eBook - ePub

Corporate Financial Reporting and Analysis in the early 1900s (RLE Accounting)

This is a test

- 244 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Corporate Financial Reporting and Analysis in the early 1900s (RLE Accounting)

Book details

Book preview

Table of contents

Citations

About This Book

The contributions in this book, most of which are not widely available, discuss the evolution of financial reporting at a time when it was rare for companies to present detailed reports to their shareholders. Some early annual reports are reprinted here, including the 1902 annual report of the United States Steel Corporation, the 1909 annual report of the International Harvester Company, the 1910 annual report of the American Telephone & Telegraph Company and the 1911 annual report of Westinghouse Electric & Manufacturing Company.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Corporate Financial Reporting and Analysis in the early 1900s (RLE Accounting) by Richard Brief, Richard P. Brief in PDF and/or ePUB format, as well as other popular books in Negocios y empresa & Contabilidad. We have over one million books available in our catalogue for you to explore.

Information

Some Notable Corporation Reports

FIRST ANNUAL REPORT

OF THE

United States Steel Corporation

FOR THE FISCAL YEAR ENDED

DECEMBER 31, 1902

DIRECTORS

| TERM EXPIRES 1903 | TERM EXPIRES 1904 | TERM EXPIRES 1905 |

Francis H. Peabody Charles Steele William H. Moore Norman B. Ream Peter A. B. Widener James H. Reed Henry C. Frick William Edenborn | J. Pierpont Morgan John D. Rockefeller Henry H. Rogers Charles M. Schwab Elbert H. Gary George W. Perkins Edmund C. Converse James Gayley | Marshall Field Daniel G. Reid John D. Rockefeller, Jr. Alfred Clifford Robert Bacon Nathaniel Thayer Abram S. Hewitt* Clement A. Griscom |

| * Deceased |

| Executive Committee | Finance Committee |

Elbert H. Gary, Chairman Daniel G. Reid William Edenborn Edmund C. Converse. James Gayley Charles Steele Charles M. Schwab. Ex-officio George W. Perkins, Ex-officio | George W. Perkins, Chairman Henry H. Rogers Norman B. Ream Peter A. B. Widener Henry C. Frick Robert Bacon Charles M. Schwab, Ex-officio Elbert H. Gary, Ex-officio |

OFFICERS

| President Charles M. Schwab | ||

| First Vice-President James Gayiev | Second Vice-President William B. Dickson | Third Vice-President Veryl Preston |

| General Counsel Francis Lynde Stetson | ||

| Secratory and Treshrer Richard Trimble | Comptroller William J. Filbert | |

| Transfer Agent Hudson Trust Company, 51 Newark Street, Hoboken, N. J., 71 Broadway, New York City | ||

| Registrars of Stock For Preferred Stock—New York Security and Trust Company, New York City For Common Stock—Guaranty Trust Company. New York City | ||

| General Offices 51 Newark Street, Hoboken. N. J | ||

FIRST ANNUAL REPORT

TO STOCKHOLDERS OF

United States Steel Corporation

OFFICE OF UNITED STATES STEEL CORPORATION,

51 Newark Street, Hoboken, New Jersey.

April 6, 1903.

51 Newark Street, Hoboken, New Jersey.

April 6, 1903.

To the Stockholders:

The Board of Directors submits herewith a combined report of the operations and affairs of the United States Steel Corporation and its Subsidiary Companies for the fiscal year which ended December 31st, 1902, together with the condition of the finances and property at the close of that year.

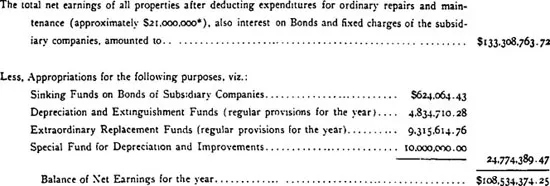

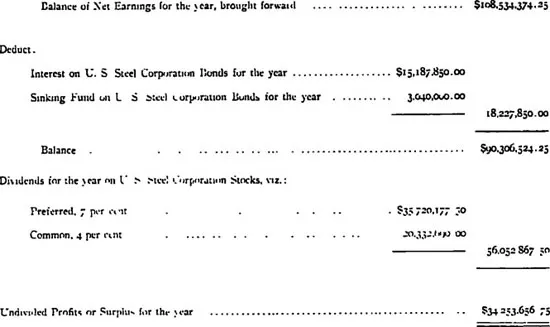

INCOME ACCOUNT FOR THE YEAR.

