![]()

Chapter 1

HIDDEN FORCES

“There should exist among the citizens neither extreme poverty nor

excessive wealth, for both are productive of great evil.”

–PLATO

_____

The title of this book is Redefining Financial Literacy, which is critical to our understanding of the knowledge and skills we need to effectively plan and manage money. Financial literacy has traditionally been defined in terms of our “ability to understand and effectively apply various financial skills, including personal financial management, budgeting, and investing.”1 This rather simple definition needs to be broadened to include historical, social, political, and economic forces that directly impact our financial planning. What is urgently needed today is the kind of financial literacy that transforms our mindset from passive spectators to active participants.

The question to ask, of course, is what are these hidden forces and why is it important that we should be aware of them? Let’s examine for a minute the paycheck you get every month. Who dictates how much you are paid? Is it simply your employer? How much FICA tax is deducted from your paycheck? Where do your tax dollars go? Why do women often make less than men for the same work? The answer to these, and other, questions involves a basic understanding of history, politics, and economics. I’m not suggesting you need a degree in history or economics; rather, the more knowledge you have about these intersecting and overlapping forces, the better questions you will raise about your financial future, which can improve how you plan for your retirement. The more you compare, contrast, and understand parallels in certain historical events, the more you will realize just how important they are to the decisions you make today.

If we look at the hidden economic forces that impact how much you earn, we find that unemployment levels, globalization, industry conditions, and cost of living all contribute to your salary. As an example, during periods of high unemployment, companies are reluctant to hire new employees and may even ask existing employees to work longer hours. In this scenario, given the abundance of workers, wages become stagnant. Globalization enables many corporations to ship high-paying jobs overseas, therefore impacting wages of domestic workers.2 Let’s suppose you have a 401(k) plan, which invests in the 60/40 portfolio. In other words, your retirement allocation is invested 60% in stocks and 40% in bonds. What happens if this strategy is potentially broken? As you keep reading, you will learn about the economic forces that are changing the investment landscape.

These hidden forces are not merely abstract concepts; in fact, they have a direct impact on your financial future. For example, the Social Security system that our parents and grandparents enjoyed may become insolvent if Congress fails to enact reforms. The pensions that past generations have relied upon to carry them through retirement are becoming extinct. Consider this: “The practice of companies sending monthly retirement checks to their former workers is headed for extinction, and remaining pension funds are in tough financial shape.”3 Again, there are hidden forces that seem to be out of our control, but there is something you could do about them. If you broaden your understanding of the hidden forces that could affect your financial future, you could be in a position to better prepare and plan for your retirement. One of the hidden forces I’ve mentioned above is history. You might remember taking history classes in high school and saying to yourself, “Who needs history?”

What you must realize is that a meaningful understanding of the financial world must include its history. You see, history is not just some abstract and pedantic study that is removed from our lives. It encroaches on us in ways that are instructive in how we plan our future. As the saying goes, “Those who cannot learn from history are doomed to repeat it.” This, as recent history has shown us, is precisely what has happened over the past century.4 Although history tends to repeat itself, we don’t have to acquiesce to the inevitable; we can use the knowledge of past events to shape our own future. This is especially true for women, who now hold more than half of the personal wealth in the United States.5 It is precisely because we have the freedom to choose that history need not repeat itself. How we exercise our right to choose will depend on our capacity to think critically about the decisions and choices that come before us.

THE GILDED AGE

The Gilded Age in America, the period between 1876 and World War I, was characterized as a time seemingly covered with glitter on the surface but corrupt underneath. It was a time of “greed and guile: of rapacious Robber Barons, unscrupulous spectators, and corporate buccaneers, of shady business practices, scandal-plagued politics, and vulgar display.”6 By 1890 more than 70% of America’s wealth was concentrated and controlled by the top 10% of the population. Although it is tempting to believe that our world is far more egalitarian today, in 2016 the top 10% of families controlled 76% of the total wealth.7 Despite the fact that we are 150 years removed from the original Gilded Age, the economic reality today is just as bifurcated and iniquitous as it has ever been. The American Dream continues to elude the vast majority of Americans, and generational wealth favors a small percentage of the population.

