![]()

1 An overview

We accountants do not resolve issues, we abandon them,… We debate them loud and long … until another issue comes along that is more current and more controversial, and then we forget the former issue…. The explanation for our inability to resolve issues is to be found in the way we conceive issues. We conceive of the issues in such a way that they are in principle unresolvable. … We phrase the questions in a way that prohibits answers. We define our problems so that the very definition precludes the possibility of a solution.

(R. R. Sterling, 1975)

1.1 Introduction

The most comprehensive review of the long and complex history of accounting for goodwill examined in the research process was compiled by Hughes (1982). It is salutary to read the foreword to his book, which commences:

When I first began this project in 1969, I believed that I would come up with the intrinsic nature of goodwill – maybe even define the asset for all time. Perhaps all of those writers were arguing and struggling toward some unforeseen Truth, and it was for me to chart the direction, extract the essence of their works, and obtain the ultimate answer that maybe all were moving unconsciously toward. My own personal exuberant and intellectual Charge of the Light Brigade was rewarded with frustration, disappointment, and – finally – relief. I at last came to accept fully that all of those unfortunate souls who struggled with goodwill's nature and treatment did so, not in some possibly great movement toward Truth, but because there was no one Truth and never will be. The origin of goodwill can be revealed through history, but its nature is a matter of personal interpretation.

Keeping the scope of the ‘struggle toward some unforeseen Truth’ within reasonable bounds, the proposal in this book will be limited to the more prosaic problem of accounting for goodwill in the context of publicly listed entities, in particular those corporate entities included in the All-Ordinaries Index on the Australian Stock Exchange (ASX). It follows that it will exclude those companies involved predominantly in the mining and extractive industries, as the concept of ‘goodwill’, as normally understood and as defined herein, is not relevant to that category. There are no particularly ‘Australian’ issues that would limit the applicability of the proposals and the discussion to this country, and the implications of the matters dealt with extend, to a large extent, beyond Australia. Nevertheless, it will be necessary to review the particular framework of Accounting Standards and legislation applicable in Australia. The general history and philosophical background to the controversy which has for so many years surrounded both goodwill as a subject and how to account for it properly are also explored.

1.2 The objectives of financial reporting in relation to intangible assets

A shareholder in a listed company is typically remote from direct contact with the management of that company, and is reliant on information provided in the company's Annual Report and the information furnished to the ASX, including six-monthly interim financial reports. It is intrinsic to such reports that they are prepared with the requirement of Statement of Accounting Concepts (SAC) 2 ‘Objective of General Purpose Financial Reporting’ in mind, that ‘The objective of general purpose financial reporting is to provide information to users that is useful for making and evaluating decisions about the allocation of scarce resources’ (para. 26).

Allowing for the organizational complexity that has developed since the point was made, this requirement was put equally well in 1788 by Hamilton:

Bookkeeping is the art of recording mercantile transactions in a regular and systematic manner. A merchant's books should contain every particular which relates to the affairs of the owner. They should exhibit the state of all the branches of his business; the connection of the different parts; the amount and success of the whole. They should be so full and so well arranged as to afford a ready information in every point for which they may be consulted.

As cited in Chambers (1995: 338)

Two hundred years later, the International Accounting Standards Committee (IASC) put the same point succinctly: ‘To be reliable, the information in financial statements must be complete within the limits of materiality and cost’ (IASC 1989: 38). ‘Cost’, in this context, refers to the expense incurred in producing the financial statements, not the limitations imposed by the historical cost principle of accounting.

Investors in a listed company constantly evaluate how best to use scarce resources with regard to that particular investment: whether to hold, sell or increase their shareholding. The general body of investors face a similar problem. They attempt to maximize the economic benefits of portfolios, limited by their resources, by allocating those resources among alternative listed investments. The market price of a share at any one point in time is given for virtually all investors. Their judgment as to the allocation of scarce resources depends upon whether they consider that the present value of continuing to hold a particular share, receiving dividends for a further period (if applicable) and realizing their investment at a later date exceeds the amount obtainable by realizing that share immediately. Each investor will bring differing utility functions, experiences and current constraints to bear on those judgments.

Intangible assets have become increasingly important in the modern economy, and Lev has developed forceful arguments that this development requires to be more fully recognized in financial statements.

We are using a 500 year old system to make decisions in a complex business environment in which the essential assets that create value have fundamentally changed.

What's the evidence for this transformation?

