![]()

| 1 | How Good We Had It: |

| The Money-Making Machine Known as High-Tech |

IN SECTOR AFTER SECTOR, THE PROFITABILITY OF SELLING TECH products is shrinking. The total amount of gross profit dollars in some tech product sectors is getting smaller every year. For the first time, most companies no longer seem able to innovate their way around the problem. Price competition is taking a huge toll on product margins not just in consumer sectors like PCs, but also in traditionally profitable enterprise segments like networking and software. It’s not because tech companies can’t innovate anymore, but because tech customers can barely use the complex technology they already own. They have unused features and licenses, excess capacity, and stable systems that serve their basic needs, so why buy more unless it’s cheaper? This is not the path to profitable growth. It is the path to commoditization, and it is forcing companies to change what business they’re in just to maintain margins. Hardware companies are jumping to services and software. Software companies are making their profits off of maintenance contracts, not selling software.

As an industry, we face a growing gap between what our products are capable of doing and what our customers actually do with them. This may be the true gating factor in the growth of tech industry profits and it’s not a problem that more features will cure. Failure to close this gap means future revenue growth that is anemic, unprofitable, or both. In the new economics of the cloud, driving usage is even more critical since nearly all the revenue will be based on consumption, and switching costs will be low for disgruntled customers. The cloud as it is currently envisioned is a tricky thing. On the one hand, it could be the rapid draining of the profit pool for high-tech—a relentless drive for cheaper and cheaper versions of standard functionality. At the Technology Services Industry Association (TSIA), we believe it could also enable a unique ability to fight commoditization. This is what this book is about. However, before we can look to the future, we need to take a look at how we got where we are today.

Technology purchase decisions have always been based on an assessment of risk and reward. If the reward was truly compelling, customers would take the risks—pay a high asking price, pay it all up front, put up with lots of frustrations, lots of complexity, even risk failure. Why would a buyer enter into such a lopsided agreement? It’s simple: Tech offers were that compelling. Not just compelling, but Wow!-compelling. After all, Wow!-compelling offers are what high-tech companies specialize in. It’s what VCs look for, what boards of directors and financial analysts reward, what R&D folks live for, and what salespeople want to sell.

For decades our offers have compelled corporations to buy complex and sophisticated hardware, software, networks, and services. While the investment risks to the buyers were significant, they gladly placed their bets because of the huge opportunity for value creation. Successful IT systems promised to dramatically increase revenues, cut costs, create competitive advantage, improve customer service, or boost employee productivity. These were rewards worth taking real risk for, even if it meant that the customer shoulders far more of it than the tech seller does.

As a consumer we experience the same phenomenon. We make trade-offs too. Hundreds of dollars and lots of personal time are required to realize the potential reward of some compelling technology offer. But instead of improving corporate profits, we just want to edit digital photographs or to entertain ourselves with awesome music and games. So no matter if you are a CIO spending $5 million on CRM or a mom spending $500 on little Bobby’s new laptop, almost everyone has stared down the barrel of the technology risk/reward decision. In either case, as long as the tech company could innovate in dramatic fashion, they got the customer to pay handsomely up front and assume the risk.

So how has this worked out? Pretty darn well for the tech companies. There has been so much breakthrough opportunity that the right product could catapult itself, its company, and its users to stardom. If you were the tech company with a hot product, you were golden. As a technology company, your goal was to join the famous parade of multibillion-dollar product franchises like Cisco routers, Microsoft Windows, Oracle databases, HP printers, VMware virtualization software, and the Apple iPhone. The list of highly profitable hardware and software products is long and impressive. Each deserves its place. These products created revolutionary opportunities for customer value. Even though the hot product rarely delivered on all cylinders, it usually worked well enough to get exciting results.