The Gilded Age coincided with the Industrial Revolution, in which factory work replaced farming as the leading source of employment, the railroad introduced a national transportation system, and the corporation revolutionized capitalism. The Gilded Age witnessed a period of unprecedented technological breakthroughs, including the telephone, the phonograph, the radio, the electric light bulb, the automobile, and countless other innovations. This was the beginning of the consumer economy, where technology and culture converged to create popular culture. For example, by the turn of the 20th century, the rise of the mass-circulation newspaper and the monetization of leisure, including sports and entertainment, fundamentally changed how we lived. As a consequence of this dramatic change over a very short period of time, an economic chasm opened between the privileged few and everyone else.

Those who accumulated vast amounts of wealth became known as robber barons. These robber barons created a closed loop, in which wealth, greed, and corruption shaped and defined the political and economic reality of their time. These captains of industry succeeded by paying workers low wages, exploiting children and immigrants, and avoiding government regulations. Men such as John D. Rockefeller, Andrew Carnegie, and J. P. Morgan amassed sufficient wealth to both control and manipulate the economy.

Andrew Carnegie, for example, made his fortune in the steel industry. He “engaged in tactics that were not in the best interests of his workers”;8 in 1892, in response to Carnegie’s attempts to lower wages, his workers went on strike. The Homestead steel strike, also known as the Homestead massacre, ended in violence and numerous deaths. Treating workers with disdain and contempt was the result of a lack of government regulations, as well as monopolistic practices. John D. Rockefeller, who owned Standard Oil, controlled 90% of the oil infrastructure in the United States. In the area of banking and finance, J. P. Morgan “invested in Thomas Edison and the Edison Electricity Company, helped to create General Electric and International Harvester, formed J. P. Morgan & Company, and gained control of half of the country’s railroad mileage.”9 The amount of power these men wielded, particularly in politics, was extraordinary.

The politics of the Gilded Age involved widespread corruption, where power was concentrated in the hands of a few men who used their money and influence to secure political favors. “Congress was known for being rowdy and inefficient. It was not unusual to find that a quorum could not be achieved because too many members were drunk or otherwise preoccupied with extra-governmental affairs.”10 Congress was filled with men who operated in smoke-filled back rooms and catered to the privileged few who made sure their empires continued to dominate the corporate world.

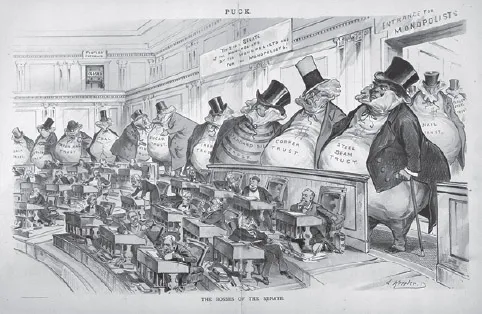

The Bosses of the Senate by Joseph Keppler10

Every president from 1876 to 1900 was elected for a single term. This helped establish a system where presidents rewarded those who helped elect them through backroom deals. The most glaring example of this was the 1876 election, which was hotly disputed. The Democratic candidate, Samuel J. Tilden of New York, won the popular vote; however, the electoral votes of three southern states were disputed. This dispute would last four months, during which both the Republicans and Democrats contested the outcome. In January 1877 Congress established a 15-member Electoral Commission to decide who would be president. The commission voted along party lines and awarded the presidency to Rutherford B. Hayes.

This election would set the stage for a series of weak presidents elected into office. Once elected, these one-term presidents spent their time repaying the political favors to those individuals who helped them narrowly win the White House. The patronage system gave presidents wide latitude to appoint friends and supporters to high political posts. This form of corruption occurred across both political parties and at every level of government. Part of the reason the patronage system took hold was that presidents during the Gilded Age had very little power of their own. There was no popular mandate for them to rule or carry out substantive policies. To exacerbate matters, Congress was controlled by corporations that dictated policies favoring their own selfish ends. The end result of the patronage system was that little was accomplished on the federal level, save for the legislation that both protected and encouraged corporate monopolies. In other words, there was no real impetus for change or protections for workers who toiled in sweatshops. The Gilded Age created one of the most bifurcated economies in American history, which exposed some of the flaws of unchecked capitalism. Historian Nell Painter described this corrupt period by arguing that “capitalism makes some people really rich, and democracy is not strong enough to counter the power of great wealth.”11 Although an intervening Progressive Era helped bring about reform, the oceanic problem of bifurcated inequality is far more pervasive today than ever before.

