- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Handbook on Securities Statistics

About this book

NONE

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2015eBook ISBN

97814983883131. Introduction

Objective of the Handbook

1.1 The Handbook on Securities Statistics (the Handbook) is the first publication of its kind to deal exclusively with the presentation of securities statistics. The objective of the Handbook is to improve information on securities markets. It develops a conceptual framework for presenting statistics on different types of securities. The methodology is based on the System of National Accounts 2008 (2008 SNA) and the sixth edition of the Balance of Payments and International Investment Position Manual (BPM6).

1.2 The intention is to develop a framework facilitating the production of timely, relevant, coherent, and internationally comparable securities statistics for use in monetary and fiscal policy formulation and financial stability analysis. The Handbook will assist policymakers and analysts in these areas, as well as national agencies preparing securities statistics within their existing presentation frameworks.

Scope of the Handbook

1.3 The Handbook covers the conceptual framework for position and flow statistics on securities. This conceptual framework is summarized below, using stylized presentation tables with aggregate statistics on securities issues and holdings.

1.4 The Handbook covers broad conceptual issues related to the presentation of statistics on debt and equity securities, thus ensuring it will remain relevant to future financial innovation. It enables the comparability of statistics across economies—statistics that can then be used to develop meaningful global aggregates.

1.5 The Handbook provides additional information on borderline cases, complementing that available in the international statistical standards and clarifying where debt securities are distinguished from equity securities and other financial instruments. The Handbook also provides a framework for classifying securities statistics based on the international statistical standards, extends the groupings used in these standards, and outlines new classifications.

Securities as Negotiable Financial Instruments

1.6 Securities are negotiable financial instruments (2008 SNA, paragraph 11.33 and BPM6, paragraph 5.15). Negotiability refers to the fact that legal ownership of the instrument is readily capable of being transferred from one owner to another by delivery or endorsement. While any financial instrument can potentially be traded, a security is designed to be traded on an organized exchange or “over the counter” (OTC), although evidence of actual trading is not required. The OTC market involves parties negotiating directly with one another, rather than on a public exchange.

1.7 Securities include debt securities, equity securities and, to some extent, investment fund shares or units.

Debt Securities, Equity Securities, and Investment Fund Shares or Units

1.8 Debt securities are negotiable financial instruments serving as evidence of a debt (2008 SNA, paragraph 11.64). They are covered by the financial assets and liabilities (financial instrument) category “debt securities” (F3) in the 2008 SNA.1

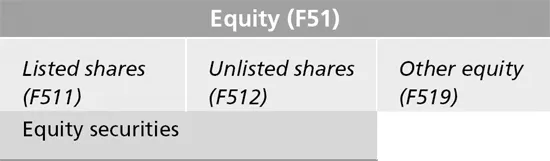

1.9 Equity securities are negotiable financial instruments that entitle holders to a share of both distributed profits and the residual value of the corporation’s assets in the event of its liquidation. Holders of these financial assets are the collective owners of a corporation.2 Equity securities are part of the financial assets and liabilities (financial instrument) category “equity and investment fund shares or units” (F5) and belong to the subcategory “equity” (F51). Equity securities comprise listed shares (F511) and unlisted shares (F512) (see Table 1.1).

Table 1.1 Equity and Equity Securities

Source: 2008 SNA, paragraph A1.26.

1.10 Investment funds are collective investment schemes that raise funds from the public by issuing investment fund shares or units (F52), in order to acquire financial or nonfinancial assets. Open-ended investment fund shares or units are not usually negotiable—the investors purchase (or redeem) shares in the fund directly from the fund itself rather than from other shareholders. They are not therefore classified as equity securities. Closed-ended investment fund shares or units are typically negotiable and are therefore covered in the Handbook.

1.11 By extending or modifying the groupings used in international statistical standards, and suggesting new classifications, the Handbook enriches the information available on securities. This is done, for example, by distinguishing issues and holdings of securities by money-issuing corporations, institutional investors, and securitization corporations, and by providing a breakdown of debt securities issues and holdings by type of interest rate.

