Structured Finance

Leveraged Buyouts, Project Finance, Asset Finance and Securitization

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Structured Finance

Leveraged Buyouts, Project Finance, Asset Finance and Securitization

About This Book

Comprehensive coverage of all major structured finance transactions

Structured Finance is a comprehensive introduction to non-recourse financing techniques and asset-based lending. It provides a detailed overview of leveraged buyouts, project finance, asset finance and securitisation.

Through thirteen case studies and more than 500 examples of companies, the book offers an in-depth analysis of the topic. It also provides a historical perspective of these structures, revealing how and why they were initially created. Instruments within each type of transaction are examined in detail, including Credit Default Swaps and Credit Linked Notes. A presentation of the Basel Accords offers the necessary background to understand the regulatory context in which these financings operate.

With this book, readers will be able to:

- Delve into the main structured finance techniques to understand their components, mechanisms and how they compare

- Understand how structured finance came to be, and why it continues to be successful in the modern markets

- Learn the characteristics of financial instruments found in various structured transactions

- Explore the global context of structured finance, including the regulatory framework under which it operates

Structured Finance provides foundational knowledge and global perspective to facilitate a comprehensive understanding of this critical aspect of modern finance. It is a must-read for undergraduate and MBA students and finance professionals alike.

Frequently asked questions

PART I

Leveraged Buyout (LBO)

CHAPTER 1

What is an LBO?

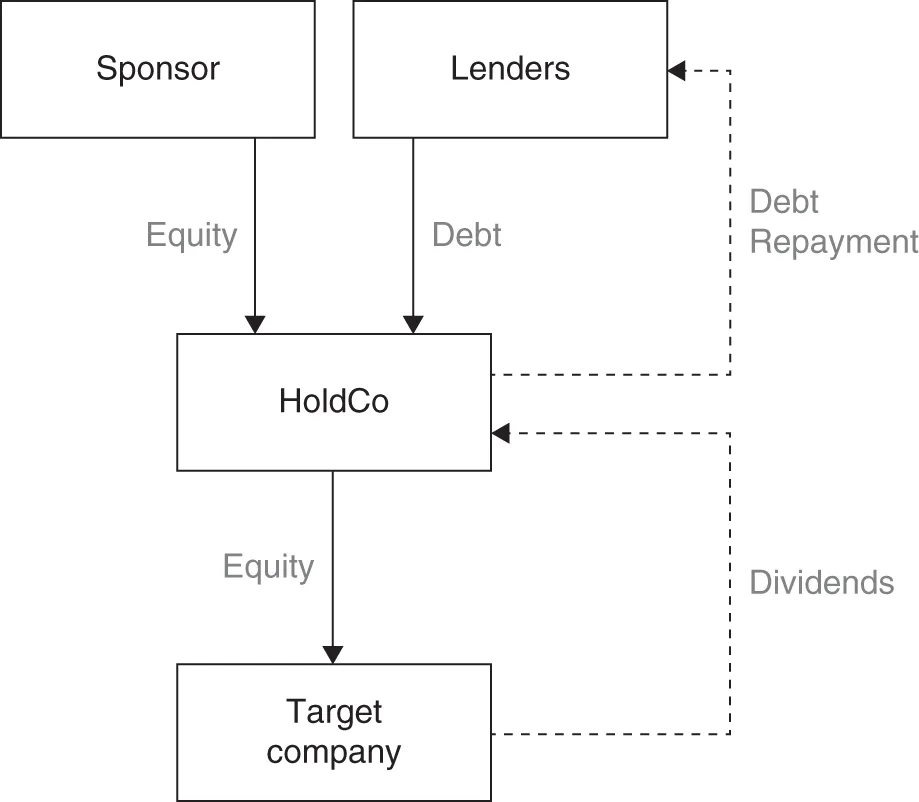

1.1 THE MAIN FEATURES OF AN LBO

1.1.1 Definition

1.1.2 Debt Sizing

- For the acquisition of very small companies (turnover of a few million US$ or below), the total debt amount is usually expressed as a multiple of net profit.

- For larger acquisitions, the acceptable level of debt is expressed as a multiple of EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization). EBITDA equals revenues minus operating costs. It is a measure of the operating profitability of a company regardless of its financial strategy, its tax position, or its investment policy. It is a very good indicator of the potential of a particular company and a pertinent reference to use when it comes to debt sizing in an LBO.

1.1.3 Various Types of LBOs

- An MBO (management buyout) is an LBO in which the management of the target company takes part in the buyout, alone or alongside another sponsor. MBOs are a very common form of LBO. They usually happen when:

- the owner of a small or medium‐sized enterprise (SME) retires and decides to sell his or her company to the managers who have worked with them for some time (typically their children or right‐hand man);

- a company is acquired by an LBO firm1 that wants to retain existing managers. Many LBO firms can offer attractive packages in terms of stocks to key people in the target company. This is a way of aligning the managers' interests with their own interests. These key people are directly incentivized to help grow the company and ensure a successful LBO.

- An MBI (management buy‐in) is an LBO in which the buyers did not work for the target company before the acquisition, but act as managers after the acquisition. MBIs are common when the founder of an SME retires and cannot find a new buyer among his or her employees. In this case, the company is put on the market and acquired by a buyer with no previous connection to the company. An MBI can be carried out by a manager alone, by a group of managers, or by one or several managers co‐investing with an LBO firm.

- A BIMBO (buy‐in management buyout) is a mix of the two previous approaches. It is a buyout in which existing managers and managers from outside the target company collaborate to buy out the target company. Here again, the buyout can be carried out by these managers alone or alongside an LBO firm. A BIMBO generally makes sense if the new managers bring expertise that the existing ones do not have but that is ...

Table of contents

- Cover

- Table of Contents

- Title Page

- Copyright

- Dedication

- Preface

- Introduction

- PART I: Leveraged Buyout (LBO)

- PART II: Project Finance

- PART III: Asset Finance

- PART IV: Securitization

- Conclusion

- APPENDIX A: APPENDIX AHow Banks Set Interest Rates

- APPENDIX B: APPENDIX BSyndication and Club Deals

- APPENDIX C: APPENDIX CCredit Derivatives

- Bibliography

- Acknowledgments

- Index

- End User License Agreement