Introduction

This book examines financial statement fraud (FSF) sometimes called management fraud. 1 Fraud committed in financial statements fundamentally distorts the monetary position of a business entity and its financial worth. The deception has the capacity to cause great harm in both a social and economic context. There are numerous ways in which to commit fraud in financial statements of account. Drawing on an array of national and international cases, we explore this phenomenon. To elaborate necessitates a framework that herein we base on Cressey’s theory of the fraud triangle. 2 It also requires a clear description of the fraud investigated. Hence we define FSF as:

Fraud in financial statements is an act of deliberate deceit that results in a misleading representation, material misstatement or intended exclusion in a business entity’s financial accounts. The deception is committed with the intent to mislead shareholders and other stakeholders about the financial state of the business entity. The fraud may mislead-ingly relate financial circumstances, or an otherwise non-financial material fact.

Previously the Treadway Commission (1987, p. 2) advised they ‘defined fraudulent financial reporting as intentional or reckless conduct, whether act or omission, that results in materially misleading financial statements.’ 3 ASIC (2005, p. 3) stated: ‘Definitions differ, but the common thread is that financial statement fraud involves deliberately misleading or omitting amounts or disclosures in financial statements in an attempt to deceive financial statement users, particularly investors or creditors.’ 4

That FSF may be called management fraud is notable. First, it emphasises that management are responsible for the financial statements and their content. Second, they are in a position to alter, enhance, or impair the accounts. Arguably those in positions of authority with a degree of power have an incentive to portray the business in a healthy, sound financial state—whether accurate or not. Such motivation is heightened when the business is financially unsteady. Hence those in senior positions are more likely to rationalise fraud in financial reports, and in all probability they have the opportunity to do so. The underlying pressure that motivates the fraud may or may not be evident.

Importantly it is not always senior management who solely commit FSF. 5 Others in positions of some authority (such as middle managers, department heads, or supervisors, who have the incentive and see the opportunity) are possible contributors. Bonus schemes based on increasing revenues, decreasing or stabilising costs, across the organization or by department, are likely motivators. Essentially anyone with the opportunity to commit fraud, especially if under some perception of pressure to do so, may well rationalise the act. The fact that pressure is perceived is significant. The perception of pressure will affect people in different ways. Some people will react adversely and subsequently their choices may not be well considered. Others may not be swayed or coerced. 6

So not all people suffering pressure under similar or dissimilar situations will participate in or become perpetrators of fraud. In 2013 KPMG reported results of their international survey that revealed characteristics of a typical fraudster who would likely, among other things, be 36–45 years, acting mostly in fraud against their organization and employed in a middle management to senior/executive position. 7 Given the difficulty of amassing details of all fraudulent activity many argue there is no particular profile of a fraudster. 8 We believe the latter is a more realistic and impartial an approach. If organizations focus on a particular profile of a fraudster, actual occurrences of fraud may go unchecked.

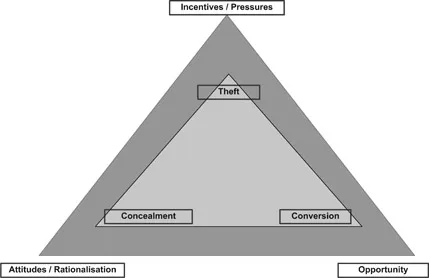

Hence Cressey’s theory of the fraud triangle is based on three fundamental factors: perceived pressure, opportunity, and rationalisation. The fraud triangle, though, has two parts, the factors or motivators to commit fraud and the elements of fraud. Fundamentally the elements of fraud are theft, concealment, and conversion. 9 This theoretical concept is expanded diagrammatically and discussed further with regard to stakeholder theory in chapter two.

In sum, for FSF to occur the perpetrator/s will suffer under some form of perceived pressure, and where the opportunity to relieve that pressure is evident, the perpetrator/s will rationalise the fraud. In that vein, the fraudster proceeds to steal from the company, conceal the theft, and convert what has been stolen into some other form. Hence, the framework to underpin the problem is established.

Diagram 1.1 The Fraud Triangle: Factors and Elements

The Problem

FSF continues to be a topical and an increasingly challenging area for business, financial accounting, and the law. The problem of fraud is a global problem, particularly from a practical and public policy perspective, as the monetary cost of fraud escalates and the ensuing confidence in financial markets deteriorates. 10 In this environment, stakeholder demand for quality in financial statements intensifies. Debate about what constitutes quality in financial statements continues. This is not least because many business organizations throughout the world continue to collapse unexpectedly. 11 At times this occurs after the business has published financial statements that portray the entity as financially sound. 12 This is perplexing and the circumstances of each case warrant scrutiny.

