eBook - ePub

The Missing Second Semester

Investing and time are a powerful combination. Your age is an opportunity

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Missing Second Semester

Investing and time are a powerful combination. Your age is an opportunity

Book details

Book preview

Table of contents

Citations

About This Book

This second book in the Missing Semester series addresses the most overlooked subject in financial-literacy education-investing. Primarily addressing students and recent graduates, its lessons are not laden with jargon; its focus is topics and choices that apply to most young people, not just a few, and not those relevant only late in life. The Missing Second Semester presents a call to action: You're in charge. Understand the opportunity, and make the choices.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access The Missing Second Semester by Gene Natali in PDF and/or ePUB format, as well as other popular books in Personal Development & Personal Finance. We have over one million books available in our catalogue for you to explore.

Information

Topic

Personal DevelopmentSubtopic

Personal FinanceCHAPTER 1

AVOIDING THE QUICKSAND

On January 1, 2020, we (you, I, and everyone else in America) woke up owing 14.15 trillion dollars. That’s the money that we, as individuals, are legally obligated to repay, the sum of all Americans’ personal debts.

Here are the components.

| Mortgage (house) debt | $9.86 trillion |

| Student-loan debt | $1.51 trillion |

| Auto-loan debt | $1.33 trillion |

| Credit-card debt | $0.93 trillion |

| Other debts | $0.52 trillion |

| TOTAL | $14.15 TRILLION |

SOURCE: FEDERAL RESERVE BANK OF NEW YORK1

Buying a house, paying for college, buying a car, and not paying off the credit card bill are expensive debt decisions. Decisions that result in many Americans paying today’s bills with tomorrow’s paycheck.

These four money choices account for a staggering 96% of personal debt in America.

What if, instead of falling behind on these four debts, you think differently, and use each expense decision as a chance to get ahead? For example,

Attend a college or school that costs you slightly less than you can afford— then save and invest the difference.

Buy a first car that costs slightly less than another possibility—then save and invest the difference.

Pay off your credit card in full each month—and never suffer the high-interest penalty on any money you don’t repay immediately.

Rent a first apartment (or later, buy a first house) that costs slightly less than your price limit—then save and invest the difference.

Why?

Because interest isn’t just something you pay (on a loan). On an investment,

Interest is something you earn.

That is, if you have money to invest. And you likely will if you make these four debt decisions wisely.

Being aware of the consequences of your money choices is a start to successful investing.

CHAPTER 2

PLANTING A SEED

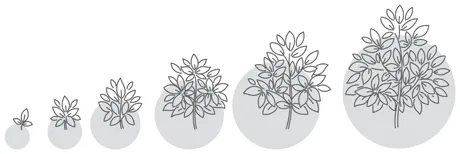

Speaking of investing, let’s talk about trees. What if every high school and college started a new club on campus? Called The Watching-Trees-Grow Club.

You’ll need a tree, a place to plant it, approval to plant it, and of course, members.

Grab a shovel, and let’s get to work!

After you plant the tree, arrange chairs in a circle or semicircle around it. Next, sit down and watch the tree grow. Meet every day as a club, and watch your tree grow.

Pssst, there is a problem. The day after you plant the tree, it looks the same. A year later it looks nearly the same. And during the winter, when the leaves dropped off, it looked even smaller. Hint, there is an investment analogy here . . . .

Your classmates who didn’t join the club walk past each day. They can see the tree doesn’t look like it’s growing. Keeping members is going to be hard . . . , recruiting new members, even harder.

But we know what the eyes can’t see. A tree has a strong foundation, its roots, and they are growing. The stronger the roots, the taller the tree can grow. Still, your tree isn’t generating much excitement, and the club dwindles down to a small, but loyal, group.

Blink.

You receive an invitation in the mail for your (gulp) 20-year reunion. The invitation says, “Meet at the big tree in the school courtyard.” When you pull into the parking lot and see the “big tree,” you smile. It’s the tree you planted. It worked!

Your friends who dropped out of the club likely feel a tinge of regret. When things don’t happen instantly, people tend to lose interest. Our tree took 20 years to grow. And now everyone at the reunion wants a tree that looks like the one you planted! So how do we get them to join the club? And to stick with it?

Here’s one idea. What if we changed the name of our club from The Watching- Trees-Grow Club, to The Watching-Money-Grow Club? Better yet, what if The Watching-Money-Grow Club worked the same way?

What if a small amount of money grew into something large? In the case of our club, not joining might be the biggest money mistake your friends will ever make.

Money does grow the same way—if you invest it wisely.

CHAPTER 3

PREPARING FOR WINTER

Alaska is a beautiful state. Beautiful, with a very long winter. So long, that when it isn’t winter, residents must use that time to prepare for next winter. Without enough food, firewood, and other essentials, winter can be more than just cold.

The same can be said about money. Especially when we don’t have enough.

As a member of our imagined Watching-Trees-Grow Club, think about helping your “tree” survive a hard winter—and saving you from having to cut it down for firewood. Preparing for problems is the first step. Preventing them is the second.

Here are two important tools to prepare for coming financial winters and prevent the problems they can bring —insurance and emergency reserve fund(s). Understanding both will protect you and your saving and investing accounts in hard times.

INSURANCE

It’s a necessary evil when you don’t need it, but critically important when you do. Insurance protects us from events that have a low probability of occurring, but that can have a large financial impact if they do.

While we all need insurance, we do not all need every kind of insurance, nor do we need it at every point in our life. Here is a summary of the basics.

| HEALTH INSURANCE This is a must have. The probability of needing it may be low, but the possibility of high-risk, high-cost events, with catastrophic long-term consequences for your financial well-being, makes it essential. Health insurance is typically covered by employers. It can be an important part of your compensation, although in most cases you still pay a portion of the e... |

Table of contents

- Cover

- Title

- Copyright

- Table of contents

- Foreword

- Author’s note

- Chapter 1: AVOIDING THE QUICKSAND

- Chapter 2: PLANTING A SEED

- Chapter 3: PREPARING FOR WINTER

- Chapter 4: THE POWER OF KNOWLEDGE

- Chapter 5: UNDERSTANDING OPPORTUNITY COST

- Chapter 6: WHAT IT MEANS TO INVEST

- Chapter 7: THINKING AHEAD

- Chapter 8: THE STOCK MARKET AND THE S&P 500

- Chapter 9: RULES OF INVESTING

- Chapter 10: PREPARING FOR THE WORST

- Chapter 11: THE DIVIDEND REWARD

- Chapter 12: WHEN NOT TO INVEST

- Chapter 13: PUTTING IT ALL TOGETHER

- The Bottom Line: WHY MONEY MATTERS

- Back Cover