This is a test

- 386 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Fintech and the Remaking of Financial Institutions

Book details

Book preview

Table of contents

Citations

About This Book

FinTech and the Remaking of Financial Institution s explores the transformative potential of new entrants and innovations on business models. In its survey and analysis of FinTech, the book addresses current and future states of money and banking. It provides broad contexts for understanding financial services, products, technology, regulations and social considerations. The book shows how FinTech has evolved and will drive the future of financial services, while other FinTech books concentrate on particular solutions and adopt perspectives of individual users, companies and investors. It sheds new light on disruption, innovation and opportunity by placing the financial technology revolution in larger contexts.

- Presents case studies that depict the problems, solutions and opportunities associated with FinTech

- Provides global coverage of FinTech ventures and regulatory guidelines

- Analyzes FinTech's social aspects and its potential for spreading to new areas in banking

- Sheds new light on disruption, innovation and opportunity by placing the financial technology revolution in larger contexts

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Fintech and the Remaking of Financial Institutions by John Hill in PDF and/or ePUB format, as well as other popular books in Negocios y empresa & Estrategia empresarial. We have over one million books available in our catalogue for you to explore.

Information

Topic

Negocios y empresaSubtopic

Estrategia empresarialChapter 1

Introduction

Abstract

New financial applications called “Fintech” are disrupting traditional financial services. The scope and importance of Fintech is not fully appreciated or taught in traditional Financial Markets courses. On the other end of the spectrum, popular coverage of Fintech tends to be overly promotional and understates the response of the big banks to protect their franchises. This book presents an overview of traditional financial products and services and the Fintech disruptors in each area. Regulation of financial markets is also covered along with a review of Fintech’s negative contribution to some important social issues. Finally, there is a review of the Fintech activities of the big banks.

KeyWords

Bitcoin; blockchain; cryptocurrency; Fintech; M-Pesa; stripe; square; P2P; SoFi; transferwise

Each year, among the coastal dunes stretching from Florida to the Carolinas, tens of thousands of turtle hatchlings fight their way out of their shells and begin a terrifying dash towards the crashing surf. They hope to avoid the hovering sea gulls, only to find more predators in the waters. Not coincidentally, these waters are also a nursing ground for many species of sharks. This scene is repeated up and down the Atlantic coast, and the odds of survival are stacked dramatically against any single turtle, yet some number manage to survive by stealth, determination, genetic design, and no small amount of luck.

The turtle’s quest for survival is an apt metaphor for Fintech startups. Each year, thousands of innovative ideas are hatched. A small percentage gets funded. One VC told me that of 5,000 pitches he receives each year, barely 5 get funded. Of those that do get funding, fewer still launch a viable commercial product. Then most discover that they do not have the field to themselves. There are competing startups pursuing the same market. And if they can reach some stage of viability there are often more substantial predators in the form of the Big Financial Institutions. At various stages along the way, there are demands for increasing scale often pulling the business away from the Founders’ vision. And then there is a need to turn a promising idea into a profit-making enterprise, often while fighting off a newer generation of disruptors. Entrepreneurs willing to take on these risks, and the very few who can succeed, overcome incredible odds, and deserve our respect, and even our support.