In addition to fast-growing revenues, successful technology companies became associated with very successful business models. These models were well documented in Bridging the Services Chasm,a book we published a few years ago. Our analysis of extensive industry benchmark data allowed us to model how successful technology companies generated their margin dollars. What we have not discussed in any of our previous works is the underlying purchase pattern that fuels all technology business models. In enterprise tech markets it looks like this:

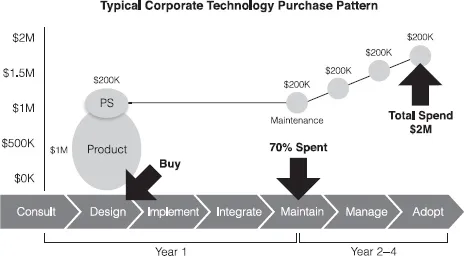

FIGURE 1.1 Typical Corporate Technology Purchase Pattern

The typical corporate IT buyer went through a selection process and picked the product(s) they wanted. They paid upfront for the product and for the installation, integration, training, and other professional services needed to get the product operational. Since the system would likely have a useful life of several years before major components would be replaced by next-generation offers, they wanted the software updates along the way and insurance against downtime. Thus, they also agreed to buy coverage for those products through an annual maintenance agreement offered by the supplier that they would continue to renew during the useful life of the solution.

What is really important about this picture are not the dollar values. In this example, the total cost of the system and related services is $2 million over a four-year period. Plug in the relevant number for one of your customer’s typical purchases. It could be $20 million or it could be $2,000, no matter. The key point is that by the time the products are actually getting adopted and used, at least 70 percent of the total four-year investment has already been spent. That money is now in the tech company’s bank account. And if the customer purchased maintenance, which 80 to 100 percent of corporate customers do, the probability that the tech company will get the last 30 percent of the money is nearly guaranteed. At “go-live,” the customer has huge sunk costs in the project. The idea of switching to another supplier is almost laughable. That customer is locked in.

Tech companies have spent decades optimizing their product development, marketing, sales, and services around this purchasing model. It also represents the financial model that Wall Street understands and can value.

Not necessarily unfair, right? Big commitments are what customers make when they buy important products. They buy cars and houses up front, so why not technology? After all, think about the investment that the tech company had to go through to get that deal:

• The development costs to build the products.

• The cost of any included hardware, third-party software, and licenses.

• The marketing costs to promote the offer.

• The sales salaries and commissions to get customers to buy it.

• The pre-sales consultants that support the sales process.

• The service personnel to implement the system and train the users.

Add that all up, and the money spent by the tech company to win that one piece of business is substantial. But they could relax because they were getting a big up-front check from the customer. The revenue associated with the initial product sale not only covered all those direct and indirect deal costs, but often returned handsome profit margins to the tech company. So who shouldered the risk in these scenarios, the customer or the tech company? Well, as we just pointed out, the tech company had plenty of up-front costs, but they got paid for those costs (and more) in the first year. So while they may have some temporary issues related to the timing of their expenses vs. their revenue recognition, billing cycle, and cash collection, their absolute risk was minimal.

What about the customer? Well, they were the proud owner of some bright, shiny, new technology. They took the risk on its potential and wrote the big check. So where does their reward come from? Let’s be honest, their reward is one hundred percent dependent on actually deriving the benefit from the new system that they were promised by the seller. The system has to actually work and has to be consumed successfully. The business users have to change their workflow from the “old way” to the “new way.” So who has primary responsibility for making sure all that happens? Customers do. It is a fact that, in nearly every technology product market, customers assumed a disproportionate share of risk in the risk/reward purchase decision. They were the party responsible for making the decision pay off, and to do that they faced a big problem.

Back in 2009, we published the book Complexity Avalanche. In it we documented a phenomenon that is now generally recognized as gospel truth in tech. That phenomenon is called the “Consumption Gap.”

