 1.3 show that, in 2008, the US was still India’s largest export market (13.07 per cent), followed by China (11.09 per cent) and the UAE (8.93 per cent). However, also in 2008, India’s largest import source (Figure 1.4) was China (11.89 per cent), followed by the US (6.86 per cent) and Singapore (4.55 per cent). Japan, a major trading country in Asia, had, however, been playing a small role in trade with India with 2.54 per cent and 2.90 per cent of export and import shares respectively.

Source: ADB (Asian Development Bank). 2011. Available at http://www.adb.org/Documents/Books/Key_Indicators/2010/Country.asp (accessed 15 January 2011); and author’s calculations.

Figure 1.3: India’s Top 10 Export Destination Shares, 2008

Source: ADB (Asian Development Bank). 2011. Available at http://www.adb.org/Documents/Books/Key_Indicators/2010/Country.asp (accessed 15 January 2011); and author’s calculations.

Figure 1.4: India’s Top 10 Import Source Shares, 2008

The shares of India’s total trade with its world trade partners (12 countries or blocs) in 2008 are given in Figure 1.5. The data here indicate that while all developing countries’ trade with India accounted for 42.6 per cent and 32.0 per cent of its exports and imports respectively, ASEAN (denoted by SEA) trade with India played only a small part in India’s global markets (8.6 per cent for exports and 8.4 per cent of imports). ASEAN—India historical total trade (exports and imports) share and the growth of this trade...