This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Taxation, Inflation, and Interest Rates

Book details

Book preview

Table of contents

Citations

About This Book

NONE

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Taxation, Inflation, and Interest Rates by INTERNATIONAL MONETARY FUND in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

1984ISBN

9780939934331

PART I OVERVIEW

1 Interest Rates and Tax Treatment of Interest Income and Expense:

FISCAL AFFAIRS DEPARTMENT

In recent years the Executive Directors of the International Monetary Fund have expressed concern over the effects on the level and variability of interest rates arising from differential tax treatment of interest income and expense across countries. They have also expressed concern with respect to the effects of these and other related tax provisions on the effectiveness of policies of monetary restraint and on international capital movements. The Executive Directors therefore asked the Fund staff to assess the role of tax factors in the high levels of interest rates prevailing in 1981–82 in the United States and other major industrial countries.1

The situation has changed somewhat in the past year. Nominal interest rates have fallen considerably in the United States and elsewhere, but real interest rates have remained high. Some industrial countries have started taking a closer look at tax provisions relating to savings and capital formation. Attention has focused on the influence of taxation on the after-tax costs of investments and returns on savings, especially in an inflationary situation. Furthermore, the tax deductibility of interest payments unrelated to income-earning activities (viewed by some observers as a “tax expenditure”) has come under close scrutiny in the United States and other industrial countries.

Nevertheless, tax reforms have been slow. Different tax policies, frequently dictated by tradition and by the national goals of individual countries, continue to be the rule. Therefore, insofar as tax factors do affect significantly the level and volatility of interest rates in a closed (domestic) economy, and differential tax regimes affect exchange rates and international capital movements in an open (international) economy, the concern expressed by the Executive Directors remains valid and significant.

I. BACKGROUND

As tax factors have generally been given little importance in the literature on monetary theory and international finance, the professional body of knowledge in this area is limited. Theories of interest rate determination and of demand for money are often discussed in terms of pretax variables, and they omit reference to taxation of interest income or to deductibility of interest payments from taxable income. Similarly, the literature on theorems of interest rate parity and purchasing power parity has largely ignored the effects of tax factors. On the other hand, public finance literature has focused on the microeconomic (allocative) and equity (redistributive) effects of taxes and has ignored their macroeconomic effects.2

Limitations of the paper

As is often the case, the research effort involved in preparing the present study, while answering many questions, has raised many more and has made the Fund staff more aware of the many problems in this area.

- There is little unanimity among economists as to the determinants of interest rates and international capital movements. As a matter of fact, no single theory of interest rate determination that has been advanced is readily accepted by the majority of economists or can explain the unusually high levels of real interest rates in recent years.

- The interrelationship between nominal or market interest rates and their determinants, particularly expected inflation, has been unstable over time, so that no specific conclusions can be reached about the precise quantitative effect of inflation on interest rates.

- The available empirical evidence on the interrelationships between taxation, inflation, and interest rates is sketchy. For the United States and one or two other industrial countries, the evidence that does exist is often conflicting or ambiguous.

- The tax provisions bearing on interest rates and international capital movements of individual countries tend to be highly complicated and thus subject to a variety of qualifications and interpretations. (Some of these problems are discussed in Appendix I.) Furthermore, recent ad hoc legislative efforts aimed at adjusting the tax systems for inflation have created uncertainties of their own.

- Finally, little statistical information is available on the taxes actually paid by groups of savers and investors in individual countries. In addition, the existence of many possibilities for tax avoidance (e.g., tax allowances for savers and tax deferrals for investors) and tax evasion (resulting from shortcomings in national tax administration and the existence of tax havens abroad) makes the available legal information of doubtful usefulness (see Appendix I).

The research on the subject, carried out in the Fund’s Fiscal Affairs Department and elsewhere, can therefore claim at best, to have reached, tentative conclusions subject to the above-mentioned limitations.

Outline of the paper

The paper focuses on the following questions:

- Does the tax treatment of interest income and payments differ markedly among major industrial countries? Do other tax provisions affecting interest rates and international capital movements also differ markedly?

- How does the tax treatment of interest income and payments influence the level and volatility of interest rates, especially in an inflationary environment? If there is an influence, what is the direction of the effects of these and other relevant tax factors?

