Food Entrepreneurs in Africa

Scaling Resilient Agriculture Businesses

- 152 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About This Book

Entrepreneurs are the lifeblood of the agriculture and food sector in Africa, which is projected to exceed a trillion dollars by 2030. This book is the first practical primer to equip and support entrepreneurs in Africa through the process of starting and growing successful and resilient agriculture and food businesses that will transform the continent. Through the use of case studies and practical guidance, the book reveals how entrepreneurs can leverage technology and innovation to leapfrog and adapt to climate change, ensuring that Africa can feed itself and even the world. The book will:

-

- Inspire aspiring entrepreneurs to start and grow resilient and successful businesses in the agriculture and food landscapes.

-

- Equip aspiring and emerging entrepreneurs with practical knowledge, skills, and tools to navigate the complex agriculture and food ecosystems and develop and grow high-impact and profitable businesses.

-

- Enable aspiring and emerging entrepreneurs to develop scalable business models, attract and retain talent, leverage innovation and technology, raise financing, build strong brands, shape their ecosystem, and infuse resilience into every aspect of their operations.

The book is for aspiring and emerging agribusiness entrepreneurs across Africa and agribusiness students globally. It will also inspire policymakers, researchers, development partners, and investors to create an enabling and supportive environment for African entrepreneurs to thrive.

Frequently asked questions

1

OVERVIEW OF THE FOOD AND AGRICULTURE LANDSCAPE IN AFRICA

Critical realities

- 1. A fragmented ecosystem still dominated by smallholder farmers: Cash and food crop production is dominated by smallholder farmers on one end of the spectrum and large, multinational trading and processing companies on the other end. Aggregators and middlemen extract value between these two extremes. Unproductive, fragmented, and unstructured value chains, with prohibitive production costs; limited use of improved seeds, fertilizer, and irrigation; and poor storage and processing make most value chains uncompetitive relative to their international counterparts.

- 2. Climate change: This is a critical reality facing the food and agriculture ecosystem in Africa. Of the ten countries considered most threatened by climate change globally, nine3 are in Africa. The recent floods, droughts, and locust infestations that have plagued most of the continent over the past few years reinforce the reality that climate change can completely reverse the advancements in the agriculture and food ecosystem unless urgent action is taken.

- 3. High rates of postharvest losses and limited local processing: There are high levels of food waste estimated at between 20% and 60%4, depending on the value chain. This is linked to the underdeveloped local food manufacturing and processing landscapes, high cost of transportation, fragmented distribution and retail channels, with the vast majority of food is still sold in the informal open-air markets and there are limited cold chain networks. This has led to a dependency on imported processed foods. These dynamics result in more than 50% of household income being spent on food in most African countries. The one exception is South Africa, which spends 19.1%, relative to Nigeria’s 56.6%. This is much higher than the United States at 6.4%, the United Kingdom at 8.2%, India at 29%, and Brazil at 15.6%5.

- 4. High rates of malnutrition: According to UNICEF’s State of the World’s Children 2019 report, undernutrition, micronutrient deficiencies, and overweight (obesity, in its most severe form) are the three strands of the triple burden of malnutrition. At least one in three African children is stunted, which affects not only their ability to grow to their full potential but also their brain development. Sadly, in the crucial first 1,000 days, the majority of children are not getting the nutrition they need. As a result, even though an increasing number of children and young people are surviving, far too few are thriving because of malnutrition6.

Overweight and obesity, historically believed to only affect the wealthy, are now increasingly a condition of the poor, given the greater availability of fatty and sugary foods around the world7. This is also leading to higher rates8 of noncommunicable diseases, such as diabetes and high blood pressure, among the adult population in Africa.

Despite government efforts to address micronutrient deficiencies through mandatory fortification initiatives, compliance has been relatively low. In addition, poor food choices and the limited availability, affordability, accessibility, and acceptability of nutritious food, especially for low-income and vulnerable populations, have further exacerbated the high rates of malnutrition. - 5. Significant infrastructure, talent, and financing gaps: Africa remains energy-poor, with more than 600 million households and many businesses without access to electricity. This directly increases the cost of doing business and the growth of the agriculture and food sectors. While there are many innovations and off-grid solutions that leverage renewable energy sources, the pace of adoption is slow. In addition, because of poor transportation infrastructure, most rural communities are not accessible by trucks and cars, and there are limited linkages between farms and markets. For example, in Nigeria, one of Africa’s biggest economies, only 25%9 of the rural villages are currently accessible via tarred roads.

