This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Book details

Book preview

Table of contents

Citations

About This Book

Digital Media Worlds tracks the evolution of the media sector on its way toward a digital world. It focuses on core economic and management issues (cost structures, value network chain, business models) in industries such as book publishing, broadcasting, film, music, newspaper and video game.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Digital Media Worlds by Giuditta De Prato,Jean Paul Simon, E. Sanz in PDF and/or ePUB format, as well as other popular books in Media & Performing Arts & Film & Video. We have over one million books available in our catalogue for you to explore.

Information

Subtopic

Film & VideoSection II

Case Studies

5

The Book Publishing Industry

This industry can be dated back to the introduction of the format used for modern books (the codex: block of wood, book)1 around the first century2: a bound book with pages. The codex gradually replaced the scroll (roll of papyrus, parchment or paper). This new format/technology allowed random access, whereas scrolls could only be accessed sequentially. This is considered as the most important ‘technological change’ before the invention of printing,3 after the invention of writing as a cognitive technology (Goody, 1977).

The seminal work of Elizabeth Eisenstein (1980) on the printing press as an agent of change described its profound effect on society when Europe was transitioning away from the medieval to the modern world. Eisenstein compared this invention with the advent of computers, stating: ‘until the recent advent of computers, has there been any other invention which saved so many man-hours for learned men’ (Eisenstein, 1980: 521). She showed that, if the printing press did not create the book, it contributed to redefining it. She stressed that a cultural change of that magnitude took quite some time to unfold, as the effects were not seen clearly for more than a hundred years; in other words, if the technological change spread quickly, the cultural changes did not. The printed book as a ‘new medium’ initially tried to replicate as much as possible the patterns of the codex.

From a more modest viewpoint, this chapter highlights some of the changes taking place within the industry and its ‘book chain’ with digitization. The first section introduces the markets at a global, regional level and describes some of the major EU markets (France, Germany, Italy, Spain and the UK). The second section analyses the value network of the European book publishing industry, identifying the transformations taking place in the value network and in business models as a result of the ongoing digitalization process. The third section concludes with an assessment of the power relationship in the new digital environment.

The book publishing markets

For 2012, the global book market revenue estimated by the consultancy PricewaterhouseCoopers (PWC) was US$101.6 billion for the consumer and educational book publishing market4 (PWC, 2013).5 In the media and entertainment markets, the book market is the only one where EU companies (Bertelsmann, Hachette, Grupo Planeta, Pearson, Reed-Elsevier, Wolters Kluwer) lead, with seven companies among the top ten (Publishers Weekly, 2012). The ten largest publishers accounted for about 47% of all revenue generated by the 54 leading world companies (Publishers Weekly, 2012). Scientific/technical/medical (STM) publishers generated the largest share of sales among the top ten publishers, but trade sales fell in the 2008–2010 period, representing 31% of revenue in 2011 (Publishers Weekly, 2011). Pearson remains the world’s largest book publisher by far (Publishers Weekly, 2011). In July 2013, Bertelsmann and Pearson have merged their trade book-based publication arms, Random House and Penguin, operating in five continents, to create the world-leading trade publisher, Penguin Random House6.

The global market

The book market is a mature market and appears almost stable. China ranked number 2 in 2011, right after the US, with revenues of €10.6 billion, ahead of Germany that year. In 2012, China was the largest publisher of books and ranked second for electronic publishing (Baozhong, 2013). India ranked tenth in 2011 with a market value of €2.50 billion, right behind Brazil (€2.54 billion euros). The new major players in book publishing are companies from China, Brazil and South Korea specializing in educational books fuelling a stronger growth as well as much of the expected growth. In China, Higher Education Press merged with China Education and Media Group7 to create a €320 million company (US$445 million in 2011). However, if these firms are quickly climbing in the global ranking of publishing firms, the first South Korean company, Woongjin ThinkBig (established in 1980 as Woongjin Publications), ranks only 29th; the first Chinese company, Higher Education, 37th; and the first Brazilian company, Abril Educacäo,8 40th (IPA, 2012).

The US market

In 2012, the entire publishing business was estimated at 27.1 billion and overall trade publisher revenues at US$15.05 billion (Publishers Lunch, May 15, 2013).9 The US market is highly concentrated, with leading firms including McGraw Hill, Random House, Penguin and Scholastic. The presence of EU companies is significant: Random House is owned by the German media group Bertelsmann, Penguin by the UK publishing house Pearson. Hachette Book Group (Lagardère, France) is a major player (Thompson, 2010: 116).

In 2012, e-books stood at 20% of trade sales (US$3 billion). In 2011, e-books became, for the first time, the number 1 individual format for adult fiction (AAP, 2012a). Internet access and the rise of e-books contributed positively to the growth of exports by volume (AAP, 2012b), 10as illustrated by the case of exports to the UK: a 1,316.8% increase in e-books but only 10.4% for printed books. Leadership of e-books followed a major increase in ownership of e-book reading devices and tablet computers11 (Pew, 2012): in all, 29% of Americans aged 18 and older own at least one specialized device for e-book reading, either a tablet or an e-book reader.

