This chapter explores the evolution of complexity theory and its increasing influence in the social sciences. It moves from the challenges of validating the concepts of complexity used in the natural sciences to the social sciences and proposes a framework of the core concepts to be used in the methodology of this book and its research. Finally the chapter visits the literature on applying complexity concepts to understanding and intervening in public policy systems both at the macro and micro levels.

Evolution of complexity theory from the sciences into the social sciences

Complexity theory originated in the natural sciences and is linked to chaos theory. Chaos is the idea that instability results from small changes in initial conditions, but the instability is nevertheless deterministic and caused by simple rules. It is determined by the initial condition rather than random events. It has been suggested that the discovery of chaos predates complexity. For example, the French mathematician Jules Henri Poincaré (1854–1912) is sometimes referred to as the father of chaos theory. He argued that the instability of the so-called ‘three body problem’ where the relationship between three objects cannot be reliably predicted but some order and attraction to a pattern is still evident given the unpredictable relationship between them. Nevertheless, despite Poincaré’s observation, in the first half of the twentieth century much applied work in mathematics continued to use linear prediction. When data used in linear prediction did not fit a generalized model this was considered as due to measurement imprecision, unknown contributing variables, or so-called noise (small variations caused by unreliable measurement or invalid aspects of measurement). In time researchers began to see these aspects as critical elements for further consideration and an invitation to further consider the causal complexity and variable interactions of what was being modelled and explained.

During the 1960s, some key developments contributed to a paradigm shift in scientific methodology. In 1960, Benoît Mandelbrot studied changes in cotton prices in the USA and challenged the statistical orthodoxy that they were normally distributed over time. Instead he proposed that prices followed more complex patterns including periods of relative stability and relative instability and a greater possibility of prices moving outside of the normal distribution that had previously been envisaged. Subsequently he explored these patterns as types of repeated simple structures and argued that they implied some higher element of structure and understanding to change over time, rather than change that was just random. The idea of an unpredictability that could not be understood within the normal distribution of observations gave his work a clear link with chaos theory and the observations of Poincaré.

In 1961, Edward Lorenz stumbled on a demonstration of chaos somewhat by accident while running an early computer model of a weather system in an effort to improve forecasting. What he discovered when computing the same data with a small different computation of decimal points was that very different results occurred. Small changes in initial conditions had exponential results. He spoke of a butterfly flapping its wings in Mexico and causing a hurricane in Texas. This implied that medium term weather forecasting of any local detail was impossible and that the only useful way forward was the comparison of historical patterns and trends, but always with some probability that different outcomes might start to evolve at any new time point. In Giles Foden’s novel Turbulence Henry Meadows, a maths prodigy from the London Meteorological Office, has to work with a reclusive academic named Wallace Ryman to apply his theory of weather systems to a prediction of the probability of stormy weather in the English Channel at the time of the 1944 ‘D Day’ allied landings in occupied France. Shortly before the invasion the protagonists are arguing over the correct theoretical method for understanding weather. The scientific traditionalists argue that if only enough reliable data were available an accurate medium term prediction would be possible, but Meadows has learnt much from Ryman and concludes:

Future weather is a judgement of probabilities based on the physical principles which are reducible to mathematical formulae … forecasts were accurate for the first day, but became increasingly less reliable after that. For the second day they were merely useful. By the third, fourth and fifth days … they had entered the realms of speculative fiction.

(Foden, 2009: 260–262)

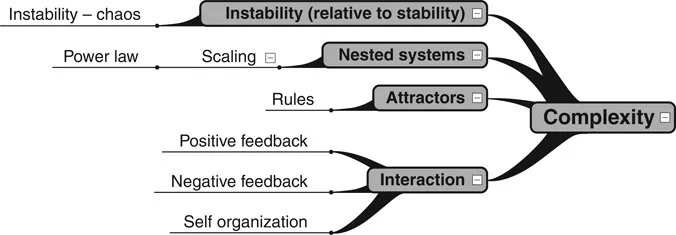

The link between chaos and complexity theory originates in the contrasting periods of stability and instability that both Mandelbrot and Lorenz had observed. While the instability of chaos was seen as surprising, given an apparently relatively simple system with a limited number of variables, part of the epistemological condition was that these systems were less simple than first thought and characterized by deeper levels, or scales, of complexity, in part to do with their existence in time and space. For example, the key variables in a weather system like the wind speed and barometric pressure are subject to important and complex variations in both time and space. Likewise cotton prices will vary across time and space. Similarly these specific systems can be linked to holistic wider system influences, such as the behaviour of the sun and ocean currents when understanding the weather and the prices of other goods and technological changes when understanding cotton prices. It is this holistic and wider systems view that moves a focus on chaos and instability to the conceptual and theoretical constructs of complexity theory. Figure 1.1 indicates the main framework of complexity concepts used in this book to apply complexity methodology in the international comparison of national public policy.

