- 240 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Clearing, Settlement and Custody

About this book

Four new chapters and updates throughout help this 2e of Clearing, Settlement and Custody summarize worldwide changes in the process of concluding a financial transaction. Noted consultant David Loader provides a highly detailed analysis of the central clearing counterparty concept, the drivers behind it, and its effects on operations teams. He also clearly illustrates the life cycle of a series of transactions to broaden the comparison process.

Emphasizing changes in the regulatory environment stemming from the 2008 market crash and liquidity crisis, this edition uses new case studies and end-of-chapter quizzes to explore the transaction value chain of trading, clearing, settlement, and custody. Students and professionals in the financial field will benefit from the book's description of the industry and the details of financial innovation and regulatory response, with their many implications.

- Supplements theoretical insights about risk with empirical data from current cases

- Provides the first algorithmic risk management technique that spans multiple asset classes

- End-of-chapter questions reinforce primary and secondary points

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Chapter 1

The structure of clearing and settlement

Abstract

This chapter introduces the concepts of clearing and settlement. It discusses the process in respect of payments and securities identifying the key systems. The chapter also looks at the evolution of clearing and settlement and the key recommendations that have shaped the processes used today.

The role of the clearing house and an overview of the major providers of central clearing are explored including DTCC, Euroclear and Euroclear Great Britain and Ireland (CREST), Clearstream, LCH Clearnet, TARGET2.

We look at the flow for a transaction through to settlement seeing how each player is involved.

Keywords

clearing; settlement; clearing house; securities depositories; payments; central clearing; G30

What is clearing and settlement?

An interesting question and one that, on the face of it, could be answered by a simple definition and yet in the financial markets it is often a very little understood but vital process.

For every transaction that takes place in the markets there is a process that concludes the transaction. In general terms that will mean some kind of exchange taking place between the two parties to the trade. The exchange may be cash for a security or the netted outcome of more than one transaction, for instance the end result of a purchase and sale.

Clearing is a term that is easily associated with banking so that we have the ‘clearing banks’. In this instance the item being ‘cleared’ is money and, historically, cheques. When a cheque is drawn it has a value that is only realized when the receiving bank has presented it to the drawing bank and received the value, hence the term ‘value date’. As most people know, the time to obtain the value may be three or even more days from the paying into the account of the cheque. Today the somewhat antiquated process of cheques being cleared has been partially replaced by automated processes or electronic banking. The payment systems that allow electronic transfer of money are usually owned and operated by the Central Bank of the country of the currency. Example of payment systems are Fed Wire and CHIPS in the USA, BACS and CHAPS in the UK and TARGET2 for the Euro. However small or low-value payments can in many cases take several days before the clearing is completed.

In the financial markets there is not only cash but also near cash or money market instruments like treasury bills. A transaction in these bills is settled in the UK through the CREST system at Euroclear. Euroclear UK and Ireland (Euroclear) provides via CREST the UK securities settlement service for both money market instruments and also UK and international securities and bonds. This includes equities, bonds, unit trusts and shares in open-ended investment companies (OEICs).

In the USA treasury instruments are cleared via the Government Securities Clearing Corporation (GSCC) and in Europe via TARGET2.

So we know that money is cleared and settled in banking and so are securities including treasury instruments, equities, debt as well as commodities and derivatives; although the processes may be very different.

We looked at clearing and settlement in the overview so we can look again at what the two terms mean.

The process of clearing can be defined as:

Settlement can be defined as:

In each market around the world transactions in financial market instruments follow the same basic principle of clearing and settlement. The process of clearing and settlement is often linked with another process, the holding of securities. When this occurs we find central securities depositories or CSDs for short. CSDs hold securities centrally on behalf of their members to speed the process of clearing and settlement. This is particularly relevant where physical securities still exist as the selling party does not have to send the securities to the buying party who may be resident overseas. The risk in moving physical securities is the possibility of the loss of the securities. As noted, this is extremely important in the case of bearer securities where there is no evidence of ownership recorded.

We should also note at this point that CSDs and International Central Securities Depositories (ICSDs) like Euroclear, Clearstream and DTCC only operate in instruments they have approved as ‘eligible’. We cannot forget that a wide range of instruments cannot be processed via a CSD or for that matter a CCP, for example private equity, which are shares in small unlisted or privately owned companies.

The clearing house

It is important to note that the clearing process is carried out by a designated function, and the organization that performs this function is often called a clearing house. The clearing house operates either completely or to a significant degree independently of the exchanges or market it serves. The responsibility for managing and overseeing the trading process is therefore quite separate from the process of controlling the transactions through to settlement. The clearing house does not make the rules and regulations pertaining to carrying out transactions but it does establish the rules, in conjunction with the regulator and the exchange, by which its members will clear and settle the business.

