- 322 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Company Law

About this book

Company Law is essential reading for business and law students, and for those studying for professional exams. The theoretical concepts are explored and developed with the use of a variety of case examples to place the learning in context. Comprehensive pedagogy with objectives, review questions, summaries, discussion questions and a case study exercise to consolidate the learning in each chapter. The accessible and concise treatment of the issues explored makes the learning easy to follow and more pertinent to the student needs, particularly for those who are studying a one-semester course.

Easy to read,with a user friendly layout, Company Law, with the use of case studies and review questions leads the reader through the various stages involved with creating and managing a private company through to dissolution.

Building on the learning covered in the companion textbook Business Law, this text is a user friendly and comprehensive introduction to all aspects of company law.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Appendix 1

The modernization of company law

In March 1998 the Department of Trade and Industry (DTI) published a consultation paper, Modern Company Law for a Competitive Economy, that introduced the Government's intention to review and modernize company law. In its foreword the then Secretary of State wrote:

Company law lies at the heart of our economy ... Our current framework ... is essentially constructed on foundations which were put in place by Victorians in the middle of the last century. There have been numerous additions, amendments and consolidations since then, but they have created a patchwork of regulations that is immensely complex and seriously out of date. The resulting costs and problems may not be obvious to all, but they are real and substantial nevertheless ... Modern companies are one of the three key pillars of our approach to competitiveness, and we are determined to ensure that we have a framework of company law which is up-to-date, competitive and designed for the next century, a framework which facilitates enterprise and promotes transparency and fair dealing.

(Margaret Beckett)

The above encapsulates the motivation and direction of current government thinking and action.

Starting with a recognition that company law evolved from Victorian times to become a 'patchwork of regulations that is immensely complex and seriously out of date', successive piecemeal reforms have, in the DTI's opinion, made law 'difficult for business people to understand, especially those in small and medium sized enteiprises, and its rules are inclined to be too detailed and too regulatory'. The fear is that over-burdensome legislation that is prone to be obscure could seriously hamper Britain's ability to compete in an increasingly global marketplace:

In a number of areas the present arrangements are holding back rather than facilitating competitiveness, growth and investment.

For these reasons the Government is committed to act.

The overall objective is the streamlining and simplification of company law. While the consultation paper flags up the problem it is sparse in substance. This, presumably, is to be expected in a consultation paper that is basically a declaration of intent. What it has done, however, is to identify a number of concerns and most probably these will be the areas of existing law that will be the most radically changed. These areas are:

- a) InappropriatenessCurrent legislation is at fault in two broad areas:

- i) Over-formal language, which is not user friendly. For example Table A, which is widely used as a specimen set of articles, is written in technical, legalistic language and would be of more practical use if it was rewritten in plain English.

- ii) Excessive detail, which makes for complexity. For example the distinction between special and extraordinary resolutions at general meetings.

- b) Over-regulationThis causes difficulties. The paper refers, as an example, to capital maintenance rules. While it is right for the Companies Act to attempt to reduce the risk of insolvency, the provisions are too detailed, too expensive, and lead to inflexibility in the use of capital. By dispensing with the requirement for shares to have a nominal value (par value) simple statements of share capital in a company's accounts ought to be possible.

- c) Complex structureThe Companies Act does not in its entirety apply to all companies. Some parts, such as disclosure of who owns shares, apply only to public companies; while other parts, such as dealings by directors, apply differently to public and private companies. Therefore, future legislation ought to differentiate more markedly between public and private as well as between large and small companies. The review that will be carried out will examine the feasibility of having separate regulations for different types of companies. If the premise is correct that the existing law is over-complex then simplification should reduce the costs of compliance and make it easier for small companies and their directors to know their responsibilities.

- d) Efficiency gainsThose parts of company law that fail to achieve their purpose need to be looked at either to make them more effective, or, if this is unnecessary or impossible, to repeal them. For example, part of the bureaucracy of administering company law is accepted as being inefficient in that Companies House allows material to be filed only in a paper-based format. This ignores the much heralded revolution in information technology. Therefore, it is felt by the DTI that Companies House should allow electronic filing. Also, at AGMs shareholders ought to be able to vote directly electronically without their having to attend or use a proxy.

