eBook - ePub

External debt : Definition, Statistical Coverage and Methodology

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

External debt : Definition, Statistical Coverage and Methodology

About this book

NONE

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

1988eBook ISBN

9789264130395Part I DEFINING EXTERNAL DEBT

Chapter I SEEKING A COMMON DEFINITION OF EXTERNAL DEBT

1. THE OBJECTIVE

The first consideration in formulating a definition of countries’ external debt is that it should respect the requirements of a wide range of users. Major users include: banks and export credit guarantee agencies for their work on risk analysis; officials involved in international financial co-operation, especially those concerned with the negotiation of debt agreements; and economic analysts in general. These and other potential users must find statistics derived from the definition relevant and realistic.

At the same time, it has to be recognised that statistics used in the assessment of external debt have already been collected and published for many years by a number of organisations, each with its own constraints and objectives. While any statistical system should be geared to the needs of the final user, the organisations are themselves among those users, and any definition is therefore bound to take into account their own practical needs.

The definition should also embody an internally consistent methodological approach to the concept of debt, capable of being articulated into some of the broader statistical systems dealing with financial stocks and flows.

It must also take into account, as far as possible, the practical problems involved in the reporting, aggregation and presentation of the statistics obtained.

This last aspect will be raised at various points in later chapters, but it will be useful, before proceeding in Chapter II to the definition adopted by the Group, to discuss briefly the historical background to the role and purposes of the existing systems, and the methodological framework in which the definition is placed.

2. THE ORGANISATIONS INVOLVED

The four organisations whose activities in the field of debt statistics are described in detail in this book had been collecting data on debt or debt-related aggregates for many years before external debt emerged in the early 1980s as a topic of major international importance in its own right. But they had been doing so in different ways, viewing the exercise from different standpoints and using the data for different purposes. In some cases, the information on debt was not originally collected as such, but was a by-product of more broadly-based statistical systems. None of the organisations on its own could be said to be producing comprehensive information on external debt.

The organisations are differently constituted and have different mandates. The focus is in some cases on creditor countries, in others on both debtors and creditors; their membership consists variously of governments or central banks, restricted to particular groups of countries or more universal; some collect data from the creditor side, the others mainly from the debtors. These differences have implications for timeliness and coverage. They may also result in data that are not easily reconcilable.

Realisation of the need for progress in this field led, in the first place, to bilateral collaboration between organisations collecting complementary information, enabling the published figures to provide a more comprehensive measure of external debt - for example, figures from the banking sector obtained by the BIS were pooled with those on official and officially-supported private export credits collected by the OECD. Other examples of productive collaboration took the form of patient behind-the-scenes efforts to improve the quality of the data. This was true of the work jointly undertaken by the World Bank and the OECD to compare detailed loan-by-loan information provided by debtors and creditors. Work of this kind was a step forward, but the process inevitably identified and drew attention to the questions raised by differences in definitions, approaches and compilation methods used by the organisations.

The four organisations whose work on debt statistics is described in this book and which have been the prime movers in the attempt to move towards a common approach are:

- – The BIS, an organisation whose members include the world’s major central banks, involved in debt statistics largely because of the monetary authorities’ concern about the commercial banks’ involvement in international lending and the stability of the international financial system;

- – The IMF, an international monetary and financial organisation with worldwide membership covering both developed and developing countries, whose concern with debt stems in large part from its task of ensuring the effective operation of the international monetary system, but also from its role in providing financial support and advice to countries in balance-of-payments difficulties;

- – The OECD, composed of the the main market-economy industrial countries, whose interest in debt arises from its activities in the field of international financial co-operation, especially with the developing countries;

- – The World Bank, with a worldwide membership of both industrial and developing countries, which collects and uses debt statistics for operational and analytical purposes related to its function as the main international development institution supplying technical and financial assistance to developing countries.

These four are by no means the only institutions interested in debt statistics or involved in their collection. They are, however, the only international organisations actively involved in collecting and publishing comprehensive original-source data of this kind.