*The actual expenditures for ordinary repairs and maintenance, as see table on page 7, were $21,230,218 13 It cannot be stated, however, that this specific sum was taken out of the net earnings for the year because in the manufacturing and producing properties the expenses for repairs and maintenance enter into and form a part of production cost. And as the net earnings of such properties are stated on the basis of gross receipts for product shipped less the production cost thereoi. the income for the year is charged with outlays for repairs and maintenance only to the extent that the production during such period was actually shipped But as the shipments in 1002 equaled practically the year’s production, approximately the entire amount of the expenditures in question has been deducted before stating the net earnings as above.

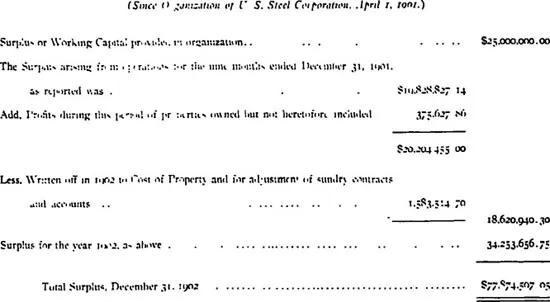

UNDIVIDED SURPLUS OF U. S. STEEL CORPORATION AND ITS SUBSIDIARY COMPANIES.

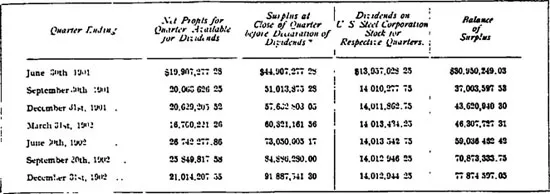

NET PROFITS AND SURPLUS OF UNITED STATES STEEL CORPORATION AND SUBSIDIARY COMPANIES AT CLOSE OF EACH OF THE QUARTERS NAMED.

(INCLUDES ONLY SURPLUS RECEIVED OR EARNED ON OR SUBSEQUENT TO APRIL 1ST, 1901.)

* Includes Capital Surplus of $25,000,000, provided at date of organization.

NOTE.—Spended Deprenation and Improvement Fund of $10,000,000, set aside from 1902 Net Earnings, is distributed in above table, $2,500,000 to each quarter of 1902.

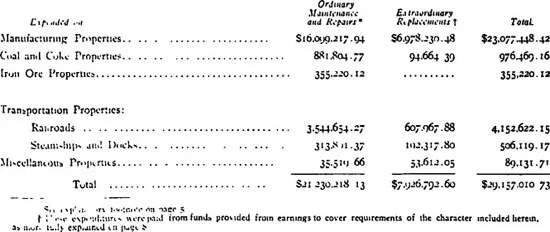

MAINTENANCE, RENEWALS AND EXTRAORDINARY REPLACEMENTS.

The physical condition of the properties has been fully maintained during the year, the cost of which has been charged to current operators. The amount expended by all properties during the year for maintenance, renewals and extraordnary replacements aggregated $29,157,010.73

This total is apportioned as follows:

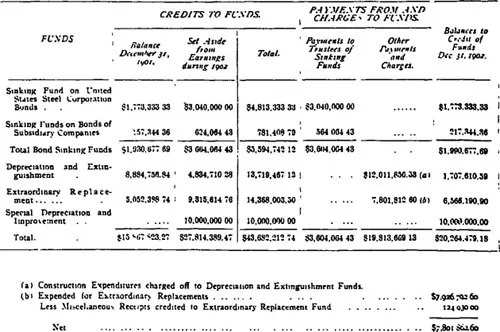

SINKING, DEPRECIATION AND EXTRAORDINARY REPLACEMENT FUNDS.

Provisional charges are made monthly to operations for Bond Sinking Funds and to establish funds for Depreciation, and for reserves for Extraordinary Replacements. The purposes for which these funds are particularly designed are as follows:

BOND SINKING FUNDS — These are the funds required by the respective mortgages to be set aside annually for retirement of the bonds issued thereunder.

DEPRECATION AND EXTINGUISHMENT FUNDS.—The appropriations for these purposes have been made with the idea that thus aided the bond sinking funds will liquidate the capital investment in the properties at the expiration of their life These moneys are used not for current operating expenses, but to offset consumption and depreciation by the provision of new property or of reserve funds.

EXTRAORDINARY REPLACEMENT FUNDS.—These are designed to be used to improve, modernze and strengthen the properties. They are not used for ordinary maintenance, repairs and renewals (such expenses are included in current operating costs), but for the substitution of improved and modern machinery, plants, facilities, equipment, etc.

