![]()

Chapter 9

OUR PERSONAL FINANCES

Where Did We Belong…Financially?

The only way that we can live, is if we grow. The only way that we can grow is if we change. The only way that we can change is if we learn. The only way we can learn is if we are exposed. And the only way that we can become exposed is if we throw ourselves out into the open. Do it. Throw yourself.

—C. JoyBell C.

It is sad to look at the data. Somewhere along the way, we have lost our way. We have gone too far from being savers to becoming consumers (with credit) in a very precarious way. And like I said, I’ll leave it to the experts to analyze such a decline in just a few short decades. On the surface, I believe there are three main contributions to this low net worth for our age group: credit card debt, car loans, and student loans.

I won’t include the mortgages here because this one is a mixed bag for me. As part of the overall consumer debt, some people allow their mortgage loans to bury them deep down. Others use this type of debt as leverage, as an investment vehicle to build a real estate empire.

The debate topic of using debt as leverage is dicey. I’ve read plenty of books and seen it done before. The result can be quite lucrative provided that one has a good business model and is being implemented correctly. The problem is, for one reason or another, the majority of businesses fail in the first five to ten years. Using debt to leverage your business can often lead to financial distress and bankruptcy, but I digress. Taking on loans for your business is a whole other issue. I’ll leave this topic to debate for another day. For now, we just want to focus on our personal economics; we want to focus on personal money matters.

I understand that money is a taboo topic that most people do not wish to talk about openly. When the topic of money is mentioned, be prepared to deal with many different ideological spectrums. Be wary of where the conversation may lead you to, because you could be in for a long, awkward Thanksgiving dinner with your family, if you’re not careful. Here are a few issues to consider that we should bear in mind:

- The most obvious-in-plain-sight issue is the socio-economic struggles, powers, and battles: wealthy vs. poor, haves vs. have-nots. You may possibly be dealing with different class levels that possibly lead to class warfare.

- Everybody looks at money differently based on one’s experiential knowledge, or lack thereof.

- Another thing to consider is that you may be dealing with contrasting degrees of intelligence, competence, and personality types. You could touch on someone’s nerve easily and things could get emotionally out of control fast.

- Or worse yet, you could even inadvertently stumble onto the issue of race—the racial divide. Especially with the recent political rhetoric in America, it is definitely not a good rabbit hole to go down.

With that in mind, I don’t think ignoring talking about money or pretending that money issues don’t exist is actually healthy. As a society, we have a money avoidance disorder as some people put it. I’d say avoiding talking about money is one of the reasons why we become financially illiterate and not so good at managing it. When you can’t be open about your finances with someone you trust, you can’t learn from one another’s money habits to either avoid the bad or adapt the good. Regardless of whether your personal situation is completely different from your counterpart, you can always apply an idea or two to increase your chances of winning with money.

Additionally, avoiding money talks doesn’t make money issues go away. At the end of the day, those numbers sitting in your bank or investment accounts will either go higher or lower, or even go into negative territory. It is entirely up to you. Unless you want to walk around like ostriches burying your head in the sand, I suggest you take out a pen, a notebook, and a calculator to start figuring out what your current financial situation is, specifically, your total net worth.

As simply put earlier, the way you calculate your total net worth is: Assets (own)—Liabilities (owe) = Total Net Worth.

Assets. Here are a few examples of some assets that we generally own: value of our home(s), vehicle(s), boat(s), the cash values of your checking accounts, savings accounts, investment accounts, insurance policies, and any items of significance such as jewelry, equipment, furniture, etc. Add up the total value of all items you own and you will have a total assets amount.

Liabilities are your outstanding debts such as personal loans, credit card debt, car loans, student loans, home mortgages, tax debt, or any other type of debt that you owe. Add up the total value of all these items and you will have the total liability amount.

Net worth = Your assets subtract your debts. The total value is considered your personal net worth. Your total could result in a positive or negative net worth.

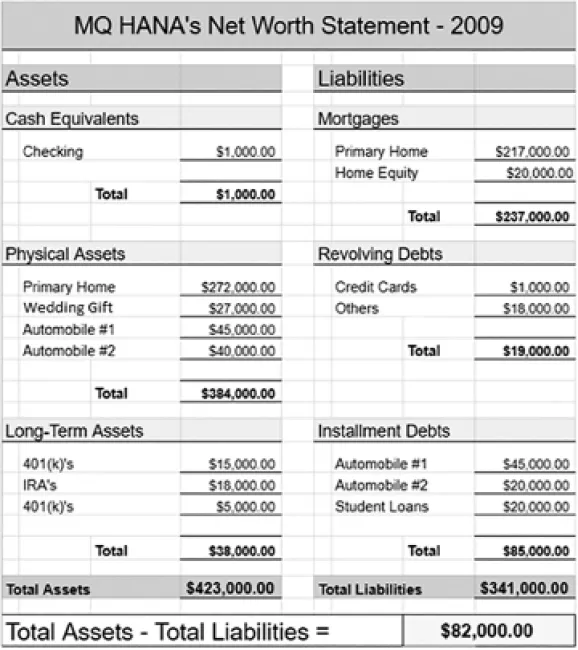

To help you figure out an easy way to calculate your net worth, you can find a free personal google net worth statement like I did in Table 9-1. Simply input all your known variables and voilà…the sheet automatically calculates your net worth for you. As easy as that! It will take you no more than three minutes once you have all your numbers. You will be able to see your wealth clearly laid out and know where you are at in order to go about working on your financial goals.

Table 9-1

Figuring out your net worth number is one of the most important discoveries of your finances. As you progress through your financial journey, you can use the net worth formula to help measure the value of your assets in the months and years ahead. You will be keener to focus on the type of spending that will increase in value; more importantly, you will be more mindful of any liabilities and hopefully deter you from spending on frivolous things that would go down in value.

If you have a low or are in a negative net worth category early in your career, no worries, you’re considered normal. Generally, people graduate with some amount of student loan debt; they could be new homeowners and just starting to save for the future. The key takeaway here is not to get carried away and get too deep into debt, rather, have a plan to minimize debts, get out of it, and get in the state of building wealth.

Hana and I were twenty-nine and thirty years old when we were married and combined all of our numbers together. Looking back, our overall financial situation in 2009 was not all that bad in comparison to our age group: $82,000 for both or average $41,000 each. We were way ahead of our peers, thanks to our parents.

As you’re probably already aware, in our Asian culture, it’s not all that uncommon, certainly not laughable, for children to stay with their parents until their late twenties, or even in their thirties. If you can tolerate living with your parents and cherish their love for you, it is very beneficial all the way around.

Children can help their parents do many chores (the real grown-up adults that don’t take their parents for granted, that is) around the house, contribute to the bills, and assist with other paperwork due to their language barriers and complexities in some paperwork. In return, you get to live in their nice house mostly rent-free or with very minimum expenses. You could save to pay off some of your student loans, get a good chunk of money built up for a nice down payment on your future mortgage, and be in a position to win big with money.

I know it’s difficult for some to fathom the idea of kids living with their parents beyond eighteen years of a...