Stability and instability

A first key defining feature of complexity theory is the interplay of stability and instability. As Peterson (1998: 65) notes: ‘In all its complexity, life requires both stability and change.’ Instability can be defined in two separate ways: either random instability or chaotic instability. Random instability has no observed interaction with other factors, to the extent that forecasting is impossible (Dooley and van de Ven, 1999). As argued above, chaotic instability may appear to be random, but it can be shown to have interactions with other factors and so is influenced and determined by history. Chaos results in observable similar patterns at certain periods of time, but these patterns are impossible to predict with any high degree of certainty about when exactly they will reoccur. A weather system is a classic example of chaos. Prediction is only reliable for very short time periods and based on comparing similar past patterns.

Chaos theory has been developed to assist our understanding of those elements of large subsystems (like economies, societies or government policy systems) that are unstable but that do have some element of historical influence. Previous work by the author has argued this to be demonstrated in the privatization and marketization of social care policy in the UK (Haynes, 2007 and 2008). In these research articles it was demonstrated that radically new national public policies tend to be chaotic in their immediate affect with a few variables influencing dynamic change, while over a longer period of time, policy systems reverted to complexity where numerous confounding variables mitigated and stabilized the more unstable aspects of change (see also Dooley and van de Ven’s (1999) definition of

Figure 1.1 A complexity theory framework.

organizational complexity). Policy systems can have periods of instability but they will also have periods of stability. This evaluation of when stability occurs will be ‘relative’ in the social world. For example, cotton prices can only be judged to be stable on the basis of comparing them with periods and measurements of previous instability. In this sense, stability and instability in human systems – like policy systems – is subjective and relies on relative judgements, whereas instability in physical systems can be demonstrated to be determined by a few simple rules that create disorder, with large differences occurring because of small differences in the initial conditions (Peterson, 1998: 139). Given the difficulty in demonstrating scientific physical chaos in complex human policy systems, with many variables influencing the system, the author’s preference as a social scientist and policy analyst is to describe and analyse contrasting patterns of stability and instability rather than to attempt to prove via measurement that scientific chaos is present. Therefore quantitative data is used to explore qualitative social and economic patterns, not to prove empirically that the patterns exist. This debate about the extent to which the scientific method of deterministic chaos can be reliably demonstrated in the social sciences was well rehearsed in Kiel and Elliot’s (1997) edited volume. As Harvey and Reed (1997: 297) conclude:

If the actual mathematical models of deterministic chaos and the concrete findings of the physical sciences have limited value in their direct application to the social sciences, they can still provide a rich heuristic base from which social scientists can work.

Edge of chaos

Given the interest of complexity theory in understanding the interplay of instability and stability a major point of empirical focus and observation is the ‘tipping point’ between them. Some theorists have referred to this as observing systems or parts of systems on the ‘edge of chaos’. Others link such instability and its consequences with the dynamics of dissipative structures in the natural sciences and the concept of a ‘bifurcation’ where a spontaneous different structure emerges (Rhodes et al., 2011: 15). Some describe key moments in the changing dynamics of systems as ‘tipping points’. Events in the recent global financial crisis (2008–09) can be viewed as potential tipping points, for example, the bankruptcy of Lehman Brothers Investment Bank in the US in September 2008 that led to unprecedented state intervention in financial markets. Or instability might be argued to emerge from a relatively short period of intense change, such as the global financial market panic and loss of confidence in the winter of 2007–08, when banks and financial institutions realized the US housing market was in decline and that their mortgage backed securities could not recover. Instability can be primarily political rather than economic, such as the uprising of populations demanding franchise in the Middle East after living under years of dictatorship. At the more local level of public policy, policy makers can observe instability in the form of shifting population changes, the closure of local industry, or weather related events, such as earthquake and flooding. Instability comes in many forms and at different levels of intensity, but it undermines the ability of the policy maker to deliver rational medium and long term plans. The policy maker and policy manager have to be highly adaptive.

