![]()

1Corporate Governance and Corporate Strategy

Wealth creation always precedes wealth distribution and requires autonomy, freedom to prosper but more importantly good governance (accountability) to sustain and develop. Autonomy and freedom to undertake may prove worthless in isolation and only an accountable and transparent autonomy, as suggested by corporate governance, would seem to be the panacea. Corporate governance is seen in this book as all the principles, mechanisms, and processes that are used to govern organizations ethically. Today and in the aftermath of serious embezzlements in major corporations throughout the world due to failures of diligence, ethics and accountability, that is, corporate governance, are becoming a powerful means of value creation (Gompers, Ishii, & Metrick, 2001). Indeed, “corporate governance has a role of vital importance to play one that is often not fully understood” (Oman, Fries, & Buiter, 2003). Most corporate governance works have, however, concentrated on immediate governance mechanisms like board structure and committees. On the other hand, most of the literature on the subject had originally taken a narrow view that aimed at ensuring that firms are mainly operated in the interests of shareholders. As commonly underlined, however, the theoretical justification for such a view is based on the existence of a perfect and complete market and in this is something that cannot be encountered in most countries. Consequently, these assumptions are far from being reasonable (Allen, 2005). In such case, a broader view of corporate governance, one that focuses on ensuring that society’s resources are used efficiently, may prove to be more appropriate.

This chapter emphasizes the necessity of dealing with corporate governance in a systemic way, underscoring interactions between its diverse components and emphasizing its multiple impacts on corporate strategy and free-market value.

CORPORATE GOVERNANCE MECHANISMS’ INTERCONNECTION

The dynamic complexity of corporate governance can only be surrounded by bringing together a range of mechanisms, and at the same time assessing their impact on organization’s strategy and market value. Indeed, such understanding needs to go beyond immediate mechanisms, like board structure or its members’ independence, to address larger issues like the impact of governance on the socioeconomic environment in which organizations operate. Defense mechanisms against weak corporate governance are diverse; some of them are internal, others institutional or operational, and others external. They are all connected, however, and all share the same impact on corporate destiny and they each bring different strengths to the task. For the sake of clarification and although not universally shared, wealth maximization hypothesis will be used throughout the book and as “Arianne’s thread” to explain and connect all organization actions in the area of corporate governance. It should always be remembered that corporate governance is more about organization values and value creation and should be considered as a strong tool for building efficient entities, whether public, private, or state owned.

THE CORPORATION

The group of people authorized to act as an individual1 and called “corporation” existed in one form or another in most ancient and Middle Ages civilizations. Mankind had indeed early discovered the virtue of such organizations and was able to use them for the common human well-being and progress. Corporate adventure as an organized system of doing business really departed around the fourteen century, when corporations were then established under frameworks set up by governments of the time, and for the purpose of undertaking tasks which appeared then to be too risky or too expensive for individuals and even for governments themselves to assume (Wikipedia). The efficient use of the corporate concept, in the centuries that follow, by colonial powers to reinforce colonial ventures gives the corporation yet another breath. The corporate concept reached, however, its highest status only during the nineteenth and twentieth centuries, when corporation became almost the only legal form of doing business and that sometimes controlled countless wealth and even economies. One reason for this remarkable development and expansion resides in the specific rights and privileges granted from the start to the corporation for the purpose of allowing it to play efficiently its expected role, mainly political, at the beginning it became economic overtime. The limited liability and perpetuity rights were but a few of the privileges, but they have unsuspected deep financial ramifications. They have drastically changed the financial scenery on earth.

The limited liability right, for instance, allows anonymous trading in the shares of the corporation and simplifies it, as well, by freeing the corporation from its creditors’ consent for new share issues. The limited liability right, on the other hand, actually limits the amount any investor can lose or pay for his participation in a company’s capital stock. The limited liability right has had a real determinant impact on the financial scenery, allowing corporations to raise a tremendous amount of money by combining funds from different shareholders who do not necessarily knowing each other. Their number is therefore greatly increased and so the amount they are likely to invest and simultaneously their risk are also reduced, thus adding volume, liquidity, and accessibility to exchanges. The perpetuity principle, on the other hand, allows corporate structure and corporate assets to exist beyond the lifetimes of any one of its stakeholders or agents. Consequently, more stability and capital accumulation can be expected and the financing of larger sized projects and over longer terms have become possible, due to the fact that larger amounts of capital are becoming available for investment.

