eBook - ePub

Rescuing Retirement

A Plan to Guarantee Retirement Security for All Americans

- 186 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Rescuing Retirement

A Plan to Guarantee Retirement Security for All Americans

About this book

Retirement shouldn't be just for the rich: "Finally, a practical plan to address Americans' lack of adequate retirement savings."—Michael Bloomberg

Everyone deserves to be able to retire with dignity, but this core feature of the social contract is in jeopardy. Companies have swerved away from pensions, and most of the workforce has woefully inadequate retirement savings. If we don't act to fix this broken system, rates of impoverishment for senior citizens threaten to skyrocket, and tens of millions of Americans reaching retirement age in the coming decades will be forced to delay retirement and will experience a dramatic drop in their standard of living.

In Rescuing Retirement, economist Teresa Ghilarducci and billionaire businessman Tony James offer a comprehensive yet simple plan to help workers save for retirement, increase retirement savings by earning higher returns, and guarantee lifelong income for everyone. Built on people's own money in individual Guaranteed Retirement Accounts, the plan requires no new taxes, no more bureaucracy, and no increase in the deficit. Speaking to Americans' growing anxiety about their ability to retire, Rescuing Retirement provides answers to anyone wanting to understand the growing movement to protect a period of life once considered a deserved time of rest and creativity and offers a practical guide to the future of secure retirement.

"Ghilarducci and James never slip into wonk-speak or jargon, and lay readers will appreciate the way the authors make sense of complex economic issues."— Publishers Weekly

Everyone deserves to be able to retire with dignity, but this core feature of the social contract is in jeopardy. Companies have swerved away from pensions, and most of the workforce has woefully inadequate retirement savings. If we don't act to fix this broken system, rates of impoverishment for senior citizens threaten to skyrocket, and tens of millions of Americans reaching retirement age in the coming decades will be forced to delay retirement and will experience a dramatic drop in their standard of living.

In Rescuing Retirement, economist Teresa Ghilarducci and billionaire businessman Tony James offer a comprehensive yet simple plan to help workers save for retirement, increase retirement savings by earning higher returns, and guarantee lifelong income for everyone. Built on people's own money in individual Guaranteed Retirement Accounts, the plan requires no new taxes, no more bureaucracy, and no increase in the deficit. Speaking to Americans' growing anxiety about their ability to retire, Rescuing Retirement provides answers to anyone wanting to understand the growing movement to protect a period of life once considered a deserved time of rest and creativity and offers a practical guide to the future of secure retirement.

"Ghilarducci and James never slip into wonk-speak or jargon, and lay readers will appreciate the way the authors make sense of complex economic issues."— Publishers Weekly

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1

SOCIETY’S RETIREMENT CRISIS

“My retirement plan,” Robert Hiltonsmith told PBS’s Frontline, “is ‘fingers crossed and pray,’ basically. Yeah, win the lottery…. The truth is, [I’m] just going to have to find a way to save way more than you should have to.”1

An economist in his mid-thirties, Robert’s plight captures much of what is wrong with the U.S. retirement system. Given his promising career and relative youth, he should have all the tools he needs to plan for a comfortable retirement. But his outlook could not be more pessimistic—or revealing.

A Society of Actuaries survey showed that a majority of Americans believe retirement benefits should provide a guaranteed amount monthly during retirement no matter how long they live.2 But today, our retirement system is so hopelessly broken—and so deeply confusing—that even Americans with well-paying, full-time jobs their entire adult lives are hard-pressed to guarantee a comfortable and secure future.

Tens of millions of lower-income workers face an even more daunting challenge. Without significant savings, they must try to continue working to the end of their lives, knowing that a single health crisis, accident, or layoff could spiral them into poverty.

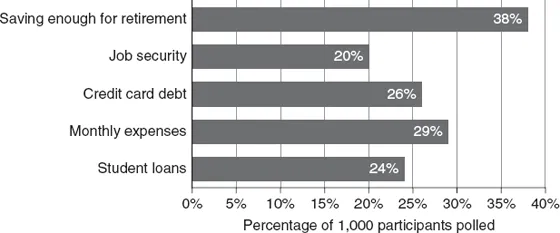

Retirement is a significant source of stress in people’s lives (figure 1.1).

Figure 1.1 Young workers say they’re worried about retirement. (Answers to the question “What is a ‘significant source of stress’ in your life?”).

Source: Schwab Retirement Plan Services, Inc. (August 2016) 401(k) Participant Survey.