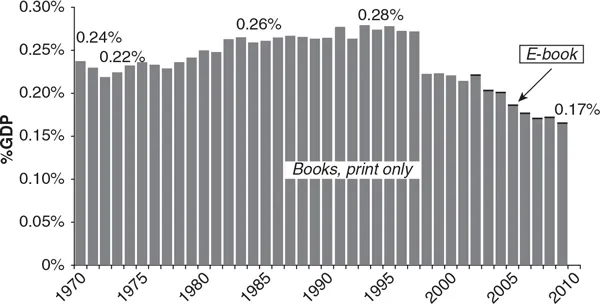

Nevertheless, this growth does not offset the losses of revenues over a longer period of time, as illustrated by Figure 5.1. Figure 5.1 shows that the relative strength of the book sector vis-à-vis GDP is declining and that this level plateaued between 1995 and 2000.

Figure 5.1 Books: Total revenue by category as a percentage of GDP, 1970–2009

Source: Waterman and Ji (2012). 12

The EU market

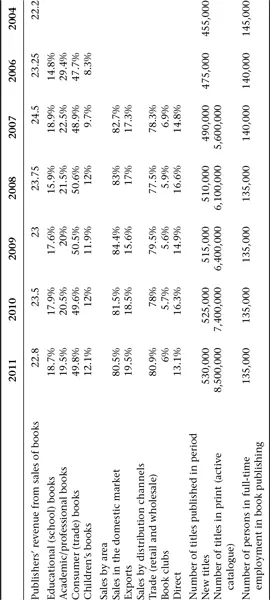

Book publishing is a significant market in the EU, with a turnover of €22.8 billion in 2011 (FEP, 2012). Book publishing is the largest cultural industry in Europe, according to the same source. Table 5.1 introduces the core data for turnover, sales, number of titles and level of employment, and the distribution across categories. These figures show a relative stability over the period 2004–2011, though employment level has decreased (by nearly 7% between 2004 and 2011), and numbers of published titles have increased, as well as the size of the catalogue (up 50% since 2004). The revenues of the different categories also remain stable: trade is the largest segment, fluctuating around 50% in 2011.

Notwithstanding the importance of the leading publishing EU firms, the fragmentation of the market is a well-known feature. It is first fragmented along linguistic lines, but its industrial structure and the size and role of the different players (the revenue stream composition) varies as well. The patterns of consumption differ from one country to another, as do the policies (for instance, the regulation of the retail price).

The main EU markets

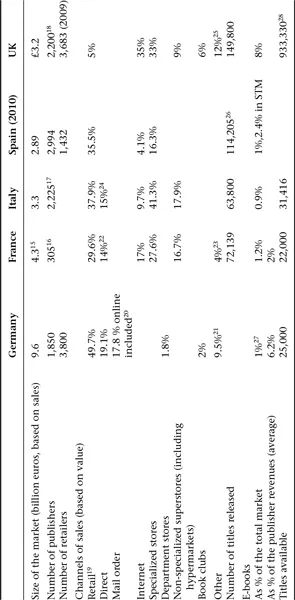

The major EU markets share some features, as shown in Table 5.2. The major EU markets are highly concentrated, although with some variations in the degree of concentration: in France’s oligopolistic market, for instance, 4.3% of the firms bring in 65.3% of the revenues, while in Spain 19 top publishers reach 30% of the titles.

The EU benefits from an important network of retailers (a significant number of bookshops), which play a major role as a leading distribution channel, as shown in Table 5.2 for the main EU markets.

A changing industry structure

The publishing value chain

Publishing is perceived as a long-term business, as profit margins are slim. This has meant a stable organization of the value chain (see Figure 5.2) to allow the publishers to build the portfolio they need to sell books over long periods of time. Such a catalogue is indeed a source of stability and profitability, but came under pressure with some developments in the 1980s and 1990s (Thompson, 2010) with the increasing role of large corporations pushing for more speed. Nevertheless, the core business involves a well-functioning relationship between the different parts of the value chain.

Table 5.1 Turnover (€ billion), number of titles and employment, 2004–201113

Source: FEP (2012), Estimates, all figures rounded.14

Table 5.2 The main EU markets in 2011

Source: Compiled by the author from AIE (2012), Booksellers Association (2008), Börsenverein des Deutschen Buchhandels (2012), Cegal (2011), FGEE (2011), lemotif.fr (2012), Minidata Ministère de la Culture (2012), Publishers Association (2012), SNE (2013). As the data comes from heterogeneous sources, the total in % may not sum up to 100%.