During the year ended December 31, 1902. the appropriations made for the foregoing funds, together with the payments therefrom, and the balances in the funds at the close of the year, were as follows:

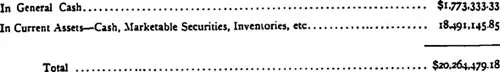

The balances to the credit of the several funds on December 31, 1902, per the preceding table, are included in the current assets of the organization, viz.:

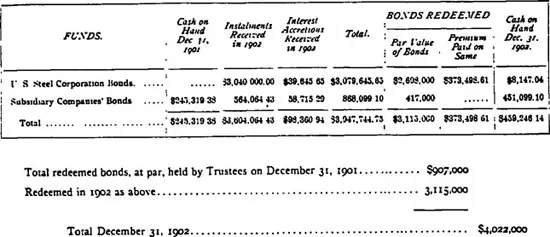

TRUSTEES OF BOND SINKING FUNDS.

BALANCE SHEET.

The Balance Sheet included in this report, page 24, exhibits the combined assets and liabilities of the United States Steel Corporation and of the Subsidiary Companies. based on the valuation at which the stocks and bonds of the Subsidiary Companies were taken over by the Steel Corporation, liabilities from one company to another company being omitted.

The accounts of the Steel Corporation and the Subsidiary Companies for the year 1902 have been audited by Price, Waterhouse & Company, the chartered accountants selected for this purpose by the stockholders at the annual meeting, February 17, 1902. The certificate of the chartered accountants is printed in full on page 24.

VOLUME OF BUSINESS.

The volume of business done by all companies during the year, including sales between the companies, and the gross receipts of transportation and miscellaneous properties, aggregated the total sum of $560,510,479 39.

PRODUCTION.

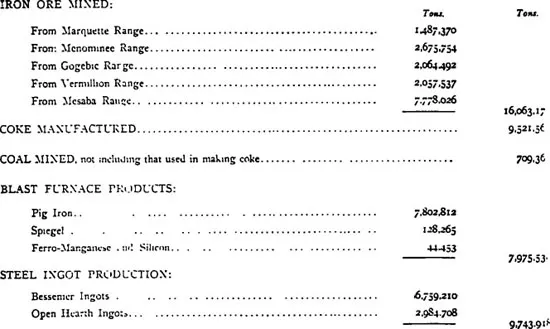

The production of the several properties for the year 1902 was as follows:

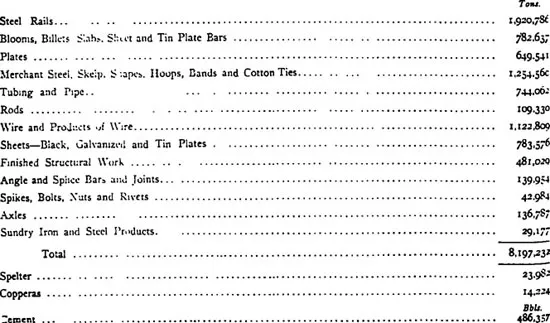

ROLLED AND OTHER FINISHED PRODUCTS FOR SALE.

INVENTORIES.

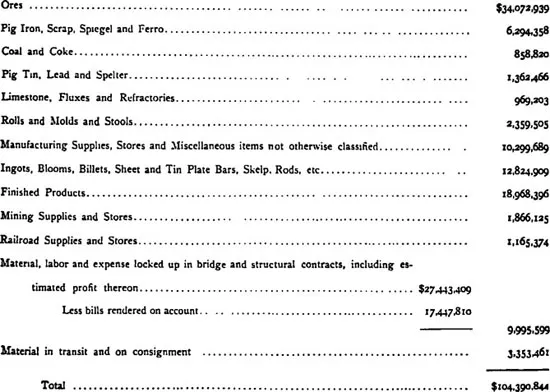

The aggregate inventories of all properties on December 31, 1902, equaled the total sum of $104,390,844. About one-third of this sum is represented by the value of iron ore on hahd. It is necessary to accumulate large tonnages of ore during the summer and fall months for conversion during the period extending from December I to April 15 when, owing to the close of navigation on the Great Lakes, the mining of ore is reduced and shipment from the mines entirely stopped.

The quantities of partly finished materials (Blooms. Billets, Bars, etc.), also of finished products, are somewhat above the normal average, owing largely to the railroad congestion at principal producing centres, which prevented prompt deliveries from the mills.

Inventories are taken on basis of actual cost of the materials and products at the several departments of the companies holding the same.

The following is a general classification of the inventories on December 31:

CAPITAL STOCK.

The outstanding capital stock of the United States Steel Corporation was increased during the year by the issues of the following amounts for the acquisition of additional shares...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Original Title Page

- Original Copyright Page

- Table of Contents

- Introduction

- An Early Proposal for Corporate Financial Reporting

- Some Notable Corporation Reports

- Financial Statement Analysis