- 148 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Indonesia needs significant additional infrastructure investment to sustain its economic growth. However, the COVID-19 pandemic has further limited the fiscal space of the government. This report proposes a new method to increase infrastructure investment based on the concept of value capture. The report studies how Indonesia's existing policies and regulations can be used to build a value capture framework that ensures the maximization of the social, economic, and environmental value of infrastructure investments. The framework focuses on strategies to deliver infrastructure projects that create greater value and, at the same time, generate funding for up-front investment.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1. Introduction: A Whole-of-Government Approach to the Funding and Financing of Urban and Transport Infrastructure

Although investments in urban and transport infrastructure generally stimulate economic productivity, the Government of Indonesia faces a funding shortfall that constrains its ability to commit to the up-front financing of infrastructure investments.

Urban and transport infrastructure are key components of achieving the United Nations (UN) Sustainable Development Goals (SDGs), especially Goal 11: creating sustainable cities and communities. To this end, this report outlines options available to the government regarding the preparation of a national-level land value capture (LVC) framework.

It appraises Indonesia’s existing policy and regulatory framework with regard to supporting value capture as a holistic means of proactive planning for enhanced economic productivity, such that incremental economic benefits can contribute to the funding for up-front investments, thus reducing funding shortfalls.

This chapter, as outlined in Figure 1.1, identifies the challenges that currently exist in the financing and funding infrastructure, value capture’s ability to address these challenges, and the target outcomes expected from value capture.

Figure 1.1: Schematic Diagram of Chapter 1

SDG = Sustainable Development Goal, UN = United Nations.

Source: Authors.

1.1. Challenges

There is a strong rationale for urban and transport infrastructure. However, four key challenges are hindering investment in the sector.

Challenge #1: Need for Urban and Transport Infrastructure

Urbanization in Indonesia has resulted in high-density conurbations, which can increase economic output, but also causes intense traffic congestion. Public transport infrastructure enables corridors for increased economic activity. However, public transport infrastructure is too expensive to be funded solely through passenger ticket sales.

Urban infrastructure is critical for accommodating the high-density urbanization that is occurring in Indonesia’s cities. High-density conurbations are desirable for the government, as they can enable the more efficient provision of public services, and can generate increased or more efficient economic output (ADB 2019a). However, higher-density conurbations in Indonesia’s cities have led to intense traffic congestion, and thus to the urgent need to connect nodes of economic activity by providing public transport infrastructure systems.

Most utility-based urban infrastructure is predominantly funded by “user charges.” However, public transport infrastructure systems have relatively high capital costs, and the revenue that can be obtained from ticket sales is typically barely enough to cover the operation and maintenance costs, resulting in a viability gap. City governments are under intense political pressure to resolve the funding gap by investing fiscal resources in public transport infrastructure systems to unlock the economic growth associated with urbanization.

Challenge #2: Fiscal Constraints

The fiscal situation in Indonesia is characterized by a funding shortfall. So, there is a fundamental need to monetize the currently increasing output to fund the country’s development plans.

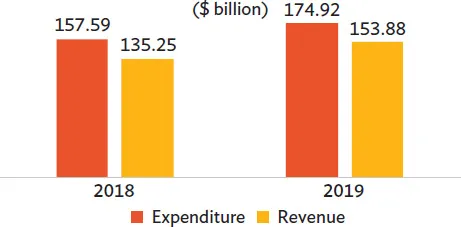

The government’s revenue and expenditure for 2018 (actual) and 2019 (projected) are shown in Figure 1.2, which indicates a continuing funding shortfall. For 2019, the projected expenditure on infrastructure was expected to be 3.4% of gross domestic product (GDP). In contrast, the current National Medium-Term Development Plan (RPJMN) has targeted infrastructure spending at 6.1% of GDP by 2024, which will evidently present a bigger funding challenge.

Figure 1.2: Indonesian Government Funding Shortfall, 2018–2019

Note: In this figure, the values for 2018 are actual, and those for 2019 are projections.

Source: Government of Indonesia. National Medium-Term Development Plan, 2020–2024.

This funding shortfall means that there is a fundamental need to monetize increased economic output to fund the country’s development plans.

The Indonesian government has a relatively low ratio of tax-to-GDP relative to its peers in the region, and could thus potentially afford to increase the tax burden. The current relatively low ratio of taxation cannot sustain the targeted level of infrastructure investment. There is also a need to identify alternative approaches that will increase the funding available for infrastructure projects.

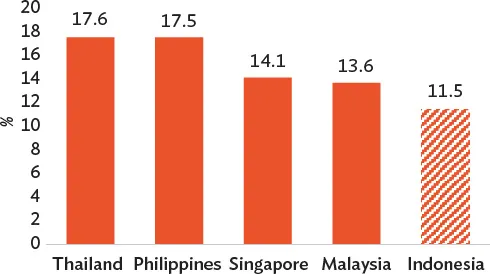

The tax-to-GDP ratio is often used to measure a government’s control over its economic resources. In 2017, Indonesia’s tax-to-GDP ratio was 11.5%, lower than those of other middle-income Southeast Asian countries, as shown in Figure 1.3. There appears to be room for higher taxes, but fiscal revenues have already been shown to be insufficient for funding the required infrastructure investments. Therefore, the government must find alternative approaches to increasing revenue and/or attracting private sector contributions, in order to achieve a high enough income to fund the necessary infrastructure projects.