Figure 5.2 The traditional value chain of the sector

The content is supplied by the author, who provides the work directly to the publisher or indirectly through the mediation of an agent. According to Thomson (2010), this kind of middleman saw his power growing in English-language trade publishing, what he described as a ‘proliferation of agents’.

As in other creative industries, a major feature of this creative workforce is that it is not usually supported directly, at least on a regular basis, by its main customer, the publisher. The author appears more in the position of a supplier working under various contractual arrangements, and will receive in most cases royalties within the range of 7–15% of the list price set for the physical book. However, the book sector is the only sector in which authors derive a significant amount from royalties (Benhamou and Sagot-Duvauroux, 2007: 11).

Publishers are at the core of the business. Their functions include the aggregation, presentation (reading, editing and designing), pricing and marketing of books and dealing with other parties in the value chain, including the technical intermediaries (printers, phototypesetting, binders, etc.) and a specialized workforce, in-house or outsourced (proofreading).29 They are also responsible for the ‘quality’ of the edited product and, even if they may not have to finance the initial content creation, their funding role nevertheless grants them a pivotal position.

Publishers have become all the more central as other segments have been considerably weakened: for example, printers, retailers (especially the smaller bookshops) and also, in the case of the US markets, the large retail chains that used to dominate the market (Borders, the second largest bookstore chain, filed for bankruptcy protection in February 2011).30 Now, with the rapid development of online distribution, distributors are also under threat.

Going digital: From books to e-books

This industry went through various technological developments. The first commercial application of e-paper (also referred to as ‘e-ink’) was launched in Japan in 2004 (Forge and Blackman, 2009). Audio books began to be developed and distributed by retailers in the late 1980s, though spoken word albums existed before the age of videocassettes, DVDs and compact discs. In 2002, Random House and Harper Collins started selling digital copies. In October 2004, at the Frankfurt book fair, Google launched its ‘Google print’ project, which later became Google books (12 million references).

New channels of distribution (the Internet) are bringing cheaper and more efficient vehicles and a strong pressure to get rid of intermediaries while, at the same time, new aggregators/distributors are appearing. Created in 1995, Amazon.com has come to dominate the online book sales market. It has had one of the fastest growth rates in the Internet’s history, even as compared with eBay and Google. Amazon has since become an e-commerce platform for others, thanks to its pioneering retail e-commerce/e-shopping business in many product categories, not just books. Amazon launched its eReader Kindle late in 2007.31 In 2008, the online retail giant emerged as the leader in the stand-alone eReader market with its Kindle line-up, and the company maintained its lead despite an array of competitors entering the space. In the two leading markets (US and UK), in 2011, Amazon dominates all other channels by far, with 61% as a purchase source in the US32 and 66% in the UK (Global eBooks Monitor, 2012b). 33

The arrival of the Apple iPad in 2010 changed the game, as the IT company set up its own sales platform iBooks (following the model of its iTunes), and proposed a different kind of contract (the so-called agency model34) to the publishers. PWC considers that 2010 was the turning point as regards penetration by eReaders into mainstream markets: eReader prices declined and spending rose by 51% (PWC, 2011). The market took off only recently. In 2012, for the French publishing house Lagardère Publishing (Hachette Livre), the sales of e-books amounted to 7.7% of the total turnover; however, although it reached 15% in the UK and up to 23% in the US, it remained under 2% in other markets (LivresHebdo, 2013).

Digital technologies were introduced upstream in the publishing value chain, but they were not used for the final product, but, rather, mostly for internal business processes.35 The legacy players appeared reluctant to opt for this direction. The ability of this new nascent market to compensate for declining or stable sales is clearly a major issue for the industry. Revenues derived from this new channel are also lower than those from printed material.

The trade segment is still lagging behind, though STM publishing is already in digital format (90%). Already in 2007, about 90% of all science journals were available online, in many cases via a subscription (EC, 2007: 3).36 In the trade segment, some specialized publishers speeded up the process so as to manage the shift, for instance, of the publisher Harlequin (‘romance’ fiction37) (Benhamou, 2012b).

Nevertheless, some major digital technological platforms,38 bringing together several national companies, were launched in the EU in 2010: in Italy (Edigita by RCS, Mauri Spagnol and Feltrinelli), France (Eden by Flammarion, Gallimard and La Martinière) and Spain (Libranda by Planeta; Santillana and Random House Mondadori). In Germany, Bertelsman and Holtzbrinck set up a joint platform, Premium Vertriebs GmbH, for e-books to compete w...

Table of contents

- Cover

- Title Page

- Copyright

- Contents

- List of Tables, Figures and Boxes

- List of Abbreviations

- Acknowledgements

- Notes on Editors

- Notes on Contributors

- Introduction

- Section I: A Horizontal View: The Dynamics of the Sector

- Section II: Case Studies

- Conclusion

- References

- Index