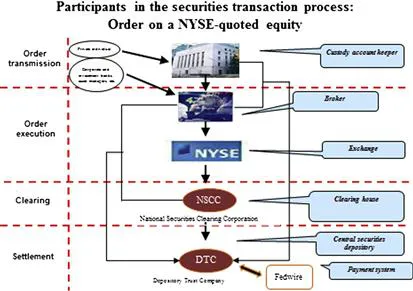

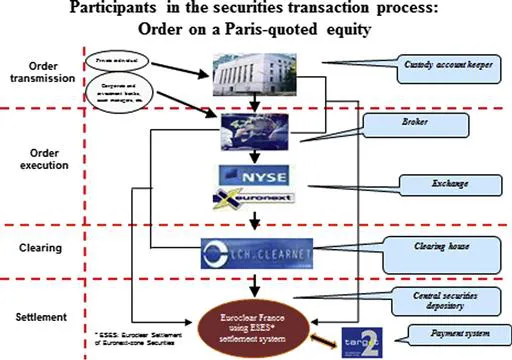

Figure 1.1 shows the process associated with an equity transaction on the NYSE whilst Figure 1.2 shows the process for a trade on NYSE Euronext in Paris.

FIGURE 1.1 The process associated with an equity transaction on the NYSE.

FIGURE 1.2 The process for a trade on NYSE Euronext in Paris. Source: The DSC Portfolio Ltd/First Finance.

We can see where some of the participant organizations that we have mentioned are located in the trade and post-trade clearing and settlement process, including the CSD and payment systems.

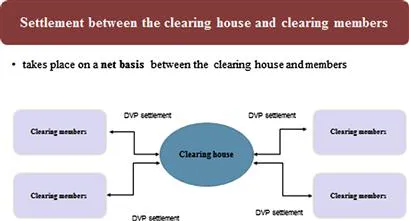

The relationship between the clearing house and its members is that the clearing house settles trades on a net basis between itself and its members. Netting means that bought and sold trades are offset and the cash position across trades is also netted. The opposite to netting is gross settlement, which is where every trade settles separately. Figure 1.3 above illustrates this and as we can see not only is netting applied, but also settlement takes place on a delivery versus payment (DVP) process, which again helps to reduce the risk of failed settlement.

FIGURE 1.3 Source: The DSC Portfolio Ltd/First Finance.

Changes in clearing

We noted in the overview that today, as with so much of the financial markets, change is taking place in the way in which activity on markets is cleared and settled.

Let us recap on this and explore further.

The central clearing counterparty (CCP), essentially a process of not just facilitating settlement but guaranteeing it, is becoming common in securities markets and thus the clearing and settlement of securities is moving towards the same process as that used for derivatives.

In the UK, the London Clearing House (LCH), a major clearer of derivatives for many years, joined with CREST to provide a central clearing process for equities called EquityClear.

In Figures 1.1–1.3 above we saw the possible relationships between the trading, clearing and settlement and the relationship with the CCP. Note that there need not necessarily be a one-to-one relationship between the trading member as legal entity and either the clearing member or the settlement entity.

We look at the CCP again in more detail later in the book but it is important to remember that the changes in clearing and settlement are impacting on operations teams and, of course, the procedures and controls they use. There are many benefits, as we have already determined of the CCP structure, but there is also a need to ensure that firms and clients are aware of what the changes mean to long-established procedures, particularly in areas like some OTC derivatives where the concept is new.

We also need to focus on the fact that clearing and settlement processes in different markets are covered by local conventions and in turn these differ sometimes considerably from jurisdiction to jurisdiction and also from one product to another.

Development of the clearing structures

The introduction of many initiatives over the years has led to a more streamlined process and yet one that is by no means uniform across countries. These initiatives include those set out by the Group of 30, an industry body made regarding issues surrounding the settlement of securities in the late 1980s. The International Securities Services Association (ISSA) later took on board the recommendations that they made, updated them and monitored markets to ascertain the extent of their implementation. Today we see many of the recommendations as standard practice in most, but not all, markets. Times have changed, and ISSA issued more recommendations in 2000 that sought to build on those of G30 and improve the whole settlement environment from the angles of both efficiency and risk. It is worth looking at the G30 and ISSA 2000 recommendations and the key points follow:

Table of contents

- Cover image

- Title page

- Table of Contents

- Copyright

- Preface

- Chapter 1. The structure of clearing and settlement

- Chapter 2. The role of the clearing house, trade repositories and central securities depositories

- Chapter 3. Bond settlement

- Chapter 4. Equity clearing and settlement

- Chapter 5. Clearing and settlement of derivatives

- Chapter 6. Custody services

- Chapter 7. Securities lending

- Chapter 8. Settlement of portfolio transactions and subscription/redemption of shares and units in investment funds

- Chapter 9. Risk and regulation

- Glossary

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Clearing, Settlement and Custody by David Loader in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.