eBook - ePub

Monetary and Exchange System Reforms in China : An Experiment in Gradualism

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Monetary and Exchange System Reforms in China : An Experiment in Gradualism

Book details

Book preview

Table of contents

Citations

About This Book

NONE

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Monetary and Exchange System Reforms in China : An Experiment in Gradualism by Marc Quintyn, Bernard Laurens, Hassanali Mehran, and Tom Nordman in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

1996ISBN

9781557755629

IX The Agenda for Developing a Market-Based Monetary and Exchange System

Assessment of Achievements and Directions for Future Reform

Assessment

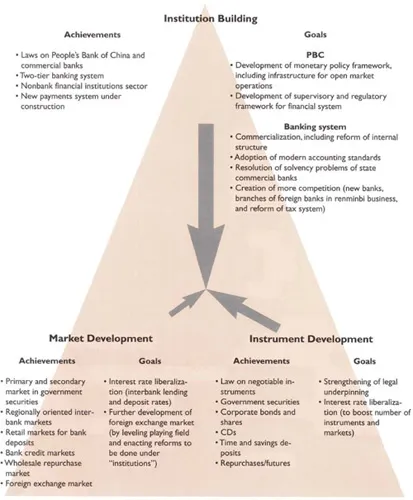

Section II has referred to the triangle of institutions, instruments, and markets as a useful tool for analyzing financial sector development. Sections III through VIII have presented a detailed account of the developments in various segments of China’s financial sector. A summary overview of China’s achievements thus far along the three axes is presented in Chart 13. The chart demonstrates the emphasis on institutional development in general and on the simultaneous development of institutions and markets in the foreign exchange system and the capital markets. By the same token, it indicates that the major efforts for the near future lie in further developing markets and instruments to complete the market-based character of the financial system. Further institution building is also required, even though several projects, such as the payments, clearing, and settlement system, are already well under way.

Chart 13. Achievements in Financial Sector Development

(Institutions, Markets, and Instruments) and Agenda for the Future

The perceived discrepancy between the well-advanced institution building and the less-advanced development of markets and instruments has its origin in two main factors: (i) the starting position of the Chinese financial sector at the beginning of the reforms; and (ii) the preference for an intermediate macroeconomic control mechanism in which the interventionist strategy continued to dominate de facto.

With respect to the first factor, the financial industry, unlike other sectors of the Chinese economy, was nonexistent when the reforms started. Institution building thus received priority treatment through the establishment of a two-tier banking system: the licensing of new banks, including branches of foreign banks; the emergence of a sector of nonbank financial institutions (NBFIs); and attempts to enhance the payments and settlement system.

This financial sector could gradually have been allowed to operate more in a market-oriented way; however, this did not happen because of the second factor, the authorities’ preference for an interventionist strategy. The lack of equal progress in developing markets (and instruments, to a lesser extent) seems to reflect the authorities’ preference for, and reliance on, an intermediate macroeconomic control mechanism. The monetary sector, in particular, was the focus of this control mechanism, in which control techniques of a planned economy continued to dominate de facto and market-based techniques operated only in a complementary role. This outcome stemmed from the authorities’ desire to use the newly established financial sector as long as possible as the main vehicle for their economic development strategy and from the lack of market mechanisms in the state-owned enterprise (SOE) sector.

The decision of the Third Plenum implicitly recognized that the imbalance between institution building and market liberalization in the financial system, if protracted, could impede the further liberalization of the economy. Thus, the logical next step, as set out in the decision, was to put the creation of efficient markets at the heart of the reform strategy.

The picture presented above also explains why further reforms in China can now—more than in the first 15 rather unique years of reform—benefit from the experiences of other countries that liberalized their financial system and adopted market-based monetary policy techniques. China’s financial system has arrived at that juncture where liberalization will need the most attention. Issues familiar to many countries in similar circumstances, including money market development, interest rate liberalization, bank restructuring, and the need for effective bank supervision and regulation, are in the spotlight.

Some General Principles

In order to put the future financial reform program in a broader context and before discussing specific issues, it is imperative to note those general principles regarding liberalization strategies that have emerged from the experience of other countries. To avoid major pitfalls while moving toward a predominantly market-based financial system relying on indirect instruments of monetary policy and, thus, to limit the cost associated with the transition that lies still ahead, a set of concomitant and mutually reinforcing reform measures has to be -considered. Country experience (Alexander and others (1995)) indicates the need to take a number of actions:

- Insulate monetary policy from deficit financing. Large fiscal deficits, often accompanied by unlimited monetary financing of these deficits, generally put monetary policy objectives under strain and reduce the effectiveness of indirect instruments of monetary policy.

