![]()

1

Money and Mindfulness:

Be Mindful of Your Financial World

“…as you get older you become the

person you always should have been.”

—David Bowie1

That popular image of retirement as a carefree twilight spent with family and friends on the porch no longer exists. In fact, it probably never did.

As I mentioned in the introduction, personal financial planning is about much more than just investing. You should start with a clear picture of your current financial situation and then combine that reality with your long-term goals and dreams. In essence, you are working toward a more complete understanding of both your present and your future. Yet too many people lack the tools or awareness to look beyond the present.

As a financial planner, I help clients wrestle with this challenge of balancing the present and the future every day. I generally meet with three types of people in my practice—one group simply ignores their financial problems out of fear; others constantly worry they haven’t done enough; while some actually enjoy financial planning and feel pretty good about their situation. That last group is quite small, and oftentimes they’re missing important pieces.

If you belong to the first group, the ones who are terrified to take a comprehensive look at their financial situation, I promise it’s not nearly as difficult or as painful as you imagine. And the sooner you start, the better. On the other hand, if you have a financial plan, but you’re still worrying way too much, then maybe all you need is a little coaching to help you get moving. People who find themselves in group two generally already know what they need to do yet still can’t seem to get their financial life in order.

What if you don’t recognize yourself in group one or two? You just might belong to that rare third group we call the overachievers. For this bunch, money has always held great importance, and they treat it with special attention. They budget and save, get the right amount of insurance, keep an eye on their taxes, and have wills that are actually signed. (You’d be surprised how many aren’t.)

The overachievers watch their finances closely. And they count. And compare. How much did they have at thirty? At forty? How much will they have at retirement? How much do their friends have? How can they get more sooner?

Are you scared and confused like group one, frustrated like group two, or maybe obsessed with your finances like group three? Tragically, the overachievers with million-dollar portfolios are often no happier or less anxious than the people in group one doing nothing. Why? Because the underlying question causing their anxiety hasn’t been addressed: Am I going to be okay? Having more and more and more will never answer that question until you start to think about your personal definition of “okay.”

You’re probably thinking right now how crazy that sounds—someone has millions of dollars, and they’re still stressed about their lives? Yes, based on my experience, those millionaires are quite often just as anxious as the next person. Take Jim and his wife Carol, for instance.

Jim started working in sales when he was seventeen. He had always been goal driven, finding success wherever he landed. By his mid-twenties he was saving a large part of his income and he had a very clear plan to have $1 million in the bank before he turned forty. That goal evolved over time into a target of several million dollars when he reached fifty and retired.

Every December, Jim would track his progress with an elaborate spreadsheet. Most years he exceeded his goals, but when he didn’t, he worked extra hard the next year to catch up. Jim and Carol came to us when they were both forty-three and well on their way to successfully retiring at fifty.

Each year we would meet to discuss their financial plan, and each year Jim would bring his spreadsheet for us all to review. There on the spreadsheet, in the row next to the year Jim turned fifty, was the word “RETIRE” in capital letters. We’ll talk more about that heavy word—RETIRE—later in the book.*

Our fourth annual meeting, when the couple was forty-six, started off a bit differently than the previous ones. Usually, we would get right to work discussing his business and reviewing the progress toward their retirement goal, which was now only four years away. “I’ve seen three changes in my life since we last met, and I hold you responsible,” he said to start the meeting this time. “I’ve gained ten pounds; bought a new car, which I’ve never done before; and started working less.”

Not knowing where this discussion was leading, I hesitated before saying anything.

“Okay. That’s interesting. How do you feel about those changes?” I asked. As I said it, I had that old legal adage swirling around in my mind—don’t ask a question if you don’t know the answer. I braced myself for the answer.

“I feel great,” Jim responded as Carol shook her head in agreement.

“He’s a different person,” she added.

We spent the next two hours talking about what had occurred that year to change his mind-set so dramatically. In his words, Jim felt like he could “finally take my foot off the accelerator.” Things were going just fine, and after three years of reviewing a financial plan that lasted until his ninety-fifth birthday, instead of looking at a spreadsheet that stopped at his fiftieth, he had finally accepted an obvious fact—they were okay.

That was something Jim and Carol had never considered before. In fact, neither one of them had ever talked about why they were trying so hard to save or why he wanted to retire at fifty. It was just a goal Jim set for himself long ago—before the kids and a job he enjoyed.

Jim had gained ten pounds because he loved to cook and entertain, something they were now doing much more often. I doubt anyone wants to learn that a successful financial plan will add ten pounds to your other bottom line, but don’t worry. Remember, we’re talking about incremental changes, which often lead to other changes over time. Jim was already talking about joining a local gym now that he had more free time on his hands.

He was working less because he had hired several people to help him expand his company into new cities. The change in mind-set had allowed him to see his business in a different, more creative light. That’s what happens when you write down your goals and track your progress—it reduces your anxiety and unleashes your creativity. That is something we’ll talk more about in chapter 5.

As for the new car, he loved it.

Without the thoughtful, incremental process of financial planning, Jim and Carol would have carried on as they had the previous twenty years. They would be striving for an arbitrary, outdated goal that was no longer relevant for their lives. Nothing had changed, except their definitions of success and purpose. Their mind-set.