Look at the Standard & Poor's 500 – 500 of the largest companies in the United States, many of which are not in high tech industries. The market-to-book ratio of these companies – that is, the ratio between the market value of these companies and the net-asset value of the company (the number that appears on the balance sheet) is now greater than six. What this means is that the balance sheet number – which is what traditional accounting measures – represents only 10% to 15% of the value of these companies. Even if the stock market is inflated, even if you chop 50% off the market capitalization, you're still talking about a huge difference in value as perceived by those who pay for it day-today and value as the company accounts for it.

As cited in Webber (2000)

Although stock market indices have both risen and fallen considerably since the publication of this article, Lev's fundamental argument that traditional accounting measures ignore a large percentage of corporate value remains true. Contrast this with a comment by Walker, who wrote an incisive article on goodwill in 1953: Probably because of the fact that goodwill is of relatively minor importance, the accounting treatment of goodwill has barely been touched by attempts to broaden the consistent application of accounting principles’ (Walker 1964: 241).

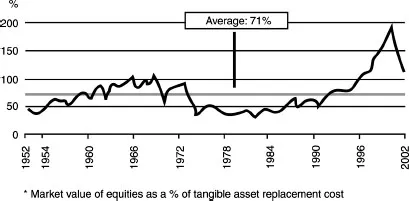

Tobin's Q is the ratio between the market value of a company and the replacement costs of the productive, physical assets of that company. This formulation was confirmed by Tobin in an interview in December 1996. He pointed out that people think of it as book value of a company’ rather than replacement cost. A ‘Tobin's Q’ analysis of the ASX showed that, whereas intangible assets represented only 10 per cent of the total value of the shares listed in the All-Ordinaries Index of the ASX in June 1984, that proportion had risen to approximately 58 per cent in June 1999 (Lonergan, Stokes and Wells 2000). The ‘tech wreck’ occurring since that date may have reduced this figure, but intangible assets still represent a material proportion of market capitalization. A comparative United States graph clearly shows the increase in the Tobin's Q index over the past fifty years and lends support to the comments by Walker and Lev quoted previously (see Table 1.1).

Table 1.1 Tobins Q ratio for US equities 1952–2002.

Goodwill, by definition, does not represent the total amount of the intangible assets incorporated in the market value of a company, merely the amount of the unidentifiable portion thereof. Notwithstanding this, accounting that does not properly take account of goodwill is becoming increasingly irrelevant to many users.

1.3 The problem and its redefinition

An extensive review of the literature on accounting for goodwill over the last 100 years confirmed that it is impossible to account for goodwill logically and completely within the context of the historical cost system. This is clearly demonstrated by the asymmetry of mandated methods of accounting for internally generated goodwill, on the one hand, and for purchased goodwill, on the other. This asymmetry occurs despite the universal acknowledgment, confirmed by an Australian Accounting Standard issued in 1996, that there is no qualitative difference between the two forms of goodwill: ‘This Standard specifies that the concept of goodwill as an asset is the same regardless of whether it has been purchased in an exchange transaction or generated internally’ (AASB 1013: 5.1.3).

SAC 3 Qualitative Characteristics of Financial Information’ notes:

This Statement identifies relevance and reliability as the primary qualitative characteristics which financial information should possess in order to be the subject of general purpose financial reporting. These characteristics may need to be balanced against each other; however, this Statement does not rank either characteristic above the other.

SAC 3 (para. 7)

There is currently agreement (as there has been for many years) between standard setters in all countries that internally generated goodwill should not be brought to account because it cannot be measured reliably, despite its relevance to readers of financial statements. A complementary reason for the non-recognition of internally generated goodwill is that it does not usually have an identifiable, reliably measurable cost, which is particularly important within a historical cost system.

On the other hand, purchased goodwill does have an identifiable, reliably measurable cost; the debate has centred around the treatment of that cost. Over the years, many methods have been advocated such as recognition at nominal value, immediate write-off against reserves, amortization against income over various arbitrary periods and continuous revaluation to measure and record impairment. The arguments have been heated over the years, but have become largely sterile. As the Sterling chapter header noted:

We accountants do not resolve issues, we abandon them, … We debate them loud and long. …until another issue comes along that is more current and more controversial, and then we forget the former issue. … The explanation for our inability to resolve issues is to be found in the way we conceive issues. We conceive of the issues in such a way that they are in principle unresolvable. … We phrase the questions in a way that prohibits answers. We define our problems so that the very definition precludes the possibility of a solution.

Sterling (1975) as cited in Chambers (1995: 907)

Traditionally, the debate has been concerned with how best to present goodwill within the context of the co...