- Strengthen and integrate money markets, including the infrastructure. Control by the central bank over the supply of reserve money is the fulcrum of indirect monetary control. Thus, a smoothly functioning market—usually the interbank market—for short-term bank liquidity (central bank money) that can signal and transmit the central bank’s actions to all market participants is essential for market-based monetary policy instruments. A prerequisite for smoothly functioning money markets is the availability of a reliable payments, clearing, and settlement system.

- Restructure the banking system and foster competition. For the rapid and transparent transmission of monetary policy actions, it is necessary that the banking sector—and the financial sector in general—be sound and competitive. If commercial banks are not able to respond to monetary policy signals by altering interest rates or liquidity conditions, those signals will not have the desired effects. A bank’s ability to respond may be impaired by such factors as management that is not used to a commercial environment, the absence of a hard budget or liquidity constraint, or a financial position so bad that the bank is unable to respond or can respond only in a perverse way. Fostering competition and liberalizing interest rates, therefore, inevitably go hand in hand.

- Adapt the supervisory and regulatory framework to market conditions. Stimulating competition among banks and liberalizing interest rates presuppose the presence of an effective supervisory and regulatory framework to foster prudential behavior by financial institutions. A set of prudential ratios, norms for financial reporting, and disclosure standards are essential elements of such a framework.

- Bolster the technical capacity of the central bank. A minimum requirement for a central bank using indirect instruments of monetary policy is a capacity to project demand for, and supply of, reserves and their impact on broader credit and monetary aggregates. Without this capacity, the central bank will not be in a position to decide on the volume and timing of its interventions. The central bank should also have the legal capacity to use the widest range of indirect instruments of monetary policy to preserve its flexibility.

Directions for the Future

As this overview makes clear, completion of the transition to a market-based financial system in China requires actions along the following lines. As is indicated in Box 1, most of these areas have been explicitly or implicitly recognized by the decision of the Third Plenum.

Institution Building

The newly enacted laws on the People’s Bank of China (PBC) and the commercial banks provide the proper legal framework for embarking upon the “commercialization” of the banking system and supporting orderly financial development. The description in Section III has revealed that a major overhaul of the structure and administrative organization of the four state-owned banks is needed. These banks are still largely based on the former command economy system, with a branch structure and hierarchy organized along political-administrative lines. The branches’ high degree of independence from headquarters makes liquidity management at a bankwide level difficult and impedes the deployment of indirect instruments by the PBC. The accounting system is also still based on command economy principles, and renminbi and foreign currency accounting is separated in the state-owned specialized banks.

The PBC’s task in capacity building lies more in the area of bank supervision than of monetary policy. Work in the latter area will have to concentrate on formulating monetary policy and preparing the infrastructure for the conduct of open market operations. The PBC should be a driving force in implementing the other reform measures discussed below to create the appropriate environment for the use of indirect instruments of monetary policy, that is, an interbank market, liberalized interest rates, and a payments system. Bank supervision that fulfills the requirements of a market system is still in its infancy.

The payments system is still largely cash driven, and the clearing and settlement functions are not yet up to the standards and requirements of more sophisticated financial markets, instruments, and transactions. However, a large project was launched in the early 1990s that will result in the establishment of China’s National Automated Payments System (CNAPS), a state-of-the-art payments, clearing, and settlement system, by the end of the decade.

Markets and Instruments

Financial market development has been quite different from that of many other countries. China has fledgling capital markets that provide a solid starting point for the development of more mature markets. The most urgent task lies in developing money markets, that is, markets for short-term funds. Well-functioning, nationally integrated money markets would not only enhance the effectiveness of indirect instruments of monetary policy but also support the capital markets in providing liquidity or funding, or both, for bond portfolios through either loans or repurchase agreements. Money market development has to go hand in hand with institutional and organizational reforms in the banking system, and with improvements in the payments system.

Capital market development has been significant, even though the market and its operations show marked contrasts. While the trade volume has been growing dramatically and the market infrastructure boasts sophisticated, well-functioning electronic trading and matching facilities, the markets are not totally integrated at the national level, which results in persistent price differentials and liquidity shortages. The most important market segment, the government securities market, suffers from the absence of short-term paper. Short-term securities, mainly traded by wholesale agents, would contribute to money market development and the introduction of market-based methods of monetary policy.

It is important for the development of the foreign exchange market to ensure equal access to the market for domestic and foreign banks and enterprises, to modernize accounting standards, and to further improve supervision and prudential regulations.

