eBook - ePub

Regional Economic Outlook, April 2011, Western Hemisphere : Watching Out for Overheating

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Regional Economic Outlook, April 2011, Western Hemisphere : Watching Out for Overheating

Book details

Book preview

Table of contents

Citations

About This Book

NONE

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Regional Economic Outlook, April 2011, Western Hemisphere : Watching Out for Overheating by International Monetary Fund. Western Hemisphere Dept. in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2011ISBN

9781616350659

1. Global, U.S., and Canadian Outlook

The global economy continues to expand, though heterogeneity and downside risks persist. The recovery in most advanced economies—where output remains below trend—is proceeding only gradually, and will continue to be constrained by the need to repair household, government, and financial sector balance sheets. Growth in emerging economies remains robust fueled by favorable external conditions, yet policies need to be tightened to avoid overheating.

1.1. The Global Outlook—A Dual Speed Expansion Proceeds with Increasing Risks

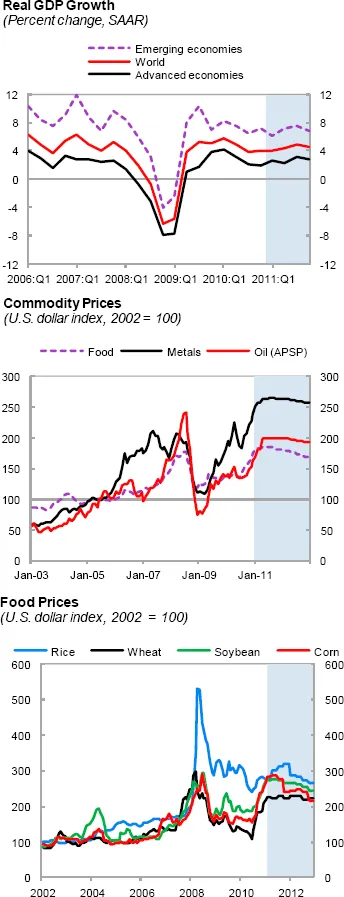

The world economy continues to expand at multiple speeds (Figure 1.1). The recovery in advanced economies remains tepid considering the depth of the recession, and unemployment remains stubbornly high. On the other hand, output gaps have closed in many emerging market economies where growth remains brisk and overheating risks are emerging.

Figure 1.1. Dual speed expansion proceeds, in the context of rising commodity prices

Sources: IMF, International Financial Statistics; and IMF staff calculations.

Commodity prices have risen further, reflecting strong demand from emerging Asia, particularly China. Weather-related supply shocks have contributed in pushing food prices to above precrisis levels, and recent political tensions in the Middle East and North Africa have added pressures to oil prices. While futures markets price in a gradual decline in commodity prices during the course of this year, as uncertainties dissipate and supply reacts, commodity prices will remain relatively high and above last year’s average.

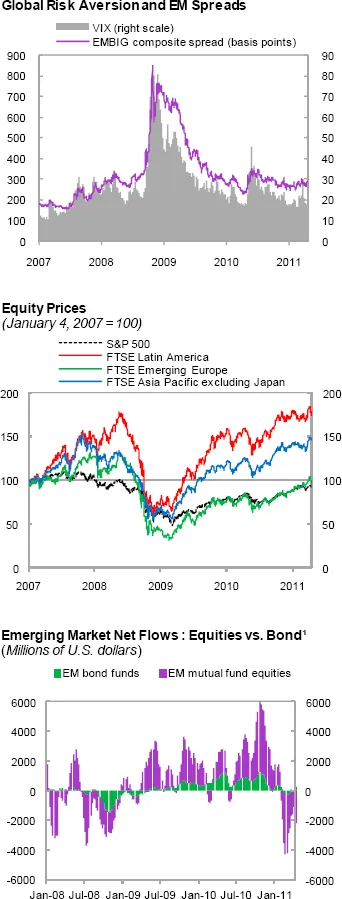

Financial conditions have been generally improving, though they remain stressed in some areas. Strong corporate profits have pushed equity prices higher, while more recent bouts of volatility in periphery Europe (Ireland and Portugal) have had limited and short-lived spillovers on global financial conditions (Figure 1.2). Attractive interest rate differentials, higher growth prospects, and other relatively more favorable fundamentals (including healthier public and private balance sheets in emerging markets than in many advanced economies), combined with declining global risk aversion, have supported strong capital flows to emerging economies through most of 2010. More recently, however, some positive news on the U.S. economy, as well as inflation risks and higher asset prices in emerging markets, have slowed such capital flows. The recent turmoil in the Middle East and North Africa and the earthquake in Japan are adding to overall uncertainties, though the impact on global risk aversion has been limited thus far.

