eBook - ePub

Controlling with SAP ERP: Business User Guide

Janet Salmon

This is a test

- 730 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Controlling with SAP ERP: Business User Guide

Janet Salmon

Book details

Book preview

Table of contents

Citations

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Controlling with SAP ERP: Business User Guide by Janet Salmon in PDF and/or ePUB format, as well as other popular books in Computer Science & Computer Science General. We have over one million books available in our catalogue for you to explore.

Information

1 Introduction

This chapter discusses the roots of Controlling with SAP ERP Financials and introduces the basic Controlling functions. You’ll learn what might be different from other systems you’ve encountered and where there is common ground.

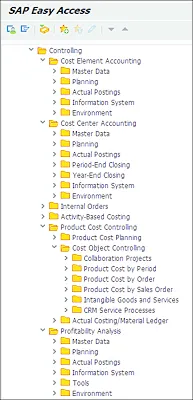

People taking their first class on Controlling with SAP ERP Financials (which we’ll refer to as CO moving forward) are often daunted by the sheer range of functions, because CO is several costing systems rolled into one, covering responsibility accounting, planning, activity-based costing, product cost accounting, and profitability management, whereas most other systems handle each of these areas separately. A quick glance at the SAP menu (see Figure 1.1) shows a series of folders that you may not instantly be able to map to your current approach to cost accounting.

Let’s start with the top menu folder: Cost Element Accounting . This can sound like an alien concept if you’re used to seeing cost centers and orders simply as account assignments in the General Ledger, with postings made to an account and a “center.” You may only be familiar with the term account and never have encountered the term cost element at all. The cost element provides the link to the General Ledger accounts, so typical cost elements are wages and salaries (for recording the costs associated with your workforce), materials and services (for recording the costs associated with the goods you buy and sell), depreciation (for recording the costs associated with your assets), utility costs, and so on. In some countries, you’ll hear this transformation discussed in terms of costs by nature. These are really just words, so if it helps to carry on thinking of a cost element as an account, by all means do, at least for primary cost elements. Cost elements are also used to store the results of any allocation, so you’ll also use several additional cost elements to define how costs flow through your organization. These cost elements are known as secondary cost elements, and we’ll look at how to define the two types in Chapter 3 and Chapter 4. When defining your cost elements, it’s also important to understand how the costs behave. Energy costs are variable, rising as the output of the cost center rises, but rent costs are fixed, remaining constant irrespective of how much work the cost center performs.

Figure 1.1 Controlling in SAP Easy Access Menu

If the cost element answers the question of the type (or nature) of costs incurred, the question of why such costs were incurred is answered in the next folders: Cost Center Accounting and, to a lesser extent, Internal Orders. Every posting in the SAP General Ledger recorded under an account with a sister cost element (the primary cost element) also requires you to enter the following:

- The cost center for which the costs were incurred (e.g., in the example of wages and salaries, for which department the employees were working)

- The order or project for which the costs were incurred (e.g., in the example of goods and services, which project required the purchase to be made)

Within this type of posting, there is an idea of responsibility accounting—that is, making the cost center manager responsible for the costs incurred for his cost center and the project manager responsible for the costs incurred for his project. For small projects, you may not even need a project in SAP ERP but will find that an internal order is adequate for your needs. The word accounting is related to accountability. It’s the controller’s task to ensure the accountability of the relevant managers for their spending on each cost center, order, or project. Another term you’ll sometimes hear in this context is stewardship, associated with the idea that the cost center manager is safeguarding the assets in his responsibility.

With Cost Center Accounting and internal orders, we are essentially looking at cost or expense accounting. If we now look at how to capture sales revenue, we move into the realm of Profitability Analysis (often shortened to CO-PA; see the bottom folder in Figure 1.1). If you’re new to SAP, you need to understand that Profitability Analysis is essentially a data warehouse within SAP ERP in which you can capture the costs and revenue associated with each customer and product and analyze your profitability by region, sales organization, business area, company code, and so on. Profitability Analysis is a very powerful tool but may provide a degree of granularity that differs from what you’re used to if you currently capture costs and revenue mainly in your General Ledger. It offers two alternative taxonomies for viewing the relevant values: by cost element (account-based) and by value field (costing-based). Although most people can imagine costs and revenue accounts, the value fields represent a different view that can be more or less detailed than the account view, depending on business requirements.

Cost Center Accounting and Internal Orders are represented as separate folders but provide base data for Profitability Analysis. Rent, payroll, and insurance costs are assigned initially to a cost center but are later assigned to the parts of the business that this cost center serves by means of an allocation. Similarly, costs assigned to a research and development order can later be settled to the product lines supported by the research activities. This effectively transforms such costs into period expenses for the income statement. In some countries, you’ll hear this transformation explained as the shift from costs by nature (wages, operating supplies, depreciation, and so on) to costs by function (production, sales, marketing, administration, and so on) with the idea that all costs will ultimately become costs of sales.

If you now look more closely at the menus for Cost Center Accounting, Internal Orders, and Profitability Analysis, you’ll see that each one contains a folder called Planning. The idea of planning and setting standards is central to CO, and we’ll talk later about how to plan and why a plan is necessary in SAP ERP. This is especially important, because it’s usually the controller who drives the creation of the plan, establishing the framework and collaborating with all the involved parties until agreement is reached.

If you’re performing any kind of manufacturing, then the process of turning the materials you buy into products you can sell is covered in Product Cost Controlling. Again, if you’re used to managing work orders in a separate system, the idea that every work order in SAP ERP is a cost object in CO may be new. In this book, we’ll discuss the different levels of detail you can use to capture the information on work orders. We’ll compare the classic approach to standard costing with newer approaches, including lean accounting, which rejects the work order as the sole focus of cost accounting. Just as we saw for Profitability Analysis, Product Cost Controlling is not used in isolation. The costs we captured for the production cost centers will be charged to the production process and flow into the cost of goods manufactured in Profitability Analysis and into the inventory values for the goods manufactured, undergoing a transformation from expense to inventory value and finally cost of goods sold. Product Cost Controlling includes options for make-to-stock, make-to-order, and engineer-to-order manufacturing.

There is also a folder for Activity-Based Cost...

Table of contents

- Dear Reader

- Notes on Usage

- Table of Contents

- Preface

- 1 Introduction

- 2 Reporting

- 3 Master Data Owned by Controlling

- 4 Master Data for Which Controlling Is a Stakeholder

- 5 Planning and Budgeting

- 6 Actual Postings

- 7 Period Close

- 8 Reporting in SAP BW and SAP BusinessObjects

- 9 Master Data in a Multisystem/Shared Service Environment

- 10 Planning Using SAP BW Technologies

- 11 Allocations Using SAP Profitability and Cost Management

- 12 Period Close Using the SAP Financial Closing Cockpit

- 13 Controlling with New Technologies

- 14 SAP S/4HANA and Controlling

- The Author

- Index

- Service Pages

- Legal Notes