This is a test

- 348 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Personal Distribution of Incomes (Routledge Revivals)

Book details

Book preview

Table of contents

Citations

About This Book

First published in 1976, the essays in this volume are concerned with the distribution of income and wealth. The papers were first presented at the Royal Economic Society's conference in 1974, which examined the evidence concerning the personal distribution of earnings, compared the distributions apparent in different periods and societies, and studied the association between personal attributes and income. The contributions, from internationally-renowned authors, reflect these areas, and address the questions surrounding inequality, the taxation of wealth and capital transfers that remain relevant in twenty-first century society.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access The Personal Distribution of Incomes (Routledge Revivals) by A. B. Atkinson in PDF and/or ePUB format, as well as other popular books in Persönliche Entwicklung & Private Finanzen. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

Theories of the Distribution of Earnings

It is not proposed in this chapter to undertake an exhaustive survey of the literature on theories of the size distribution of earnings. The subject has ramified to such a degree that it is virtually impossible to mention every suggested hypothesis, let alone all the empirical work which has been published in recent years. I intend, therefore, to concentrate my attention on the theories which I believe to be more important.1 I shall also suggest some new hypotheses for future consideration and, at the end of the chapter, make a few comments on issues of policy which arise out of our topic.

I | THE PROBLEM |

Before we start our discussion of theories of the distribution of earnings it is necessary to decide what phenomena we are trying to explain. Some authors, who have given insufficient attention to this matter, have produced theories which purport to explain distributions which are either unrealistic or untypical.2

First it is necessary to decide what is meant by ‘earnings’. Various definitions are possible, depending on the purpose of the inquiry. For example, earnings may be limited to the wages and salaries of employees or may also include the incomes of the self-employed. They will inevitably be measured in money, but they may include the imputed value of benefits received in kind as well as monetary benefits such as employers’ contributions to pension funds. Earnings may be measured before tax and other deductions, e.g. national insurance contributions, or they may be taken after various deductions.3 For descriptive purposes, or for assessing the distribution of welfare, it would be useful to subtract taxes; but it would also be necessary to add the imputed value of social security benefits. If our main purpose, however, is to explain the distribution of earnings, we can do better by concentrating initially on the pre-tax distribution. In principle, we would expect to be able to provide a better theoretical explanation of a distribution of real pre-tax benefits, rather than of pre-tax nominal income; but this would necessitate adjusting published data on income distributions for fringe benefits, for variations in the cost of living in different areas, and for non-pecuniary benefits of different occupations.

In practice, the variable which most earnings theories have been trying to explain has been pre-tax money wages and salaries of employees. There is no inherent objection to this. After all, theories can be developed to explain any phenomena. But it must be remembered that the theories which are constructed to explain nominal earnings are often more appropriate for explaining real benefits.

The second major problem of definition is the period of measurement of income. Wages and salaries may be paid at various intervals – usually each week or each month – but they may also be measured for longer periods, e.g. a year. Within any such period, the number of days or hours worked may vary from one worker to another, and for any one worker it may vary in different periods. To avoid the confusing effect of differences in work intensity, the earnings to be explained should be those received for full-time work without interruption on account of sickness, holidays, etc. Ideally, perhaps, they should relate to the same number of working hours; but this is rarely possible, and standardisation of earnings for hours worked may do more harm than good.4

It may seem that it is a matter of indifference whether earnings are measured for a week, a month, or a year, so long as only fulltime employees are included.5 But this overlooks the role of ‘transitory’ effects on income, which have rightly been emphasised by Friedman (1957). The shorter the period of measurement of income is, the greater the relative importance of transitory income is likely to be, and the greater is the role which transitory effects will need to play in explaining the distribution of earnings.6

Third, it is necessary to define the population to be covered by the distribution. Should it include all employees in a given country, or should it be limited to one reasonably homogenous group? The shape of the distribution is affected, often very greatly, by the inclusion of low-paid groups, e.g. women, young people, or farmworkers, or by the limiting of its coverage to particular industries or areas. By changing the coverage it would be possible to produce thousands of different earnings distributions of widely varying shapes. It is desirable, therefore, to select one or more of these distributions as the main object of the theoretical explanation.

After reviewing these problems of definition, the conclusion which I reached in my earlier study of earnings distributions (Lydall, 1968, p. 60) is that it is desirable to select a standard distribution, the coverage of which should be defined as ‘Male adults, in all occupations, in all industries except farming, in all areas, working full-time and for the full period. The income measured should be money wages and salaries only, and before tax.’

The characteristic shape of this standard distribution is approximately lognormal, but with a higher peak and thicker tails than a strictly lognormal distribution, i.e. it is leptokurtic in the logarithms of incomes. Because of its thicker upper tail, the distribution is usually well fitted in this area by the Pareto function, except perhaps in some communist countries.7

The principal questions which need to be answered by a theory of the size distribution of earnings seem to be:

1 Why is the standard distribution approximately lognormal, with some leptokurtosis?

2 Why is the upper tail of the distribution usually well fitted by the Pareto function?

3 Why does the dispersion of the distribution vary between different countries and over time within particular countries?

4 Why do the dispersion, skewness, and kurtosis of the earnings distribution vary across occupations and age groups?

Theories of the size distribution of earnings can be conveniently grouped under three headings: stochastic theories, the human capital theory, and multifactor theories. These groups of theories will be considered in that order.