Giving anything or anyone your undivided attention has become an uncommon luxury in our fast-paced world, but that is exactly what I’m going to ask you to do: give your financial situation the attention it deserves. You needn’t be afraid, worried, or consumed by your financial issues, but you do need to commit the time and effort to understand your future goals and purpose. Like Jim and Carol, you will find the process prepares you to see your future differently.

In Eastern philosophy there is the concept of mindfulness—an ability to focus intently on your present condition or experience. Over the last few decades this Eastern concept of focus or attention has found applications in Western medicine, psychology, and economics, just to name a few areas. The conclusions from Western science and Eastern philosophy agree: an ability to focus your attention helps reduce your overall stress and improves how you manage stressful situations.

In his book The Mayo Clinc Guide to Stress Free Living, Dr. Amit Sood explains:

Stress is the struggle with what is. A mind that doesn’t have what it wants or doesn’t want what it has experiences stress . . . Understanding and working with the brain’s and the mind’s imperfections isn’t a luxury; it is an absolute necessity if we hope to survive and thrive as a species.2

What do you have, and what do you want in life? Finding a stress-free balance between the two is one of the essential goals of any financial plan. But finding this balance is easier said than done. Dr. Sood warns us what we’re up against: your brain and mind are hardwired to keep you stressed, constantly distracted from the present moment by impulses, infatuations, and fears.3

Remove Those Roadblocks

In his book The Happiness Hypothesis, psychologist Jonathan Haidt uses the story of a rider (the planner) and an elephant (emotion) to explain how our brains work. Yes, the rider may have the reins, but which animal is really in control of the journey? That elephant doesn’t have to go anywhere he doesn’t want to go.4

It might surprise you to know the planner voice in your head—that guy or girl keeping everything organized with all of the lists—never gets anything done. It’s the other voice—the guy or girl who wants something—that makes things happen. Have you ever tried for years to do something hard, like getting rid of debt or losing weight, with no long-term success to show for it? Then one day you just wanted it, and the rest is history. Professor Haidt’s research shows us that motivation comes from our emotions, not our intellect.

Each of us has a rider in our head with lots of plans and lists. He thinks he’s in control, but we also have an elephant to manage, and he has lots of wants and fears. You need to understand both animals in order to change your paradigm and expand your financial possibilities. People rarely take the time—purposefully make the time—to discuss their hopes and dreams and then make plans for achieving them. Sure, we all hope to retire someday, and we think occasionally of that incredible vacation of our dreams, but hope and daydreams won’t help us reach our goals.

The greatest challenge for your logical side is managing the relentless tyranny of the urgent. We all know that getting your car washed, for example, is less important than having enough life insurance, but somehow the car gets taken care of and the life insurance doesn’t.

This kind of procrastination comes in many shapes and sizes in the financial world. I often see couples whose wills were neglected for decades and then hurriedly drafted days before a trip out of the country. I also meet with people who, after months of avoiding the inevitable, must make a decision about a pension or early retirement with only days to consider their options. These aren’t the kinds of issues to be tackled at the last minute, and yet they very often are.

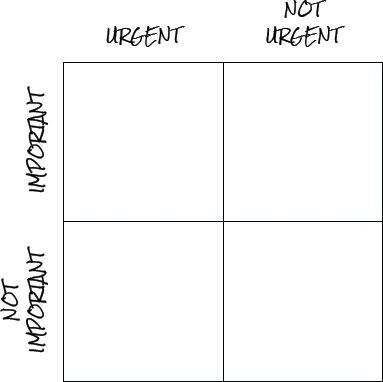

I mentioned President Eisenhower in the introduction because he is credited with a framework for prioritizing the incessant stream of things to be done. It is presented below as a simple grid you may recognize:

The process of purposely giving your full attention to your unique financial situation will help you sort out the things in your financial life that are unimportant or not urgent. From there you can set priorities and begin taking action based on importance rather than urgency. It has been estimated that an average brain is constantly occupied with approximately 150 items on its bucket list. Is it any wonder we modern Americans report being overwhelmed and stressed5, or that money is our single biggest stressor?6

As Dr. Judson Brewer points out, it’s the executive center of our brain—the prefrontal cortex—that goes offline first when we’re stressed. His research into addictive behavior tells us what we can all attest to—stress leads to that pint of ice cream, cigarette, or Netflix binge we know isn’t good for us.7 So why do we do it? Because the executive control center (the rider) shuts down, leaving you to wrangle with your emotional, stressed-out elephant.

And like stress, too much information or too many choices can lead to the same problem with executive control. Your rider just can’t handle the workload. We’ll talk about choice overload and how it can paralyze you later in the book.

“A wealth of information creates a poverty of attention.”

—Herbert Simon, Nobel Laureate, Economics8

Get Ready for Change

The stars of the movie are a flock of emperor penguins facing immense challenges—they lay their eggs and incubate them through the Antarctic winter (not an easy thing to do); to avoid predators, they must nest far inland, many miles from their food source in the ocean, and, well, they’re penguins. They can’t fly.

The birds have met these challenges by adopting what economist Jeffrey Ely calls “perpetually suboptimal behavior” that makes little sense to an outside observer. The penguins march sixty miles inland, starving for many months while they incubate their single egg in subzero Antarctic temperatures, then eventually trek back to the ocean to eat again. These adaptations allow the penguins to survive, but with each evolutionary adaptation their existence has become increasingly more complex. In the words of Ely, they have become kludged.9

The idea of a “kludge” crops up in a wide range of areas like the military, software progr...