- e) Corporate governanceWhile acknowledging that self-regulation, in the form of codes, was preferable to specific legislation, three possible exceptions were identified where 'legal underpinning' may be needed. These are:

- i) Director duties to be broadened. At present, while theoretically a director's fiduciary duties are owed to the company as a whole, in practice this is interpreted narrowly as equating with majority shareholder interests. This sectional view does not sit well with Labour's belief in a stockholder economy where a company must account not just to major shareholders but to other interested parties as well e.g. employers, creditors and the community.

- ii) The conduct of AGMs may have to be amended in order to make it easier for shareholders to table resolutions, and if they do not hold shares in their own name, to attend and to vote.

- iii) Shareholders may need to have a legal right to vote separately on directors' pay and not the present system of having to vote en bloc on a whole package that includes directors' pay.

Review timetable

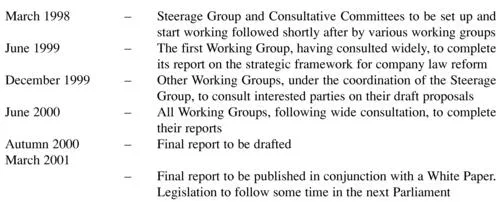

On publication of the Consultative Paper in March 1998 the DTI outlined a broad timetable that it was determined to adhere to. This was:

The Steerage Group is charged with the task of overseeing the management of the Review and 'ensuring that its outcome is clear in concept, internally coherent, well articulated and expressed, and workable'. For reasons of efficiency the Steerage Group will be small, comprising: lawyers, representatives of business (large and small), the Chairs of Working Groups, the Project Director and a Scottish representative.

The Consultative Committee will be widely based with the members drawn from the Steerage Group, the professions and business, e.g. the Law Society, CBI, TUC, the accountancy bodies and other Government departments.

The Working Groups will do most of the detailed work but to ensure that they do so within a common framework a first Working Group will concentrate on an overall strategic framework. This legal framework will cover the requirements for the birth, existence and death of companies:

... it will identify the fundamental rules governing the procedures for incorporation, the basic constitutional structure, and cessation of existence. It will examine the rights and responsibilities of the entity and its participants and identify in which areas there should be mandatory rules to protect the interests of shareholders, creditors, employees and other participants.

As the new Companies Act must be 'user-friendly' the first Working Group will look at the structure and style of the new legislation to see that it is as accessible as possible to non-specialists.

The procedure to be adopted is that the work of the first Working Group will be published for wide consultation. Other Working Groups, set up by the Steerage Group, will consider detailed aspects identified in the strategic framework as needing in-depth examination. Drawing on a wide range of legal and business expertise the work of each Working Group will be published for full consultation with a final report drawing together the work of all the Working Groups.

Company Law Steerage Group Report

In February 1999 the Steerage Group published its consultation report. Three themes may be identified as follows.

Stakeholders

Stakeholders (employees, customers, creditors, the local community, as well as shareholders) had to be recognized and included into company thinking. The report provided comments on two stakeholder approaches. Firstly, the enlightened approach is where progress may be made subject to current company law being amended so that, for instance, more corporate information will be made available to the public. Secondly, a pluralist approach is more pro-active in that directors will be either encouraged or compelled to balance shareholder interests against those of other stakeholders.

Small companies

Company law grew out of the need to support large commercial concerns, and thus much in the Companies Act is inappropriate to small company ventures. Therefore, the report advocates making the law simpler to understand, e.g. company formation and ho...

Table of contents

- Cover

- Title

- Copyright

- Contents

- Introductory comments

- Table of Cases

- Table of Statutes

- Table of Regulations, Rules, Orders and Directives

- Birth of a Company

- The Company Constitution

- Obtaining and Controlling Capital

- Companies’ Securities

- Company Management

- Shareholder and Creditor Protection

- Companies in Trouble

- Appendix 1 The modernization of company law

- Appendix 2 Statistics of director disqualification

- Appendix 3 Statistics of company insolvencies

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Company Law by Douglas Smith in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.