II | STOCHASTIC THEORIES |

By stochastic theories I mean theories which rely mainly or wholly on random effects (or ‘chance’) to explain the earnings distribution. In view of the observed fact that earnings distributions are approximately lognormal, and for some groups of workers even approximately normal, it is not surprising that the suggestion should have been made that the dispersion of earnings is the result of random effects. While a large number of small additive random effects would tend to produce a normal distribution, a large number of small multiplicative random effects would tend to produce a lognormal distribution.8

Apart from the question of whether the random effects are believed to be additive or multiplicative, stochastic theories can be divided into two main types. In the first type of theory the random effects are assumed to combine instantaneously; that is, there is no time factor. For example, Roy (1950) suggested that the outputs of workers in a particular job are affected by numerous influences, e.g. speed, accuracy, education, health, and the number of hours worked. If each of these is a random variable, and no single variable dominates, then output per worker – and, in the usual case, earnings per worker – will tend to be either normally or lognormally distributed, depending on whether the variables combine additively or multiplicatively.9

A similar assumption, although not always stated explicitly, presumably underlies those theories of the distribution of earnings which postulate that earnings are determined by ‘ability’ and that ‘ability’ is normally distributed.10 Although such theories start from an exogenously given distribution of ‘ability’, the normal distribution of ‘ability’ could be explained by a combination of many small random effects, including both genetic and environmental characteristics.

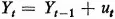

But the more influential type of stochastic theory has been that which embodies a sequence of stochastic changes operating through time in a Markov chain.11 For example, it may be assumed that

where Yt is income in year t and ut is a random variable. If the parameters of the distribution of ut are constant for all t, and if ut is independent of Yt–1 and ut+r for all r, then Yt will converge towards a normal distribution as t → ∞. And if Yt = log Xt, then Xt will converge towards a lognormal distribution.

With the addition of special assumptions about the distribution of ut, Champernowne (1953) was also able to generate a two-tailed Pareto-type distribution.12

There seem to me to be three main objections to the Markov chain type of stochastic theory. First, in order to achieve results consistent with actual observations, it is necessary to make arbitrary assumptions about the parameters of the distribution of ut. Champernowne (1953), for example, assumed that the geometric mean of ut is negative; while Kalecki (1945) amended Gibrat’s (1931) theory, in order to avoid a steadily increasing relative dispersion of income, by adding the assumption that ut is negatively correlated with Yt–1, i.e. that there is ‘regression towards the mean’. Assumptions of this sort give the right mathematical results but have no obvious economic justification.13

The second objection is that the empirical assumptions on which these models are based seem to be mistaken. Champernowne, for example, took it for granted that income in year t is equal to income in year (t–1) plus the change in income between (t–1) and t. If ‘change’ means ‘difference’ this is, of course, a tautology. But the implied assumption is that ‘changes’ in income are absorbed permanently into income, with the income flow in year t starting from where it left off in year (t–1). But if, as suggested by Friedman (1957), income in any period contains both ‘permanent’ and ‘transitory’ components, observed ‘changes’ in income might be merely the differences between consecutive transitory effects. Since both general knowledge and empirical evidence support the view that measured income does have a transitory component, there is no warrant for the use of observed ‘changes’ in income between two years as an empirical estimate of the matrix of changes in a Markov chain.14

The third, and most fundamental, objection to this type of stochastic theory is that it is not scientific in the usual sense. The ‘explanation’ which it offers is at a very superficial level and does not identify any of the real factors – economic or other – which are responsible for the shape of the distribution. Such theories give no information about how one may influence the distribution of earnings, and hence no guide to the likely effects of recommended acts of social policy, e.g. the enforcement of minimum wages, the equalisation of education opportunities, or changes in the internal structure of enterprises.

I think it very probable, however, that a Markov chain type of process does operate on ‘permanent’ income, in the sense that the development of each individual’s career – and hence earning capacity – is to some extent a matter of luck. The problem is to separate this effect from, on the one hand, the transitory effects – which create a great deal of stochastic ‘noise’ – and, on the other hand, the effects of identifiable causes, e.g. ability, education, health, experience, intensity of work, responsibility, etc. This is a problem which has hardly even been considered so far, let alone studied empirically.

III | HUMAN CAPITAL THEORY |

While stochastic theories ‘explain’ the dispersion of incomes by attributing it entirely to the existence of an indefinite number of small unidentifiable influences, the human capital approach goes to the other extreme and attempts to explain the structure of earnings by only one factor, namely the value of investment in education and on-the-job (OTJ) training. The adherents of this approach show some distaste for allowing chance to play a significant role in determining the distribution of earnings, and an even stronger aversion to sociological or institutional factors, e.g. ability, family background, quality of education, age, or market imperfections. Indeed, the human capital approach was regarded by Becker (1964, p. 66) as ‘the means of bringing the theory of personal income distribution back into economics’.15

The typical assumptions of human capital theory are:16

1 Each young person leaves high school – or whatever is the normal end of schooling – with a predetermined level of economic ability, i.e. ability to produce.

2 If at this point he takes a job which does not give him any further training, he will earn an income corresponding to his productive ability.

3 So long as he remains in this job he will continue to earn the same income.

4 But he has the choice of two other alternatives: forgoing that income and entering full-time education, or forgoing part...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Original Copyright Page

- Table of Contents

- Preface by A. B. Atkinson

- 1 Theories of the Distribution of Earnings by H. F. Lydall

- 2 Stalin and British Top Salaries by P. J. D. Wiles

- 3 The Mathematical and Statistical Theory of Income Distribution by J. A. C. Brown

- 4 The Genetic Basis of Inequality by C. O. Carter

- 5 Personal Characteristics and Income by J. Tinbergen

- 6 Progress in Human Capital Analyses of the Distribution of Earnings by J. Mincer

- 7 Personal Characteristics and the Distribution of Earnings by P. Taubman

- 8 The New Earnings Survey and the Distribution of Earnings by A. R. Thatcher

- 9 Future Development of Work in the Government Statistical Service on the Distribution and Redistribution of Household Income by A. J. Boreham and M. Semple

- 10 The Redistribution of Income by J. L. Nicholson and A. J. C. Britton

- Index