This is a test

- 68 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Book details

Book preview

Table of contents

Citations

About This Book

Disaster events impact Asia and the Pacific more than any other region in the world. In light of current and future climate and disaster risks, there is an urgent need to address the region's underinvestment in disaster risk and reduction. This publication aims to guide policy makers and other stakeholders on how to scale up disaster risk reduction financing in developing member countries of the Asian Development Bank. It provides an overview of financing opportunities—including instruments and mechanisms—as well as country case studies and practical tips for governments to implement enhanced disaster risk reduction.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Financing Disaster Risk Reduction in Asia and the Pacific by in PDF and/or ePUB format, as well as other popular books in Ciencias sociales & Estudios de desarrollo global. We have over one million books available in our catalogue for you to explore.

Information

Topic

Ciencias socialesSubtopic

Estudios de desarrollo global1 Introduction

Setting the Scene

When it comes to disaster events, Asia and the Pacific suffers more than half of all people affected and a staggering 70% of the deaths and missing people worldwide.1 It also experienced the largest economic losses at 43% of the global total between 2005 and 2017, which was more than its global share in gross domestic product (GDP). While the region’s higher-income countries have the largest absolute economic impacts from disasters, it is low- and middle-income countries that have to deal with higher relative levels of risks and large economic impacts on their comparatively small GDPs.2

Statistics indicate a growth in estimated annual losses from disasters that is outpacing GDP growth in Asia and the Pacific—meaning that disaster losses are a serious threat to the development goals of the region.3 This includes immediate direct losses from disasters, but also, for instance, indirect losses on supply chains, wider impacts on the tourism sector, and macroeconomic repercussions on fiscal stability. Indeed, developing economies in Asia and the Pacific will need to invest around $1.7 trillion each year between 2016 and 2030 to sustain their economic growth, eradicate remaining poverty, and respond to climate mitigation and adaptation needs.4 Urgent action is, therefore, required in reducing disaster risks through comprehensive, cross-sector strategies and investments.

The most recent international agendas recognize the importance of disaster risk reduction toward this end (Appendix 1). In particular, the Sendai Framework (2015) encourages public and private sector actors, as well as civil society to avoid decisions that would create (additional) risk, develop risk-reducing actions, and support communities and systems (e.g., infrastructure networks and financial markets) to build resilience. Related international agendas, such as the Paris Agreement (2016) and the Agenda 2030/Sustainable Development Goals (SDGs) (2015) also underscore the interlinkage of disaster risk reduction and climate change adaptation, and highlight opportunities to building resilience into sustainable development.5

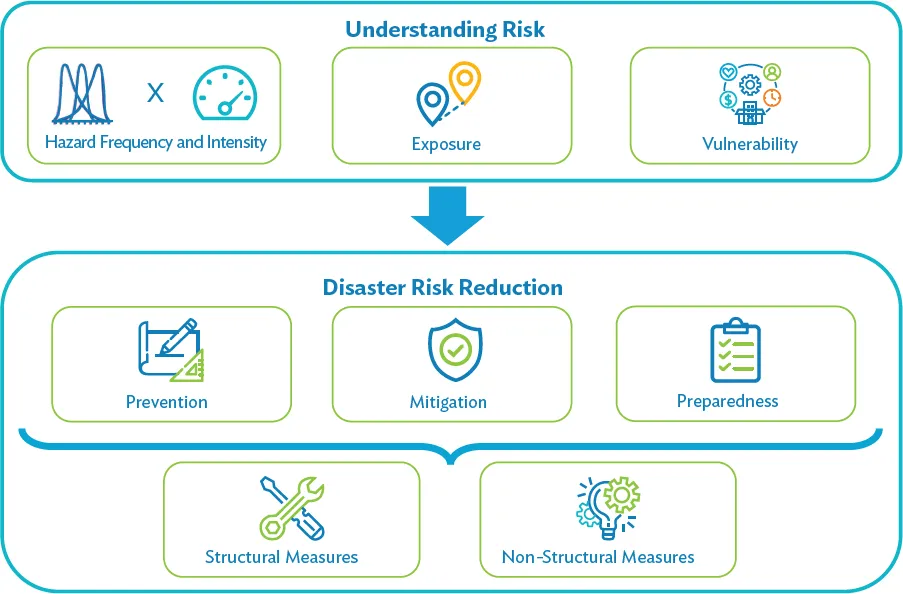

As illustrated in Figure 1.1, disaster risk reduction advocates for prevention (to avoid disasters), mitigation (to minimize disaster impacts), and better preparedness (anticipation before disasters strike). It incorporates both structural (physical) and nonstructural (planning and management) measures, which can save lives, reduce the impacts from disasters, and allow for more effective development and reconstruction.6

Disaster risk reduction also requires close consideration of current and projected climate change impacts and their influence on the exposure and vulnerability of people and assets. Future climate and disaster risks do not simply follow linear trajectories based on historical patterns. Therefore, policy development, infrastructure planning, and prioritization have to incorporate the best available data and methods for decision-making under conditions of uncertainty to future-proof assets.7

Business Case for Disaster Risk Reduction

Many investment decisions come with disaster and climate risks. If misinformed, development actions can exacerbate existing risks and have detrimental impacts on “neighboring” elements in their network or region (footnote 3). For example, investing in coastal assets may promote economic development and tourism in the short term, but may increase risk in the long term as these assets contend with sea-level rise, or the development itself may increase coastal erosion and associated flood risk.