Figure 1.2. Low global interest rates and risk aversion are helping to push equity prices higher, though flows to emerging economies slowed in recent months

Sources: Bloomberg, L.P.; Datastream; EPFR Global; and Morgan Stanley.

1Five-week moving average of net flows.

Against this backdrop, IMF staff projects world growth to moderate somewhat from about 5 percent in 2010 to slightly less than 4½ percent during 2011–12, a scenario not very different from six months ago. Growth in advanced economies is expected to reach 2½ percent in 2011, ½ percent lower than last year as most countries consolidate their public finances, but still somewhat above potential growth rates. Emerging and developed economies are projected to expand by 6½ percent in 2011 (from 7¾ percent in 2010), as the policy stimulus is unwound and they gradually slow to trend growth.

Downside risks to the global outlook continue to dominate. While the likelihood of a double-dip recession in the United States has receded since the last Regional Economic Outlook, new downside risks have emerged. The potential for continued turmoil in the Middle East and North Africa and a more protracted nuclear crisis in Japan could also dent global growth and add to overall uncertainties. Moreover, vulnerabilities remain elevated in periphery Europe, with attendant risks to financial sector balance sheets in core European economies. In the case of many emerging economies, risks are more balanced—delays in stimulus withdrawal could add to growth in the near term, although they would raise concerns about a hard landing down the road.

Global imbalances persist, with continued official reserve accumulation, particularly in emerging Asia. Although the current account balances of key surplus and deficit countries have receded from precrisis peaks, a disproportionate portion of demand rebalancing has been through a shift of demand from deficit countries to emerging economies with flexible exchange rates and open capital markets—but not large surpluses, and indeed many in Latin America with increasing deficits. IMF staff projects that the imbalances will widen again in the coming years. The lack of sufficient demand rebalancing—between important advanced economies with deficits and emerging economies with surpluses—is a key concern for the sustainability of the recovery over the medium term.

Advanced Economies

The main challenge for advanced economies is to secure the recovery, while making further progress in repairing government, household, and financial sector balance sheets. Because fiscal consolidation needs to proceed, monetary policy will likely remain accommodative for a prolonged period in some advanced economies, given high unemployment, subdued core inflation, and stable long-term inflation expectations. Survey-based expectations suggest the policy rate in the United States will remain unchanged through late 2011, with some participants not expecting hikes at least until mid-2012.

Most advanced economies are appropriately seeking to consolidate their public finances in 2011, with the exception of the United States and Japan, where fiscal policy will remain accommodative. In the euro area, fiscal deficits are projected to decline by an average of 1½ percent of GDP in 2011, and an additional 2½ percent over the course of the next five years, though the specifics of the adjustment measures need to be better defined to bolster credibility. In the United States, the government adopted in late 2010 a new stimulus package worth 1 percent of GDP in fiscal years 2011–12 (partially offset by the recently agreed cuts to FY2011 spending). This development, which was not anticipated at the time of the last Regional Economic Outlook, has modestly raised the U.S. growth outlook for 2011. At the same time, it adds to uncertainties over the speed and content of plans to stabilize and reduce public debt over the medium term. Structural fiscal adjustment also has been postponed in Japan, where spending is bound to increase even more following the recent earthquake.1

Financial sector repair in advanced economies needs to be accelerated, as discussed in the Spring 2011 Global Financial Stability Report (GFSR). As explained in the GFSR, market pressures persist in the euro area as countries continue to face large refinancing needs, and the European Central Bank should ensure orderly conditions in funding and sovereign debt markets while countries undertake the necessary fiscal and structural adjustments. Rigorous stress tests and credible recapitalization and restructuring plans are also needed to strengthen confidence particularly in Europe’s financial sector. Similarly, in the United States, bank balance sheets will need to be strengthened should weaknesses in the housing sector persist, and a thorough implementation of financial sector reforms is necessary.

