![]()

1. THE FORCES OF DESTRUCTION: Change and what drives it

In 1871, Finnish mining engineer, Fredrik Idestam, had two paper mills in south-western Finland. He decided his company needed a new name, and settled on Nokia, after the town closest to one of his mills. Fastforward almost a century to 1967 and Idestam’s Nokia Ab merged with Finnish Rubber Works – founded in 1898 – and Finnish Cable Works Ltd, a company formed in 1912, to form the Nokia Corporation. The new Nokia had five core businesses: rubber, cable, forestry, electronics and power generation.

Some years later, in 1989, Nokia produced its first mobile phone, beginning a switch to telecoms. By 1998 it was the world’s largest mobile phone manufacturer, and turnover had reached €31bn. In nine years the company went from market entry to market dominance. However, an event just another nine years later dented that dominance irreversibly.

The 2007 launch of Apple’s iPhone wrong-footed Nokia, which couldn’t produce a smartphone with similar consumer appeal. Nokia’s dominance in feature phones – the low-end handsets lacking the advanced functionality of smartphones – meant that it remained the world’s largest mobile phone manufacturer until 2012, but the decline had begun long before. In September 2013, following second quarter losses of €115m, Nokia sold its mobile phone business to Microsoft for $7bn, a fraction of its turnover, let alone its market value, in 1998.

Working against Nokia, and all businesses, is a force known as “creative destruction”. It is not a new concept; in fact, it derives from Karl Marx. In essence, it says that the economy is always undergoing revolution – its structure, and the companies within it, under attack from and being rebuilt by new processes, markets and developments. Nokia had successfully transitioned between business models on a number of occasions, something that many businesses struggle with, but the transition to smartphones was one too many.

Furthermore, the rate of creative destruction is increasing and, as a result, company lifespans are getting shorter. Research by Yale’s Professor Richard Foster demonstrates that corporations in the Standard and Poor 500 in 1958 spent an average of 61 years on the list. That had fallen to 25 years by 1980, and to just 18 years by 2012.

In 2012, Chris Zook, a partner at Bain and Company, said: “We have never seen companies losing their leadership positions as quickly as they are today. A list of the top 20 banks today contains only seven that were on the list a decade ago. A similar pattern holds for airlines. And for telecom. And for many others.”

We believe that this increasing pace of change is being driven by three significant, and linked, forces: technology, shifting consumer behaviour and increasing competition. In this chapter we will explain these forces, and look at some examples of the impact they’ve had.

1.1 The Forces of change

Of these three forces of change, advancing technology is the most significant because it enables and fuels the others. New, more powerful technology has arrived and, with ever lower costs, access to it has grown considerably. The always-on, always-connected nature of this technology has driven shifts in consumer behaviour, and transformed the competitive landscape of sectors as diverse as retail and healthcare.

The first personal computer, Olivetti’s Programma 101, was launched in 1965 at a price of $3,200. It wasn’t until the early 1990s, however, that the PC became a presence in the average home. Fastforward to September 2014, and the latest iPhone contains 625 times more transistors than a 1995 Intel Pentium-powered PC, at around a quarter of the price. The launch weekend of the last iPhone saw Apple sell twenty-five times more CPU transistors than were in all the PCs on Earth in 1995.

The Internet, connecting all these devices to the world’s information, arrived in British homes in the early 1990s, at a speed of around 64 kilobits-per-second (Kbps). Anyone who used it at that time will remember the wait while the modem dialled-in to the network and the slow loading times for websites as text and pictures slipped into place a bit at a time. These days, most British homes have sufficient Internet speed to stream live video – something that requires a connection of 8–10 megabits-per-second (Mbps). Once you understand that a megabit is 1,000 kilobits, you can begin to understand just how much faster Internet speeds have become in twenty years. The current fastest Internet connections available in UK homes offer more than 150Mbps.

Meanwhile, mobile broadband speeds have also been steadily climbing. The 2G Internet speeds – up to 237Kbps – that first brought the mobile Internet to a mainstream audience soon increased to an average of 6.1Mbps on 3G in the UK, and are increasing to around 15Mbps as 4G rolls out across the country.

Not only has consumer technology and speed of connectivity changed but the tools used to create services and applications have also drastically changed. The arrival of open source technologies brought software that was powerful and freely available to anyone. First becoming popular in the late 1990s, open source made a significant impact in a couple of ways, both relating to cost. Firstly, and most obviously, the lack of software licensing fees lowered development costs. Secondly, the inherent sharing of work that happens in open source communities means a business building software today doesn’t have to design and produce code for every feature of their application, meaning the commodity functionality can be quickly integrated. A user login model will already be available, a powerful search engine technology could easily be integrated with via an API, a library that manages easy scanning of an uploaded document through optical character recognition will be available off the shelf.