Figure 1.3: Indonesia’s Tax-to-GDP Ratio Compared with Those of Other Southeast Asian Countries, 2017

GDP = gross domestic product.

Source: Organisation for Economic Co-operation and Development (OECD). Revenue Statistics in Asian and Pacific Economies 2019 — Indonesia. https://www.oecd.org/tax/tax-policy/revenue-statistics-asia-and-pacific-indonesia.pdf.

If the tax-to-GDP ratio does not improve, the projected target infrastructure spending in 2024 of Rp6,445 trillion will take up more than half of the country’s revenue (BAPPENAS 2019). Thus, there is a need to borrow money for investments in infrastructure. However, to sustain fiscal discipline, Indonesia’s fiscal regulations restrict the country’s budget deficit to 3% of GDP, and cumulative public sector loans to 60% of GDP. Current public sector loans amount to 20% of GDP, so the public sector can only borrow around Rp1,400 trillion. That is why there is the need for alternative approaches, such as leveraging private sector financing.

Challenge #3: Project Viability

Appraisals of overall transport project viability normally focus narrowly on revenues from transit fares, non-fare revenues, time savings, and vehicle savings, while ignoring the fundamental motivation for investing in public transport infrastructure in the first place: to create corridors of increased economic activity.

Traditional Approach to Appraising a Project’s Commercial Viability

A commercial viability assessment of a transport infrastructure project typically focuses on the revenues from transit fares, which are sensitive to the underlying demand and pricing analysis. When this type of project is put up for a public–private partnership (PPP), the government typically contributes a generous amount of viability gap funding (VGF) or subsidy payments to improve project yields and attract investors. The addition of non-fare and value capture revenues in assessments of project viability would improve project yields, without requiring the government to commit as much up-front financing or subsequent funding.

Narrow Focus in Appraising Project Economic Viability

The economic viability assessment of transport infrastructure projects is normally required to provide the government with a rationale for making fiscal contributions such as VGF or subsidies. The conventional approach is to carry out an economic cost–benefit analysis (ECBA). However, ECBAs of transport infrastructure projects focus on their direct and measurable effects, typically taking into account only fare and nonfare revenues, time savings, and vehicle savings (ADB 2017a). Infrastructure projects, especially public transport systems, provide economic uplift in other ways too, such as the following:

• Land can be used much more intensely, providing improved economic efficiency and productivity.

• Improved transport connectivity results in employers having access to a much larger labor pool, enabling them to improve their productivity and reduce frictional unemployment, while suppressing wage inflation.

Challenge #4: Silos Within the Government

Shortfalls in economic planning, land use planning, and infrastructure procurement will often lead to escalating project costs and program overruns.

Infrastructure projects are likely to span across more than one administrative boundary and be regulated by various governing bodies. Resolving these many, sometimes contradictory, regulatory requirements consumes considerable amount of time and resources. Moreover, shortfalls in planning and consultations can lead to escalating project costs and program overruns. A concerted inter-government approach to streamlining infrastructure regulations is paramount for promoting the more effective use of infrastructure funding.

1.2. Solution: The Virtuous Value Cycle

This subsection sets out the rationale for the use of a virtuous value cycle as a solution to the challenges set out in the previous section.

Definitions to Provide a Common Vocabulary

Definitions can provide a common vocabulary for this new topic, with “value capture” providing the broadest and most useful perspective on the topic. Recognizing the difference between funding and financing is also key.

The term “value capture” introduces several new concepts, and requires a correct understanding of them. Therefore, this section first sets out several definitions to facilitate a common understanding and a consistent narrative that can be shared among stakeholders in the government, as they craft a policy framework for value capture.

A range of definitions is used for “value capture” and “land value capture,” but this report uses the broader view of value capture, which encompasses all the opportunities for a constructive sharing of the economic uplift that arises from public investment in economic infrastructure assets, as well as from the public services enabled by these infrastructure assets. Additional definitions are included in the Glossary.

Value capture presents an opportunity to create a virtuous cycle of economic uplift through public investment in infrastructure. However, the lack of and/or uncertainty regarding sources of funding to pay for infrastructure development has created a vicious cycle of limitations on economic productivity in developing countries such as Indonesia. These funding constraints have discouraged financing for infrastructure development, and remain a key challenge in addressing the gap for both economic and social infrastructure.

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Tables and Figures

- Foreword

- Acknowledgments

- Abbreviations

- Foreign Exchange Rates

- Executive Summary

- 1. Introduction: A Whole-of-Government Approach to the Funding and Financing of Urban and Transport Infrastructure

- 2. The Regulatory and Institutional Frameworks for Value Capture Implementation in Indonesia

- 3. The Value Creation Framework

- 4. The Value Capture Framework

- 5. Value Funding Framework

- 6. Value Creation and the Capture Policy Road Map

- Appendixes

- Glossary

- References

- Footnotes

- Back Cover

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Innovative Infrastructure Financing through Value Capture in Indonesia by in PDF and/or ePUB format, as well as other popular books in Business & Infrastructure. We have over one million books available in our catalogue for you to explore.