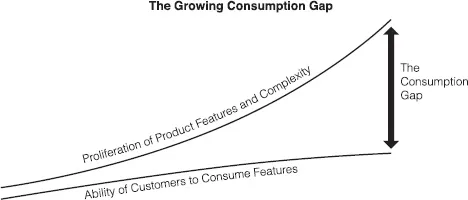

FIGURE 1.2 The Growing Consumption Gap

The Consumption Gap is based on the idea that technology companies can add features and complexity to their products at a much more rapid rate than their customers have the ability to consume them. The result is a growing gap between the potential value that products and services can provide vs. the business value that customers are actually achieving. The proof litters the industry. Software upgrade rates are slowing, the percent of features in use are declining, and product sales cycles are lengthening as customers struggle to digest all the product features they already own. The end result is that technology refresh rates in many product categories are slowing as “good-enough IT” is becoming a reality. Almost every company is feeling it. . . bet yours is too!

Those trends are how the Consumption Gap negatively affects things from the perspective of the tech company. But how does it present itself from the customer’s side? Consider these statistics:

• The average effective usage rate of enterprise software is only 54 percent.1

• Only 14 percent of enterprise software deployments are rated as “very successful” by the IT execs who own them.2

• Of the nearly $14 billion in consumer electronics that were returned by customers to retailers in the U.S. during 2008, only five percent were actually broken.3

• Hard-to-use software is behind the leakage of sensitive health data online, according to a study by Dartmouth researchers. “So many of the systems, particularly in health care, are bad,” said the study’s co-author, M. Eric Johnson. “So people find workarounds—using word-processing and spreadsheet tools that aren’t secure.”4

The Consumption Gap is huge and its impact on the tech economy, and society in general, is almost incalculable. Sure, there are ranges in the severity of the Consumption Gap—the more software you have in your product, the more likely you will have a gap. But name a product category that isn’t rapidly adding capability and complexity through software? As products evolve, the gap between what products can do vs. what they actually deliver is getting larger, not smaller. Forums on Microsoft’s Word product estimate that there are now over 1,200 features available in this product.5 What percentage of those features is being used by the typical Microsoft Word user? A TSIA member company just released the latest version of their software and they added 1,500 new features. Fifteen hundred on top of what was already there. Really?

Complexity Avalanche laid out many key tactics that tech companies could adopt to stem the Consumption Gap by inserting themselves actively into the process of monitoring and driving successful customer outcomes. It showed them how they could do this by repurposing and restructuring their existing customer service and support assets. Some companies like Xerox, Apple, and GE Healthcare have made the decision to take on that market-leading role. They realize that getting customers on a steady path of capturing more value from their existing technology is not only a competitive advantage—it is the key to making them hungry for more product capability.

Why has the industry gotten away with the Consumption Gap for so long? Once again, it has been a function of the Wow! compelling nature of our offers and the purchasing model for customers. The potential rewards that our offers proposed were so compelling that customers accepted the shortcomings, challenges, and risks. Once customers made the purchase decision, they were locked in. There was no turning back. They had to learn to work around the frequent realities of:

• High implementation costs (sometimes five times or more than the product cost!).

• Lack of interoperability.

• Extraordinary complexity.

• Frustrated business leaders.

• High cost of ownership.

• High switching costs.

• Poor end-user adoption.

• Hard-to-measure business benefits.

We knew it. Our customers knew it. But our offers were that compelling. No one wants to say this, but tech companies have been guilty of some over-promising and under-delivering for decades. Our customers lived with that because they were committed, and they had to drive through whatever obstacles they encountered to get to the Wow!-compelling rewards. Most customers did so to one degree or another.

Here is the bottom line: If you were the tech company, the questions of how well your products got used or how often did not usually have a meaningful, immediate financial impact. It was, after all, a product model, and we got paid up front. Of course, no tech company could survive repeated customer failure. That is not what we are talking about. We are talking about under-delivering on the full potential of the product. Tech companies learned that “good enough” consumption of value was all they needed to achieve for their economics to be optimized in this model.

These companies do c...