This has implications for the way policy systems are organized. Maclean and MacIntosh (2011: 238) argue that organizational systems on the edge of chaos ‘appear to constantly adapt to ensure compatibility with their ever changing environment’. Such organizations therefore tend to move away from traditional fixed structures and experiment with flexible forms of organization. This might lead to a preference for networking and task based groups to solve particular challenges and problems rather than waiting for institutionalized committees with rigid rules and written procedures to slowly adapt. Policy formulation is inevitably institutionalized in modern democracies and this is an important part of transparency and accountability in terms of mapping the reasons for decisions and the responsibility attached to them. However, one premise of the new public management (NPM) literature from 1980 onwards (Haynes, 2003: Ch. 1) was that politicians attempted to focus on strategy and strategic decisions, while looking to delegate the implementation of operational detail to managed agencies. This trend is also linked to the increased marketization of policy delivery and the possibility that delivery may be contracted to the market place. Arguably the importing of business management methods as part of NPM with the increased business contracting of annual service agreements has placed the public service experience more on the edge of chaos for front line operational managers and professionals. This needs to be contrasted with the pre-1980 documentation of public policy as organized in predominantly stable institutions of public administration. Here stability is argued to be characterized by ‘path dependency’ where systems settle into a particular set of characteristics in part determined by early events and their sensitivity to initial conditions (Rhodes et al., 2011: 14).

Maclean and Macintosh (2011) note the difference between organizations that find themselves on the edge of ‘chaos’ (because of market conditions or political instability), with organizations where managers seek to move the system towards the edge of chaos to get their workers to embrace external change. Having studied 18 private and public organizations, they concluded that organizations do not naturally always exist on the edge of chaos, but more naturally seem to move between states of instability and stability over time. It was therefore difficult for managers to artificially keep an organization or part of it permanently on ‘the edge’, even if they wished to do this to achieve change. Given that being in a period of instability, or on the edge of one, was associated with increased stress for the workforce, the authors concluded that most managers and organizations act to implement stability rather than more instability, although they did find a small number of exceptions. The exceptions were two private companies; one was pharmaceuticals and the other electronic. In these companies instability was deliberately created by frequent restructuring and job rotation. Even worse, senior managers fed misinformation, manipulated events and spread negative rumours about the scale of external change that was faced. No evidence was available about the long term outcome for the organizations concerned. In five of the six public organizations studied, the trigger for change was external and driven by the external political context. The one local authority example they studied (that appeared to choose change to improve the quality of service) could also be argued to be acting indirectly to external pressures. In conclusion the experience of many public organizations is that they constantly struggle to meet external drives for change while seeking to retain elements of stability that ensure a reasonable degree of stability of function for the complex public goods they provide. This is similar to the findings (Haynes, 2003) that major organizational restructuring either enforced top-down by politicians, or chosen by senior managers as a method to cope with external change, was unlikely to be optimal and that adaptive, evolutionary change was more likely to prove resilient in the longer term.

It is important to note the link in complexity theory between the edge of chaos and the ‘emergence’ of new forms of order. Emergence is often discussed in its own right as a subconcept of complexity theory, or even as an evolutionary theory in its own right (for example, see Johnson, 2002: 18, who defines emergence as ‘the movement from low-level rules to higher-level sophistication’). Another concept often referred to in relation to the edge of chaos and emergence of new forms of order is ‘fitness peaks’. This is the idea that organizations and societies reach a historical point of success where they ‘get stuck’ and fail to continue to evolve to fit with the changing world around them. This allows other competing groups to overtake them and this may threaten their ultimate existence if they continue to refuse to move off that peak (see Kauffman, 1995). We can draw parallels here with the economic decline of certain major nations and need for indebted nations like the US and UK to revisit their social, political and economic purpose after the 2008–09 economic crisis.

Nested systems

A second key feature of complex systems is that they have characteristics that are nested or defined by scaling. In other words, patterns present at the most holistic and generalized level will be reproduced at other micro and local levels in the system. This is similar to Mandelbrot’s concept of fractals where basic patterns are found to reproduce themselves within systems to create a patterned order. The term ‘fractal’ comes from the Latin word fractus, meaning broken or fractured. The concept was developed by scientists to describe things that reproduce themselves with similar patterns and representations at different hierarchical levels.

In the natural sciences a fractal is a pattern that reproduces itself with very similar structures at different levels. Examples would be mountains, coastlines and certain plants. Plants like cauliflowers and ferns have the same structure both as an overall plant, but also demonstrated in their branches and flowers. This is also referred to as self similarity. Mandelbrot, the French mathematician – sometimes referred to as the father of fractals – defines fractal geometry as the study of patterns, in space and time, that remain the same even as the scale of observations changes. Fractals are defined ‘recursively’, that is by reference to their own basic structure. And so a core structure or pattern is then reproduced in similar ways, many times over and at different levels or scales.

In economic systems price variation patterns may demonstrate such cha...