With climate change projections indicating higher average temperatures and a greater frequency in extreme weather events in the region,8 service disruptions with cascading effects are increasingly likely, and certain assets are at risk of becoming “stranded”— i.e., an asset which once had value is either losing it or no longer has value—in this case, due to the impacts of or technological changes occurring due to climate and disaster risk.9 This, in turn, can have significant impacts at the individual, household, and firm level in terms of lost money, time, and well-being, while also resulting in economic welfare losses and political instability (with climate and disaster-induced mass migration as a scenario already now emerging across the world).10

To be sure, reducing disaster risk and taking risk-informed decisions is a feasible and cost-effective way to future-proof new development and retrofit existing infrastructure to withstand current and emerging climate and disaster risks.11 Resilient infrastructure offers what has been coined a “triple dividend” (Figure 1.2).12 The business case for resilience investments is compelling with an average $1 spent saving $4–$7 in response.13 Cost–benefit analyses specifically conducted for the Asia and Pacific region have shown ratios from 1:2 to as high as 1:55 in terms of the benefits from investing in disaster-resilient measures (footnote 3).

However, significant barriers remain to financing disaster risk reduction (and related climate adaptation measures), as financing has yet to match the scale of existing (and future) disaster risks.14 Both public and private actors are underinvesting in disaster risk reduction. Instead, funds and budgets are often overly focused on disaster response and recovery, with only a fraction dedicated to preventing disasters in the first place.15

To illustrate the gap in financing, international aid from 1991 to 2010 had a resource envelope of some $3.03 trillion, of which around $106.7 billion went to disasters, and only $13.5 billion of that ended up in disaster risk reduction funding—barely 13% (0.4% of the total).16 Moreover, from 2005 to 2017, $137 billion was provided in development assistance for disasters, with $9.60 out of every $10 spent on emergency response, reconstruction, relief, and rehabilitation; while less than 4%, $5.2 billion, was invested into disaster prevention and preparedness.17

This publication speaks to this discrepancy in financing disaster risk reduction by (i) providing an overview of the opportunities for advancing disaster risk reduction and its financing (Chapter 1), (ii) explaining key concepts of financing disaster risk reduction (Chapter 2), (iii) collating instruments and mechanisms that can accelerate the speed and increase the scale of financing future-proof development investments (Chapter 3), and (iv) outlining steps for governments to advance disaster risk reduction finance (Chapter 4). Top tips throughout the four chapters offer guidance on how to apply the knowledge on disaster risk reduction finance in practice. The appendixes provide more detailed elaboration on specific policies, case studies, and instruments.

2 The Context of Disaster Risk Reduction and Finance

Elements for Institutionalizing Disaster Risk Reduction

There is a wide range of good practice examples for reducing disaster risk and a plethora of tools and guidance notes available to inform the development and planning of resilient infrastructure investments.18 However, pragmatic measures and quick fixes will not suffice in addressing climate and disaster risks that are deeply embedded in infrastructure networks, economic markets, and governance systems and processes. Most national and, particularly, subnational governments are highly exposed and vulnerable to a range of hazards and impacts stemming from a lack of catalytic investments in disaster risk reduction, combined with a shortfall in long-term strategic approaches and institutional reforms.19

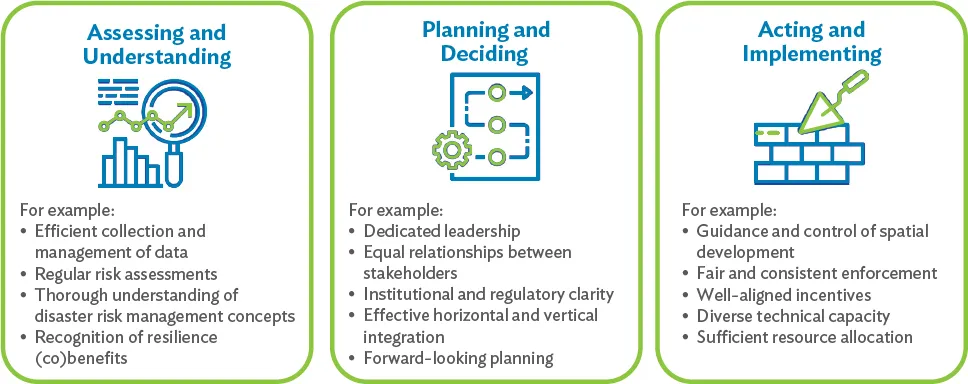

Figure 2.1 provides a structured illustration on key elements that can support more institutionalized disaster risk reduction in the public sector (footnote 3). Furthermore, Appendix 2 summarizes five entry points identified by the Global Assessment Report by the United Nations Office for Disaster Risk Reduction (UNDRR) on how to advance resilience against disaster risks more broadly (footnote 17).

Assessing and understanding. Knowing the risks to which a neighborhood, infrastructure utility, or economic sector is exposed to is the first step to inform disaster risk reduction. This includes assessing the exposure of people and assets to those hazards, and the vulnerability that communities or infrastructure networks may h...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Figures and Boxes

- Acknowledgments

- Abbreviations

- Executive Summary

- 1. Introduction

- 2. The Context of Disaster Risk Reduction and Finance

- 3. Conceptualizing Disaster Risk Reduction Finance

- 4. Instruments for Financing Disaster Risk Reduction

- 5. Steps toward Enhanced Disaster Risk Reduction Finance

- Appendix

- Glossary

- References

- Footnotes

- Back Cover