Our nation stands at a watershed moment. More Americans than ever are approaching retirement with inadequate savings. Their numbers are poised to grow dramatically in coming years because we are both saving less and living longer. Further aggravating this problem is that too many people—56 percent of men and 64 percent of women—unwisely claim Social Security before full retirement age.3

Since 1980, the number of Americans making it into their nineties has tripled. Today’s retirees will need their savings to last longer than ever.4 As life expectancies rise, the prevailing retirement income plans—mostly 401(k)s and Individual Retirement Accounts (IRAs)—are proving less and less adequate. Our patchwork system leaves too many people with paltry savings and anemic investment returns.

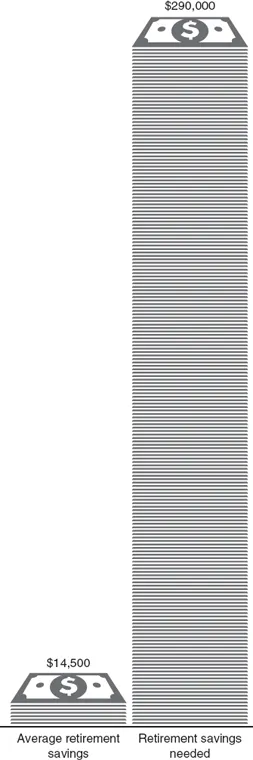

The U.S. experiment with 401(k)s and IRAs, launched in the 1980s, has failed miserably to deliver on its promises. Predatory fees, low returns, leakages, lump-sum payouts—all have served to discourage or inhibit workers from accumulating enough for retirement. Here is the hard reality: more than half of working people nearing retirement today won’t have enough to maintain their standard of living.5 Among Americans between forty and fifty-five, the median retirement account balance is $14,5006—less than 4 percent of the $375,000 the median-income worker will need in savings.7

For the next generations of retirees—including today’s young people—the challenges will be greater still. For the past forty years, America’s median household income has stagnated; ditto for entry-level wages. In real terms, our minimum wage has regressed to where it was in the 1940s, a time when most workers were eligible for true pensions.

Meanwhile, health care costs are rising two to three times faster than income; rent and child care expenses are escalating; and outstanding student loan debt has tripled over the last decade to more than $1 trillion. When we compare the last half-century to the next fifty years, productivity and economic growth rates are projected to drop by half. Meanwhile, ultra-low-interest rates are depressing returns on any savings we somehow manage to put aside.

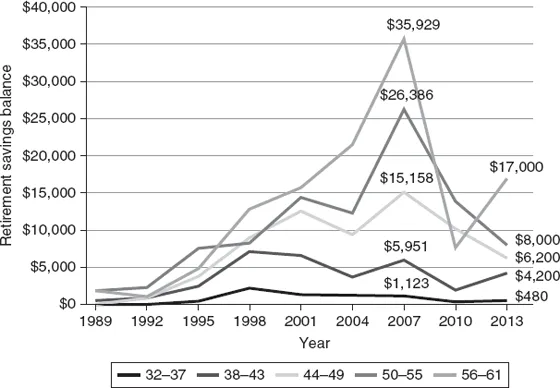

When it comes to retirement savings, across all age groups, the United States is acutely behind where it needs to be (figure 1.2).

Figure 1.2 Median retirement account savings of families by age, 1989–2013 (2013 dollars).

Given this stark reality, it is little wonder that a 2015 survey found that 86 percent of Americans believe “the nation faces a retirement crisis.”8

Based on current trends, we will soon be facing rates of elder poverty unseen since the Great Depression. Of the 18 million workers between ages fifty-five and sixty-four in 2012, 4.3 million were projected to be poor or near-poor when they turn sixty-five,9 including 2.6 million who were part of the middle class before reaching retirement age.

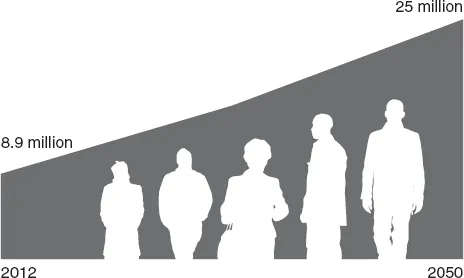

Today, 15 million elderly people spend less than twelve dollars per day for food. By 2035, nearly 20 million retirees will be living in poverty or near-poverty. By 2050, that number will reach 25 million (figure 1.3).

Figure 1.3

Source: T. Ghilarducci and Z. Knauss. (2015) “More Middle Class Workers Will Be Poor Retirees.” Schwartz Center for Economic Policy Analysis and Department of Economics. The New School for Social Research. Policy Note Series.