THE NEW DEAL AND FORDISM

The free-market capitalism that marked the Gilded Age benefited a small elite group who manipulated the political system in order to perpetuate their economic dominance. The government failed to intervene when greed and excess, which came at the expense of the vast majority of Americans, was out of control. These hidden forces would continue to dominate the economic landscape well into the 1920s. Let’s look at the rampant greed that defined the 1920s. Greed captured the imagination of both the banks and the individual investor. Banks engaged in speculative investing by lending money to people who wanted to buy stocks. At the time there were no regulations, which led to a market bubble. By 1929 the stock market crashed under the weight of its own irrational exuberance. On October 28, 1929, which is remembered today as Black Monday, the Dow Jones Industrial Average plunged nearly 13 percent. On the following day, Black Tuesday, the market fell an additional 12 percent.12

President Herbert Hoover advocated for laissez-faire economics, which is the idea, first developed by the philosopher and economist Adam Smith, that governments should take a hands-off approach to the market. Hoover believed “that economic assistance would make people stop working. He believed business prosperity would trickle down to the average person.”13 This noninterventionist belief in economic affairs would lead to the greatest economic disaster in American history as well as Hoover’s defeat in 1932. By the time Franklin Roosevelt took office on March 4, 1933, “unemployment had risen from 3% to 25% of the nation’s workforce. Wages for those who still had jobs fell. U.S. gross domestic product was cut in half, from $103 billion to $55 billion, due partly to deflation.”14 By his first 100 days in office, Roosevelt had introduced numerous government programs called the New Deal.

One of the first things Roosevelt did upon taking office was to appoint Frances Perkins to be his Secretary of Labor. Perkins would become the first woman appointed to the US Cabinet, the longest-serving Secretary of Labor (1933–1945), and the architect behind Roosevelt’s New Deal programs. She was responsible for either introducing or implementing such programs as the Civilian Conservation Corps, the National Industrial Recovery Act, Public Works Administration programs, the Social Security Act, the Fair Labor Standards Act, pensions, unemployment compensation, a minimum wage, the 40-hour work week, and countless other programs.15 In addition to the New Deal programs, Roosevelt wanted to address the fundamental causes of the financial collapse.

Let’s remember that before the stock market crash of 1929, retail banks used depositors’ funds for the purpose of investing in initial stock sales, otherwise known as initial public offerings. Many banks facilitated risky mergers and acquisitions and operated their own hedge funds without any governmental oversight. In response to the near collapse of the banking system, Congress passed the Glass-Steagall Act in 1933, which removed and separated investment banks from retail banks. The Glass-Steagall Act “restored confidence in the U.S. banking system. It increased trust by only allowing banks to use depositors’ funds in safe investments. Its FDIC [Federal Deposit Insurance Corporation] insurance program prevented further bank runs. Depositors knew the government protected them from a failing bank.”16 Over the next several decades the banking industry fought to repeal what they believed to be excessive government regulations.

Following World War II, a new form of economic growth helped give rise to the postwar boom and, by extension, a strong viable middle class. This mode of growth became known as Fordism. It offered mass consumption, sufficient wages to support families, job stability, and rising incomes. From the late 1940s to the early 1970s, “Fordism extended well beyond the factory walls; it reshaped the spatial and demographic configuration of cities; it ignited bouts of economic development, industrial concentration, and social conflict.”17 Fordism was a broadly defined system of standardized production in which workers were offered a decent wage to afford the very goods they produced. In many ways Fordism gave rise to the American middle class, which, in turn, helped spread the American Dream. The end of Fordism marked the beginning of a new economic philosophy that favored free markets and little to no government intervention. Neoliberalism, as you will see, would prove to be disastrous.

NEOLIBERALISM AND MILTON FRIEDMAN

By the early 1970s a new economic philosophy was s...