None of the four organisations is authorised to publish all the debt information collected. It is only after various aggregation processes have been carried out that the results can be made available to the public. It should not be inferred, therefore, from the fact that a particular type of information is collected by an organisation that this is information which can be freely made available by the organisation concerned.

The work of the Group set up by the four organisations covers a wide range of topics relating to the practical measurement of external debt and debt-related aggregates. Clearly, however, progress in many of these fields, especially those where the aim is to move closer towards a common approach by the different organisations, is only possible if there is at least minimum agreement on what constitutes debt itself.

This was one of the considerations providing the starting-point for the formulation of the core definition of debt. Before discussing this definition, it is useful to examine some of the more general considerations involved in the concept of external debt, and how this statistical aggregate relates to some of the major international reporting systems.

3. RELATING EXTERNAL DEBT TO OTHER STATISTICAL SYSTEMS

For accurate measurement of any economic variable it is necessary to have a clear concept of what is to be measured. The development of a concept implies establishing boundaries which include what is to be measured and exclude all else. One method of ensuring that this is done consistently is to construct a comprehensive framework which gives guidance with respect to the definition and classification of all related variables. Existing examples of such frameworks are: national accounts; flow of funds; and balance of payments.

Unlike national accounts and balance-of-payments concepts, external debt has never been defined in a manner which has been agreed by compilers and analysts. Furthermore, the different definitions employed by international organisations and other compilers and users of data indicate that no single concept is appropriate for all uses. This points to the need for an agreed benchmark for the concept of external debt. One criterion guiding the Group’s work has been compatibility with existing well-structured systems.

The term “debt” implies a liability, represented by a financial instrument or other formal equivalent. The United Nations’ System of National Accounts (SNA) defines financial assets and liabilities as:

- – “the gold, currency, and other claims on (and obligations of) other parties owned by an economic agent; or the claims on (or obligations of) an economic agent owned by other parties.”

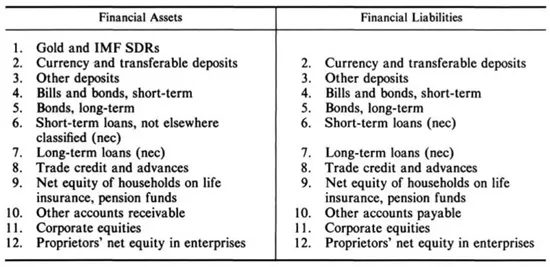

With the exception of gold and, by convention, IMF special drawing rights (SDRs), a fundamental characteristic of financial instruments is the existence of a contractual creditor/debtor relationship, i.e., one agent’s liability is another agent’s asset. Analysis of the economic impact of financial transactions is facilitated by reference to the characteristics of the different classes of financial instrument. The SNA has identified 12 categories of financial instrument, as listed in Figure 1.

Figure 1. Financial instruments

As debt is a liability concept, the focus is on all instruments except gold and SDRs. The instruments vary widely in the nature of the liability involved, but instruments 2 to 8, unlike equity, involve a clear contractual obligation to pay a fixed or pre-determined variable amount of income and/or an amount of principal. These instruments may differ substantially in terms of maturity – ranging from demand deposits to perpetual bonds – and in negotiability, but all involve a contractual payment obligation which differs from that incurred by equity issuers. Instruments 9 and 10 may also include some items of a contractual nature, but cannot be included “en bloc” on the same footing as the earlier items. It is perhaps also worth noting, in connection with the future work outlined in Chapter III, how the pairing of instruments in Figure 1 may be used to measure net indebtedness.

There is no clear rule within the SNA framework for defining debt. The broadest view of debt would include all instruments that represent financial liabilities, irrespective of the type of payment or repayment involved. The heterogeneous nature of the various instruments, however, suggests a narrower grouping of them for inclusion in a limited debt concept.

Transactions in different instruments will have varying impacts on the economy. Grouping instruments according to their impact provides an analytical basis for subdividing the whole category, saying in effect that some liabilities are more “debt” than others. However, since all financial liabilities share some common characteristics, it is clear that no one grouping of instruments will serve all requirements of analysis and policy. The work of the Group, in focusing on the nature of the payment liability, has involved reviewing instruments to see how far they carry clear contractual obligations to pay, as these have a direct, unavoidable and measurable impact on the economy.