- How do potential international movements of capital and related tax provisions alter the results of changes in tax treatment regarding interest income and expense initiated by a single country?

- What implications does the tax treatment of interest income and expense and related tax policies have for the impact of changes in the degree of monetary restraint?

- What are the consequences of tax policy for the volatility of interest rates and what are the procedures for changing tax policy?

Sections II, III, and IV attempt to answer these questions and to present the available empirical evidence. Section V brings together the major conclusions of the paper and states their implications for Fund activities.

Summary of major conclusions

Section II, supported by three tables in Appendix III, shows that, even though the taxation of interest income is nearly universal and that such income is generally taxed at ordinary income tax rates, the tax regimes of major industrial countries differ in major respects. The marginal rates of the income tax differ among industrial countries, and the tax allowances offered to savers by individual governments also differ markedly. Furthermore, the changes that have been made in income tax structures in response to inflation in most industrial countries have been ad hoc ones and have been incomplete. As a result, the effective tax rates for real interest income differ among industrial countries, although no estimates of these rates are available.

The differences in the tax treatment of interest payments are even more marked. Of the 16 industrial countries surveyed,3 7 offer deductibility from taxable income of all interest payments, including those for income-earning activities, mortgage payments, and consumer loans; 8 allow tax deductibility of interest payments for incomeearning activities and for mortgages but none for consumer loans; and only one country does not allow any deduction for either mortgages or consumer loans.

The tax treatment of foreign exchange gains and losses also differs among industrial countries, although the legal provisions are more complex. In some countries, gains are treated as capital receipts and are thus subjected to capital gains taxes, which are generally levied at lower rates; in other countries, they are treated as current receipts and are subjected to the regular income tax.

Section III suggests that, even in the absence of income taxes, the one-to-one relationship between expected inflation and nominal interest rates (the basic Fisherian hypothesis) may not be valid for a variety of reasons. The existence of expected inflation may, in fact, lower the rate of return on real investment and, consequently, the real rate of interest, thereby limiting the increase in nominal interest rates.

The taxation of nominal interest income and the tax deductibility of nominal interest payments, which typically exist in many industrial countries, can theoretically cause a more-than-proportional increase in nominal interest rates as a result of a given expected rate of inflation. But this increase is also limited by the existence of many other tax factors, including the tax treatment of other capital income and capital gains that limit the investor’s capacity to avoid taxes, the tax depreciation allowances and inventory procedures that increase taxation on companies and thereby reduce their ability to pay higher interest rates, the existence of tax-exempt lenders and borrowers, tax evasion, tax havens, etc. Because of these many tax factors, the positive impact of the tax treatment of interest income and interest payments is likely to be somewhat reduced. The few empirical investigations covering this area tentatively suggest that, when all factors are taken into account, the nominal interest rate, on average, does not increase more than proportionately with expected inflation (e.g., see Section III, Table 1). However, this empirical result does not rule out the possible existence of tax effects.

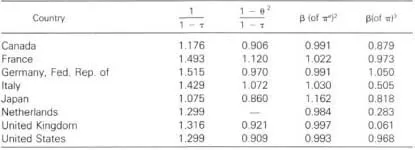

Table 1. Eight Industrial Countries: Impact of Taxation on Adjustment of Interest Rates to Inflation, 1971–811

Source: Background paper by Menachem Katz, “Inflation, Taxation, and the Rate of Interest in Eight Industrial Countries,” in Part II of this volume (Chapter 7), Table 4.

1 The average income tax rate applicable is denoted by τ and the capital gains tax rate is denoted by θ.

2 The tax rates used here are given in Table 15 of the Katz paper (see Source). The difficulties of calculating the effective tax rates are well known; hence, it was necessary to adopt a variety of approaches for estimating these rates. The method used, as well as its limitations and the biases it creates, is explained in the Katz paper (see Source).

3 The coefficients β (of πe) and β (of π) represent, respectively, the Fisher effect for expected and actual inflation rates.

Many proposals have been made to restrain the positive effect of the “typical” tax treatment of interest income and payments on nominal interest rates. In particular, these have included (1) a complete inflation adjustment of interest income and expense for taxation pur...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Foreword

- Acknowledgment

- List of Papers

- Contributors

- Introduction

- Part I. Overview

- Part II. Background Papers

- Index

- Footnotes