The emergence of cloud technology, a term popularised in 2006 by Amazon with their launch of Elastic Compute Cloud, Platform-as-a-Service and Infrastructure-as-a-Service had a further impact on cost and enabled companies adopting it to scale quickly and cost-efficiently. These services provide access to vital components for running a company, but only as-and-when the company needs them. Instead of, for example, predicting when you will need a new server, ordering it, configuring it and turning it on, companies can just rent more server capacity from a cloud provider. Likewise, powerful scaling, monitoring and load balancing technology, which would previously have had to be designed and coded by each business, is now available for rent as part of a packaged service from companies such as Heroku and Amazon Web Services. And not only is a rental model preferable, but the costs of rental are also decreasing significantly.

Marc Andreessen, co-founder of Netscape, the first Internet browser, and now a partner in prominent Silicon Valley VC, Andreessen Horowitz, said: “In 2000, when my partner Ben Horowitz was CEO of the first cloud computing company, Loudcloud, the cost of a customer running a basic Internet application was approximately $150,000 a month. Running that same application today in Amazon’s cloud costs about $1,500 a month.”

Lower startup costs, increased availability of cheap capital (increasingly so with the growth of crowdfunding services) and easy access to global audiences through cheap media, Google and the App Store have combined to create an opportunity for a new category of company – the software company. These companies can challenge established players without major infrastructure or staffing costs.

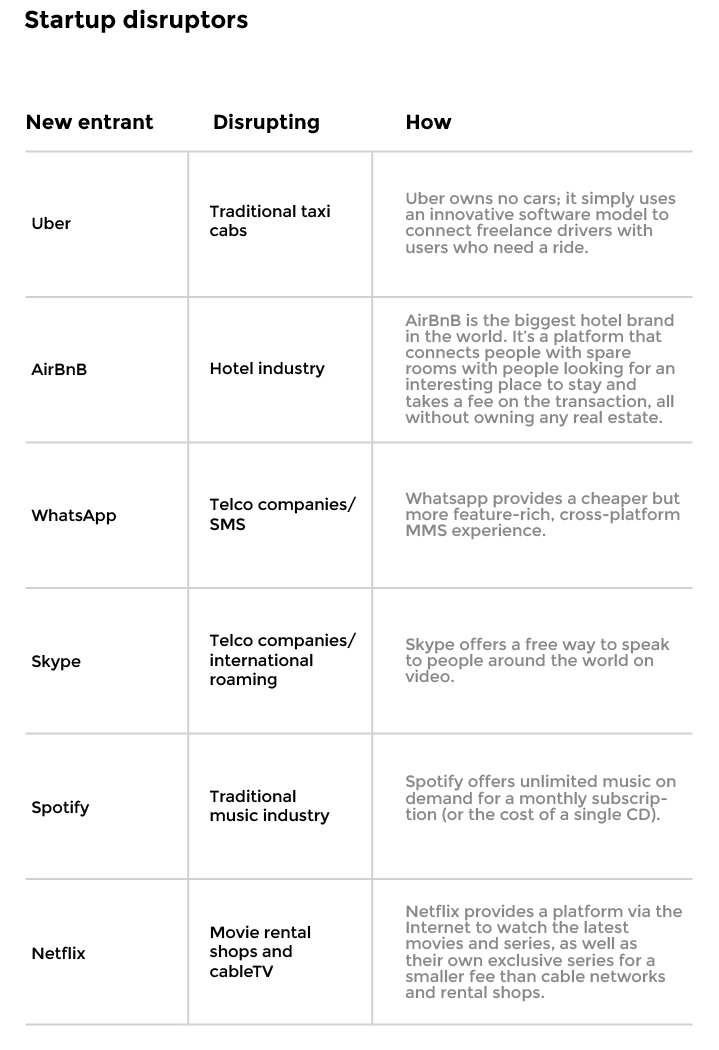

“Software,” Andreessen argues, “is eating the world”. The table below shows just a few examples of these companies, and the businesses they are challenging.

These advances in technology, combined with increasing access to it and a range of new businesses, have driven considerable changes in consumer behaviour over the last 20 years. In 1995, according to World Bank figures, just 2% of Britons were online. By 1999 it was more than 20%, and in 2013 UK Internet penetration was 89.8%. Mobile use has grown even faster. Ofcom reported that by Q1 2014 93% of adults in the UK owned a mobile phone and 61% of the population owned a smartphone, giving them access to a powerful computer and, through it, access to the world’s information.

This access has transformed every sector and business you can think of. The high street has been decimated, and many previously massive brands, such as Woolworths and Comet, have gone, due to the ease, wide selection and often lower prices available online.

The Internet has also made it easier for consumers to research purchases. Customer reviews inform purchase decisions on products ranging from kettles and TVs to holidays and cars. Likewise, the Internet has broken down borders, making it simple to order products from other countries

This change in consumer behaviour has forced companies to change how they do business. Pre-Internet, the...