- 360 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Raising Entrepreneurial Capital

About This Book

Raising Entrepreneurial Capital guides the reader through the stages of successfully financing a business. The book proceeds from a basic level of business knowledge, assuming that the reader understands simple financial statements, has selected a specific business, and knows how to write a business plan. It provides a broad summary of the subjects that people typically research, such as "How should your company position itself to attract private equity investment?" and "What steps can you take to improve your company's marketability?"

Much has changed since the book was first published, and this second edition places effects of the global recession in the context of entrepreneurship, including the debt vs. equity decision, the options available to smaller businesses, and the considerations that lead to rapid growth, including venture capital, IPOs, angels, and incubators. Unlike other books of the genre, Raising Entrepreneurial Capital includes several chapters on worldwide variations in forms and availability of pre-seed capital, incubators, and the business plans they create, with case studies from Europe, Latin America, and the Pacific Rim.

- Combines solid theory with a practitioner's experience and insights

- Case studies illustrate theory throughout the book

- Updated to reflect the realities of the global economic recession

Frequently asked questions

Introduction

Keywords

Getting Started

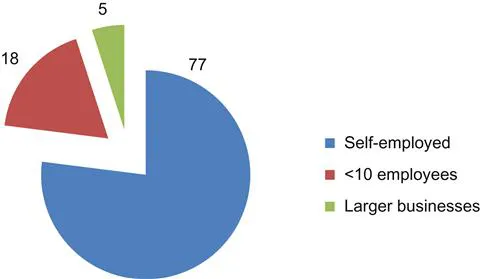

The Typical American Business

Requirements for Being Considered a Small Business

| NAICS Number Code | Sales Maximum ($ million) | Employee Number Maximum | |

| 111992 | Peanut farming | 0.75 | |

| 112310 | Chicken egg production | 12.5 | |

| 493110 | Warehousing | 25.5 | |

| Food manufacturing | |||

| 311230 | Breakfast cereals | 1000 | |

| 311821 | Cookies and crackers | 750 | |

| 311830 | Tortillas | 500 | |

Small Businesses’ Role in the U.S. Economy

Table of contents

- Cover image

- Title page

- Table of Contents

- Copyright

- Dedication

- Preface

- Acknowledgments

- 1. Introduction

- 2. Alternatives in Venture Financing: Debt Capital

- 3. Alternatives in Venture Financing: Early-Stage Equity Capital

- 4. Determining the Amount Needed: The Business Plan

- 5. Valuation: Survey of Methods

- 6. Venture Capital

- 7. Exit Strategies

- 8. Anatomy of a Venture Funding

- 9. Franchising

- 10. Internal Financial Management

- 11. Essentials of Risk Management

- 12. Opportunities to Do Business and Raise Capital Globally