This is a test

- 282 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Modelling Pension Fund Investment Behaviour (Routledge Revivals)

Book details

Book preview

Table of contents

Citations

About This Book

First published in 1992, this title conducts an in-depth examination of the investment behaviour of pension funds, presenting the first econometric model in this area. Using the well-established framework of modern portfolio theory, David Blake derives a model of optimal portfolio behaviour that explains pension fund asset holdings in terms of the most important macroeconomic and cyclical indicators. He shows how factors such as industry profitability, the balance of payments and the monetary and fiscal policies of the government influence pension fund investments. Broad in scope, this reissue will be of particular value to students and academics with an interest in econometrics, investment analysis and the pension fund industry.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Modelling Pension Fund Investment Behaviour (Routledge Revivals) by David Blake in PDF and/or ePUB format, as well as other popular books in Personal Development & Personal Finance. We have over one million books available in our catalogue for you to explore.

Information

1 UK pension funds and their investments

Pension funds are part of the long-term investing institutions of the UK. Their purpose is to accumulate assets, the income from and capital values of which are used to pay for the pensions of retired workers. Of about 18 million people with pension rights, about 11 million are in schemes with pension funds. The rest receive their pensions on what is known as a pay-as-you-go basis. The income of the pension funds comes mainly from the contributions of both employers and employees and from the rents, dividends and interest on the assets of the funds.

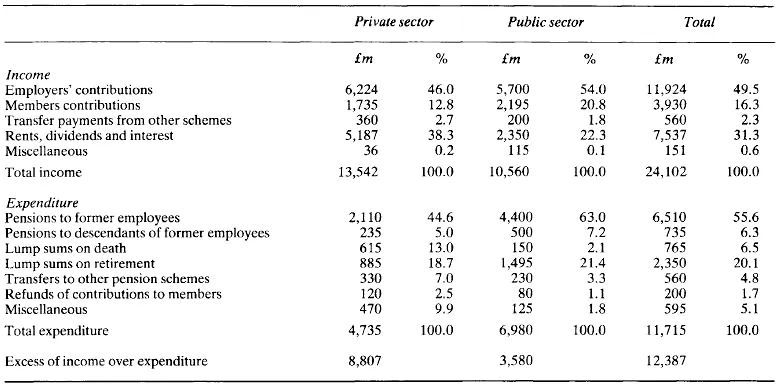

In 1983, the Government Actuary conducted a survey of occupational pension schemes in the UK. Some of his findings are presented in Table 1.1. The table shows that in total 31.3 per cent of the income of pension schemes comes from the rents, dividends and interest on the assets of the funds. The fund income is sufficiently large by itself to pay all the pensions to former employees and all the pensions to descendants of former employees. Fund income is the second largest category of total income, second only to employers’ contributions which account for about 50 per cent of overall income. In total, fund income is nearly twice the size of members’ contributions. The early 1980s was the period during which substantial pension fund surpluses built up. This is clearly seen in Table 1.1 with the excess of income over expenditure exceeding the total expenditure of pension schemes in 1983. The 1986 Finance Act put a stop to systematic pension fund surpluses.

Table 1.1 also presents income and expenditure figures disaggregated between private sector and public sector schemes. The most significant difference is the relatively smaller proportion of rents, dividends and interest in the total income of public sector schemes compared with private sector schemes. This reflects the fact that more schemes are unfunded in the public sector than in the private sector. For example, the central government civil servants’ scheme is entirely unfunded (i.e. it is a pay-as-you-go scheme).

Table 1.1 Estimates of the income and expenditure of pension schemes in 1983

Source: Government Actuary’s Survey 1983: Table 4.1

Table 1.2 shows the market value of pension fund assets in 1963 and 1989. The funds are classified according to whether they are in the private sector or in the public sector, and the latter category is divided between local authority funds and other public sector funds such as those of the nationalized industries and public corporations. In 1963, the market value of pension fund assets amounted to £4.5 billion, with 62 per cent of the assets held by private sector funds, 16 per cent by local authority funds and 22 per cent by other public sector funds. By 1989, the value of pension fund assets had risen to £254.4 billion, and, as a result of the government’s privatization policy of the 1980s, the share of private sector funds had risen to 70 per cent. How are these funds invested?

Pension funds have the choice of allowing an insurance company to undertake the task of investing the contributions flowing into the fund (called ‘insured fund management’) or exercising that choice themselves, directly through an appointed investment manager or indirectly through a single external financial intermediary or a group of external financial intermediaries, such as brokers or investment banks (called uninsured or strictly ‘self-insured fund management’).

Direct investment is the investment strategy pursued by very large pension funds. Like all direct investors, pension funds and their investment managers face a certain opportunity set of assets. Their strategy is first to select the broad asset mix between cash and money market securities, bonds (both fixed-interest and index-linked bonds), shares, property and other tangible investments, from both the domestic and overseas sectors (this is known as the asset allocation decision). They then make more detailed selections within these broad categories, e.g. shares in different companies or government bonds as against corporate bonds etc. (this is known as the security selection decision). When investing abroad, pension funds must take into account the various restrictions that may be imposed by either the home or overseas governments from time to time. For example, the major factor affecting investment outside the UK until 24 October 1979, when they were abolished, was the set of exchange control regulations. These penalized overseas investment by forcing investors to transact in ‘investment curren...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Original Title Page

- Original Copyright Page

- Dedication

- Table of Contents

- List of figures

- List of tables

- Preface

- 1 UK pension funds and their investments

- 2 A theoretical model of portfolio behaviour

- 3 The investments and returns of private sector pension funds

- 4 Modelling the expected returns and risks of private sector pension funds

- 5 Modelling the portfolio behaviour of private sector pension funds

- 6 Simulating the portfolio behaviour of private sector pension funds

- Postscript

- Index