The corporation was able to skillfully take advantage of the granted special status and the corporate model was suggesting, till recently, that individual well-beings do not necessarily conflict with each other and therefore the corporation should not be moved by any social consideration. Consequently, neither the unthinkable accumulated volume of wealth nor the high level of concentrated power should be seen as problems. Opportunism in business relationships was then put at the forefront of economic analysis (Smith, 1817), at a time it was still strongly believed that society can last only if every individual cares for others and is convinced that social order depends on his altruist behavior. Smith’s model was, however, often misunderstood, in a sense that although individuals deliberately seek personal interests and use every means to reach them, they are supposed also to have made sure that personal interests are pursued within the boundaries of ethics. Moreover, the means of realizing individual objectives are deemed to be legally permitted, if only economically efficient individuals acting in such a manner will actually contribute to the improvement of the common welfare. Although in some situations individuals may indeed help others while helping themselves, mankind seems to be generally compromising on moral and social values whenever monetary interests are involved. Business efficiency and business ethics often prove to be unconceivable, and modern businesses have instead learned how to subjugate heterogeneous means of wealth maximization, resulting in de facto opportunistic corporate attitudes that are based on frauds, tricks, and hypocrisy with regard to conformity to the rules. Such orientation has been building up slowly but surely for so long, and it seems today almost impossible to imagine corporations behaving differently. Being often freed in the twentieth century from much monitoring constraints, corporations became jealous of their independence and were constantly, strongly, and fiercely opposing any risk of sovereignty loss. In this regard corporations have actually adopted a rushing-ahead strategy, combining cleverly processes’ innovation, transactions’ sophistication, accounting number manipulation, and so on, whose sole objective is information opacity. Confusing investors and consumers was not enough for modern corporations; their managers learned also how to interfere with corporate democracy.

In a relatively very short period of time the corporate form became the dominant form of business all over the world, and also in a much shorter period of time corporate managers took over its complete destiny at the expense of shareholders. The discipline dealing with the authority within corporations is known as corporate governance and is concerned with the way managers behave themselves while running corporations, supposedly belonging to shareholders. Consequently, corporate governance goes beyond that of regulating shareholders-management relationships to cover other issues to be discussed in this book. As corporations play a crucial role in modern economies that rely intensively on such private organization for securing savings, regulating investments, and securing incomes, good corporate governance is becoming an essential requirement to an extensive and growing segment of the population and a major issue for public-policy makers. Such interest for governance was exacerbated by the unfair economic and social harms recently and overtly caused by notorious corporate embezzlements. Ultimately this crisis may have, after all, a positive effect if it succeeds in making policymakers become more sensitive to the necessity of good corporate governance in business dealing and making them aware of its major contribution to financial market development, investment, economic growth, and social stability. This crisis may also prove to be beneficial if, for their part, organizations better understand how good corporate governance may contribute to their competitiveness and prosperity. It is also susceptible of making investors realize the role they can play for ensuring good corporate governance practices within corporations they own.

THE EXPLOSIVE COCKTAIL OF CORPORATE COMPLICATIONS AND MARKET SOPHISTICATIONS

Corporate privileges would have no value if an appropriate market was not tailored and created specifically for them. For this reason, corporate advances and sophistications were accompanied, hand in hand, with the financial market development and sophistication and these changes have had profound implications for corporate governance (Bradley, Schipani, Sundaram et al., 1999). The result was a new financial order, mainly characterized by a vast volume of financial transactions, but also doubtful opportunities of frauds, a kind of financial hurricane that is impossible to master, at least till now, as represented in Figure 1.1.

