This is a test

- 606 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Central Finance and SAP S/4HANA

Book details

Book preview

Table of contents

Citations

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Central Finance and SAP S/4HANA by Carsten Hilker, Javaid Awan, David Dixon, Marc Six in PDF and/or ePUB format, as well as other popular books in Computer Science & Computer Science General. We have over one million books available in our catalogue for you to explore.

Information

Part I

Getting Started with Central Finance

1 The Basics: What Is Central Finance?

Central systems for finance have been around for ages and in different styles. SAP’s Central Finance represents yet another step in the evolution of central systems for finance, based on next-generation technologies and innovations in process execution that are substantially different from the traditional, central ERP systems for finance of the past.

In this chapter, we’ll explain the basic idea behind Central Finance: a central finance system that creates a single financial source of truth for executing reporting and finance processes among disparate financial applications, and a way to reap the benefits of SAP S/4HANA without a full-blown data migration. In this chapter, we’ll describe the building blocks of Central Finance and elaborate on its natural limits.

1.1 A Centralized Finance System

The idea of a central enterprise resource planning (ERP) system to use for financial processes has been around for as long as multi-ERP system landscapes have existed. Mostly as a consequence of mergers and acquisitions (M&A) and postmerger integration (PMI) or business consolidation (organic growth initiatives and business model optimizations), many companies need to bring together different and diverse ERP systems for centralized financial reporting and process execution.

In the following sections, we’ll begin by describing the evolution of Central Finance, starting with how traditional approaches to finance created the need for a new system. We’ll then move on to discuss Central Finance more specifically, including its central process execution model.

1.1.1 Evolution of Central Finance

In traditional approaches deployed over the last 10 to 15 years, a central ERP system was deployed and custom integrated with source systems; integration used extract, transform, and load (ETL) tools and was batch-oriented; and the coding block was limited. Reporting may have been performed in separate data warehouses, and planning and consolidation were performed in separate, parallel applications outside the central ERP system.

Market Research

Per a July 2019 SAPinsider research study (http://s-prs.co/v500600), the majority of the current pain points related to finance and accounting come from a lack of integration and visibility. In fact, 49% of respondents reported this as a key challenge they seek to solve.

Complexity and inefficiency are driving organizations to alter their business strategies and overall investment, with the largest sources of pain being budgeting and financial planning (54%) and financial closing (52%).

Many expressed that they felt tied to a mix of legacy systems and highly manual integration and reconciliation processes.

Traditional central ERP systems for finance are limited by the technologies available at the time they were developed. Decades ago, everything was about duplicating and moving data to where the data needed to be; thus, all the interfaces had to be updated every time an organizational or business model changed. Perhaps additional interfaces to yet another system have been introduced, causing master data to get out of hand. Finally, due to timing and latency issues and on-the-fly personal macros in Microsoft Excel spreadsheet-based reporting, finance information was rarely consistent, true, or trusted.

Today’s centralized finance system benefits from technological innovations like in-memory databases, predictive analytics, machine learning, cloud-based applications and services, and virtualized reporting and analysis. With today’s technologies, a central finance system can—in one system, regardless of number of records or size of the coding block—be the digital twin of all the financial records in your entire organization, both across IT systems and agnostic with regard to business models. In other words, harmonized.

With finance processes built into the central system, moving data to separate applications for finance processes like reporting, planning, and consolidation is no longer required. Everyone, for reporting and for process execution, can work on the same dataset, the single source of truth, with one process execution layer and one SAP S/4HANA user interface, with the first layer facing the organization internally and the second layer facing the customer. Additionally, if desired, central process execution can be performed via scalable shared services. A central finance system today is no longer a barrier holding back finance departments but rather an enabler of business growth and business optimization.

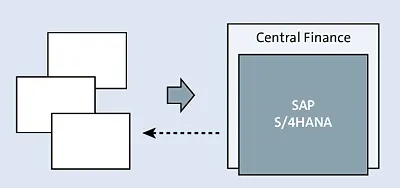

SAP’s Central Finance is different from traditional central systems for finance in that Central Finance is based on an intelligent ERP system called SAP S/4HANA, shown in Figure 1.1. SAP S/4HANA leverages many in-memory, business network, predictive, cloud, machine learning, and user experience (UX) technology innovations that have become mainstream since traditional ERP systems were developed. Next-generation ERP systems like SAP S/4HANA only come around every 15 to 20 years, and now is the time.

Figure 1.1 SAP S/4HANA at the Core of Central Finance

What also makes SAP S/4HANA different is that the business environment and the state of information technology are different, with various disruptive technologies, such as Central Finance, now mainstream.

Today’s digital economy requ...

Table of contents

- Dear Reader

- Notes on Usage

- Table of Contents

- Preface

- Part I Getting Started with Central Finance

- 1 The Basics: What Is Central Finance?

- 2 The Mechanics: How Does Central Finance Work?

- 3 The Motivation: Why Central Finance and Why Now?

- 4 Reporting: What Can I Learn About My Data?

- 5 Finance Processes: What Can Central Finance Improve?

- 6 Finance Data Harmonization: How Does Central Finance Standardize Data?

- 7 Deployment Options: How Do I Implement Central Finance?

- Part II Deploying Central Finance

- 8 System Architecture

- 9 Implementing Central Finance

- 10 Implementation Project and Operations

- 11 Master Data Management

- Part III Next Steps with Central Finance

- 12 Mergers and Integrations

- 13 Central Finance as a Stepping Stone to SAP S/4HANA

- 14 Finance Transformation

- 15 Platform Transformation

- 16 Central Finance Business Case Development

- A The Authors

- Index

- Service Pages

- Legal Notes