There is also a shortage of talent for driving growth and innovation in the sector. Sahel Consulting’s Quarterly10 research reveals that most agriculture programs in African universities struggle to attract students. The curriculum is outdated, and there are limited links between theory and practice. For governments that manage extension services programs, the ratios of extension workers to farmers is as low as 1:8,00011, and these workers often do not have the latest training or technology, which, in turn, limits knowledge transfer and the effectiveness of their interventions.

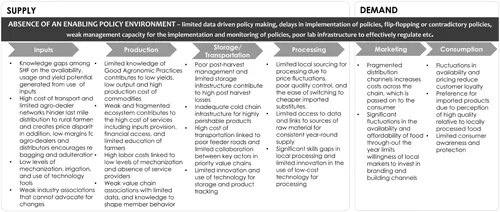

Despite recent positive initiatives to promote financing in the African agriculture and food landscapes, entrepreneurs still cite access to affordable and patient growth capital as the most significant constraint. This is especially evident in the $50,000–$250,000 funding window, which investors claim requires the same amount of due diligence and monitoring time as much larger amounts, while generating smaller returns with more higher risk exposure. - 6. Poor enabling and regulatory environment and weak enforcement of standards: Many countries still struggle with limited data-driven policymaking, delays in implementation of policies, abrupt reversals or contradictory policies, inadequate management capacity for the implementation of standards, and ineffective trade regulations. This limits the effectiveness and efficiency of entrepreneurs and frustrates investors, deterring the influx of growth capital. It also fosters unethical behavior and rising rates of food fraud12, a term used to describe substandard food sold in many markets that has been altered, misrepresented, mislabeled, and substituted.

- 7. Gender inequity: According to the UN Women13 report The Gender Gap in Agricultural Productivity in Sub-Saharan Africa: Causes, Costs and Solutions, significant gender gaps persist that directly impact productivity, livelihoods, and poverty levels in Africa. In fact, the report revealed gender productivity gaps between 11% in Ethiopia and 28% in Malawi, which are linked to a range of constraints, including limited access to fertile land, inputs such as improved seeds and fertilizer, and mechanization support. Other gender gaps exist in agriculture research and development, land ownership, agricultural extension services, access to financing, aggregation, distribution, logistics, and the production and processing of high-value crops.

Closing the gender gap in Africa will have a transformational impact not only on the most vulnerable households but also on the entire ecosystem within countries and across regions. For example, according to the estimates shared in the UN Women report, addressing the productivity gap alone in Rwanda will increase crop production by 19% and GDP by more than $419 million and lift more than 238,000 people out of poverty over ten years. - 8. Regional and global trade dynamics: Africa remains a net importer of food, spending between $45 billion and $50 billion in 2019 on imports, exporting between $35 billion and $40 billion with only $8 billion in interregional trade14. The continent is also a large exporter of cocoa, coffee, tea, sesame, and cashew to the world15. Many countries contend with straddling a focus on food crops versus cash crops, given the risks of exposure to highly volatile commodity markets and competing with other economies that offer significant subsidies to their farmers.

The pace of globalization has increased, and national economies have become ever more interconnected; however, the patterns of trade in Africa still echo the patterns that characterized African economies under colonial rule. In many instances, food producers still export “raw materials” such as unprocessed coffee and cocoa to be processed and packaged in other countries. In some cases, consumers even “buy back” products such as chocolate bars and instant coffee that were processed in different countries and then imported as manufactured goods. These processed goods often generate much higher prices than the raw material that went into making them. This usually leaves producers and consumers at either end of the supply chain unable to capture the added value that comes with processing and manufacturing.

There is also tremendous inequity in global trade and double standards with Africa. This includes different standards for food imports and exports, depending on the country of origin, with the greater burden placed on African entrepreneurs to prove themselves repeatedly, to enter Europe and the United States, and lower standards for imports into the continent.

Table of contents

- Cover

- Endorsements

- Half-Title

- Title

- Copyright

- Dedication

- Contents

- List of Illustrations

- About the Author

- Foreword

- Acknowledgments

- Introduction

- 1 Overview of the Food and Agriculture Landscape in Africa

- 2 Developing a Compelling and Sustainable Business Model

- 3 Talent for Scaling

- 4 Leveraging Technology and Innovation to Scale Your Business

- 5 Building Your Brand and Amplifying Your Impact

- 6 Financing Your Growth

- 7 Shaping Your Ecosystem

- 8 Building Resilience – Adapting to Climate Change, Mitigating Risks, and Shocks

- Conclusion

- Index