This is a test

- 240 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Rational Expectations and Efficiency in Futures Markets

Book details

Book preview

Table of contents

Citations

About This Book

Do traders in futures markets make use of all relevant information and is this reflected in prices? This collection of original essays by a team of international economists considers these and other questions central to futures markets.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Rational Expectations and Efficiency in Futures Markets by Barry Goss in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

1 Rational expectations and welfare in financial futures markets

Futures trading in traditional commodities has been carried on for over a century. Its economic effects have been studied both theoretically and empirically (see Goss and Yamey 1976; Peck 1985). In recent years, the major growth and volume have been in financial futures: treasury bonds, bills and Standard & Poor’s 500 Index futures. Their economic roles in the economy are less well understood.

The investment process links three sets of institutions: (a) corporations which undertake capital formation by selling securities to financial intermediaries; (b) financial intermediaries which bid for and then distribute these securities to institutional investors; (c) institutional investors who manage the savings of households and purchase the securities from the intermediaries. The major users of financial futures are the financial intermediaries and institutional investors.

In this chapter we develop a model of the effects of financial futures markets upon the rate of real investment and level of social welfare.

THE SUPPLY OF RISKY ASSETS BY CORPORATIONS

The rate of capital formation is determined by the interaction between the demand for risky assets by the intermediaries and the supply offered by the corporations which want to finance capital formation. The supply function will be derived by using the analysis developed by Keynes (1930), Modigliani and Miller (1958) and Tobin (1969).

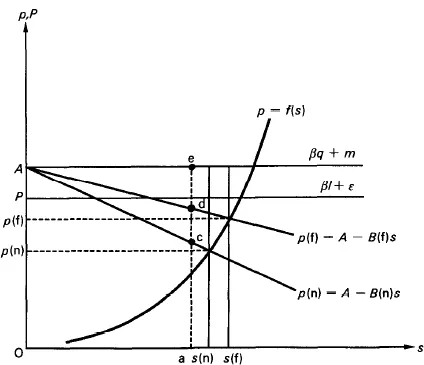

The value of the firm is equal to the discounted value of expected profits F(K), where K = K0 + δK is the capital stock and the input of labour is such that the value of its marginal product is equal to the wage. The supply price of capital is 1 dollar and the corporation plans to issue new debt with a face value of s dollars. The value of the corporation is distributed between the value s of the newly issued securities and the equity VE of the existing stockholders:

At time t, the newly issued securities are sold to financial intermediaries at price p(t). The corporation uses the proceeds p(t)s to purchase δK of additional capital:

The price p(t) offered by the financial intermediary to the corporation is proportional to the Keynes–Tobin Q ratio. The value of the marginal Q = F′(K)δK/s is the change F′(K)δK in the value to the firm divided by a change s in the debt. From equation (1.2), marginal Q = pF′(K). The higher the intermediary’s bid price p(t), the more capital goods can be purchased from the sale of s dollars’ worth of face value of newly issued securities and the higher is Q.

The object of the corporation is to select a value of s to maximize the equity of VE of the existing stockholders:

At the optimum, the equation

is satisfied. The increase in the value of the firm per additional dollar of newly issued debt or equity pF′ is equal to 1 dollar. Marginal Q will equal unity at the optimal s.

Specifically, let the production function of the corporation be Cobb–Douglas, where v is the share of the value of output received as profits. Then we can solve (4) for the supply of securities as a function of the price offered by the intermediary:

In so far as the share of profits is less than 0.5, the supply curve of risky assets offered by the corporation is convex from below, as shown in Figure 1.1. In general, write the supply curve of risky assets to finance capital formation as (the number of corporations is normalized at unity)

We have described the supply side of the market. Next, we describe the demand for these risky assets by financial intermediaries.

Figure 1.1 Supply of risky assets

FINANCIAL INTERMEDIARIES

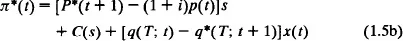

The corporation offers to sell s dollars’ worth of bonds with a face value of 1 dollar per bond to the financial intermediary, and asks for a forward bid price. The profits of the intermediary are described by

The intermediary offers the firm p(t)s for the securities. The carrying cost to the intermediary, from the time t of purchase until time t + 1 of the sale to the institutional investor, is measured by the short-term interest rate i. The total cost per unit to the intermediary is p(t)(t + 1), and the total commission is C(s).

The securities will be sold at time t + 1 to the institutional investors at price P*(t + 1). The securities may be the same as those purchased: for example, high-grade corporate bonds. Alternatively, the intermediary may be the Federal National Mortgage Association which holds these securities as investments and sells s dollars’ worth of its own securities to the institutional investors. The Government National Mortgage Association (GNMA) does something similar. In this case, the intermediary substitutes its own credit for that of the corporation, and is able to sell in a broader market at a higher price. In either case, when the intermediary bids p(t), it does not know the price P*(t + 1) at which it will be able to market the securities. The asterisk denotes a stochastic variable.

If the intermediary does not use the futures market, its profit π consists of the first two terms on the right-hand side of

The first term is the capital gain or loss, and the second term is the commission. The third term, to be discussed below, refers to transactions in futures. It will simplify matters if we assume that commission C(s) is ip(t)s, where i is equal to the normal return on the value of the securities purchased. Then (1.5b) implies (1.5a).

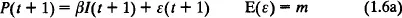

A crucial equation is

There is a relation between the price of the corporate bond P(t + 1) to be marketed to the institutional investors and the price I(t + 1) of a treasury bond. I is referred to as the absolute price level of securities, the yield curve or the index. There are two components to the market price P(t + 1) of the corporate security. The first part βI(t + 1) is its relation to the yield curve. The second part ε(t + 1) is the relative price of the security, which is constructed to be independent of the absolut...

Table of contents

- Cover

- Title

- Copyright

- Contents

- List of figures

- List of tables

- Notes on contributors

- Introduction

- 1 Rational expectations and welfare in financial futures markets

- 2 Foreign currency futures spreads and risk premiums

- 3 Assessing market performance: an examination of livestock futures markets

- 4 Rational expectations and experimental methods

- 5 Efficiency of the yen futures market at the Chicago Mercantile Exchange

- 6 Simultaneity, forecasting and efficiency in the US oats market

- 7 Alternative performance models in interest rate futures

- 8 A rational expectations model of the Australian wool spot and futures markets

- 9 The announcement effects of economic variables

- Index