This work therefore draws on the SNA for a consistent treatment of all financial instruments used in an economy’s transactions; to obtain the basis for measuring only external transactions, and thus for external debt, it draws on the IMF balance-of-payments (BOP) system. These two systems are consistent and interrelated1: balance-of-payments accounting provides criteria to distinguish foreign assets and liabilities from domestic for each major class of financial instrument defined by the SNA. External debt is a sub-set of foreign liabilities in both the SNA and BOP systems of accounts.

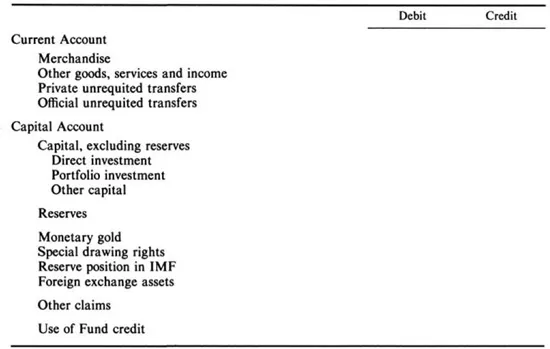

Balance-of-payments accounts are broadly divided between current-account operations, which cover goods, services, income and unrequited transfers, and capital-account operations, which comprise transactions in foreign assets and liabilities (Figure 2).

Figure 2. Balance of payments

The balance-of-payments accounts identify foreign operations on the basis of residence of the transactor; foreign liabilities are therefore those owed to non-residents. Residence (as opposed to currency, ownership, nationality or another basis) was chosen as the criterion for distinguishing foreign from domestic because it provides a clear rule for identifying those transactors whose main economic interest lies within an economy. Further, the residence criterion defined in the IMF’s Balance of Payments Manual is identical to that employed in the SNA.

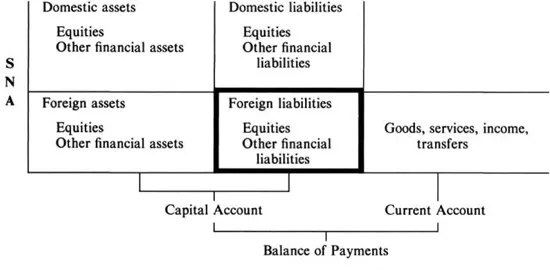

Figure 3 illustrates the overlap of a national balance sheet, which records all financial assets and liabilities, and the balance-of-payments, which records all foreign transactions. The coverage of the capital account of the balance-of-payments coincides almost perfectly with the foreign sectoring of financial instruments in the SNA. The quadrant entitled “Foreign liabilities”, of which the items in the core definition form a sub-set, covers all instruments which would fall under a broad concept of gross debt including equity-type liabilities.

Figure 3. Financial instruments in SNA and BOP

Chapter II THE “CORE” DEFINITION OF EXTERNAL DEBT

1. THE PURPOSE OF THE “CORE” DEFINITION

The core definition represents an agreed view of the essential elements in the definition of external debt. Especially in the case of systems focusing on a particular sector, it provides criteria for the inclusion or exclusion of various types of financial instrument. It also provides a yardstick facilitating comparison of the practices of individual organisations.

At the same time, the core definition does not claim to be the unique definition of debt for all purposes. It may well have to be revised in due course in the light of further progress in statistical reporting, the evolution of financial markets or changes in the requirements of the users of the statistics. Nor is it applied in full detail by any of the four organisations, for reasons which will be clear from the chapters dealing with the individual reporting systems. However, its establishment has already led to changes in the practices of some of the organisations, sometimes in the composition of the actual debt totals recorded and sometimes in the presentation of data in such a way as to permit reconciliation of the totals with the core definition.

It also provides the starting-point for the considerable amount of work tha...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Content Page

- Part I Defining External Debt

- Part II

- Footnotes