As the U.S. population continues to simultaneously grow and gray, and traditional pensions become relics of the past, elderly people living in deprivation will become a progressively greater share of the population. This wave of older poor Americans will strain our social safety net programs, from the Supplemental Nutrition Assistance Program (SNAP) to Medicaid. It will devastate federal, state, and local budgets. Left unaddressed, poverty among the elderly could drive up federal income tax rates by ten percentage points. The expenses of poor or near-poor older Americans will inevitably be passed on to other citizens, from higher Medicaid entitlements (for nursing homes and assisted living costs) to the taxpayer burden from a spike in homelessness.

It may be tempting to fault the savers for this sad state of affairs, but it is wrong to blame the victim. Here is the hard truth: existing tools make it impossible for most people to afford to save enough for retirement, and employers are not bridging the gap. People could try to delay retiring, but for various reasons that isn’t always the worker’s choice to make. Even those with significant savings to invest commonly see subpar returns, due in large part to lack of financial literacy and an industry short on reliable advice. Financial advisors, whose fees to their clients cost savers an estimated $17 billion per year, often guide them into trouble.10

It is not individual workers who are to blame for our retirement crisis. Nor is it their employers. It is the fault of a haphazard, ramshackle system.

We cannot educate people out of this crisis. Given the reality on the ground, the most sophisticated among us would be hard-pressed to master the complex machinery of “personal finance.” Yet instead of focusing on reforms to fix our train wreck of a retirement system, our policy makers are distracted by campaigns for partial stop-gap measures. As lawmakers grapple with payday loans and usurious credit card interest rates, retirement security goes by the boards. The World Economic Forum (WEF) estimates that the United States had a $28 trillion retirement savings gap in 2015—the largest in the world. By 2050, they project this will grow to $137 trillion. This is almost a $3 trillion annual increase—five times the annual U.S. defense budget.11

A SIMPLIFIED APPROACH TO PROVIDING RETIREMENT SECURITY

1. Every worker owns a portable retirement saving account. However long they work before retirement, employees maintain total control over a government guaranteed account. It is funded by a minimum 3 percent of the employee’s salary—half contributed by the worker, half by the employer. A tax credit fully subsidizes the employee’s share for all those earning under the median income and defrays the cost for everyone else. (We talk more about this later.)

2. Savings are pooled and invested to achieve higher returns. Workers select a GRA pension manager who invests in relatively high-return, well-diversified strategies. People can change managers annually. Pension managers have a fiduciary duty to GRA holders and provide a layer of protection between them and Wall Street.

3. Upon retirement, the account is annuitized to provide consistent, government guaranteed income until death.

In sum, our country is facing an across-the-board retirement savings gap (Figure 1.4). Americans of almost all ages and income levels face nearly insurmountable obstacles to building a strong retirement foundation. One way or another, this crisis will affect us all in the years to come.

Figure 1.4

Sources: Center for American Progress (2015) “The Reality of the Retirement Crisis.” Aon Hewitt (2012) “Retirement Income Adequacy at Large Companies: The Real Deal.”

A BETTER WAY FORWARD

There’s a better way forward for our country. It is a journey we can start today, drawing on straightforward, proven ideas.

It’s a way to ensure every full-time worker can save enough to guarantee his or her standard of living in retirement.

A way to save for retirement with a tool that delivers a higher and safer rate of return than the typical 401(k) or IRA.

A way to address a national crisis without adding a dime to the deficit or creating any new government infrastructure.

In this book, we have designed a retirement system that meets all of these specifications and delivers a retirement plan to 85 million Americans that don’t have one today. And our solution is simpler than you might think. It is called a Guaranteed Retirement Account, or GRA.

What the GRA Is

Pragmatism, Not Politics

The GRA is a pragmatic way t...

Table of contents

- Cover

- Title Page

- Copyright

- Dedication

- Epigraph

- Contents

- Foreword

- Acknowledgments

- 1. Society’s Retirement Crisis

- 2. How We Got Here: America’s Broken Retirement System

- 3. Six Key Problems: The Consequences of a Broken Retirement System

- 4. Rescuing Retirement: A Four-Pronged Solution

- 5. Case Studies: Similar Plans in Action

- 6. Why Not Just Expand Social Security?: Americans Need a Universal Pension System

- 7. Growing Support from the American People and a Mandate for Congress

- 8. The Employer’s Stake in Retirement Reform

- 9. Conclusion

- Questions and Answers on the Guaranteed Retirement Account

- Appendix A: The Cost of a Principal Protection Guarantee

- Appendix B: GRAs Versus Other Policy Solutions

- Appendix C: Looking at Retirement Coverage Across the Country

- Notes

- Bibliography

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Rescuing Retirement by Teresa Ghilarducci,Tony James in PDF and/or ePUB format, as well as other popular books in Politics & International Relations & Labour Economics. We have over one million books available in our catalogue for you to explore.