1.12 The quality and comparability of securities statistics across economies are also important in the context of developing financial accounts and balance sheets, particularly since the latter are used to provide national and global aggregates. Securities statistics may also help to clarify the nature and degree of nonresident holders’ exposure to securities issued by residents, or resident holders’ exposure to securities issued by nonresidents, and any potential linkages.

Use of Statistics on Securities for Policy Analysis

1.13 Because securities carry obligations to make future payments, they have the potential to render an economy, or sectors of an economy, vulnerable to solvency and liquidity problems, as seen during the recent periods of global financial turmoil. These problems can have adverse effects on the real economy, with implications for financial stability and monetary and fiscal policy. It follows that securities markets clearly need to be monitored and measured.

Statistics on Debt Securities

1.14 Statistics on debt securities are required for monetary and fiscal policy, and also for financial stability analysis. The Handbook considers them from both the issuer’s side (issuance statistics) and the holder’s side (statistics on holdings). A “from-whom-to-whom” approach is presented, reflecting the links between issuance and holdings.

1.15 From a monetary policy perspective, much interest lies in changes in the wealth conditions and asset prices related to debt securities held by resident sectors, such as households, and by nonresidents. Furthermore, information on debt securities issues and holdings of financial corporations may help to enhance the analysis of “external” corporate finance by counterpart sector. Data—broken down by residence and sector—on the holders of debt securities issued by general government are required for fiscal policy analysis.

1.16 For financial stability purposes, however, a more detailed breakdown is required, with holdings of debt securities classified by individual issuer, as well as by currency, maturity, type of interest rate, or type of debt security, such as asset-backed securities (ABS). Issuer-by-issuer data may also be required for systemically relevant investors, such as large and complex financial groups. In addition, a breakdown of investors may be useful, in particular of debt securities holdings by financial corporation subsector (money-issuing corporations, insurance corporations, pension funds, and non-MMF investment funds).

1.17 Security-by-security (SBS) databases can, in conjunction with debt securities holdings statistics, significantly improve the quality of monetary, financial, government finance, balance of payments and international investment position statistics, financial accounts, and financial balance sheets. Such data are also useful to estimate accrued interest and revaluations due to changes in interest rates and exchange rates.

Statistics on Equity Securities

1.18 The Handbook also considers statistics on equity securities from both the issuer’s side (issuance statistics) and the holder’s side (statistics on holdings). A “from-whom-to-whom” approach is also presented, reflecting the links between issuance and holdings.

1.19 Issues and holdings of equity securities are presented in an unconsolidated form. This is recommended for monetary policy analysis and indeed is the approach adopted by the 2008 SNA. This means that all gross positions, transactions, revaluations and other changes in the volume of assets and liabilities in equity securities of institutional units are summed. The transactions and positions of institutional units belonging to a particular sector or subsector are shown vis-à-vis all institutional units in all sectors of an economy and in other economies, including those in the same sector or subsector.3

1.20 For monetary policy purposes, information on equity securities held by resident sectors (such as corporations, households, and general government) and by nonresidents enhances the analysis of investment in financial assets. Information on equity securities issued by residents and held by nonresidents, or holdings by residents of securities issued by nonresidents, enhances the analysis of cross-border corporate finance.

1.21 For financial stability purposes, however, a more detailed breakdown is required, with issues and holdings of equity securities broken down by individual issuer (or consolidated for each corporate group) and by type of equity security (e.g., l...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Foreword

- Preface

- Abbreviations

- 1. Introduction

- 2. Main Features of Securities

- 3. Financial Instruments Classified as Securities

- 4. Institutional Units and Sectors

- 5. Positions, Flows, and Accounting Rules

- 6. Specific Operations Related to Securities

- 7. Classification of Securities

- 8. Issuance and Holdings of Securities in a “From-Whom-to-Whom” Framework

- 9. Detailed Presentation Tables

- Annexes

- Glossary

- References

- Footnotes