Arguably shareholders and other stakeholders may expect an entity’s published financial statements to be precise and informative, and that the financial details within the statements are serviceable to their needs. It is evident, however, as reportedly profitable and financially sound business organizations do collapse unexpectedly that seemingly uninformative, imprecise financial details are sometimes published. If the intent in those publications is to mislead the readers of those financial reports, then almost certainly FSF prevails. This is likely to occur where the entity’s attention to governance and its internal control environment are lacking. In that context the culture generated throughout the organization is of concern.

An organization’s culture grows from a combination of factors throughout the entity. Mostly it is a philosophy that emanates from the top and it is essentially that which drives the organization’s culture, work ethic, and spirit. So the outcomes of decisions, actions, and behaviour of the directors, executive officers, and managers spread throughout the business. Consequently, that tone will affect the attitude and behaviour of all employees. If dishonesty is endemic, then the probability of fraud committed for the organization, as well as against the organization, will in all likelihood occur.

An act committed for the organization usually is intended to portray the financial state of the business in a much stronger position than it actually enjoys. There are many reasons why this may be done and many ways in which it may be achieved. On the one hand, assets and their financial equivalents might be intentionally misreported, expenses may be understated, liabilities might be undisclosed, and details in the notes to accounts could be uncommonly vague. 13 Alternatively relevant details about the organization’s business activities and the outcome of some might not be disclosed or may be ill-defined. In which case the financial statements and accompanying notes published to inform shareholders and other stakeholders will be imprecise or false. As such the market is misinformed.

Sometimes fallacious accounts and erroneous stories radiate widely throughout business and are not ever discovered. Thankfully many are and the likelihood of discovery into the future increases, as awareness of FSF and unacceptance of its outcomes across communities increase. Progressively investors, regulators, and others realise the adverse social and economic outcomes of fraud and FSF to local, national, and international communities. Those interested seek further data, information, and explanation to enable their education and vigilance. To identify how best to combat the problem necessitates a heightened attentiveness to detail, awareness, and continued investigation. Evidence shows that experienced, well-educated, knowledgeable professionals and regulators and business participants generally can be deceived, and sometimes for a long time. 14

Instinctively a business organization in an apparent healthy financial condition is unlikely to be questioned. It is most likely to enjoy a stable reputation, continuing business operations, and, if a listed company, a healthy market capitalization position. On the other hand, a business that is seen to be floundering financially is likely to be pursued by its creditors, experience diminishing support from its financiers, and observed with increasing caution by other investors. In which case, the management team or part thereof might be tempted to do something to augment the organization’s published financial story. Given the incentive some managers may easily rationalise a necessity to fiddle the figures to help the financially challenged business to look good—even if it is for a short while.

The motivation to commit such fraud may stem for example from personal greed, coercion from others, or a misguided attempt to maintain the business’ status. 15 In a bizarre form of perceived altruism, the focus may be to retain the reputation of the company, to sustain employment opportunities for staff, and to maintain or grow financial returns to and for shareholders. On the other hand, the latter may also constitute an element of personal greed whereby the perpetrators, through shareholdings, options, or the like, secure a financial reward and also retain their employment, reputation, and status.

Many cases of unexpected corporate collapse and fraudulent endeavour 16 indicate the necessity for further research into the constructs that underpin FSF. The reasons why perpetrators embark on the journey are at times exposed. 17 In other cases the actual reasons may not ever be known. Perceptions of why perpetrators commit FSF warrant further research but that is beyond the scope of this book. Herein we explore and analyse critically, elements of financial accounting that may contribute to FSF. In this vein we investigate how best to mitigate opportunities for FSF to persist into the future. 18 In that context we examine a particular construct sometimes utilized by business that facilitates asset transfers and off-balance sheet liabilities.

This activity is known as the phoenix phenomenon. Otherwise it is deciphered as a complex area of re-structuring companies under the guise of a phoenix. Interestingly it is a type of business reconstruction that can be legal or illegal. It is an area that is, in part, explained but it is not well defined in accounting or the law. It is also an area that is rife for fraud. Hence a major contribution of this work to the deliberations of FSF has regard for phoenix activity. This particular spectacle of business is explained and analysed with supporting case examples in chapter six.

Elements of Fraud in Financial Statements

In financial reports there are many components to consider. Each part contains fundamental elements that may seem innocuous, but provide opportunities for fraud. Revenue (sales and revenue recognition), asset misappropriation (valuation, theft), expenses (periodicity, matching, capitalization), liabilities (obligations disclosed or non-disclosed), and inventory (valuation, COGS, units of work in progress, units obsolete) are the common subjects of fraud. They may also be the subject of error. So, to recognize anomalies that may exist in and between such accounts is imperative. A business and its attention to its inte...