Indeed, corporate specific characteristics have contributed to exchange development and to exchange transactions explosion. By creating new financial instruments such as options, derivatives, and exchange indexes, the exchange fuels the financial hurricane even more by adding fuel to the fire process. Market exchange operators became voracious and can hardly wait for an event to occur; they tend to anticipate them along with their eventual return in a foolish race for profit, creating more often false expectation that result in many unnecessary deceptions. Major fraudulent transactions, although involving corporations, are now of a macro nature and are taking place at the market level. A recent round of financial frauds is seen as the natural and inevitable consequence of a trend which was building up for so long now. Inevitably the market becomes the master governance system (Clarke, 2005, p. 1410). “Ironically, the blunt truth is that recent accounting scandals and broader phenomenon have made corporate managers more accountable to the market” (Coffee, 2002) and less to shareholders or citizens. Consequently, the corporation has become the privileged field for fraud and misappropriation that are both difficult to detect and to predict, due mainly to market sophistication. Corporations’ gain of power and their lobbying activities for regulations dilution has rendered them difficult to monitor, and engaged them in an interdependent complex system of conflicts of interest.

Figure 1.1 The financial hurricane.

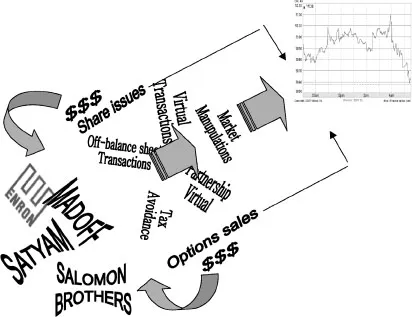

THE GLOBALIZATION OF FRAUD AND MISTRUST

Corporate regulations’ strength coupled with corporate expansion and management power explosion can only lead to mistrust behavior proliferation. The most notable corporate frauds were initiated from economically advanced environments but should not divert us from the fact that other economies seem to have experienced their own share of misfortune and surely deserve their own share of blame. The truth is that “the dangers that accompany deception and abuse of trust loom large around the globe” (Frankel, 2006). Four fraud failure stories tell it all: Satyam, Enron, Salomon Brothers, and Madoff. (see Figure 1.2).

Figure 1.2 Four failure stories of fraud.

Enron is the first major corporate fraud to be known to the public and concerns the nonrespect of corporate governance and market inefficiency that allowed Enron management to create a virtual company with virtual profits. This involved a combination of aggressive accounting, off-balance-sheet deals, employee intimidation and adviser bribing, and market manipulations. Satyam Systems, a global IT company based in India, also joined, beginning in 2009, the list of notorious companies involved in fraudulent financial activities. It undertook accounting improprieties that overstated the company’s revenues and profits and reported a cash holding of approximately $1.04 billion that simply did not exist. Like many others financial institutions, Salomon Brothers expanded aggressively into property-related investments, including so called subprime mortgages—loans to people on low incomes or with poor credit histories. Salomon traders were also caught submitting false bids to the US Treasury in an attempt to purchase more Treasury bonds than permitted by one buyer. Finally, Madoff used a giant Ponzi scheme to rob a long list of sophisticated investors. “For years, it seems, the returns paid to investors came, in part at least, not from real investment gains but from inflows from new clients. It might still have been going on, were it not for the global financial crisis” (The Economist, 2008a). All four fraud cases were finally caught in what we call here the market liquidity trap. Indeed, the market can temporarily be fooled by fraudulent assertions, but in the long run it always requires a cash flow at the level of the assertions, and as Warren Buffett put it, “Only when the tide goes out is it clear who was swimming naked.” The financial sector, which was intended to protect against fraud and crisis, is no exception either.

For the critics of modern finance, Bear’s swift end on March 16th was the inevitable consequence of the laissez-faire philosophy that allowed financial services to innovate and spread almost unchecked. Fraud has been rampant in the sale of subprime mortgages. Spurred by pay that was geared to short-term gains, bankers and fund managers stand accused of pocketing bonuses with no thought for the longer-term consequences of what they were doing. Their gambling has been fed by the knowledge that, if disaster struck, someone else—borrowers, investors, taxpayers—would end up bearing at least some of the losses.

(The Economist, 2008b)

Investment banks have become real debt machines trading heavily for themselves. “Goldman Sachs is using about $40 billion of equity as the foundation for $1.1 trillion of assets. At Merrill Lynch, the most leveraged, $1 trillion of assets is teetering on around $30 billion of equity” (The Economist 2008b). As should be expected, any trivial decrease in assets values will wipe out investors.

Frauds and...