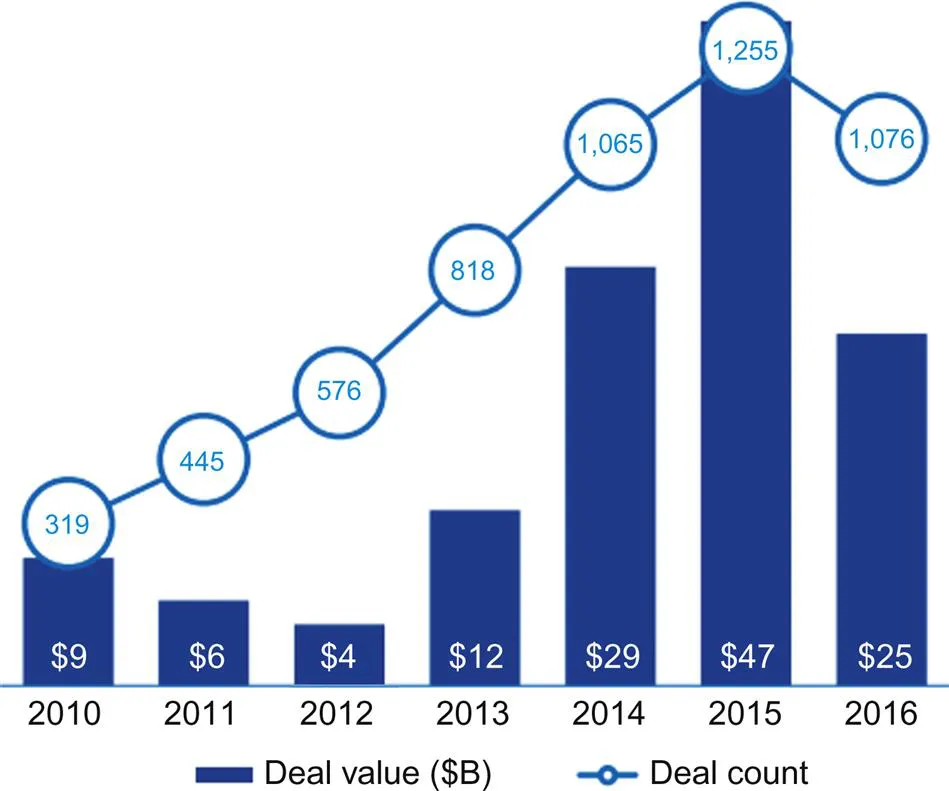

However, it is also important to go beyond uncritically cheer leading for the startup community. It’s important to have a historical perspective on startups within a context of financial products and institutions. Equally essential is to have a balanced view of the value and likely success of startups as well as new products offered by the Big Financial Institutions. The entrepreneurial startup community is aggressively developing new “Fintech” applications, which are dramatically changing the way financial services and products are delivered, especially to Millennials. There are now over 200 Fintech companies valued at over $1 billion each, the so-called “Unicorns”. Global investment in Fintech for 2016 totaled $24.7 billion, a total exceeded only by the record investment levels of 2014 and 2015. As shown in Fig. 1.1, $100 billion have been invested in Fintech in 3 years, 2014–2016 (KPMG).

While professionals obviously need to stay abreast of all the latest news, there is also huge popular interest in Fintech. There are stories about new financial applications in the press every day. Even “60 Minutes” has done segments on these companies. There are also many books which herald the coming revolution in finance, where there will be no need for brick-and-mortar branches, investment counselors, or even physical money itself.

The reality is likely to be a more gradual adoption and integration of new technology and mobile applications into the existing financial system. Mobile payments is a fertile area for startups, yet JPMorgan Chase has over 22 million mobile accounts. Half of all new JPMorgan accounts are opened by Millennials. The big banks, with their massive internal budgets, will continue to fund active captive investments. So, while most of the focus in this book is on the startup Fintech ecosystem, it is important to realize that the Big Financial Institutions can and will play a substantial role. They are not going to go away. They will adopt new technology in three different ways: by partnering with startups, by acquiring some of them, and also by internal development. This is not to say that there won’t be successful, enduring disruptive startups. After all, two of the pioneering disruptive Fintech companies are PayPal, which disrupted the payments system, and ICE, which disrupted exchange markets. But the vision of startups turning Big Financial Institutions into zombie shells is not credible. Unfortunately, much of the Fintech literature is just too uncritically promotional of this outlook.

On the other side of the coin are mainstream books on Money, Banking, and Financial Markets. These academic volumes may have an occasional sidebar on M-Pesa or SoFi, but there is no systematic discussion of Fintech in terms of what it is, why now, what does the future hold, etc.

In sum, the existing literature is either uncritically fanboy, snarky, or oblivious.

This book seeks to present a balanced, unified view of Fintech in the current and future system of money and banking. In order to do so, some background understanding of financial products and institutions is required, and will be provided in subsequent chapters. Additional chapters focus on international Fintech developments, startup financing, and the regulatory environment surrounding Fintech. Finally, some thoughts will be offered on the future trajectory of financial services.

“We need banking, but not banks”, Bill Gates

This quote from the former chairman of Microsoft could have been made today. It neatly summarizes both the opportunity and the challenge for Fintech startups. There is a huge opportunity for disruption which is made clear in the Gates’ quote. He makes the distinction that while many functions are necessary, the existing structure of banking institutions is not. What is less obvious is the challenge presented by this statement: It was made in 1994! Clearly, the biggest financial institutions have not ceded much of their business. While many startups have had success, the largest banks continue to thrive.

What do we mean by the term “Fintech”? The word itself is a concatenation of “finance” and “technology”. Historically, technology has always played a significant role in financial markets and institutions. It has been crucial to a wide range of applications such as customer onboarding, order management, investment analysis, position reporting, risk, post-trade processing, regulatory reporting, and more. But “Fintech” has a more specialized meaning which focuses on 21st century developments utilizing new technology innovations which are more often than not disruptive challengers to the Big Financial Institutions. These new applications and financial services cover a wide field ...

Table of contents

- Cover image

- Title page

- Table of Contents

- Copyright

- Acknowledgments

- Chapter 1. Introduction

- Chapter 2. Disruption and Disintermediation in Financial Products and Services: Why Now?

- Chapter 3. Money: A Medium of Exchange, Unit of Account, and Store of Wealth

- Chapter 4. Financial Institutions

- Chapter 5. Bubbles, Panics, Crashes, and Crises

- Chapter 6. Bank Lending

- Chapter 7. Time Value of Money: Interest, Bonds, Money Market Funds

- Chapter 8. Equities

- Chapter 9. Foreign Exchange

- Chapter 10. Futures, Forwards, and Swaps

- Chapter 11. Commodities

- Chapter 12. Options

- Chapter 13. Startup Financing

- Chapter 14. Fintech in a Global Setting

- Chapter 15. Fintech and Government Regulation: If It Quacks Like a Bank…

- Chapter 16. Social Issues: Diversity and Inclusion, Unemployment, and Income Distribution

- Chapter 17. They are Not Dead Yet: How Big Financial Institutions Will Work with Fintech Startups to Define the Market Structure of the Future

- Index