Inherently related to all aspects of market development is interest rate liberalization. The weak financial position of many SOEs and the prospects of insolvency for an increasing number of them has presented a major obstacle to the liberalization of interest rates; however, differences in perceptions among the authorities on the sequencing and the risks of a liberalization of interest rates have also played a major part in slowing down the pace of interest rate liberalization. Consequently, competition in the banking sector, although increasing, is still limited. While there is some nonprice competition, competitive behavior remains constrained by the institutional structure, formal and informal rules and regulations (such as the limited choice of banking for several customers), and the credit plan and its accompanying quota. As is shown by the experience of several other countries, interest rate liberalization will stimulate the development of new financial instruments and thus the diversification of money and capital markets.

The subsequent subsections review in more detail the steps needed to complete the transition to a market-based financial system. These steps relate to interest rate liberalization, the shift to indirect instruments of monetary policy, and the reform of the foreign exchange system.

Interest Rate Liberalization

The liberalization of interest rates in China is undoubtedly a critical—and probably the most difficult—aspect of financial reform. The Third Plenum has set interest rate liberalization by the year 2000 as one of the key actions, and it has become generally recognized that interest rate liberalization should be expedited. The main reasons for liberalizing interest rates are discussed in the next subsection. The following subsection reflects upon some structural impediments to a fast liberalization, and the final subsection presents current thinking in China on the liberalization process.

Reasons for Liberalizing Interest Rates

The main justification for expediting the liberalization of interest rates is the need for a more efficient allocation of financial resources in the Chinese economy. Even though interest rates have remained close to market-clearing levels, it is now generally recognized that liberalization of the interest rates will contribute to more efficient resource allocation in a full-fledged market system.62 Other reasons relate to the operation of indirect monetary policy instruments, the liberalization of the foreign exchange system, and the growing inconsistencies between the present rate structure and setting and the other reforms in the financial sector.

The effectiveness of indirect instruments of monetary policy greatly depends on the central bank’s ability to influence the commercial banks’ market behavior and thus their setting of prices. In other words, to the extent that indirect instruments are to become the dominant force in China’s monetary policy, interest rates need to be liberalized or at least given greater flexibility.

The opening of the Chinese economy to the rest of the world and the liberalization of the foreign exchange system in 1994 broke the fence that partially shielded domestic financial markets in China from outside markets. This liberalization makes domestic interest rate flexibility not only desirable but also necessary to support the exchange rate and to achieve domestic policy goals, such as combating inflation.

Also, interest rate administration in China is becoming increasingly cumbersome as a result of the rapid changes in the financial system. First, administering the large number of different interest rates set directly by the authorities and trying to maintain their parities are very difficult and cumbersome tasks. Second, under the present rate structure, banks are facing very narrow margins between lending and deposit rates; this will certainly pose problems in the future, when banks will have to make more provisions for loan losses and competition in the market becomes fiercer. Third, the present interest rate structure gives little incentive for the commercial banks to try to raise funds by increasing the deposit base. By financing their credit operations for one year or more through the PBC, banks earn a larger spread and incur lower overhead costs than by using deposits. In such circumstances, the constant pressure on the PBC to extend credit to the commercial banks limits the PBC’s freedom to use its lending as a policy instrument.

Finally, the current dual system of interest rate setting—the coexistence of fixed interest rates to be used by the state banks and freer interest rate setting available to other financial institutions—is a source of distortions.63 The dual interest rate system, besides making arbitrages possible that can fuel speculative activities, results in a segmentation of the money market that will delay the contribution of interest rates to improving the allocative efficiency of financial resources.

Structural Impediments

SOE Impediments

For the liberalization of interest rates to be successful, other countries’ experiences suggest that the main economic players (enterprises and financial institutions) should be subject to hard budget constraints to avoid adverse selection problems. Without such constraints, credit could be directed to the most risky borrowers and projects. The recognition of these risks turns the reform of the SOEs into a crucial issue.64 Many SOEs are operating with extremely narrow profit margins or are incurring losses.65 Any significant increase in interest rates would rapidly erode those margins and make more enterprises unprofitable. Thus, there is the risk that, if interest rate liberalization is not accompanied by reform of the SOEs, more enterprises will become loss making.

Moreover, interest rate liberalization might fail because of the inverse reaction of insolvent and nonprofit firms to ...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Preface

- Glossary Of Abbreviations

- I Introduction

- II China’s Financial Reforms Since 1978:An Overview

- III Financial Sector Development

- IV Legal Underpinning for a Market-Based Financial System

- V Development of Money and Capital Markets

- VI Payments, Clearing, and Settlement System

- VII Instruments of Monetary Policy and Monetary Developments

- VIII Developments in the Exchange System

- IX The Agenda for Developing a Market-Based Monetary and Exchange System

- X Assessment and Conclusions

- Bibliography

- Boxes Section

- Footnotes