Emerging Market Economies

Policy challenges for many emerging market economies center on avoiding growing overheating risks resulting from favorable external financial conditions, remaining macroeconomic policy stimulus, and in some cases from improving terms of trade. These risks are manifesting themselves through a combination of higher inflation, widening current account deficits (prevalent in Latin America), and strong credit and asset price growth. Although most countries have begun to remove the policy stimulus implemented during the crisis, many remain behind the curve in normalizing monetary and fiscal policies.

Emerging economies facing large capital inflows and appreciation pressures should generally tighten fiscal policy ahead of the full withdrawal of monetary accommodation. They may also need to strengthen prudential measures to contain the excessive procyclicality of credit and prevent asset bubbles from forming. Under certain circumstances, and provided appropriate macroeconomic policies are in place, temporary restrictions to the capital account may be needed. Such measures, however, cannot substitute for essential action on these other policy fronts. Rising food and fuel prices are adding to the challenge, both in terms of containing inflation and protecting the poor.

1.2. United States—Ongoing Recovery with Downside Risks

The U.S. economy continues to recover but downside risks are still dominant. Output and employment gaps are likely to close only gradually. Weak household, financial, and government balance sheets will continue to weigh down the growth outlook.

The U.S. economy expanded by an above-trend growth of 2.8 percent in 2010. After a strong start driven by a massive inventory boost, growth cooled considerably in the late spring just as European sovereign strains started to roil financial markets. Yet the economy managed to shrug off pervasive talk of a renewed dip and deflation risks, eking out above trend growth in the second half of 2010, helped by improved confidence on a new round of U.S. Federal Reserve easing. In particular, private consumption—after gradually accelerating through the year—gained some speed at end-2010. However, the recovery failed to produce a meaningful recovery in the labor market, and core inflation weakened to midcentury lows, given high levels of idle capacity.

The tentative signs of a stronger and more selfsustaining recovery at end-2010 have since been followed by certain setbacks and new risks. In particular, the surge in oil prices, if sustained, could significantly slow the recovery.

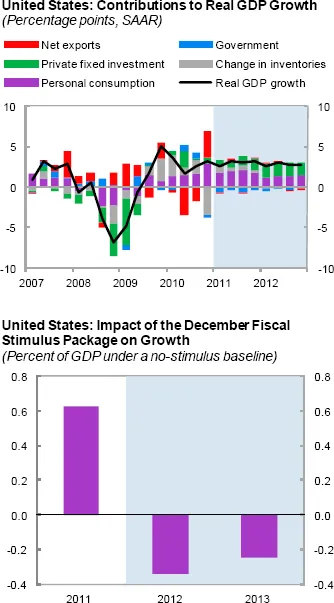

Monetary policy will remain supportive of growth through much of 2011. Policy interest rates are at the lower bound, with the U.S. Federal Reserve’s bond purchases providing accommodation in the face of high unemployment and low inflation. Meanwhile, in contrast to what was projected six months ago, the federal fiscal structural deficit is now estimated to increase by 1¼ percent of GDP in 2011, following approval of the new stimulus package in December 2010 and despite the recently agreed cuts to federal FY2011 spending (Figure 1.3). The U.S. administration is committed to halving the federal fiscal deficit by 2013 relative to 2010, an adjustment that is included in staff forecasts. The commitment implies a large 5 percent of GDP cumulative structural primary adjustment for the federal government during fiscal years 2012–13.

Figure 1.3. Growth will be led by the private sector as the policy stimulus is withdrawn

Sources: Bureau of Economic Analysis; and IMF staff calculations.

Drags from labor and housing fronts persist. Despite the recent decline in unemployment rates (from a peak of 10.1 percent to 8.8 percent in March 2011), long-term unemployment remains near historical highs and the employment-population ratio has barely increased since output began to recover in mid-2009 (Figure 1.4). Although the downtrend in initial unemployment insurance claims since early 2011 suggest some strengthening ahead, payroll growth has so far gathered only limited momentum. The mirror image of the weak growth in jobs has been sizable labor productivity gains and declining...

Table of contents

- Cover Page

- Copyright Page

- Content Page

- Preface

- Executive Summary

- 1. Global, U.S., and Canadian Outlook

- 2. Outlook and Policy Issues for Latin America and the Caribbean

- 3. Foreign Exchange Market Intervention: How Good a Defense Against Appreciation Winds?

- Western Hemisphere: Main Economic Indicators

- References

- New Publications from the Western Hemisphere Department, July 2009–April 2011

- Boxes

- Footnotes