- English

- ePUB (mobile friendly)

- Available on iOS & Android

About This Book

Discover the latest essential resource on equity portfolio management for students and investment professionals.

Part of the CFA Institute's three-volume Portfolio Management in Practice series, Equity Portfolio Management offers a fuller treatment of active versus passive equity investment strategies. This text outlines key topics in the portfolio management process with clear, concise language to serve as an accessible guide for students and current industry professionals.

Building on content in the Investment Management and Equity Valuation volumes in the CFA Institute Investment Series, Equity Portfolio Management provides an in-depth, technical examination of constructing and evaluating active equity methods.

This volume explores:

- An overview of passive versus active equity strategies

- Market efficiency underpinnings of passive equity strategies

- Active equity strategies and developing portfolios to reflect active strategies

- Technical analysis as an additional consideration in executing active equity strategies

To further enhance your understanding of the tools and techniques covered here, don't forget to pick up the Portfolio Management in Practice, Volume 3: Equity Portfolio Management Workbook. The workbook is the perfect companion resource containing Learning Outcomes, Summary Overview sections, and challenging practice questions that align chapter-by-chapter with the main text.

Equity Portfolio Management alongside the other Portfolio Management in Practice volumesdistill the knowledge, skills, and abilities readers need to succeed in today's fast-paced financial world.

Frequently asked questions

CHAPTER 1

OVERVIEW OF EQUITY SECURITIES

LEARNING OUTCOMES

- describe characteristics of types of equity securities;

- describe differences in voting rights and other ownership characteristics among different equity classes;

- distinguish between public and private equity securities;

- describe methods for investing in non-domestic equity securities;

- compare the risk and return characteristics of different types of equity securities;

- explain the role of equity securities in the financing of a company’s assets;

- distinguish between the market value and book value of equity securities;

- compare a company’s cost of equity, its (accounting) return on equity, and investors’ required rates of return.

1. INTRODUCTION

- What distinguishes common shares from preference shares, and what purposes do these securities serve in financing a company’s operations?

- What are convertible preference shares, and why are they often used to raise equity for unseasoned or highly risky companies?

- What are private equity securities, and how do they differ from public equity securities?

- What are depository receipts and their various types, and what is the rationale for investing in them?

- What are the risk factors involved in investing in equity securities?

- How do equity securities create company value?

- What is the relationship between a company’s cost of equity, its return on equity, and investors’ required rate of return?

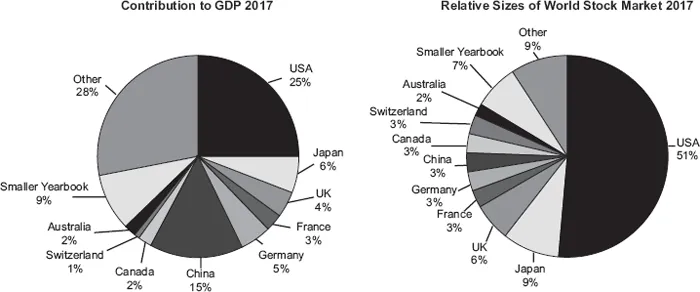

2. EQUITY SECURITIES IN GLOBAL FINANCIAL MARKETS

| Rank | Name of Market | Total US Dollar Market Capitalization | Total US Dollar Trading Volume | Number of Listed Companies |

| 1 | NYSE Euronext (US) | $22,081.4 | $16,140.1 | 2,286 |

| 2 | NASDAQ OMX | $10,039.4 | $33,407.1 | 2,949 |

| 3 | Japan Excha... |

Table of contents

- Cover

- Title Page

- Copyright

- Contents

- PREFACE

- ACKNOWLEDGMENTS

- ABOUT THE CFA INSTITUTE INVESTMENT SERIES

- CHAPTER 1 OVERVIEW OF EQUITY SECURITIES

- CHAPTER 2 MARKET EFFICIENCY

- CHAPTER 3 OVERVIEW OF EQUITY PORTFOLIO MANAGEMENT

- CHAPTER 4 PASSIVE EQUITY INVESTING

- CHAPTER 5 ANALYSIS OF ACTIVE PORTFOLIO MANAGEMENT

- CHAPTER 6 ACTIVE EQUITY INVESTING: STRATEGIES

- CHAPTER 7 ACTIVE EQUITY INVESTING: PORTFOLIO CONSTRUCTION

- CHAPTER 8 TECHNICAL ANALYSIS

- GLOSSARY

- ABOUT THE AUTHORS

- ABOUT THE CFA PROGRAM

- INDEX

- END USER LICENSE AGREEMENT